When Facebook announced its plan to build Libra cryptocurrency in June 2019, mixed reactions trailed the entry of the social media giant into the cryptocurrency space. On the one hand, many crypto enthusiasts saw Facebook’s entry as proof that cryptocurrency is the future of money. On the other hand, some crypto fans were worried that Facebook’s recent skirmishes with regulators could cause collateral damage to the crypto industry if Facebook becomes the poster boy of crypto.

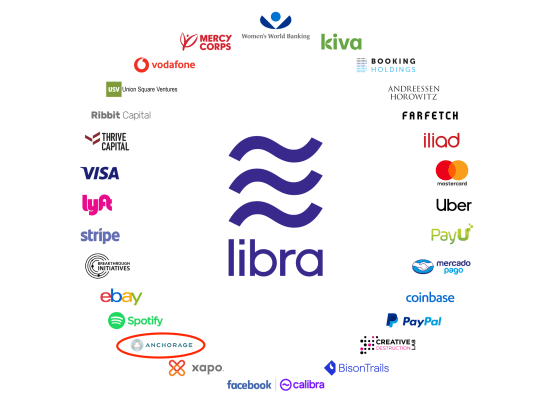

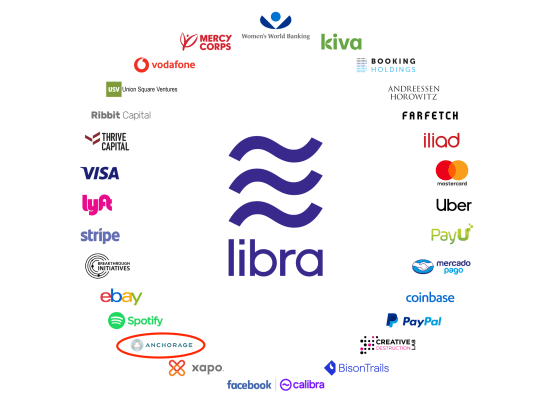

Irrespective of the reactions, Facebook’s entrance into the crypto space suggests that cryptocurrencies have metamorphosed from being a futurist niche into a mainstream idea. The fact that Facebook also managed to sign up the likes of VISA, MasterCard, eBay, Spotify, Andreessen Horowitz, PayPal, and Vodafone among others heralds the mass-market adoption of cryptocurrency.

Unfortunately, PayPal announced its withdrawal from the Libra Association as it chooses to focus instead on its “existing mission and business priorities”. There are also indications that MasterCard and VISA and MasterCard might also be reconsidering their involvement with Libra as its regulatory battle appears to be endless.

Libra, however, says it isn’t worried about such exits as it has a long list of more than 1,500 institutions that are enthusiastic about participating in the project.

It is refreshing to see Facebook being optimistic about the odds of Libra’s survival. Beyond Facebook and Libra, this piece explores how other institutions are embracing cryptocurrency and its underlying blockchain technology.

Top educational institutions are now offering crypto/Blockchain courses

A Coinbase report on higher education powered by Qriously has asserted that 56% of the top 50 Universities in the world are not offering at least one course in cryptocurrency or Blockchain technology. In 2018, only 42% of the profiled universities offered such courses; hence, there’s a 25% year-over-year increase in standardization of crypto education. Some of the leading universities offering cryptocurrency and Blockchain courses include Stanford, which offers 10 crypto and Blockchain courses. Others on the list include Cornell, MIT, University of California – Berkeley and Columbia University.

Interestingly, crypto and Blockchain courses are taught as a cross-functional discipline across the computer science, finance, engineering, humanities, management, and data science departments. Also, computer science professor Cesare Fracassi, who leads the Blockchain Initiative at the University of Texas at Austin McCombs School of Business observes that, “Some of the students interested in this topic are ones who feel mistrustful of the current banking system… they want to create an alternative system where the decision-making process isn’t centralized.”

Challenger banks are starting to offer crypto products

Challenger banks are small and relatively young financial service providers that compete with older and established traditional banks to meet the needs of users that are typically unserved or underserved by the banks. Challenger banks are also called App-Banks because they tend to provide financial services via Webapps, iOS, and Android apps without necessarily having a physical presence in their markets.

In the last five years, the number of digital payment companies now embracing crypto and offering crypto services to their users has increased exponentially. In the U.S., Square is one of the digital payments companies actively supporting the mass-market adoption of cryptocurrencies. In Q2 2019, Square reported that it recorded more than $125 million in Bitcoin sales through its crypto-focused Cash App.

Ally is also actively supporting the growth of the cryptocurrency industry. Last year, the company revealed that it was ready to start offering its users Bitcoin Futures from the CME. After the CME held off the launch of Bitcoin Futures, Ally provided a statement noting that “we will closely watch the Bitcoin Futures market as it develops and continue to evaluate the offering for our clients.”

From the UK, Skrill is one of the leading challenger banks making a concerted effort to support the development of the cryptocurrency industry globally. Skrill is a global player in the financial services industry with a global HQ in London and offices is the U.S. and Europe.

Skrill, which has been operating since 2001 as a platform for making simple, quick, and secure digital payments launched its crypto offering last year. The company noted that wants crypto to become part of its core business offering by utilizing its existing rails. As a part of Paysafe Group Holdings with more than $1.9B in annual revenues, Skrill’s involvement in the crypto market could move the needle for a significant mass adoption.

Skrill allows its users to buy and sell cryptocurrencies through a dedicated crypto tab where it currently provides support for 8 cryptocurrencies while plans are ongoing to add more coins down the road. Users can buy and sell Bitcoin, Ethereum, Ripple and five other coins through a dedicated crypto tab on Skrill’s web and mobile app. Skrill’s parent company, Paysafe Group also has a working partnership with Coinbase to help the later roll out its cryptocurrency cards in the UK as part of efforts to deepen crypto adoption.

European banking giants are bridging the gap between regulators and the crypto industry

While traditional financial institutions generally tend to maintain an indifferent disposition towards cryptocurrencies, many people suspect that the growing popularity of cryptocurrencies is a source of concern. For one, the aggressive scenario suggests that cryptocurrencies could potentially replace fiat currencies and kick these traditional financial institutions out of business. Yet, even the most conservative predictions suggest that cryptocurrencies will coexist with fiat as the preferred means of exchange in the digital economy.

Interestingly, several traditional financial institutions are embracing the crypto disruption and they are actively looking for ways to participate in the crypto revolution. France’s Société Générale was caught posting a job listing in the search for an “IT developer on bitcoin, blockchains, and cryptocurrencies”. Also, BNP Paribas has been linked to analysts' reports suggesting that it might add Bitcoin to its currency funds. Earlier in 2015, British multinational bank, Barclays announced plans to run a pilot program with Swedish Safello to explore how Blockchain could improve the financial services industry.

Traditional financial institutions are highly regulated and thus they have huge war chests to devote towards lobbying efforts with policymakers. The growing interest of these traditional financial institutions suggests that the cryptocurrency industry might be on the fast track to getting regulatory clarity because these banks won’t dabble in crypto until the regulators have given them the green light to proceed.

Conclusion

There are several other interesting developments that paints an optimistic picture for the future of cryptocurrencies. Samsung is reportedly set to launch a crypto-enabled smartphone which will have a pre-installed crypto wallet among other features. Samsung’s bold play into crypto might, in turn, trigger a crypto war among device manufacturers as they jostle for market leadership in the growing crypto space.

In the final analysis, the growing interest of traditional institutions in cryptocurrencies and blockchain technology can only be positive for the industry. It would be interesting to what the coming years hold in terms of the mass-market adoption of cryptocurrencies.