The Bubble

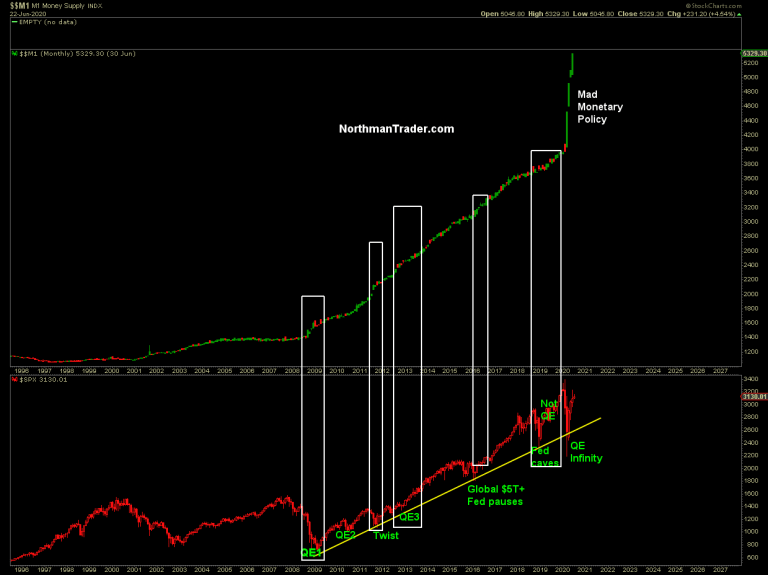

At this stage markets are basically just a liquidity meth lab, an artificial behemoth constructed and subsidized by the Fed stepping in on any downside in markets. Following $3 trillion in liquidity injections in 3 months ($12 trillion annualized) markets have entirely disconnected from the economy and any traditional valuation metrics. The Fed’s role in managing markets is becoming ever larger and has now expanded into buying $AAPL and $VZ bonds among others in addition to monetizing US debt. Call it what you like, just don’t call it capitalism, rather a nationalization of sorts.

Indeed just in June we saw the Fed making policy announcements 3 times, each time following the S&P 500 seeing downside action toward retesting its 200MA and each time markets reacted with bounces and rallies. Call it a coincidence if you like, but it’s not. These markets remains closely managed and watched by the Fed.

Wall Street analysts have largely been made obsolete as earnings growth metrics have long been rendered irrelevant with everybody bowing to the Fed put as the primary reason for buying stocks.

Cases in point: The 2019 rally didn’t kick off until the Fed expanded its balance sheet via repo beginning in September 2019 and markets rallied 30% on zero earnings growth. The 2020 crash didn’t stop until the Fed went into QE unlimited mode, and the current rally stopped on June 8th for the broader market during the same week the Fed’s balance sheet peaked. Negative earnings growth for 2020 yet $SPX is now flat on the year. Nothing happened. Nothing matters.

With no earnings growth during both years it is folly to pretend markets are about anything else but the Fed.

The state of affairs: The unemployed and poor are dependent on government handouts, the middle class is sweating staring at permanent job losses mounting as the top 1% and billionaire stock owner class is subsidized by the Fed as stocks keeps rising despite the worst economic backdrop in decades. All the while the Fed is steadfastly denying against all evidence that it is contributing to ever expanding wealth inequality even though that is precisely what it is doing.

How to navigate through our new nationalized markets? Buy the dips, sell the rips and watch your back as we’re witnessing a historic asset bubble that could pop at any time or take on ever more extreme proportions as nothing and nobody is stopping central banks from continuing to inject liquidity into the system.

But tech is increasingly dangerous and the bifurcation in market performances getting ever more apparent, a point I highlighted this morning on CNBC:

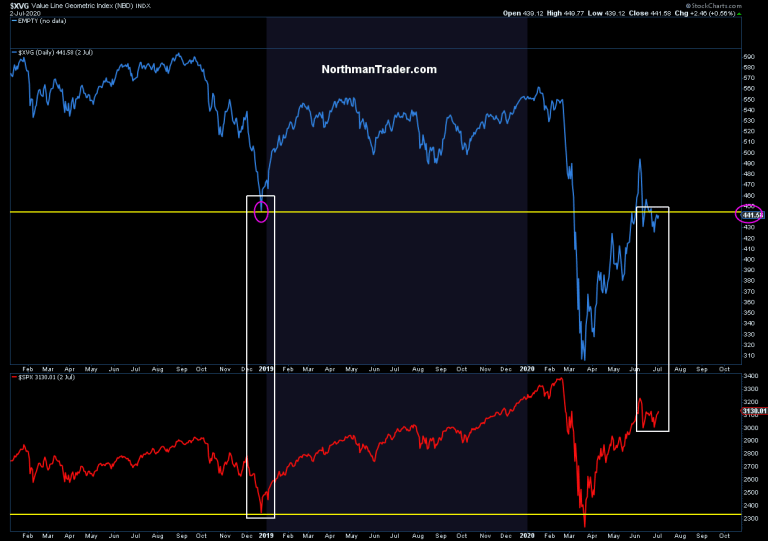

In equal weight there is truth I mentioned, highlighting the great distortion in markets. On an equal weight basis the S&P500 is actually sitting at the December 2018 lows when $SPX was trading at 2350:

Chart: $XVG equal weight compared to $SPX going back to Jan 2018:

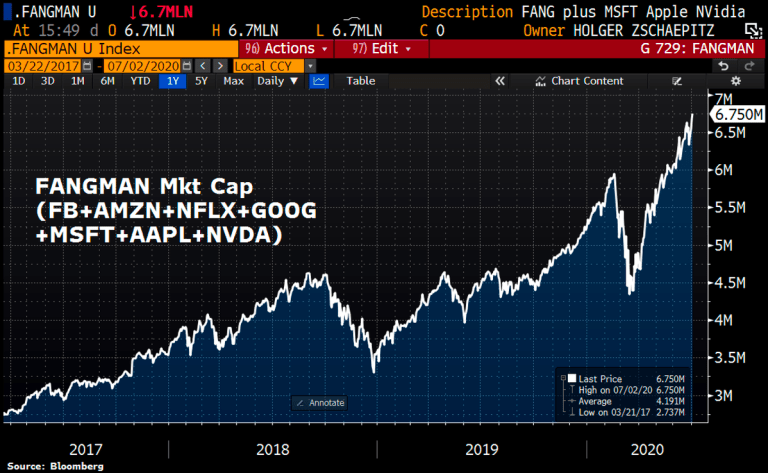

The disconnect of course driven by the Nasdaq which now has 7 stocks equaling $6.75 trillion in market cap hiding that most indices are in substantially worse shape than is advertised:

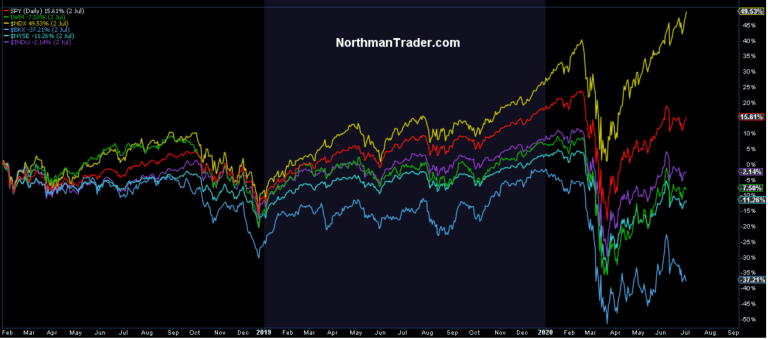

The rest? Not so much:

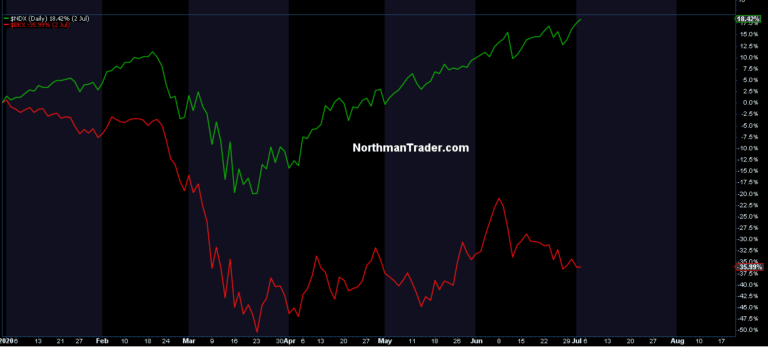

The message: The real economy is in much worse shape and the presumed “V” is not confirmed by the bond market or the banks. In fact the contrast in performance between the banking index and the tech sectors couldn’t be more crass:

$NDX+18% year to date with the banking index down 36% on the year.

Which brings me to tech itself. Overvalued and over owned. Massive valuation expansion over the past year.

Examples:

$AAPL forward P/E in the past 12 months has increased from 16 to over 24, a 50%+ increase.

$AMZN PEG ratio (price earnings growth) increased from 1.32 to over 3.0 in the past 12 months, an increase of over 135%.

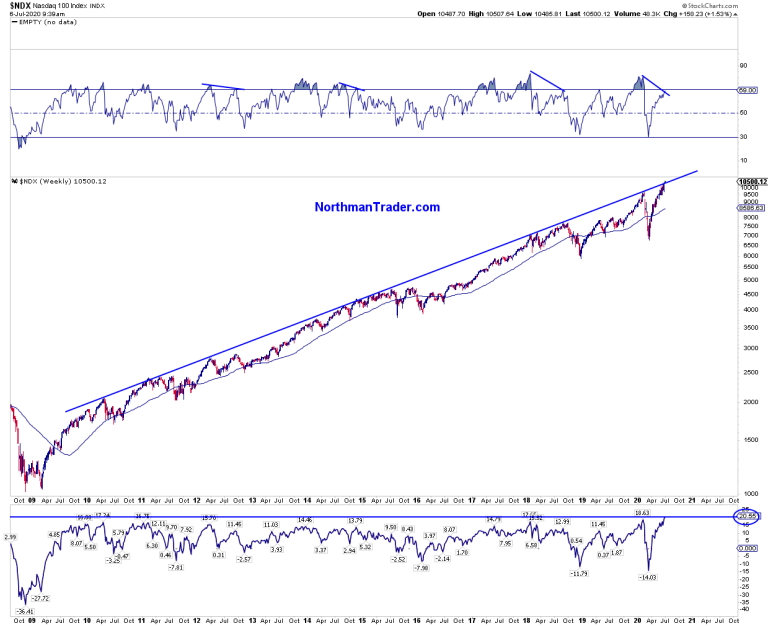

And this massive multiple expansion has led tech to a multi year resistance trend line with $NDX the most extended above its daily 200MA and weekly 50MA since the year 2000 tech bubble.

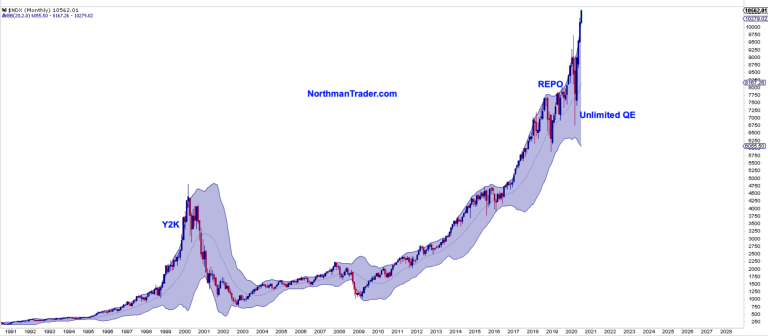

And perhaps a monthly linear chart of $NDX highlighting the vertical nature of this latest Fed sponsored rally showing tech far outside its monthly Bollinger band:

No, markets remain beholden to the greatest monetary expansion in human kind making a mockery of the very basic concept of price discovery:

Want to celebrate massive improvement coming from historic collapsing data? Be my guest, but don’t neglect to keep an eye on the year over year data and it’s dreadful. Permanent job losses keep mounting and they don’t speak to a V shaped recovery any time soon:

Bottomline: We have an asset bubble in tech, dependent on unrealistic multiple expansions as Fed liquidity has prompted a chase in the supposed save havens creating the most divergent stock market in decades.

Buy the dips, sell the rips and watch your back. The natural market is much lower in price and risk remains that the broader market is still in bear market rally mode. As it stands $SPX remains below the June highs, as does $DJIA, $RUT, $NYSE, $BKX, you know, the broader market altogether.