Presented with little comment, aside to ask - how many 'people' went to jail for this?

MAY 20, 2015 DISCLOSURE NOTICE

The purpose of this notice is to disclose certain practices of JPMorgan Chase & Co. and its affiliates (together, “JPMorgan Chase” or the “Firm”) when it acted as a dealer, on a principal basis, in the spot foreign exchange (“FX”) markets. We want to ensure that there are no ambiguities or misunderstandings regarding those practices.

The purpose of this notice is to disclose certain practices of JPMorgan Chase & Co. and its affiliates (together, “JPMorgan Chase” or the “Firm”) when it acted as a dealer, on a principal basis, in the spot foreign exchange (“FX”) markets. We want to ensure that there are no ambiguities or misunderstandings regarding those practices.

To begin, conduct by certain individuals has fallen short of the Firm’s expectations. The conduct underlying the criminal antitrust charge by the Department of Justice is unacceptable. Moreover, as described in our November 2014 settlement with the U.K. Financial Conduct Authority relating to our spot FX business, in certain instances during the period 2008 to 2013, certain employees intentionally disclosed information relating to the identity of clients or the nature of clients’ activities to third parties in order to generate revenue for the Firm. This also was contrary to the Firm’s policies, unacceptable, and wrong. The Firm does not tolerate such conduct and already has committed significant resources in strengthening its controls surrounding our FX business.

The Firm has engaged in other practices on occasion, including:

- We added markup to price quotes using hand signals and/or other internal arrangements or communications. Specifically, when obtaining price quotes for bids or offers from the Firm, certain clients requested to be placed on open telephone lines, meaning the client could hear pricing not only from a salesperson, but also from the trader who would be executing the client’s order. In certain instances, certain of our salespeople used hand signals to indicate to the trader to add markup to the price being quoted to the client on the open telephone line, so as to avoid informing the client listening on the phone of the markup and/or the amount of the markup. For example, prior to agreement between the client and the Firm to transact for the purchase of €100, a salesperson would, in certain instances, indicate with hand signals that the trader should add two pips of markup in providing a specific price to the client (e.g., a EURUSD rate of 1.1202, rather than 1.1200) in order to earn the Firm markup in connection with the prospective transaction.

- We have, without informing clients, worked limit orders at levels (i.e., prices) better than the limit order price so that we would earn a spread or markup in connection with our execution of such orders. This practice could have impacted clients in the following ways: (1) clients’ limit orders would be filled at a time later than when the Firm could have obtained currency in the market at the limit orders’ prices, and (2) clients’ limit orders would not be filled at all, even though the Firm had or could have obtained currency in the market at the limit orders’ prices. For example, if we accepted an order to purchase €100 at a limit of 1.1200 EURUSD, we might choose to try to purchase the currency at a EURUSD rate of 1.1199 or better so that, when we sought in turn to fill the client’s order at the order price (i.e., 1.1200), we would make a spread or markup of 1 pip or better on the transaction. If the Firm were unable to obtain the currency at the 1.1199 price, the clients’ order may not be filled as a result of our choice to make this spread or markup.

- We made decisions not to fill clients’ limit orders at all, or to fill them only in part, in order to profit from a spread or markup in connection with our execution of such orders. For example, if we accepted a limit order to purchase €100 at a EURUSD rate of 1.1200, we would in certain instances only partially fill the order (e.g., €70) even when we had obtained (or might have been able to obtain) the full €100 at a EURUSD rate of 1.1200 or better in the marketplace. We did so because of other anticipated client demand, liquidity, a decision by the Firm to keep inventory at a more advantageous price to the Firm, or for other reasons. In doing so, we did not inform our clients as to our reasons for not filling the entirety of their orders.

* * *

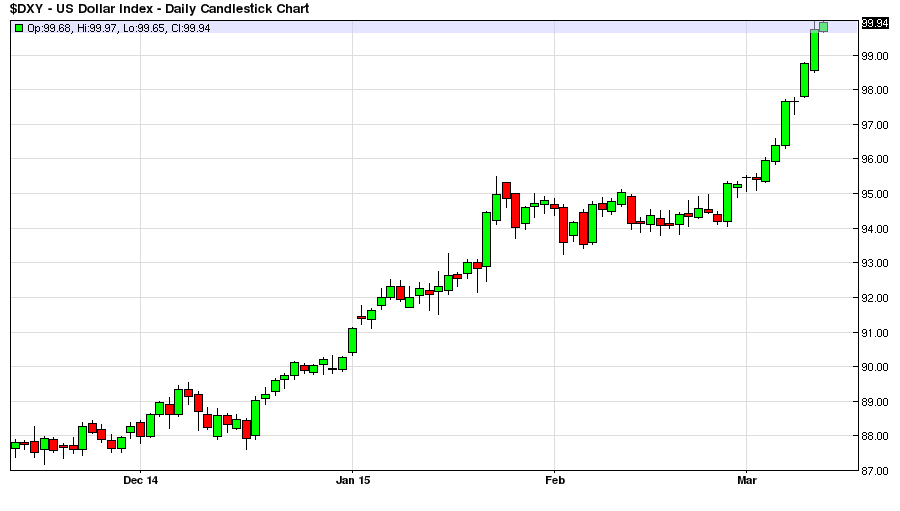

We have helped a little here...