Sunday, July 12, 2020

Saturday, July 11, 2020

Swiss Mountain Vault Offers Wealthy Elites $500,000 Plots For Storing Valuables

From Zero Hedge:

With world trade collapsed, socio-economic chaos has unfolded across the Western world as central bank money printing and massive fiscal injections by governments might not be enough to ward off the next round of economic declines.

The virus pandemic and social unrest in the US has shown just how fragile everything is - as wealthy elites flee metro areas for rural communities. We've shown those with economic mobility, considering the virus-induced recession has crushed tens of millions of folks into financial ruin - are buying underground bunkers so if Western economies plunge deeper into chaos - they will be protected, from social unrest and or nuclear war with China.

The wealthy have been the primary asset gathers in the last decade, thanks to central bank policies that has decimated the bottom 90% of Americans, stripped of assets, hence the record wealth inequality - and maybe another reason why people are protesting.

Now, these wealthy folks have to figure out where they can safely store their post-war Ferraris, expensive artwork, rare wine collections, precious metals, and anything else of value.

Bloomberg might have found that place, located in Switzerland, where a company is set to embark on a project to build deep underground vaults within a mountain.

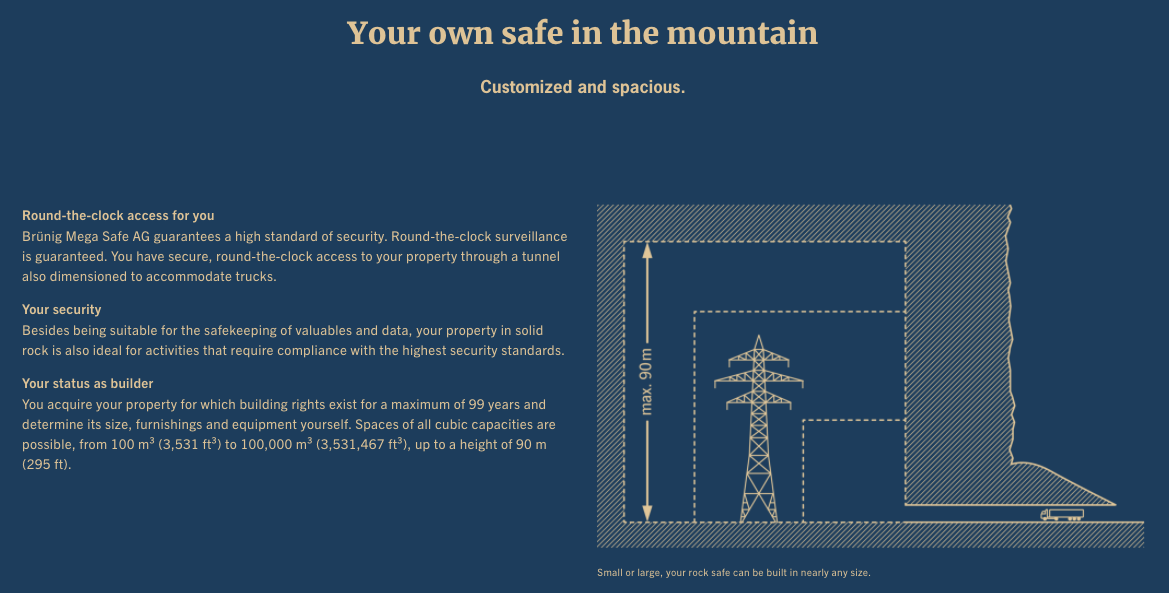

The Brünig Mega Safe Project, the firm heading up the project to build underground vaults in the Swiss Alps, said on its website, "Your treasure chamber in a solid rock massif," adding that, "The secure place for safekeeping your assets and sensitive data."

The vault is expected to be absolutely massive - equivalent to about ten soccer fields, according to board member Hugo Schittenhelm. He said the underground space could "multiply" if needed.

"The Swiss vaults will range from 100 cubic meters (3,531 cubic feet) to 1,000 times that large with heights of up to 90 meters, according to the website. The rock walls ensure a constant relative humidity of 40% and a temperature of 12 degrees Celsius (53.6 degrees Fahrenheit). Prices start at $500,000 and go up from there," said Bloomberg.

Brünig Mega Safe will be constructed by engineering and underground construction firm, Gasser Felstechnik AG.

Already, the project has attracted potential clients, including family offices, corporations, art galleries, and high net worth individuals, said Schittenhelm.

Bloomberg notes the project needs $7.5 million to begin construction, expecting work to start as early as next year - the first vaults are expected to be commercially available 18 months from construction start.

With no V-shaped recovery in the global economy this year - turmoil is expected to last for the next several years as social fabric unravelings will continue in many Western countries, more specifically, in the US - it now might make sense for wealthy folks to start storing valuables in rock valuts before the social-economic implosion worsens.

Friday, July 10, 2020

Thursday, July 9, 2020

Chinese Banks Preparing For "Worst Case" Scenario: Being Cut Off From SWIFT, Hong Kong Bank Runs

From Zero Hedge:

In the latest escalation over China's de facto annexation of Hong Kong, Reuters reports that Chinese state lenders are "revamping contingency plans" in anticipation of the soon to be enacted U.S. legislation (just waiting for Trump's signature) that would penalize banks for serving officials who implement the new national security law for Hong Kong.

In a "worst-case scenario" under consideration by Chinese commercial megabanks Bank of China and Industrial and Commercial Bank of China (ICBC), the lenders are said to be looking at the possibility of being cut off from U.S. dollars or losing access to U.S. dollar settlements, two Reuters sources said.

The worst-case scenario also envisions what would happen in the event of a run on its branches in Hong Kong if customers feared that it would run out of U.S. currency, one of the sources said (this is the scenario discussed in "If 500,000 Rich Hong Kongers Leave The City, The HKD Peg Would Surely Collapse"). The scenario was also looking at the experience of banks in Iran, the same person said. Iranian banks have been hit from time to time by U.S. sanctions dating back to the 1979 Islamic Revolution.

"We are hoping for the best, but preparing for the worst. You never know how things will turn out," one of the sources said.

In a milder scenario being looked at by the Agricultural Bank of China (AgBank), lenders would need to find ways to address the problem of clients blacklisted by the United States, especially those who might face a sudden loss of liquidity.

As Reuters adds, the contingency planning has been initiated by the banks themselves, who have the most to lose should the US effectively trigger a massive dollar bank run.

As Reuters calculates, Bank of China, the country's most international lender, had the biggest exposure of the country's big four lenders to the greenback at the end of 2019, with about $433 billion in liabilities. China's top four banks, which also include ICBC, China Construction Bank and AgBank, had a combined 7.5 trillion yuan ($1 trillion) in U.S. dollar liabilities at the end of 2019, annual reports show.

According to the report, at least three state-run leasing firms, including an ICBC unit and CSIC Leasing, are also making contingency plans. Leasing firms are often heavily reliant on dollar borrowing to fund purchases of aircraft, machinery and facilities.

China's contingency plans are in response to the unanimous passage in the House and Senate of a bill last week which seeks to impose financial sanctions on Chinese banks in response to the National Security Law. It has yet to be signed into law by President Donald Trump. The bill calls for sanctions on Chinese officials and others who help violate Hong Kong's autonomy and on financial institutions that do business with them. But it does not spell out what the sanctions would look like.

"There are sanctions in this bill which could be interpreted to prevent a bank from clearing some dollar transactions via U.S. institutions, but unlike other congressional sanctions bills there are not specific provisions mandating it," said Nick Turner, a lawyer specialising in sanctions and anti-money laundering at Steptoe & Johnson in Hong Kong.

Aside from its contingency planning, China has said it would "launch a counterattack against US hegemony" if Trump was to block access of Chinese banks to dollar funding and the SWIFT payment system

SGH Macro have noted that countermeasures from China could include a speeding up of the use of the Renminbi for China’s own parallel Cross-border Interbank Payment System (CIPS), a surge in issuance of RMB denominated loans to Belt and Road Initiative countries, a push for greater RMB use through the Shanghai International Energy Exchange (INE) crude oil futures, and an acceleration of the implementation of China’s Digital Currency Electronics Payment (DCEP), the first digital currency issued by a central bank.

Wednesday, July 8, 2020

BIS Innovation Hub: The Gradual March To Central Bank Digital Currency Continues To Advance

This time last year when the Bank for International Settlements released their Annual Economic Report, it combined with the announcement of a new initiative called the ‘BIS Innovation Hub‘ (also known as ‘Innovation BIS 2025‘). The BIS refer to the Innovation Hub as a medium term project that comprises three main elements:

- Identify and develop in-depth insights into critical trends in technology affecting central banking

- Develop public goods in the technology space geared towards improving the functioning of the global financial system

- Serve as a focal point for a network of central bank experts on innovation

As you can see, technological innovation is at the core of the Hub’s remit.

The initial phase of the project saw Hub’s opened up in Switzerland, Hong Kong and Singapore. An operational agreement was signed with the Hong Kong Monetary Authority in September 2019, followed by an agreement with the Swiss National Bank in October. The Hub in Singapore began operations in November.

With phase one completed, the BIS have now moved into the second phase which they warned was going to happen when the Hub first launched. Accompanying the release of this year’s Annual Economic Report, the institution announced that the Hub is expanding to new locations in both Europe and North America.

Over the next two years, the Bank of England will be opening a centre, along with the Bank of Canada, the European Central Bank and four Nordic central banks (Sweden, Denmark, Norway and Iceland). A ‘strategic partnership‘ will also be formed with the Federal Reserve System.

East and West may appear divided in the geopolitical sphere, but in the world of central banking they are very much united behind the common goal of the Hub.

As the BIS outlined in a press release, the expansion will ‘allow Innovation Hub to spur central bank work across multiple fintech pillars‘. General Manager Agustin Carstens confirmed that the ‘new centres will expand our reach significantly and help create a global force for fintech innovation‘.

Most pointedly, however, the expansion, according to the Head of the Innovation Hub Benoit Coeure, will mean that it is ‘well placed to advance work on a broad range of issues of importance to the central banking community, including digital currency and digital payments‘. Coeure also cited distributed ledger technology as a key aspect of the Hub’s work.

In October 2019 I posted an article about the Hub (Innovation BIS 2025: A Stepping Stone Towards an Economic ‘New World Order’) and argued how the introduction of it tied directly into the agenda for implementing a network of central bank digital currencies over the next few years. I followed up this article with another which offered more detail on the Innovation Hub (BIS Announce New Appointments and Launch Singapore Hub Centre).

To add more weight to the idea that the Hub exists to help facilitate a CBDC future, Agustin Carstens mentioned on presenting the BIS Annual Economic Report that ‘if CBDCs are to fulfil their potential and promise as a new means of payment, their design and implications deserve close study and consideration. The BIS will continue supporting central banks in their CBDC research and design efforts, through the new BIS Innovation Hub, its committees, and broader analytical work.’

As the Hub gathers experience, a home-grown agenda will quickly be developed. A key question informing the BIS Innovation Hub’s work is whether money itself needs to be reinvented for a changing environment, or whether the emphasis should be on improving the way it is provided and used.

As I have written about previously, central banks have now begun to outline specific technical details on how a CBDC could be built (A Look at CBDC Developments at the Bank of England – Part One). This comes as global payment systems are being reformed so as to be compatible with blockchain and distributed ledger technology – a process that is earmarked for completion around 2024.

With the events of the past few months, it is impossible to discuss CBDC’s without factoring in the impact of Covid-19. This appears increasingly to be the major international crisis that global planners hope will catalyse the move into a fully digital economic system. And the BIS Innovation Hub is ideally placed to respond.

In remarks made in April, Benoit Coeure asked whether the pandemic would ‘accelerate the shift towards virtual banking‘. Musing on his own question, Coeure stated that ‘in the next months and years, the BIS Innovation Hub will remain busy scanning technological trends in finance and their consequences for central banks and financial regulators‘.

The importance of the Hub to the CBDC agenda is there to see, particularly with the onset of Covid-19. A line in the BIS Annual Economic Report supports what Coeure had to say:

The Covid-19 crisis, and the attendant rise of electronic payments, are likely to boost CBDC development across the globe.

IMF Managing Director Kristalina Georgieva recently told Italy’s National Consultation that ‘digital is a big winner in this crisis‘ and that the pandemic may have ‘accelerated the digital transformation by two or three years‘.

The BIS insist, however, that research on CBDC’s is ‘still in its early stages, and development efforts will take some time‘.

From my perspective, by 2025 CBDC’s will begin to be introduced, initially in conjunction with cash. But the long term objective is for the abolition of all tangible financial assets to be replaced with intangible wealth. The BIS attempted to convey in their annual report that a CBDC would prove as a ‘digital complement to physical cash‘. Perhaps to begin with, but nobody should deceive themselves into believing that cash has any sustainable future if and when CBDC’s are offered to the general public.

To reinforce this notion, this is what Agustin Carstens stated during a speech at the Central Bank of Ireland in March 2019:

Like cash, a CBDC could and would be available 24/7, 365 days a year. At first glance, not much changes for someone, say, stopping off at the supermarket on the way home from work. He or she would no longer have the option of paying cash. All purchases would be electronic.

What central banks (in line with state legislatures) are not going to do is simply outlaw cash when CBDC’s become available. I believe what they want is for banknotes to dwindle to a level where they can make the argument that the servicing costs of maintaining the cash infrastructure outweigh the amount of cash still in circulation and being used for payment.

An Access to Cash report published in the UK last year warned that because of bank branch closures and the decline of ATM’s, Britain’s cash network was at real risk of collapsing. Introduce a CBDC into the equation and you can see how cash will soon be deemed nonviable. Those who might opt to use cash over a digital currency would eventually have no other option than to transfer their money into a CBDC.

One of the main goals of global planners is to target what they call the ‘unbanked‘ or the ‘underbanked‘. In other words, those who exist largely outside of the financial system and trade anonymously. The BIS Annual Report declared that 1.7 billion adults and hundreds of millions of firms ‘are tied to cash as their only means of payment‘. That is one fifth of the world’s population that central banks are seeking to bring into their world – a digital only construct in which the only alternative is a life of destitution.

Essentially, the central banking fraternity will want to be able to pinpoint the abolition of cash on the advancement of technology and the changing payment habits of the consumer, thereby taking the emphasis off themselves.

With regards to changing consumer behaviour, the unproven fear perpetuated throughout the media that cash could transmit Covid-19 has successfully managed to undermine cash to the point where a large swathe of people have stopped using it. The latest statistics from Link show that in the UK transaction volume is down 47% on this time last year.

Over time, central banks will be able to use a sustained reduction in demand for cash to their advantage. As Yves Mersch of the European Central Bank mentioned in May, ‘if our customers, the people of Europe signalled a change in payments behaviour, we would want to preserve their direct link to the ultimate owner of our currency by maintaining their access to central bank liabilities‘.

The owner being the central bank, the liabilities being a CBDC.

The ideological agenda of central banks to digitise the entirety of the world’s financial system and to maintain their power base is being spearheaded by the Bank for International Settlements through their Innovation Hub. Unless people begin to recognise where the manipulation and growth in the CBDC narrative is coming from, and how there is a targeted agenda to guide the world into a cashless society, global planners will in the years to come get their way.

Hydroxychloroquine And Fake News

The anti-hydroxychloroquine media has been full of the supposed dangers of hydroxychloroquine and its failure as a treatment for the virus.

Does hydroxychloroquine work or does it not, is it safe or dangerous, and should we be using it as a treatment for the virus?

Here we examine the evidence for and against it.

A New York doctor Vladimir Zelenko looked at treatments being used in China and Korea and gave it to 405 patients over 60 or with high-risk problems such as diabetes, asthma, obesity, hypertension or shortness of breath. In this high risk group he claimed to have cut hospital admission and mortality rates compared to what could be expected without treatment by 80 to 90%. https://internetprotocol.co/hype-news/2020/04/14/a-detailed-coronavirus-treatment-plan-from-dr-zelenko/

Dr Zelenko sent a letter to President Trump urging him to issue an executive order to roll out the treatment which the FDA was blocking. Trump announced that hydroxychloroquine looked like it could be a “game-changer”, and thus the politicization of hydroxychloroquine began.

Dr Fauci the director of the National Institute of Allergy and Infectious Diseases who was supposed to be advising Trump disagreed with him and backed Gilead’s rival treatment Remdesivir. YouTube deleted a video of Dr. Zelenko talking about the treatment on his Rabbi’s channel and despite objections that there was nothing wrong with the video YouTube never reinstated it.

In this YouTube video interview with Rudy Giulliani from July 1, which hopefully will not be deleted by the time you read this, Dr. Zelenko claims 99,3% survival rate for the high-risk patients he has treated. https://www.youtube.com/watch?v=TFwjY0qe7ro

Professor Didier Raoult of Marseilles used a similar protocol to Dr. Zelenko without the zinc. His study with a small group using hydroxychloroquine and azithromycin showed a fifty-fold benefit. He then went on to get similar results with a much larger group of 1,061 patients. Contrary to the warnings the media had been running that hydroxychloroquine would cause heart problems, no cardiac toxicity was observed and he achieved a mortality rate of only 0.5%. http://covexit.com/professor-didier-raoult-releases-the-results-of-a-new-hydroxychloroquine-treatment-study-on-1061-patients/

The media quickly found critics who claimed that the only valid proof any treatment worked was a “gold-standard” double-blind clinical trial and dismissed Dr. Zelenko’s and Raoult’s results. Dr. Zelenko and Prof. Raoult both refused on ethical grounds to give placebos to half the patients in clinical trials and they defended their data as sufficient to show the treatment did work. They both stressed that the urgency of the situation made it necessary to act on available evidence, not clinical trials which would take months to produce results and be verified. There have subsequently been over a dozen studies which confirm that Dr. Zelenko’s and Prof. Raoult’s protocols do work.

A study from the New York University Grossman school of Medicine published in May found patients given hydroxychloroquine and azithromycin at an early stage had a lower need for hospitalization than those who were not. The addition of zinc improved the results even more. https://www.medrxiv.org/content/10.1101/2020.05.02.20080036v1.full.pdf

“I’ll tell you what. If this is me, and I am me, and I end up getting this thing, I am going to want Zinc plus Hydroxychloroquine plus Azithromycin. I would want that treatment.” commented Chris Martenson, PhD, in his video series about COVID-19 where he talks about this study. http://covexit.com/i-am-going-to-want-zinc-plus-hydroxychloroquine-plus-azithromycin-chris-masterson-phd/

Yale Professor Harvey Risch submitted a report of five trials and studies using hydroxychloroquine in the American Journal of Epistemology titled “Early Outpatient Treatment of Symptomatic, High-Risk Covid-19 Patients that Should be Ramped-Up Immediately as Key to the Pandemic Crisis. https://www.medrxiv.org/content/10.1101/2020.05.02.20080036v1.

Prof. Risch agreed that, in an ideal world, randomized double-blinded controlled clinical trials would be preferable but in the meantime “for the great majority I conclude that hydroxychloroquine and azithromycin, preferably with zinc can be this outpatient treatment, at least until we find or add something better. It is our obligation not to stand by as the old and infirm are killed by this disease and our economy is destroyed by it and we have nothing to offer except high-mortality hospital treatment. Available evidence of efficacy of HCQ+AZ has been repeatedly described in the media as anecdotal, but most certainly is not” http://covexit.com/yale-epidemiology-professor-urges-hydroxychloroquine-azithromycin-early-therapy-for-covid-19/

A Brazilian study found 4.6 times less hospitalization in patients who took hydroxychloroquine and azithromycin within seven days of infection. Professor Paolo Zanotto reported that there were “41% of deaths among those who did not choose therapy and were hospitalized against 0% among those who chose by therapy.” http://covexit.com/new-brazilian-study-shows-telemedicine-hydroxychloroquine-treatment-reduce-need-for-hospitalization/

A retrospective study of 2,541 Detroit cases showed up to 71% reduction in mortality in early treatment with hydroxychloroquine azithromycin. https://doi.org/10.1016/j.ijid.2020.06.099

A retrospective study of 3,737 cases in Marseille showed a reduction of 50% in mortality without any adverse effects in the Hydroxychloroquine and Azithromycin group. https://doi.org/10.1016/j.tmaid.2020.101791

A meta-analysis of 105,040 cases from 20 studies in 9 countries found a reduction in mortality by up to three times in groups treated early with Hydroxychloroquine and Azithromycin: https://doi.org/10.1016/j.nmni.2020.100709

A study of 6,493 patients with COVID-19 at Mount Sinai Hospital, New York, showed that hydroxychloroquine helped to reduce mortality in hospitalized patients. . https://doi.org/10.1007/s11606-020-05983-z

On July 3 a study by a Michigan team at Henry Ford Health System found that 13 percent of patients who were given the drug early on survived while 26 percent of patients who were not given the drug died. The study which included 2,541 patients was published in the International Journal of Infectious Diseases and determined that hydroxychloroquine and azithromycin provided a 71% hazard ratio reduction.

“Our results do differ from some other studies. What we think was important in ours … is that patients were treated early. For hydroxychloroquine to have a benefit, it needs to begin before the patients begin to suffer some of the severe immune reactions that patients can have with COVID” said Dr. Marcus Zervos, head of infectious disease for Henry Ford Health System. https://www.ijidonline.com/article/S1201-9712(20)30534-8/fulltext

A statement from the Trump campaign hailed the study as fantastic news.

“Fortunately, the Trump Administration secured a massive supply of hydroxychloroquine for the national stockpile months ago, yet this is the same drug that the media and the Biden campaign spent weeks trying to discredit and spread fear and doubt around because President Trump dared to mention it as a potential treatment for coronavirus. The new study from the Henry Ford Health System should be a clear message to the media and the Democrats: stop the bizarre attempts to discredit hydroxychloroquine to satisfy your own anti-Trump agenda. It may be costing lives.”

Also on July 3 results from another study by Dr. Takahisa Mikami and his team at Icahn School of Medicine at Mount Sinai in New York, was published in the Journal of General Internal Medicine. The study analyzed the outcomes of 6,493 patients who had laboratory-confirmed COVID-19 in the New York City metropolitan area and found that hydroxychloroquine decreased mortality hazard ratio by 47% percent. https://doi.org/10.1007/s11606-020-05983-z

Many more studies in addition to those above also show that treating early with hydroxychloroquine and azithromycin and preferably also zinc is the key to ending hospitalization and death. https://c19study.com/

The trials that confirm Dr. Zelenko’s and Prof. Raoult’s finding have been mostly ignored or dismissed by the anti-hydroxychloroquine media.

The trials that they have given attention to are those that supposedly show that hydroxychloroquine doesn’t help or even increases the death rate.

Statistics from the US Veterans hospital study (Magagnoli, 2020) showed patients who were given hydroxychloroquine died more frequently than those who did not. https://www.medrxiv.org/content/10.1101/2020.04.16.20065920v2

In this study hydroxychloroquine was only given to patients who were already seriously ill and those who were getting better without any treatment were not given it. Predictably those given hydroxychloroquine did worse than the untreated group but those conducting the study claimed it as proof that hydroxychloroquine did not work. Professor Raoult commented “In the current period, it seems that passion dominates rigorous and balanced scientific analysis and may lead to scientific misconduct. The study by Magagnoli et al is an absolutely spectacular example of this,” http://covexit.com/the-definitive-guide-to-discrediting-hydroxychloroquine-based-treatments-to-covid-19-part-1/

One of the collaborators in the trial reportedly received a $260 million grant from Gilead Sciences Inc. which produces the rival treatment Remdesivir.

The US Secretary of Veteran Affairs Robert Wilkie, acknowledged that the drug was given to veterans at their last stages of life and added “We know the drug has been working on middle-age and young veterans … it is working in stopping the progression of the disease.”

Another study that supposedly showed that hydroxychloroquine was dangerous and didn’t work came from a group that claimed to have data on hydroxychloroquine use for Covid-19 from hospitals around the world The study was published on 22 May in the Lancet medical journal. The results were immediately disputed by one of the Australian hospitals from which Surgisphere, the company which supplied the data claimed to have obtained it.

Following this a group of 140 scientists, researchers, and statisticians wrote an open letter to the Lancet and the authors of the study questioning the data used. A Guardian investigation revealed that Surgisphere was run by employees who lacked any scientific background. One was a science fiction author and fantasy artist and another was an “adult model and events hostess.” The Lancet conducted an independent investigation, retracted the study and in an interview with The New York Times, Dr. Richard Horton, the editor in chief admitted that the study should never have appeared in his journal. https://www.thelancet.com/journals/lancet/article/PIIS0140-6736(20)31180-6/fulltext

On the basis of the flawed Lancet study the WHO suspended the hydroxychloroquine trials it was sponsoring. When the study was retracted they resumed them briefly but soon after suspended them again on the results of another faulty study, the Oxford University’s “RECOVERY Trial”.

The researchers in this trial gave patients massive doses of hydroxychloroquine without the necessary addition of azithromycin and they started treatment too late. That the RECOVERY Trial was never going to work was pointed out on the Covexit website two months before it started. http://covexit.com/uk-recovery-trial-inadequate-hydroxychloroquine-treatment-predictably-fails/”

Prof. Raoult compared the Oxford academics who carried out the hydroxychloroquine section of the RECOVERY trial to the Marx Brothers in a video interview titled “The Marx Brothers are Doing Science – the Example of RECOVERY” http://covexit.com/professor-raoult-compares-the-oxford-recovery-trial-academics-to-the-marx-brothers/

Prof. Raoult sarcastically commented that the good news that came out of the trial was that hydroxychloroquine is not toxic. The RECOVERY trial used a 2,400 mg dose on the first day compared to Dr.Raoult’s 600 mg. Even with such high dosage there were no cardiac side effects with any of the participants. Prof. Raoult recalled that “two weeks ago one was told everybody was dying because of cardiac issues. At least, this trial is good to assess the toxicity of hydroxychloroquine as they did not announce any toxicity, even at such high dosage”.

Although by now it should have been abundantly clear that hydroxychloroquine and azithromycin only worked in combination and if given early, not to patients in hospital more than seven days after infection, in April the US National Heart, Lung, and Blood Institute (NHLBI) at the National Institutes of Health (NIH) started hydroxychloroquine trials on hospitalized patients too late, some already in emergency wards, and then abandoned the trials with the conclusion that “hydroxychloroquine does no harm but provides no benefit”. The FDA cancelled its emergency use authorization and the NIH halted their clinical trials of hydroxychloroquine

The media hostile to hydroxychloroquine successfully whipped up hysteria about its supposed dangers although it has an excellent safety record and it is not even alongside aspirin on the WHO list of the 100 most dangerous drugs. Specialists and doctors prescribing hydroxychloroquine for Rheumatoid Arthritis and Lupus have confirmed that thousands of patients are being prescribed the same dose Dr. Zelenko is giving for five days for years on end without problems.

Were the failed studies faulty because of ignorance or by design?

Who gains from them?

The drug companies can’t make much money on a generic drug, and they found in the media and the scientific community willing accomplices to stop its use. Gilead Sciences Inc. gives grants in addition to those mentioned above to Oxford University and the WHO. Is it possible that people in these prestigious institutions may have their integrity compromised by money, or is it mere coincidence that Gilead with their rival treatment is funding them?

Some of the media will do anything to make Trump look like a fool and these faulty trials were the perfect opportunity. The media hostile to hydroxychloroquine downplayed or cast doubt on the many successful studies and trials with hydroxychloroquine and made the most of the faulty trials as proof that the drug Trump had touted didn’t work.

For the media it seems to have been more about scoring political points and increasing their audience ratings rather than investigative reporting which uncovers the truth. For those who are dying and their families and friends as a result of this treatment not being used because of media misinformation it is lives tragically lost, and for the rest of us it is our economies sinking, businesses failing, and unemployment, poverty and suffering rising.

Hundreds of thousands of lives could be saved, and los,s ruin, suffering and devastation to our economies and societies avoided if we simply started using this safe, cheap and readily available treatment. It is a ludicrous and tragic farce that because of the massive misinformation on behalf of corporate greed and political point scoring that we are not.

Subscribe to:

Posts (Atom)