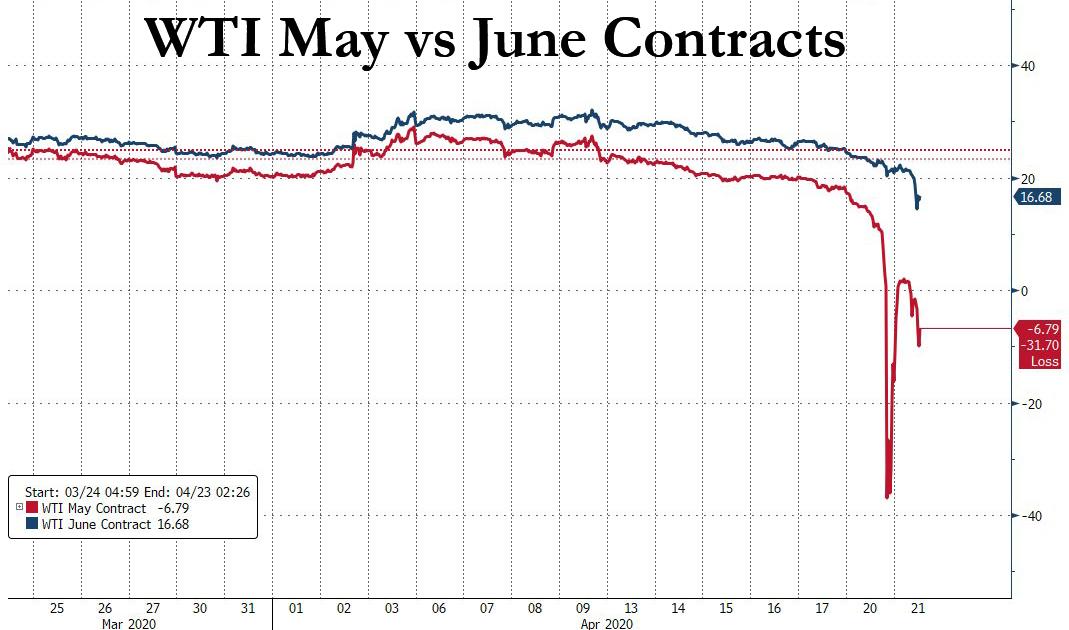

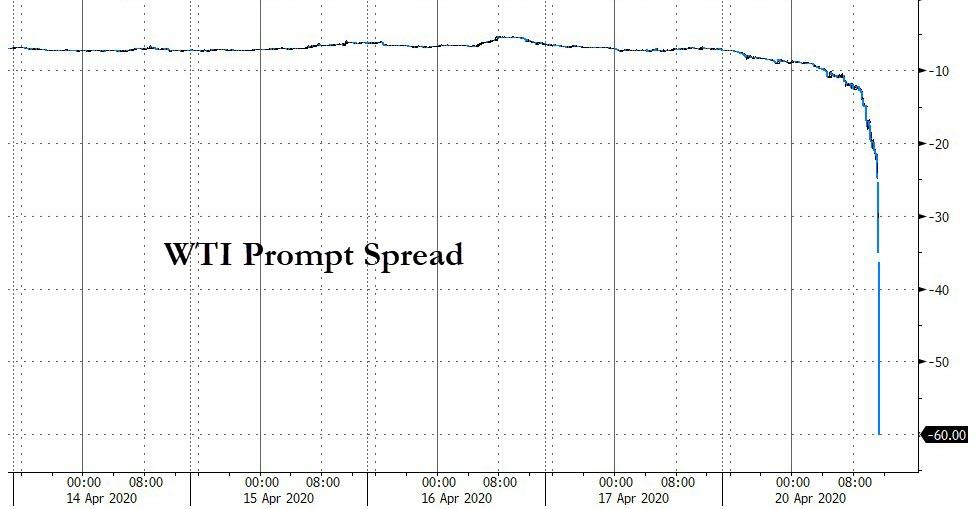

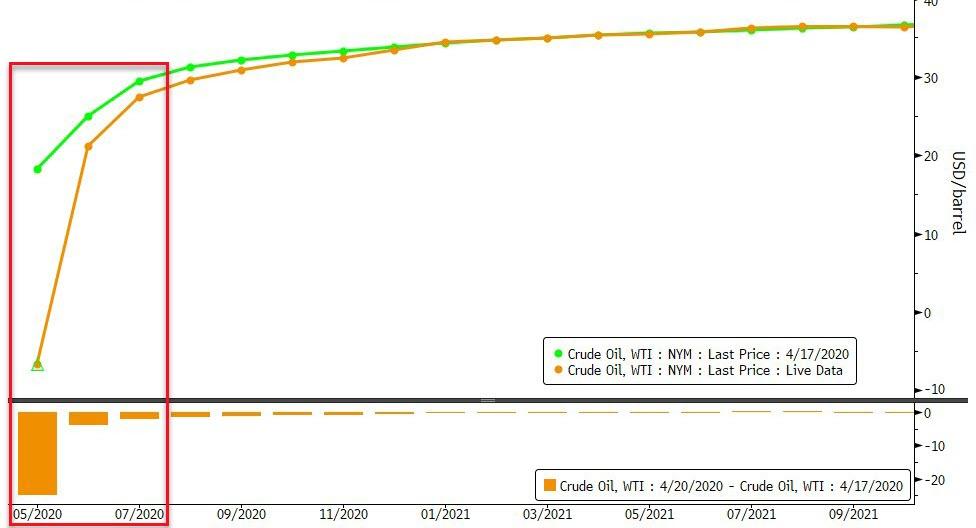

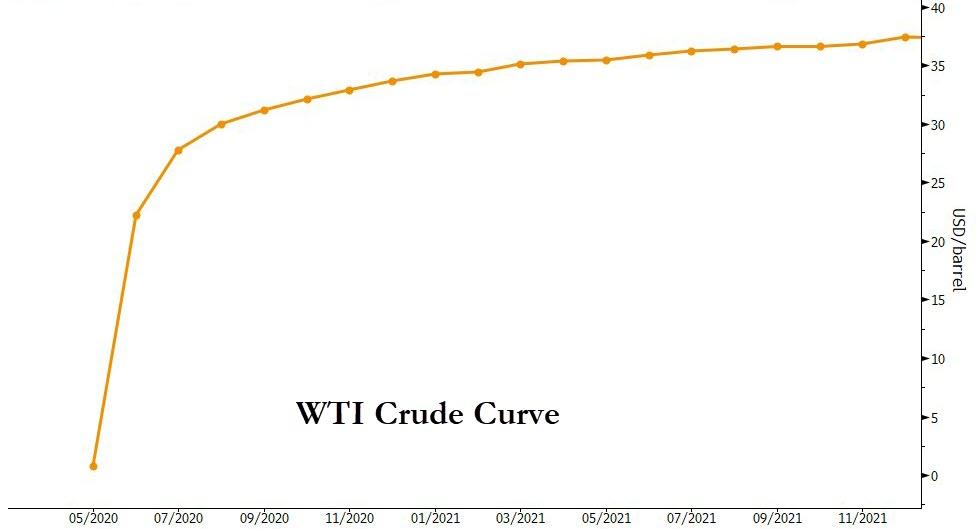

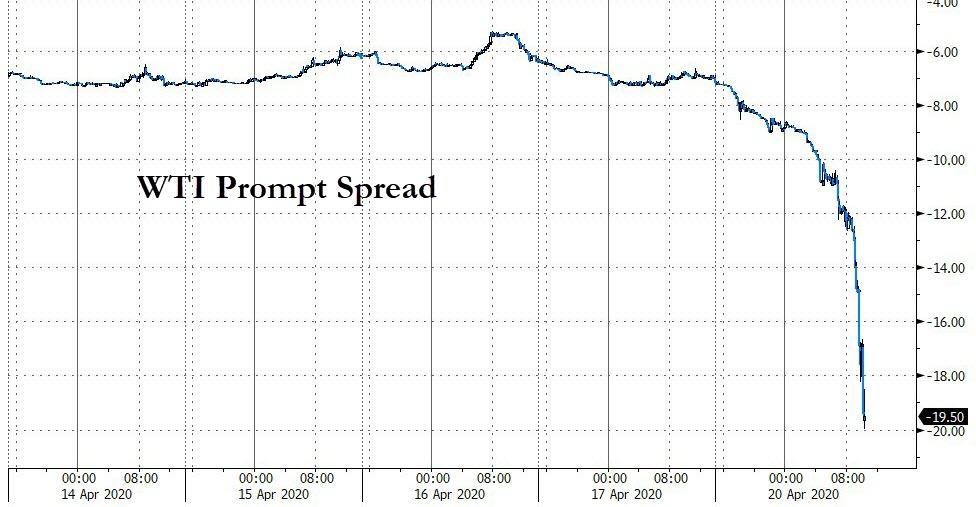

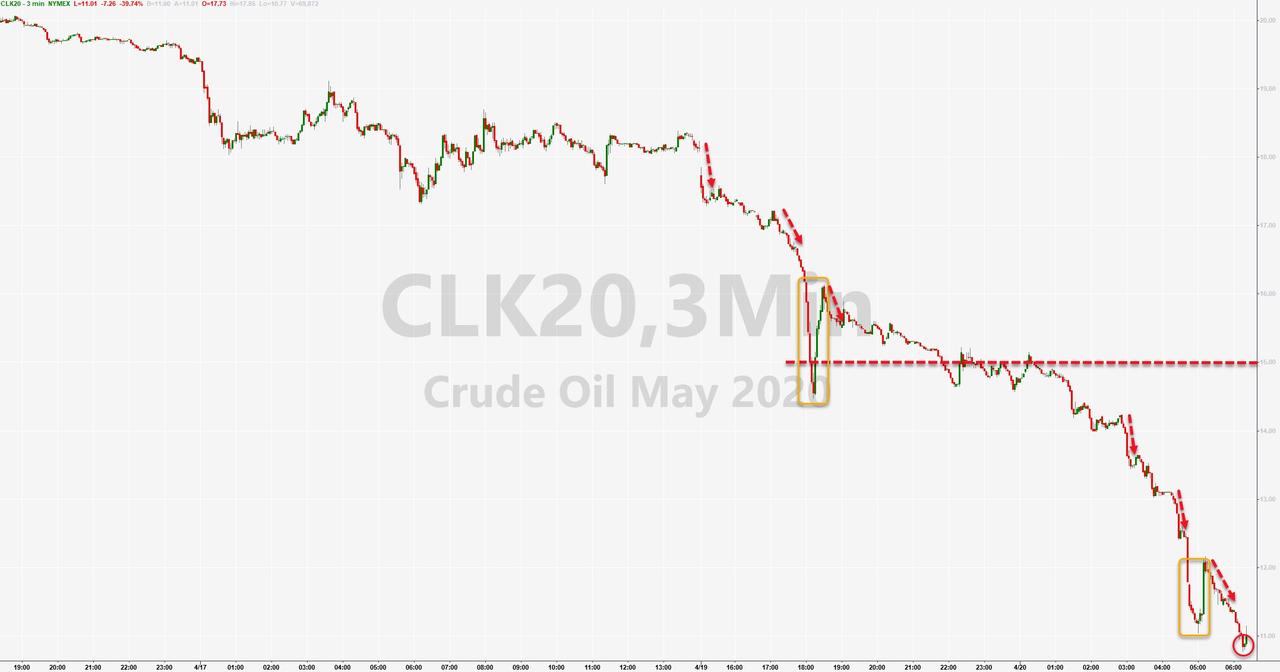

When recapping yesterday's day of devastation for oil prices - and amateur oil traders - we quoted from the latest Goldman report (the bank's strategist Damien Courvalin has been spot on and well ahead of the curve in predicting the drop to negative prices as far back as a month ago), who said that a similar "price dynamic could play out again tomorrow, the last trading day of the May contract. After that, the physical reality of a still massively oversupplied oil market will likely exert downward pressure on the June WTI contract (currently still trading at +$21/bbl)."

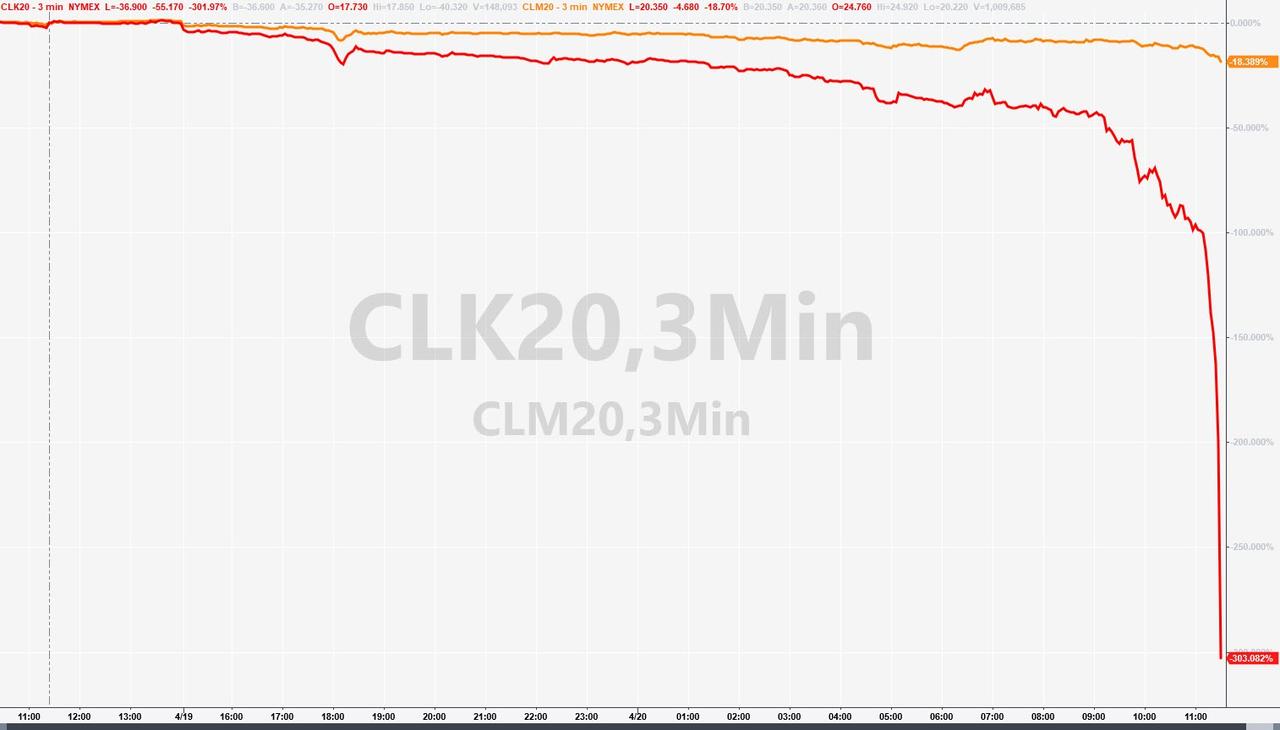

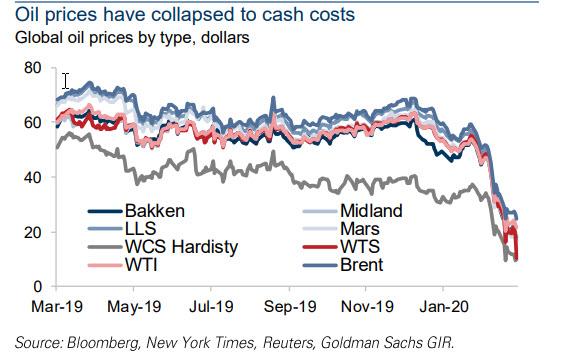

He was spot on, because on Tuesday morning, the panic selling that originated in the May contract, which expsires today at 230pm and which settled at just shy of -$38 yesterday, has spread to the June contract - just as we warned would happen yesterday - which briefly dropped as much as 42% to $11.79 a barrel, and was last trading just above $16 even as the May contract remains deep in negative territory.

More ominously, Brent - which is not landlocked and thus not subjected to the same (excess) supply/(zero) demand dynamics as landlocked WTI, also dipped below $20 briefly, sliding as low as $18.10 before recovering to $21.26

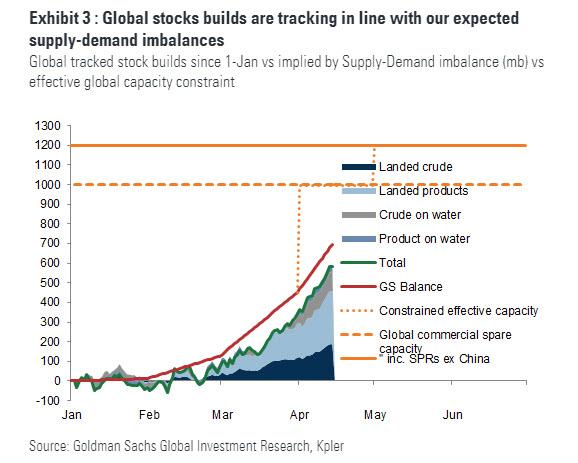

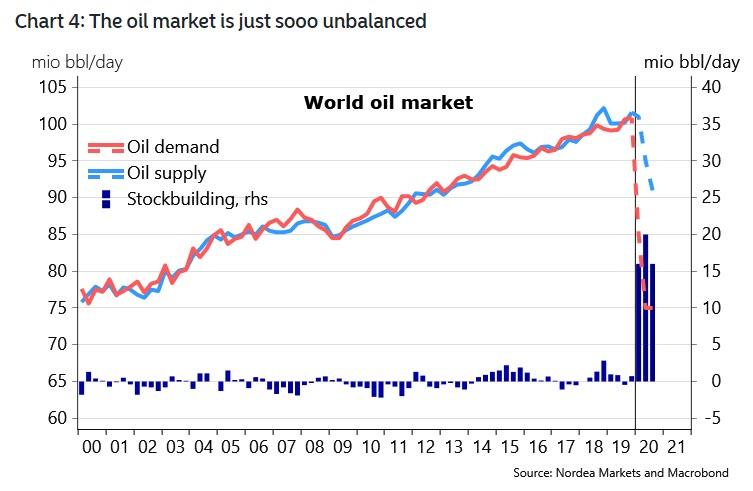

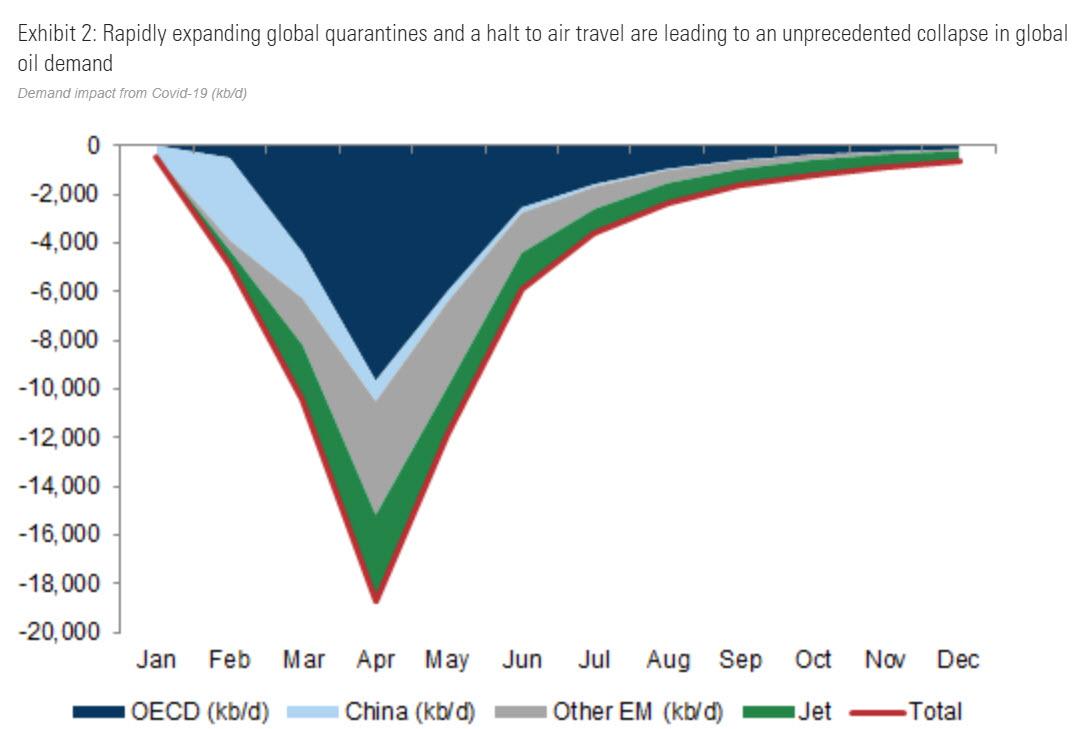

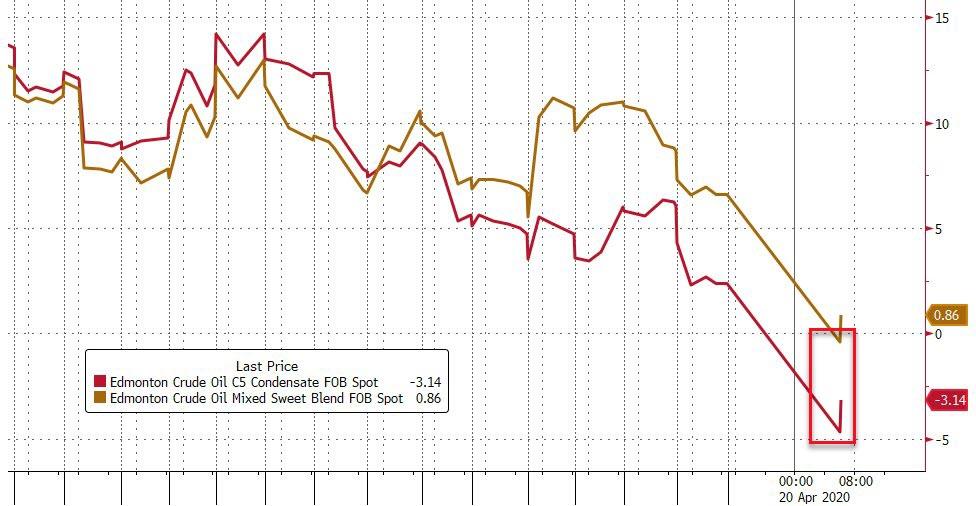

Echoing what we said yesterday, Bloomberg writes today that "the widening of the price collapse to futures that aren’t close to expiry underscored the severity of the crisis in the oil market. Storage tanks, pipelines and tankers are rapidly being overwhelmed by a vast oversupply caused by slumping fuel demand as countries are locked down to slow the spread of the coronavirus."

Overnight, Morgan Stanley joined Goldman in warning that with current total usable capacity is around 79MM bbls, the remaining storage capacity will probably be exhausted in 4 weeks, "this puts 'tank tops' in the middle of May, after that, there is probably no more storage capacity available."

While negative prices should prove fleeting as WTI for May delivery expires on Tuesday, their psychological impact will endure, according to Olivier Jakob, managing director at Petromatrix GmbH. Plunging June contracts for both the U.S. and international crude benchmarks show producers will feel severe pain for some time to come.

"Once you have negative prices in crude oil, the limits change totally,” said Jakob. “What happened yesterday was extremely bad for the confidence in the futures market. It’s not just back to normal trading anymore. It’s a confidence breaker."