Elite Forex Blog - Market analysis & intelligence, see more at globalintelhub.com

Wednesday, March 31, 2021

Tuesday, March 30, 2021

Health Care Workers Bragging About Forged Vax Cards As Fake "Passports" Hit The Street

It was inevitable.

Healthcare workers across the country are taking to social media to brag about stealing COVID-19 vaccination cards from their jobs in order to falsify their vaccination status - allowing them to falsify their vaccine status.

"I work at a pharmacy and grabbed blank ones for me and my hubby," said one TikTok user, who was identified by other users as a pharmacy tech in Illinois - and promptly reported to state healthcare authorities, according to the Daily Beast.

"Can I pay you to ship a couple to me," another TikTok user identified as a Texas nurse wrote under the original video bragging about the theft - and was also promptly reported to Texas healthcare authorities.

"I got a template if u want it," posted one TikTok user under a viral video about faking vaccination cards.

Becca Walker, one of the two users sounding the alarm, posted: "I’m pretty sure you’re not supposed to steal from your job. And I’m pretty sure you’re not supposed to steal blank vaccination papers for COVID-19 to falsify information and claim that you and your husband were vaccinated when in actuality you were not."

"Stop hating on me! I don’t care what any of you think. I did what is best for my husband and I," posted the Illinois pharmacy tech right before she wiped her TikTok account history - only to try and cover her tracks by posting a fake TikTok claiming to be a 16-year-old British girl doing a social media experiment for her filmmaker father.

Walker, along with user Savannah Sparks, have since posted several more TikTok videos calling out healthcare workers for allegedly forging or attempting to forge vaccine cards. They claim dozens of tips have been sent to them by other users on the platform, but which they haven't been able to verify.

If it seems surprising that vaccine resistance would exist among medical professionals, even those with a strong background in science, Schaffer said it simply highlights how many Americans are still resistant to vaccination, more than three months after the first jabs went into the arms of frontline health-care workers. In February, a survey conducted by experts from Northwestern, Northeastern, Rutgers and Harvard universities found that 21 percent of health-care workers surveyed did not want to be vaccinated. Hesitancy, which indicates skepticism towards the vaccine but not an outright unwillingness to be vaccinated, was 37 percent. -Daily Beast

Meanwhile, fake "vaccine passports" are already being sold on the street. Via Summit News:

* * *

Fake ‘vaccine passports’ are already being sold by criminals on the streets, according to TV personality Andrew Gruel, who said he saw it happen.

Earlier this week it was revealed that the Biden administration has been working with tech companies and non-profits to create a vaccine passport that “will play a role in multiple aspects of life.”

According to a CNN report, the vaccine passports, which could be ready in weeks, will be a condition of the United States returning to “normalcy” before the end of the year.

However, it appears as though street scammers have already beaten the government to the chase.

“Had to work late last night,” tweeted TV host Andrew Gruel. “Walked through a back alley to get to my car. There were 2 shady guys selling fake vaccine passports out of the back of a Cadillac. A market is born.”

The ridiculous takeaway from the introduction of vaccine passports is that Americans may be forced to show ID to watch a baseball game while voting can still take place with no ID requirements whatsoever.

As we highlighted yesterday, the vaccine passport isn’t just a proof of vaccination system, it’s a digital ID card that will likely be linked to the facial recognition camera network.

This will then grease the skids for the full implementation of a Communist Chinese-style social credit score system where dissidents are denied basic rights and services and have to live in a de facto state of permanent lockdown.

Monday, March 29, 2021

Lockdowns Worsen The Health Crisis

Authored by Kiley Holliday and Jenin Younes via the American Institute for Economic Research,

One of the most infuriating aspects of a year replete with illogical, short-sighted public health mandates has been the utter failure of those within the public health profession to adequately address the role that poor diet and lack of exercise have played in exacerbating the coronavirus crisis. In fact, many of the decrees ostensibly issued in the name of public health have had the effect only of aggravating the underlying problem.

A recent global study found that obesity is a “driving factor in COVID-19 deaths,” and that Covid-19 death rates are an astonishing ten times higher in countries where most adults are overweight. Although advanced age is the strongest indicator of a severe outcome from a coronavirus infection, “being overweight comes a close second,” the report determined. The CEO of the World Obesity Federation went so far as to blame the “failure to address the root causes of obesity over many decades . . . for hundreds of thousands of preventable deaths.” While the study makes evident the degree to which poor underlying health is a driving force in coronavirus deaths, we have known almost since the beginning that being overweight or obese significantly increases the risk of a severe outcome.

Given this information, the Anthony Faucis and Eric Feigl-Dings of the world should focus on alerting people to the dangers of being overweight and obese, and expending significant efforts to encourage exercise and healthy diet. Instead, they have spent the past twelve months urging people to “stay home, save lives” and to wear two masks, if not three or four, a measure not shown to have mitigated coronavirus deaths at all.

In a similar vein, governors around the country have ordered gyms closed, along with countless other businesses. In New York, gyms have been open since this past summer, but patrons must wear a mask at all times, even while exercising. Due to the extreme discomfort of exercising while masked, I (Jenin) quit my gym months ago for the first time in two decades and began relying solely on outdoor forms of exercise to stay in shape. I doubt I am the only one to have done so for similar reasons.

Thus, equally counterproductive are outdoor mask mandates in states like Massachusetts, which have the pernicious effect of discouraging outdoor as well as indoor exercise. All this, despite the fact that the World Health Organization (WHO) advised against wearing a mask while exercising, pointing to research demonstrating that wearing them even during mild to moderate physical activity can “lead to significant negative cardiovascular and pulmonary effects in both healthy people and those with underlying respiratory diseases.” (Of course, these findings contradicted the religion of face-coverings that has overtaken our society, so were automatically discounted, not on the merits but because they did not fit within the dominant narrative).

Likewise, especially at the beginning of the crisis, governors around the nation closed playgrounds, national parks, and hiking trails, another policy choice that simply deprived people of the opportunity to engage in healthy outdoor activities. Mercifully, many of these orders have been reversed following significant pushback from the public, although never with an admission on the part of government officials that such measures were detrimental to public health.

While exercise is vital for overall health, significant research suggests that those who are struggling with obesity require dietary changes in order to lose weight. Predictably, the shutdown strategy, which entailed people working from home much more often or exclusively, led to a sharp increase in unhealthy eating habits. People began snacking on processed foods in much greater quantities, in large part to ease stress, giving Mondelez International — the manufacturer of Oreos — and other unhealthy, processed snacks cause to celebrate.

The exhortations of the “stay home” crowd, as well as the implementation of measures such as gym and park closures have had the expected impact, which is that 42 percent of adults in the United States reported undesired weight gain during the past year, with an average of twenty-nine pounds. Millennials as a group fared the absolute worst, with 48 percent reporting unwanted weight gain, at an average of forty-one pounds. Suffice it to say, a significant portion of adults who in March of 2020 were not at substantial risk of a severe outcome from coronavirus now can be categorized as in an elevated risk group.

The cause of this national belt-loosening is not merely staying home and moving around less, but anxiety and depression caused by social isolation, both of which have been demonstrated to cause weight gain and obesity. Society has now organized itself around the principle of depriving people of meaningful social contact with family, friends, and coworkers for the better part of a year. One need not have a degree in psychology to recognize that such an approach is bound to aggravate the obesity crisis, as indeed it has. In fact, our newly confirmed Surgeon General, Dr. Vivek H. Murthy has written an entire book on health effects of loneliness, arguing that it is associated with increased risk of heart disease, dementia, obesity, and sleep disorders.

Yet despite these circumstances, publications such as the New York Times have been running grossly irresponsible pieces with headlines such as Should You Worry About Your Kid’s Pandemic Weight Gain? (the answer of the author, Virginia Sole-Smith is, generally speaking, ‘no’). In typical fashion, Sole-Smith ascribes the rising incidence of childhood obesity to the pandemic itself, rather than the decision to shutter classrooms for many months. She contends that because childhood dieting can lead to adult eating disorders, parents should avoid treating their children’s weight gain as a “problem to be solved.” Parents should inquire about the mental health of their children, but also accept that the circumstances causing their depression and late-night stress eating simply cannot be changed, as though it is perfectly reasonable from a public health perspective to prioritize Covid prevention (a virus less harmful to children than the flu) above all things.

A more recent Times article, by Sandra E. Garcia dodged the issue of underlying health, and instead argued that people whose body mass index (BMI) qualified them for early vaccination should take advantage of that status. The article quoted Emma Specter of Vogue magazine saying “a metric of health that has long been called into question by fat activists and medical experts alike could stand to actively benefit fat people for the first time.”

Similarly, Garcia quoted a tweet that quipped “because my BMI permits me to get the vaccine tomorrow, and because the vaccination will enable me to protect myself and others, my thick thighs will in fact save lives.” While BMI is an imperfect measure of an individual’s health and, of course, not all thin people are healthy, the past thirty years has shown us that rising rates of obesity and chronic diseases go hand in hand.

Apparently, Garcia’s ideological commitment to the narrative of identity politics precludes any admission that being overweight, and particularly obese, is a significant predictor of a severe outcome from a coronavirus infection, and that many people can take steps to lose weight and thereby become healthier and even remove themselves from at-risk categories. Getting vaccinated will not solve the larger problem, as it can only protect one from the coronavirus and does not cure the various comorbidities resulting from poor diet and a sedentary lifestyle.

Under the pretense of “body positivity,” the authors of these articles are normalizing a lifestyle that leads to significant health problems. Instead of questioning the circumstances that create obesity – conditions that have only worsened during the pandemic – they propound against all reason and logic that obesity is not unhealthy, or that it is somehow unhealthier to recognize and deal with it. This effectively steers people away from drawing the all-too obvious conclusion that the decision to close schools, gyms, and workplaces and force people to shelter in place for months at a time was never in the interest of public health.

Of course, not everyone can lose weight for a variety of reasons, spanning the spectrum from metabolic disorders to inadequate access to healthy food or time to exercise. The inability of many to lead a healthy lifestyle can be directly tied to significant, systemic problems in our society and country today, and it is not within the scope of this article to address this matter. Nor do we advocate “fat-shaming,” or any cruelty directed at individuals because they are overweight or obese. Rather, we are suggesting that the government and public health authorities should not issue and support, respectively, mandates that curtail freedom to the point of fostering depression and disease in the general population. That includes not only closures of parks and gyms, but measures such as mandatory mask-wearing during exercise and stay-at-home orders, which inevitably leads to social isolation.

In stark contrast to the approach they have taken, public health authorities, and by extension politicians and the media, ought to encourage the public to maintain a healthy weight, and not just during the pandemic. In fact, it is their moral obligation to address the issue head-on, rather than putting identity politics or political correctness before public health, and to vigorously renounce measures that are creating an unhealthier nation.

We suspect that one day, the quarantining of entire societies that was carried out in response to the coronavirus pandemic, leading to vast swaths of the population becoming unhealthier overall and ironically more susceptible to severe outcomes from the virus, will be seen as the 21st century version of bloodletting. As the epidemiologist Martin Kulldorff has observed, public health is not just about one disease, but all health outcomes. Apparently, in 2020, the authorities forgot this obvious truth.

CFDs - The Dirty Little Secret Behind The Collapse Of Archegos

Stop us if you've heard this one before - Wall Street prime brokers allowed hedge funds to dance while the music was playing with ever greater leverage in off-exchange and unregulated derivatives... until the first sign of trouble and the whole house of cards comes crashing down in a potentially systemic manner.

The bloodbath in various media stocks on Friday has brought light back to one of the dark corners of the equity trading business - so-called contracts-for-differences (CFDs).

As Bloomberg reports, much of the leverage used by Hwang’s Archegos Capital was provided by banks including Nomura and Credit Suisse - who have most recently admitted huge losses - as CFDs, which are made off exchanges, allow managers like Hwang to amass stakes in publicly traded companies without having to declare their holdings (far in excess of the 5% stakes that require regulatory reporting).

Crucially, as Bloomberg notes, this means Archegos may never actually have owned most of the underlying securities - if any at all - as the CFD is akin to a privately-arranged (i.e. off exchange and bespoke) futures contract where the differences in the settlement between the open and closing trade prices are cash-settled (there is no delivery of physical goods or securities with CFDs).

What makes the situation worse is that Archegos reportedly took positions in these CFDs with various prime brokers - and because these positions are by their nature not centrally cleared or aggregated, this left prime broker X unaware of their client's exposures with prime broker Y... which in this case was huge.

The leverage Hwang was given made him look like a trading genius as the various positions he took were pumped and pumped (and helped by gamma-squeezers) but now look like a reckless gambling fool as the bets collapsed.

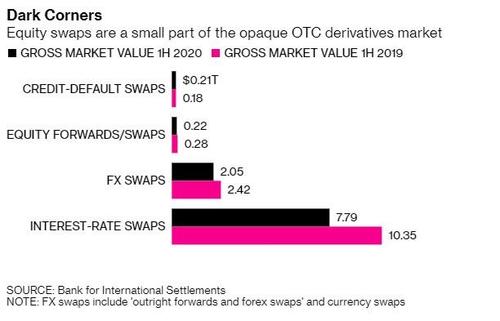

CFDs linked to stocks (with a gross market value of around $282 billion at end June 2020) are among bespoke derivatives that investors trade privately between themselves, or over-the-counter, instead of through public exchanges. This is exactly the kind of hidden risk that amplified the losses during the 2008 financial crisis.

As Bloomberg notes, regulators have begun clamping down on CFDs in recent years because they’re concerned the derivatives are too complex and too risky for retail investors, with the European Securities and Markets Authority in 2018 restricting the distribution to individuals and capping leverage. In the U.S., CFDs are largely banned for amateur traders... but not for hedge fund managers who are "sophisticated"?

But, banks still favor them because they can make a large profit without needing to set aside as much capital versus trading actual securities (driven to this opaque market as an unintended consequence of heavy regulation following the 2008 financial crisis).

In the case of Archegos, there is very little transparency about Hwang’s trades, but market participants suggest his assets had grown to anywhere from $5 billion to $10 billion in recent years with total exposure topping $50 billion. And bear in mind, this is not 'leverage' in the old-fashioned sense (i.e. banks allow you buy X-times the amount of stocks relative to your capital); this is purely synthetic - the firm has no actual underlying asset to fall back on, but is linearly exposed to losses (and gains) on a margined basis.

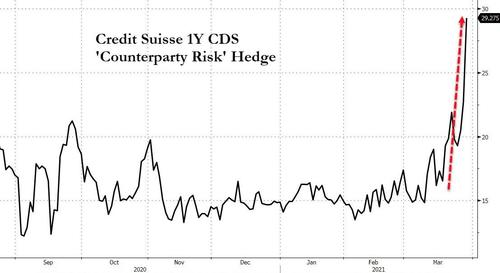

And as we noted at the beginning, this has the potential to be much more systemic as the losses created by Archegos' margin calls trigger more margin calls and more potential losses for the prime brokers. Think we are exaggerating, then explain why the costs of counterparty risk hedging for Credit Suisse for example, has exploded in the last few days...

Source: Bloomberg

Mohammed El-Erian told CNBC this morning that "It seems to be a one-off ... for now, it looks contained. And that's a good thing." But added "what we don't want is a pile-up."

We look forward to the Congressional hearings on this.

Sunday, March 28, 2021

Objective:Health: Ivermectin: The Suppressed Miracle Drug for Covid-19

The studies on the drug are nothing short of astounding - more effective than any drug or intervention previously studied. Yet YouTube felt justified in banning videos of congress testimony about the drug, Twitter has blocked links to a peer-reviewed medical journal that had the audacity to publish a study on the drug and the corporate media have been full of articles about the 'dangers' of this drug - despite the fact that it's been approved by the FDA (unlike Covid vaccines) and has been used safely for the last 5 decades.

Join us on this episode of Objective:Health where we give you the low-down on a truly amazing drug that 'THEY' don't want you to know about: Ivermectin.

For other health-related news and more, you can find us on:

♥Twitter: https://twitter.com/objecthealth

♥Facebook: https://www.facebook.com/objecthealth/

♥Brighteon: https://www.brighteon.com/channel/objectivehealth

♥LBRY: https://lbry.tv/@objectivehealth:f

And you can check out all of our previous shows (pre YouTube) here:

♥https://docs.google.com/spreadsheets/d/16H-nK-N0ANdsA5JFTT12_HU5nUYRVS9YcQh331dG2MI/edit?usp=sharing

Running Time: 00:31:09

Download: MP3 — 28.5 MB

UN Decries "Mass Murder" After 114 Single-Day Protester Deaths In Myanmar

Authored by Kenny Stancil via CommonDreams.org,

While Myanmar's military celebrated Armed Forces Day on Saturday with a parade through the capital, the ruling junta's security forces killed more than 100 people elsewhere throughout the country in the deadliest crackdown on peaceful pro-democracy protesters since last month's coup.

According to Myanmar Now, soldiers and police had killed at least 114 people, including children, nationwide as of 9:30 pm on Saturday in Myanmar. "The military celebrated Armed Forces Day by committing mass murder against the people it should be defending," said Tom Andrews, the United Nations special rapporteur on the situation of human rights in Myanmar. "The Civil Disobedience Movement is responding with powerful weapons of peace."

"It's past time," Andrews added, "for the world to respond in kind with and for the people of Myanmar." Saturday's brutal massacre, which came just one day after a regional human rights group reported that the total death toll since the military regime seized power on February 1 had climbed to 328, was widely condemned by diplomats around the world. "This bloodshed is horrifying," said US Ambassador Thomas Vajda. "Myanmar's people have spoken clearly: they do not want to live under military rule."

The European Union's delegation to Myanmar tweeted: "This 76th Myanmar Armed Forces Day will stay engraved as a day of terror and dishonor. The killing of unarmed civilians, including children, are indefensible acts." British foreign secretary Dominic Raab said that "today's killing of unarmed civilians, including children, marks a new low. We will work with our international partners to end this senseless violence, hold those responsible to account, and secure a path back to democracy."

In a statement issued Thursday, Andrews had warned that "conditions in Myanmar are deteriorating, but they will likely get much worse without an immediate robust, international response in support of those under siege."

"It is imperative that the international community heed the recent call of U.N. Secretary-General António Guterres for a 'firm, unified international response,'" Andrews said. "To date, however, the limited sanctions imposed by member states do not cut the junta's access to revenue that help sustain its illegal activities, and the slow pace of diplomacy is out of step with the scale of the crisis." Andrews noted that "the incremental approach to sanctions has left the most lucrative business assets of the junta unscathed. It needs to be replaced by robust action that includes a diplomatic offensive designed to meet the moment."

"Without a focused, diplomatic solution, including the hosting of an emergency summit that brings together Myanmar's neighbors and those countries with great influence in the region, I fear the situation of human rights in Myanmar will further deteriorate as the junta increases the rate of murders, enforced disappearances, and torture," he said.

Andrews' fears were realized Saturday as the military escalated its use of lethal violence against anti-coup demonstrators and other civilians. "They are killing us like birds or chickens, even in our homes," resident Thu Ya Zaw told Reuters in the central town of Myingyan. "We will keep protesting regardless... We must fight until the junta falls."

The resolve of pro-democracy protesters is evident. According to Al Jazeera, citizens defied a "military warning that they could be shot 'in the head and back'" in order to take to "the streets of Yangon, Mandalay and other towns." Kyaw Win, the director of the Burma Human Rights Network in the United Kingdom, told BBC News that the military had shown it had "no limits, no principles." Win added, "It's a massacre, it's not a crackdown anymore."

In his statement released prior to Saturday's wholesale killing, Andrews emphasized that "it is critical that the people of Myanmar... the duly elected illegally deposed parliamentarians who make up the Committee Representing Pyidaungsu Hluttaw, and opposition leaders and activists see that the international community is working towards a diplomatic solution in support of the peaceful Civil Disobedience Movement."

"This combined course of action—domestic peaceful resistance, sustained pressure, and international diplomatic momentum—will have a greater chance for success than taking up arms," Andrews continued, "and will save untold numbers of lives."

"Member states have an opportunity to demonstrate this alternative, but the window in which this can be achieved is closing rapidly," he said, adding: "I fear that the international community has only a short time remaining to act." That warning has become even more urgent since it was first shared.

WARNING – Stupidity pandemic, take action to protect life and property

As explained in Splitting Pennies, the world is not as it seems.

Trading is information arbitrage, anytime you buy the seller has the opposite opinion. Generating alpha whether from day trading or long-term investing involves the same analysis on the underlying strategy. Therefore, the more the opponent can cripple your information advantage, the better. Of course, markets are not fair – hedge funds, banks, market makers, and other big fish will do whatever it takes to make sure they win, even if they might do something that violates the rules they sign to agree to.

In fact, they spend billions of dollars promoting stupidity, in the hope of dumbing you down to the point of making bad decisions, and not understanding how inflation is slowly killing you. So we don’t sound trite, let’s use the most recent ridiculous public example of this, in the spirit of the Simon Black absurdity of the week. Bill Gates Funds An Effort To Teach Kids That Math Is Racist

According to Bill Gates, math is racist. Judging from where he spends his money, the Microsoft co-founder seems to believe it suffers from white supremacy and the billionaire is funding a course teaching that to kids. He’s already handed out a $1 million grant.

Bill Gates’ foundation, The Bill and Melinda Gates Foundation, recently handed over the sizable grant to The Education Trust Inc., the non-profit that, per their mission statement, “works to close opportunity gaps that disproportionately affect students of color and students from low-income families.” A very worthy cause, no doubt. But what is making its way around social media is a screenshot of the EquitableMath.org website and its corresponding statement, “White supremacy culture shows up in math classrooms when…The focus is on getting the ‘right’ answer.”

What’s scary is not the absurdity, that is clear – TO US. What affect will programs like this have in 5, 10, or 20 years? Small children are now being exposed to this nonsense, will they question science in favor of cult when they grow up?

Clearly Bill Gates is a genius, so why would he be funding a program to make people stupid? Because it serves his agenda in many ways. First and foremost, he’s involved in a conspiracy which can be only boiled down to a plot to steal the world they call the “Great Reset” and having informed, healthy, and active humans on this planet is only a huge barricade to their success. They need addicted, obese, brainwashed sycophants fighting over petty squabbles, so absorbed with their daily struggle for survival, or for corporate power, they become anesthetized to the drama of their plans, motives, and means to get there.

Wall Street is happy to comply with this plan, so groups like Robinhood can fleece retail customers out of whatever they were able to cobble together. We’re going to do a follow up piece on the plot to steal the world, here we are focusing on the growing stupidity pandemic. The point is that stupidity is good for business! Do you think all those Robinhood traders who got fleeced are reading trading books to re-tool their strategy, or do you think they are kicking back another 6 pack washing over their fast food GMO dinner?

“COVID” is not the threat they say it is, just like “Terrorists” were a fake threat. The real threat to life and property is stupidity. We’re not referencing the Darwin awards, we’re talking about the mass extermination mass vaccination program that has been in the skunk works for more than 10 years. The goal of reducing the population of the world is also a sideshow to the real goal, but it provides a good reference. So let’s start with the public statements and work top down:

“First, we’ve got population. The world today has 6.8 billion people. That’s headed up to about nine billion. Now, if we do a really great job on new vaccines, health care, reproductive health services, we could lower that by, perhaps, 10 or 15 percent …”

The obvious thought of rational humans reading this (there are so few) is: Is this hyperbole, or a description of a plan? Well, let’s take a few examples of things going on this may reference.

New research conducted by environmental justice scholars at Vermont's Bennington College reveals that between 2016 and 2020, the US military oversaw the "clandestine burning" of more than 20 million pounds of Aqueous Fire Fighting Foam in low-income communities around the country—even though there is no evidence that incineration destroys the toxic "forever chemicals" that make up the foam and are linked to a range of cancers, developmental disorders, immune dysfunction, and infertility. PFAS are so risky that they not only endanger public health but threaten to undermine human reproduction writ large.

- It was announced that the International Planned Parenthood Federation, Western Hemisphere Region, Inc. announced today that it has received a $1,730,000 gift from the Bill & Melinda Gates Foundation.[1] … For those identifying historical figures with racist roots who should be removed from public view because of their evil histories, Planned Parenthood’s founder, Margaret Sanger, must join that list. In promoting birth control, she advanced a controversial "Negro Project," wrote in her autobiography about speaking to a Ku Klux Klan group and advocated for a eugenics approach to breeding for “the gradual suppression, elimination and eventual extinction, of defective stocks — those human weeds which threaten the blooming of the finest flowers of American civilization.”[2] “We do not want word to go out that we want to exterminate the Negro population, and the minister is the man who can straighten out that idea if it ever occurs to any of their more rebellious members.”

- In 2009, several schools for tribal children in Khammam district in Telangana — then a part of undivided Andhra Pradesh — became sites for observation studies for a cervical cancer vaccine that was administered to thousands of girls aged between nine and 15. The girls were administered the Human Papilloma Virus (HPV) vaccine in three rounds that year under the supervision of state health department officials. The vaccine used was Gardasil, manufactured by Merck. It was administered to around 16,000 girls in the district, many of whom stayed in state government-run hostels meant for tribal students.

Months later, many girls started falling ill and by 2010 five of them died. Two more deaths were reported from Vadodara, Gujarat, where an estimated 14,000 children studying in schools meant for tribal children were also vaccinated with another brand of HPV vaccine, Cervarix, manufactured by GSK. Earlier in the week, the Associated Press reported that scores of teenaged girls were .. The committee found that consent for conducting these studies, in many cases, was taken from the hostel wardens, which was a flagrant violation of norms. In many other cases, thumbprint impressions of their poor and illiterate parents were duly affixed onto the consent form. The children also had no idea about the nature of the disease or the vaccine. The authorities concerned could not furnish requisite consent forms for the vaccinated children in a huge number of cases.[3]

Ironically, the Rockefeller Foundation is the lead creator of the COVID mask policies, lockdowns, and related policies. They are also the creator of Eugenics, which was later adopted by Hitler and the Nazis (not the other way around):

Beginning in 1930 the Rockefeller Foundation provided financial support to the Kaiser Wilhelm Institute of Anthropology, Human Heredity, and Eugenics,[25] which later inspired and conducted eugenics experiments in the Third Reich.

The Rockefeller Foundation funded Nazi racial studies even after it was clear that this research was being used to rationalize the demonizing of Jews and other groups. Up until 1939 the Rockefeller Foundation was funding research used to support Nazi racial science studies at the Kaiser Wilhelm Institute of Anthropology, Human Heredity, and Eugenics (KWIA.) Reports submitted to Rockefeller did not hide what these studies were being used to justify, but Rockefeller continued the funding and refrained from criticizing this research so closely derived from Nazi ideology. The Rockefeller Foundation did not alert "the world to the nature of German science and the racist folly" that German anthropology promulgated, and Rockefeller funded, for years after the passage of the 1935 Nuremberg racial laws.[26]

So their agenda is clear. And 90% of people have bought into this fantasy, that an invisible scrouge is flooding our society with the potential to kill us all.

Mask wearing increases your risk of dying from COVID because of ‘mask mouth.’ In fact, if you combine all the policies together, there’s only one common theme – get sick. No where in the CDC or other recommendations for avoiding COVID do they mention a good diet, healthy habits, exercise, eating Vitamin D and C or Zinc, or other immune boosters – or doing anything to help your general health, which will help fight any disease including COVID if you get it. They are only selling vaccines which are similar to pharmaceuticals in that the likely long term prescription is to get daily or weekly vaccines because an mRNA ‘vaccine’ disrupts your body’s natural ability to fight disease. They want people to be dependent on big pharma. Like any homeopathic remedy such as the conspiracy against Cannabis, the COVID mainstream narrative is pushing for stupidity so you feel weak and helpless, and boy do they have a solution to help you.

By the way, COVID operation is a means to an end, it is not the end. Our hypothesis here is that Stupidity as it is being spread is more dangerous than COVID itself. Finally we have learned that respirators were killing people, how many doctors, who caught the stupid bug, were brainwashed into gassing their patients to an early death because they watched too much TV?

Trump was never the prize – YOU are the prize, like Trump once said. They don’t want to come after me, they want to come after YOU, and that’s what they are doing.

But again, this is a big IQ test. America is a free country and as long as 100 Million of us own guns, our freedoms are not going to be taken away (except perhaps in select cities).

Traders should take note as this is not only about your health but your financial health. There is only one chart you need to understand and it’s this M1 chart produced by the St. Louis Fed:

Although Crypto has been on a tear, Bitcoin is denominated in US Dollars. Crypto is a closed system. You need to first buy USD and then buy BTC. When people are buying BTC they are selling USD. For a detailed explanation of the Forex & Crypto pair trading system, see Splitting Pennies or Splitting Bits.

Real Estate, Crypto, Stocks, Private Equity (particularly Pre IPO) is all going up. Look again at the above chart to answer the question where the money is coming from.

Before closing, let’s address one last myth. The Fed cannot unwind QE – they can only default. The Fed created the USD system based on debt, when new money is created it is done through issuance of debt (loans, treasuries, etc.). The Fed does not actually create ‘money out of thin air’ it creates ‘debt out of thin air’ – here’s how it works.

The US Government or JP Morgan call the Fed and say “Hi, Fed, I need 50 Billion by 5pm ET.” The fed then opens the discount window and provides a LOAN to JP Morgan at a discounted, wholesale rate. JP Morgan then repackages that loan and charges a higher rate to it’s end user. Or it buys stocks. Once JP Morgan has the money, it can theoretically do what it wants – as long as it pays the interest.

The virus we are calling Stupidity is being seeded by these NGOs promoting ‘education programs’ to explain to us how 2+2=4 is racist, how wearing masks helps stop the spread (contrary to the CDC’s own report findings), and why we should social distance, take vaccines, and avoid healthy behaviors like eating right, exercise, and reading. Censorship is part of this, with the news being totally overwhelmed with pro-vaccine and pro-globalist propaganda.

How this relates to markets is simple – ‘they’ who are creating this narrative are the same people who don’t want you to understand how the Fed creates money, who are the same people that believe you aren’t intelligent enough to make your own decisions, so they should decide for you.

If you are thinking, how can I not catch ‘stupidity’ – it’s easy. Follow these steps:

- Turn off your TV.

- If you see someone wearing a mask – run in the other direction.

- Do not wear masks.

- Avoid communicating to people who are part of the vax cult.

- Read! Read THIS SITE www.zerohedge.com Read BOOKS. [Don’t get them on your Kindle, buy paperbacks or hardcover and read them. If you don’t have budget, get used or visit the library.

- Do your homework (for trading). Reddit, no offense, is not a source of information.

For an alternative view on markets and news, see www.globalintelhub.com

For a Robinhood alternative, checkout www.levelx.com

Second Sight is a service for active traders only. We focus on special situations such as appraisal arbitrage, fraud investigations, catalyst analysis, and mergers & acquisitions. Our analysis is deep macro analysis even if the asset is a domestic equity. Proprietary metrics and analysis, with confidential sources. https://www.crediblock.com/secondsight/