The Chief Economist at

Citi Willem Butler has said

today on CBC in an interview that the fiasco over the US budget and the

lack of money is nothing more than irresponsible on all political wings

and that the country is being run by Munchkins in the Land of Oz. Most

of us will agree that he has got it spot on with the second label and

all we can wonder is if

President Obama will be wearing the red shoes in Judy-Garland fashion, banging out an old tune of the

Star Spangled Banner even

if it is on an untuned piano. Will he be clicking those heels together

and wishing he were at home with Aunt Em and Uncle Henry or will the

Wicked Witch of the East come along and gobble him and the US up because

the country is being run by cowardly

darragh duffy the Lion?

The first statement made by Butler about the irresponsibility of not

voting the budget is largely an open debate and must be questioned.

The Land of Oz

The Wonderful Wizard of Oz may have been written more than a century

ago, but it is such a fitting tale of today’s sorry state (in more ways

than one) of affairs in the USA. Butler was right more than he probably

thinks when he spoke of the Land of Oz, the land where the ounce of gold

will now shoot through the roof because of the irresponsibility of all

political parties that have held power in the USA in the past decades.

Investors will seek a safe haven in gold from today onwards and the

price of

gold will inevitable increase. Politicians can

never be trusted to do the right thing (if there is a right thing to do

in the circumstances) and that means that the markets will be volatile.

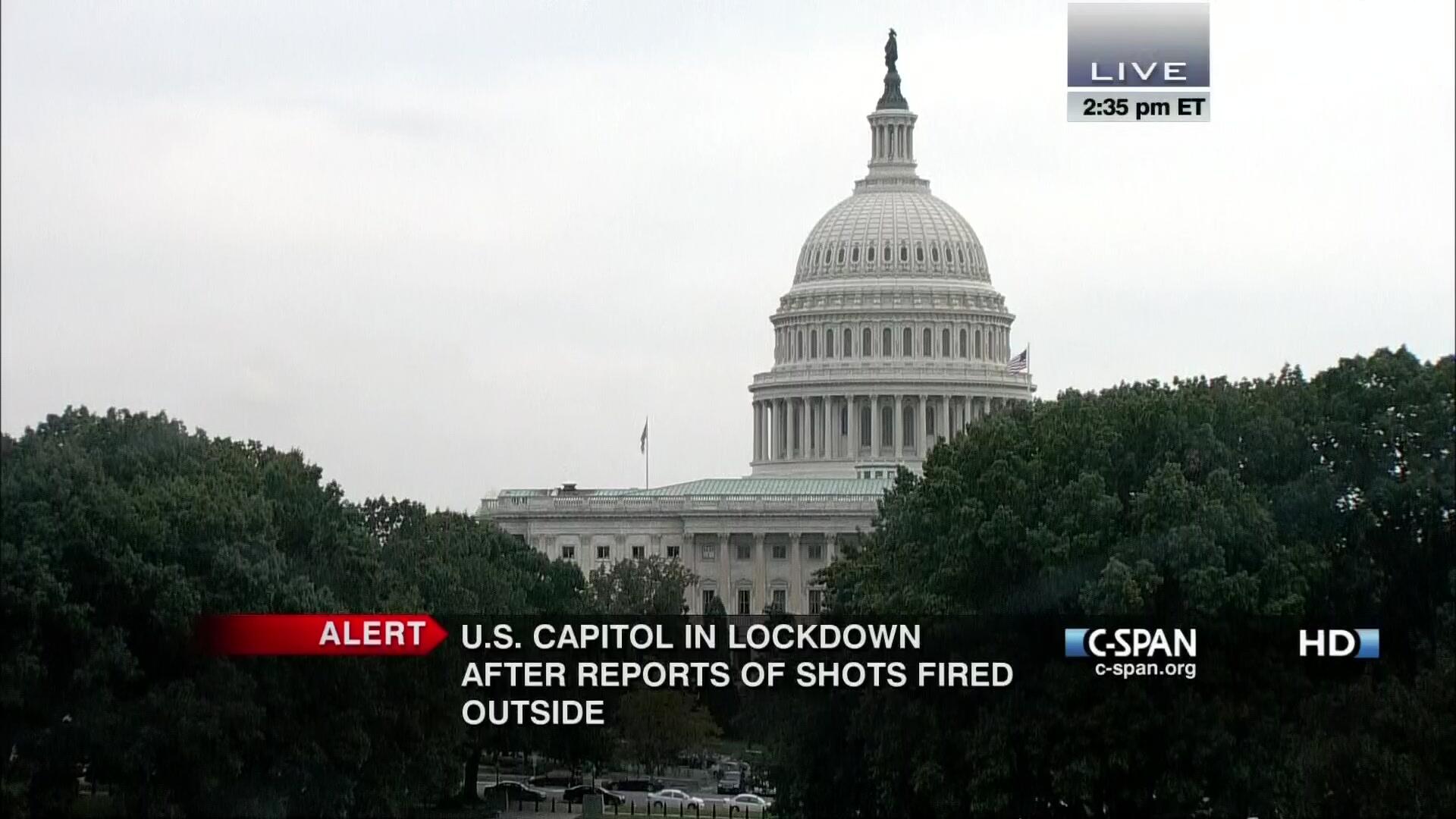

The partial shutdown has happened today as hundreds of thousands of

Americans stay at home because the government spent too much money. Will

the Senators and the Representatives and the government aides or even

President Obama take a cut in their salaries in steadfast solidarity for the nation? They should, but they won’t. We all know that.

- According to analysts, gold will possible fall marginally and then rise this week.

- That’s exactly what is happening today with COMEX gold ready for delivery in December that has fallen by 2.3%(down -30.5 to $1.296.5).

- It is suggested that gold will increase to between $1, 500 and $1, 575 in the coming weeks as investors move into a safe haven.

The Dollar is not worth investing in as that will drop as it already

has done against the Yen, the Euro and most major currencies today:

- The Euro is up against the Dollar by 0.22% (+0.0031 to 1.3557)

- Sterling is also up by 0.32% (to 1.6237, +0.0051)

- The Australian Dollar increased also by 0.79% (up +0.0074 to 0.9391)

- The Dollar fell against the Japanese Yen by 0.41% (down -0.4 to 97.87).

The Dollar had been on an up-trend. Now, that is well and truly over

as it has been falling since this summer in July. That will continue

again now to decline in coming weeks.

Irresponsibility of the US Government(s)

For those out there that believe this is nothing, for those that think that this has happened for the

18th time in

the history of the USA today, think on and think again. It may be

nothing, but then you are probably not a federal government worker that

has been sent home without pay. This is not just hyperbole. It’s

happening. You are probably not one of the guys that has to look for a

way to pay your bills this month because the government hasn’t been able

to pay the bills and because successive governments have been winging

it on both a prayer and on the evil credit that we are told not to live

on day in and day out. Certainly, it’s nothing much to write home about

in the

I’m-alright-Jack-couldn’t-give-a-damn-world, but what about the

700, 000 federal workers from the national parks and the monuments that are joining the soup kitchens and the

breadlines today because they aren’t getting a paycheck (and it happens to more than you think)?

Think about the knock on effects. The tourists that won’t be visiting

those sights, that won’t be spending their hard-earned cash in the

parks and at the national sites. It’s not because something has happened

endless times that it becomes more acceptable. It’s not because that’s

the only thing that the media is talking about today that it makes it

less prominent in your everyday life. The knock-on effect will filter

through. It always does. The only way it won’t be going is up. But, it

will be going down and sideways and that’s where the people are. If

that’s not important, then what is? Maybe when it comes down to the fact

that you won’t be able to get a passport because that department will

be closed, or you won’t be able to get a gun permit because the workers

there will have been sent home. Maybe that will start to affect everyone

else.

Federal-Government Shutdowns

Today is just a long line of shutdowns in the history of the USA. The others have all taken place since

1976:

- 10 days between September 30th and October 11th 1976

Out-of-control spending under the Presidency of Gerald Ford when

Congress vetoed the funding bill for the Department of Labor and the

Department of Health, Education and Welfare.

- 12 days between September 30th and October 13th 1977

This was due to the House of Representatives refusing to allow

Medicaid Dollars to pay for abortions (the Senate believed that this

should be allowed in the case of rape and incest). The dispute between

the House and the Senate caused a funding gap and an ensuing rift with

the government.

- 8 days between October 31st and November 9th 1977

A funding agreement enabled to bide for time to discuss the funding

gap, but when this expired and a solution had still not been reached

there was another shutdown that came about. Jimmy Carter was President.

- 8 days between November 30th and December 9th 1977

The second temporary funding agreement was also not good enough and

the Senate and the House were still in dispute over the funding of

abortions via Medicaid. The Senate eventually got funding for rape and

incest cases.

- 18 days between September 30th and October 18th 1978

President Jimmy Carter decided to veto the funding of a

nuclear-powered aircraft carrier and also public works bills, stating

that they were unnecessary.

- 11 days between September 30th and October 12th 1979

Two reasons led to government shutdown in 1979. The first was because

the House of Representatives wanted a 5.5% pay increase and they wished

also to restrict the possibility of abortion to mothers whose lives

were in danger. Both were opposed by the Senate.

- 2 days between November 20th and November 23rd 1981

President Ronald Reagan ordered that the spending bill include 50% of

the budget cuts he had intended to do (amounting to $8.4 billion). The

Republican Senate agreed, but the Democratic House demanded more

military and defense cuts and approved only $2 billion less than Reagan

had asked for. The President vetoed the bill and shut down government

until he got what he wanted.

- 1 day between September 30th and October 2nd 1982

The spending bill was held up by one day. But, it was passed.

- 3 days between December 17th and December 21st 1982

Both the House and the Senate (the first was controlled by the

Democrats and the second by the Republicans) wanted to include funding

for jobs in the budget. President Reagan refused and vetoed the bill.

- 3 days between November 10th and November 14th 1983

The Democratic House wished to increase the budget for education and

to reduce defense. Reagan refused and vetoed the budget again.

- 2 days between September 30th and October 3rd 1984

Ronald Reagan wanted to link the budget to a water-supply project but

the House (despite agreeing to do this) also wanted to link it to the

fight against crime (which Reagan refused). The President vetoed the

budget yet again and shutdown government.

- 1 day between October 3rd and October 5th 1984

There was an extension granted on the budget but when it expired,

government shut down. Reagan stood his ground and the House backed down

on the crime package.

- 1 day between October 16th and October 18th 1986

There was a dispute between the Democratic House, President Ronald

Regan and the Republican Senate. Reagan shut down government yet again.

- 1 day between December 18th and December 20th 1987

This was related once again to a dispute between the House and the

senate that were controlled by the Democrats and President Reagan over

the funding of the Contras.

- 4 days between October 5th and October 9th 1990

President G. W. Bush shut down government at this time since he

demanded that if there were a continuing resolution (legislation to fund

government where a formal bill has not been signed), then it would have

to be accompanied by a deficit-reduction plan. Otherwise he would veto

it and close down government, which is exactly what happened.

- 5 days between November 13th and November 19th 1995

President Bill Clinton decided to veto the continuing resolution of Congress (controlled by the Republicans).

- 21 days between December 16th 1995 and January 6th 1996

President Clinton was forced to provide a seven-year schedule to

balance the state budget. But, he was asked to use the Congressional

Budget Office figures and not the Office of Management and Budget of his

own making. He refused and so government was closed down.

- ? (unknown so far) days as from October 1st 2013

Due to a dispute over the Affordable Care Act and the fact that the

government has not passed a funding bill. How long it will continue is

another matter.

If there’s one thing that runs through all of these shutdowns, it’s

the feuding between the Senate and the House of Representatives or both

that are against the President. Is that the crux of the matter? The real

cause behind all of this? Three parties vying for power and pulling the

bed sheets to their side so that they can keep themselves warm? But,

they are not the ones that suffer, are they? They just vote the bills or

veto and it’s as easy as all that.

Wizard of Oz and the US Government Shutdown

Oz and the USA

The Wizard of Oz was a satirical parody of money and politics. But,

the Munchkins were the ordinary people that were enslaved and held in

the bondage of the Wizard. The ordinary federal workers and the average

Americans are those Munchkins and it’s not the US that is being run by

them. But, the US is the flawed utopic Land of Oz where every man would

make it rich. Yes, that was possible while the credit line was there.

Now is ancient history and fairytale material.

Washington is the Emerald Green City with the greenbacks the line the

walls of the offices of the lawmakers and Congress. That fake

charlatan, the Wizard? You decide who he might well be. Looks as if we

might just be needing a new scarecrow to replace that Wizard. But,

scarecrows are just dummies too, anthropomorphic personifications of

man, made just to scare the birds away.

The irresponsibility of the governments that have done nothing but spend since Ronald Reagan jacked

in acting to play the role of President of the USA, there has been

nothing but a successive line of Presidents that have been playing a

role-game for the entire country. It’s about time that all that changed.