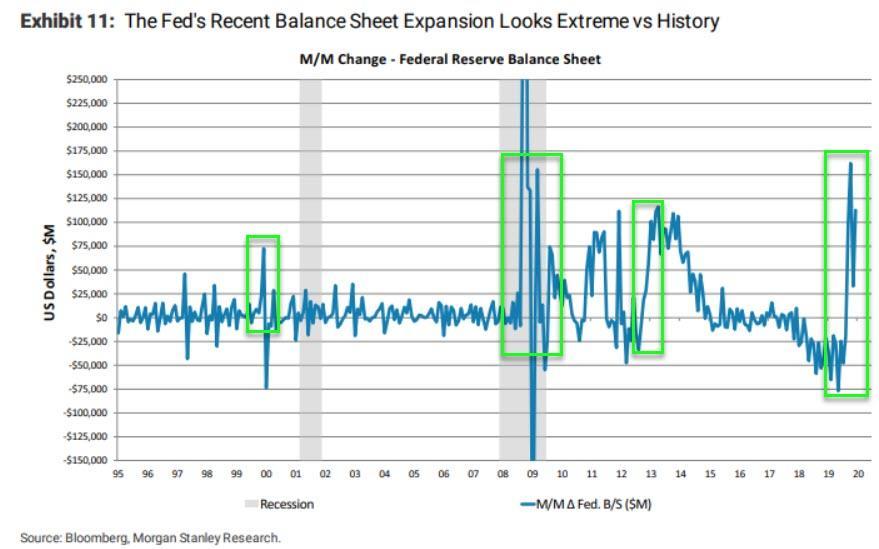

On Friday, Minneapolis Fed president Neel Kashkari, who just two months earlier made a stunning proposal when he said that it was time for the Fed to pick up where the USSR left off and start redistributing wealth (at least Kashkari chose the proper entity: since the Fed has launched central planning across US capital markets, it would also be proper in the banana republic that the US has become, that the same Fed also decides who gets how much and the entire democracy/free enterprise/free market farce be skipped altogether) issued a challenge to "QE conspiracists" which apparently now also includes his FOMC colleague (and former Goldman Sachs co-worker), Robert Kaplan, in which he said "QE conspiracists can say this is all about balance sheet growth. Someone explain how swapping one short term risk free instrument (reserves) for another short term risk free instrument (t-bills) leads to equity repricing. I don’t see it."

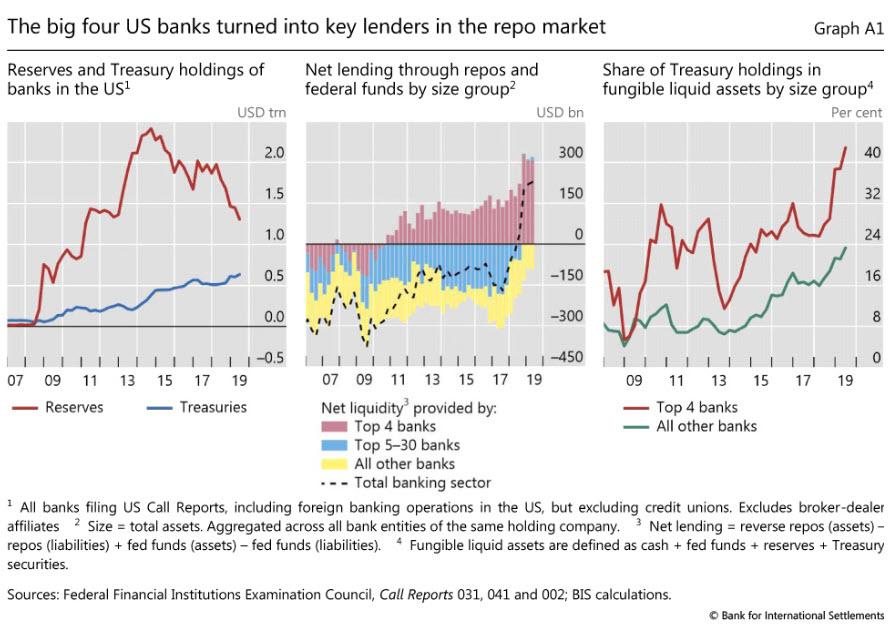

To the delight of Kashkari, who this year gets to vote and decide the future of US monetary policy yet is completely unaware of how the plumbing underneath US capital markets actually works, we did so for his benefit on Friday, although we certainly did not have to: after all, the "central banks' central bank", the Bank for International Settlements, did a far better job than we ever could in its December 8 report, "September stress in dollar repo markets: passing or structural?", which explained not just why the September repo disaster took place on the supply side (i.e., the sudden, JPMorgan-mediated liquidity shortage at the "top 4" commercial banks which prevented them from lending into the repo market)...

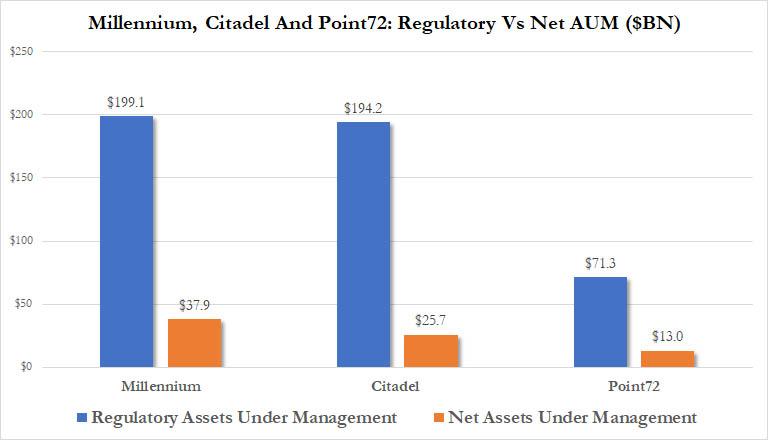

... but also on the demand side, which as Claudo Borio, head of the monetary and economic department at the BIS, explained was the result "high demand for secured (repo) funding from non-bank financial institutions, such as hedge funds heavily engaged in leveraging up relative value trades."

Incidentally, we harbor a slight suspicion that Kashkari, who also admitted to "finding amusement in needling critics calling them conspiracists or goldbugs" (which is a delightfully ironic statement for a person responsible for the biggest asset bubble in history, and one which we are confident in 1-2 years time he would love to retract), was being disingenuous and knows exactly how the Fed is impacting markets, because in what was perhaps the most important news last week which flew under the radar, the WSJ reported that the Fed was considering lending cash directly to - i.e., bailing out - hedge funds, or as we put it, "Fed officials are considering a new tool to ease repo market stress: namely bypassing the existing system entirely, and lending cash directly to smaller banks, securities dealers and hedge funds through the repo market’s clearinghouse, the Fixed Income Clearing Corp., or FICC."

And so we once again get to the real issue at hand, namely the bailout of those hedge funds which even the BIS said were on the verge of failure had the repo market not been unfrozen - and which the Fed was all too aware of - and had the massive leverage that some hedge funds operate under collapsed, forcing an unprecedented liquidation cascade.

Incidentally, it is the repo-utilizing hedge funds that is the transmission mechanism of the Fed's monetary policy, and the source of so much Neel Kashkari confusion. Luckily for Neel, and everyone else still confused, the BIS explained that too:

Shifts in repo borrowing and lending by non-bank participants may have also played a role in the repo rate spike. Market commentary suggests that, in preceding quarters, leveraged players (eg hedge funds) were increasing their demand for Treasury repos to fund arbitrage trades between cash bonds and derivatives.

And there you have it: when properly funded, repos issued by commercial banks are critical in preserving and boosting risk prices, by way of levered hedge fund pair trades; indeed as the FT noted in December, "one increasingly popular hedge fund strategy involves buying US Treasuries while selling equivalent derivatives contracts, such as interest rate futures, and pocketing the arb, or difference in price between the two."

While on its own this trade is not very profitable, given the close relationship in price between the two sides of the trade. But as LTCM knows too well, that's what leverage is for. Lots and lots and lots of leverage. And when the repo market seized in September, the risk was that all this leverage would be pulled, forcing an unprecedented liquidation wave among the massively levered hedge fund world.

Hence the need for an emergency liquidity intervention by the Fed.

But as the WSJ noted, it's not just about preserving a handful of hedge funds - fundamentally, the very foundation of the US financial system was suddenly at risk, and with the Fed suddenly targeting liquidity injections into claringhouses, it immediately became apparent what the weakest link was: Clearinghouses themselves.

This is hardly the first time we have discussed clearinghouses as the weakest link in the US financial system. As a reminder, the "hail mary" thesis of the uber bearish CIO of Horseman Global, Russel Clark (who in 2019 was down a record 35%) is that clearinghouses will collapse as liquidity is drained from the market:

LCH claim to have done a quadrillion of compression trades or netting in the last year, this is more than twice the notional of all outstanding interest rate derivatives.If initial margins rise significantly, the only assets that will see a bid will be cash, US treasuries, JGBs, Bunds, Yen and Swiss Franc. Everything else will likely face selling pressure. If a major clearinghouse should fail due to two counterparties failing, then many centrally cleared hedges will also fail. If this happens, you will not receive the cash from your bearish hedge, as the counterparty has gone bust, and the clearinghouse needs to pay from its own capital or even get be recapitalised itself.

For those confused, here is another quick primer on clearinghouses from Horseman's November letter to clients:

Clearinghouses have become the center of the financial system, but they do not bear the cost of any mistakes they make in pricing risks. This is borne by other clearinghouse members. But what the BIS note and the note issued by the banks and other users of clearinghouses makes clear is that the market has become very directional, with banks supplying liquidity to the repo market, while leveraged funds are taking liquidity (until 2017 banks were taking liquidity from the system). As the near bankruptcy of a clearinghouse highlighted last year, it is other members that bear the risk when things go wrong, and hence big US banks have acted rationally in looking to reduce liquidity to the repo market, which of course forced the Federal Reserve to act.

And since things are getting a bit fuzzy, let's summarize here is what we know:

- The repo crisis was the result of a liquidity shortfall at the "Top 4" banks, precipitated by JPMorgan's drain of over $100BN in repo market liquidity (a wise move, which eventually forced the Fed to launch QE4, and helped JPM report its most profitable year on record)

- The Fed addressed the "supply side" of the Sept repo crisis by injecting over $400BN in liquidity to replenish bank reserve levels, first via repo and then via T-Bill POMO, i.e., QE4.

- The Fed has yet to address the "demand side" of the Sept repo crisis, namely the market transmission mechanism which is intermediated by hedge funds. And it is here that, as the WSJ reported, the Fed is currently contemplating providing liquidity directly to hedge funds to prevent a systemic collapse during the next repo crisis, whenever it may strike.

But going back to the clearinghouse issue, how are these linked to the potential failure of a handful of (massive) hedge funds? Well, we have an explanation for that too, and it once again comes from Horseman's Russell Clark, who in his latest letter to the few clients he has left (which is a damn shame, because despite his dismal performance in 2019, one can argue that Clark is one of the best investors of his generation, yet one who will soon be out of a job due to endless central bank intervention), writes that "since 2016, its has become much harder to short. There are two reasons. One is negative interest rates have made almost any amount of investment risk justifiable, as owning a safe asset will cost you in real terms. The second is that the malinvestment has moved from bad investment in real assets, into bad investment in financial structures that actually push up markets before crashing them."

How is that relevant to clearinghouses... thus hedge funds... thus repo... thus liquidity... thus the Fed.... thus QE4? Clark explains:

In 2019 there were many signs that the Japanese were perhaps beginning to step away from US debt markets, which made me very bearish. Yet US corporate debt continued to trade very well, which ultimately was the main support for US markets. As I looked more and more closely at clearinghouses, I realised the way they priced risk, and the provided leverage through compression, meant they were the grease that kept the US debt markets operating, and in fact kept spreads much tighter than they should be.

This brings us to the punchline, namely the reason why clearinghouses have emerged as the weakest link in the Frankenstein monster of a market that the Fed has created over the past decade, and why the Fed is, quietly, preparing to backstop hedge funds and clearinghouses themselves during the next crisis. Or rather 944 trillion reasons. Here is Clark's conclusion:

Regulators, clearinghouses and central banks have published notes saying that clearinghouses are safe and the problems in the Swedish exchange in 2018 were due to one rogue trader. But when the biggest clients of the clearinghouses, banks, say there is a problem, then I suspect they are right. I spent the Christmas period trying to prove that compression is dangerous, and the best nugget I could come from was from the biggest interest rate clearinghouse in the world, LCH.

In a pamphlet on their website, pushing the benefits of “Compression with Swap Clear”, in the 12 months to October 2019, LCH did a record 944 trillion USD (11x world GDP) of compression. LCH also provide an estimate of the amount of capital this saved members (i.e. banks) under Basel III, a princely 37 million USD. To restate, USD 944 trillion of compression, yielded the banks USD 37 million of regulatory capital saving.

Which leads to the 944 trillion dollar question asked by the Horseman CIO: "If the banks are not benefitting, who is?"

His answer:

"Leverage funds with huge interest rate derivative positions. And who is on the hook if they blow up? The big banks who are on the other side of the trade, as they would be forced to recapitalise the clearinghouses."

In other words, if enough liquidity is drained, mutual assured destruction between funds and banks will almost instantly follow. And since banks are now aware of the risk and are trying to reduce their exposure, it is very hard if not impossible to see how this can be unwound "without triggering all the other bad financial structures and malinvestment that QE has produced."

It also explains why the Fed had to get involved, if under the guise of saving the repo market, when in reality the Fed was once again bailing out the banks and levered funds that are facing trillions of dollars in losses should one clearinghouse go under, as the cascade of resulting events would lead to a domino effect where one counterparty after another failed, and one clearinghouse after another has to be bailed out, initially by banks, and ultimately by the Fed.

And there you have it: while the September repo crisis was fundamentally represented by the Fed as one of insufficient reserves, and the resultant QE4 was painted by Powell merely as an exercise in "reserve management" the real reason why the Fed stepped in so decisively was to prevent a cascading sequence of hedge fund failures that would have not only sent the market crashing as funds were forced to liquidate all positions once leverage as high as 10x (see chart above) was yanked, but would culminate in the failure of one or more clearinghouses. Which is also why now that the Fed has stepped in, and backstopped this weakest link, stocks keep hitting new all time highs.

As for Mr Kashkari's childish "needling of critics", if after reading the above he still doesn't understand what is going on, we have a suggestion: announce on Monday the Fed will no longer inject $100 billion in liquidity each month via repo and POMO, and see what happens to the stock market. After all, the Fed's actions - or in this case the lack thereof - do not lead to "equity repricing", right?