Wednesday, April 22, 2020

The Real COVID-19 Mortality Rate Is 25-60x Less Than Governments, Media Claim

SouthFront offers a scientific-based survey providing an in-depth look at the real death toll statistics and the spread of SARS-COV-2.

1. The research issued by the Bonn University Hospital

The research issued by the Bonn University Hospital and made by the group of scientists including Prof. Dr. Hendrik Streeck (Institute of Virology), Prof. Dr. Gunther Hartmann (Institute for Clinical Chemistry and Clinical Pharmacology, Spokesman for the Cluster of Excellence ImmunoSensation2), Prof. Dr. Martin Exner (Institute for Hygiene and Public Health), Prof. Dr. Matthias Schmid (Institute for Medical Biometry, Computer Science and Epidemiology).

In the framework of the research, all residents of Germany’s Gangelt were tested on the existence of SARS-CoV-2 infection and antibodies to SARS-CoV-2.

Gangelt is one of the most COVID-19-affected German municipalities. It is believed that the outbreak was caused by the carnival held on February 15, 2020. After the event, several people tested positive for SARS-CoV-2.

Preliminary result: the existing immunity was determined at about 14% (IgG against SARS-CoV2, method specificity>, 99%). About 2% of people had current SARS-CoV-2 infection detected by the method of polymerase chain reaction (PCR). The overal infection rate (the presence of a current infection or antibody in the body) was about 15%. The mortality (mortality rate), based on the total number of infected people in the Gangelt community, is approximately 0.37% based on the preliminary data of this study. The mortality rate based on the total population in the Gangelt is currently 0.06%.

2. A new Epidemiological bulletin from German Robert Koch Institute

A new Epidemiological bulletin from German Robert Koch Institute – “Estimation of the current development of the SARS-CoV-2 epidemic in Germany” issued on April 15 confirms that:

“in general, it is true that not all infected people have symptoms, not all who has symptoms go to a doctor’s office, not all who go to the doctor are tested and not all who test positive are recorded in a survey system. In addition, a certain amount of time passes between all these individual steps, so that no data collection system, however good, can make a statement about the current infection process without additional assumptions and calculations.”

Meanwhile, April 18 Daily Situation Report of the Robert Koch Institute shows that 86% of deaths, but only 18% of all cases, occurred in persons aged 70 years or older. The median age was 82 years. Pneumonia was reported in 2,764 cases (3%). COVID-19 related outbreaks continue to be reported in nursing homes and hospitals. In some of these outbreaks, the number of deaths is relatively high. The current estimate is R= 0.8 (95% confidence interval: 0.7-1.0).

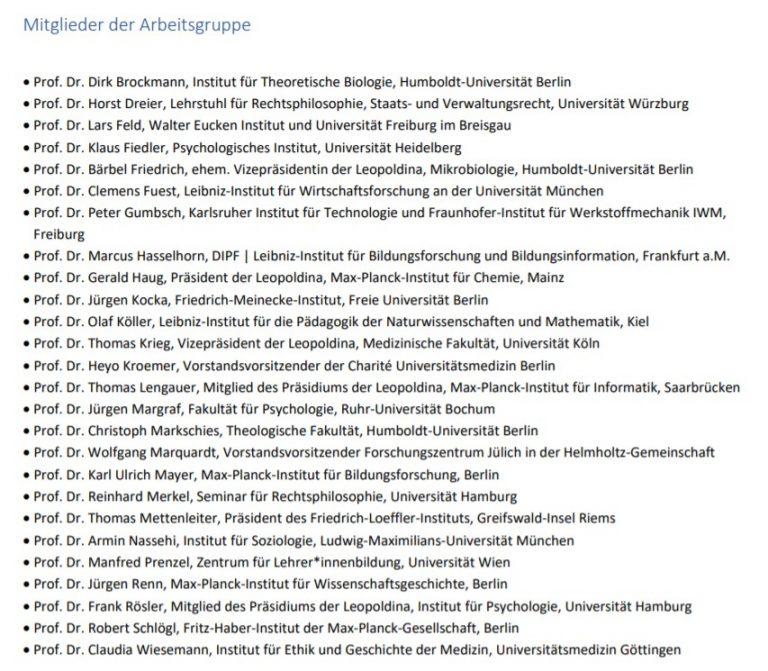

3. On 13 April, the German National Academy of Sciences, Leopoldina, published its third ad hoc statement on the COVID-19 pandemic in Germany (the group of 26 Prof. Doctors)

The statement, which supplements its two predecessors, describes strategies for a stepwise lifting or modification of measures against the pandemic, taking into account psychological, social, legal, pedagogic and economic aspects. The document recommends in particular the re-opening of classroom primary and lower-level secondary education as soon as feasible, giving priority to the former, with observation of hygiene and physical distancing measures.

Click to see the full-size image

Click to see the full-size image

The National Academy of Sciences Leopoldina takes a stand with psychological, social, the legal, educational and economic aspects of the pandemic, following key recommendations:

- Optimizing the basis for decision-making: The data collection, which has so far been largely symptom-based, leads to a distorted perception of the infection process. It is therefore important to collect the infection and substantially improve the immunity status of the population, in particular through representative and regional survey of infection and immunity status.

- Enable a differentiated assessment of the risks both for social and individual dealings with the corona pandemic, contextual classification of the available data is important. Data to serious illnesses and deaths must be compared to those of other illnesses and related to the expected risk of death in individual age groups. A realistic one. Presentation of the individual risk must be clearly illustrated. This also applies to systemic risks such as overloading the health system and negative consequences for the economy and society.

- To cushion psychological and social impacts: measures taken for implementation intrinsic motivation based on self-protection and solidarity is more important than the threats of sanctions. Providing a realistic schedule and a clear package of measures for gradual normalization increases the controllability and predictability for everyone. This helps to minimize negative psychological the physical andeffects of the current stress. Firs of all, aid and support should be provided for high-risk groups, such as children, who are particularly affected by the consequences of current restrictions in difficult family situations or people who are exposed to domestic violence must be provided become.

There are more another recommendations in the third ad hoc statement of the German National Academy of Sciences that now are being implemented by German leadership.

4. New research from the United States

Group of authors from Stanford University, Stanford University School of Medicine, University of Southern California, Health Education is Power, Inc., The Compliance Resource Group, Inc., Department of Psychiatry and Behavioral Sciences, Stanford University School of Medicine, Bogan Associates, 8 ARL BioPharma, Inc., Sports Medicine Research and Testing Laboratory, Department of Epidemiology and Population Health, Stanford University School of Medicine, Department of Medicine, Stanford University School of Medicine measured the seroprevalence of antibodies to SARS-CoV-2 in Santa Clara County and made some conclusions.

The data received and conclusions of the US team are well corresponding with the research of German Bonn University Hospital taking into account that the German research came out on April 9, and the American one on April 14, with the reasonable assumption that the spread of SARS-CoV-2 in the German city of Gangelt began at least two week earlier (February 15, 2020) than in the American Santa Clara.

The US researchers estimated that under the three scenarios for test performance characteristics, the population prevalence of COVID-19 in Santa Clara ranged from 2.49% (95CI 1.80-3.17%) to 4.16% (2.58-5.70%). These prevalence estimates represent a range between 48,000 and 81,000 people infected in Santa Clara County by early April, 50-85-fold more than the number of confirmed cases. Conclusions. The population prevalence of SARS-CoV-2 antibodies in Santa Clara County implies that the infection is much more widespread than indicated by the number of confirmed cases. Population prevalence estimates can now be used to calibrate epidemic and mortality projections.

5. More data from the United States

Between March 22 and April 4, 2020, a total of 215 pregnant women delivered infants at the New York–Presbyterian Allen Hospital and Columbia University Irving Medical Center. All the women were screened on admission for symptoms of Covid-19. Four women (1.9%) had fever or other symptoms of Covid-19 on admission, and all 4 women tested positive for SARS-CoV-2 (Figure 1). Of the 211 women without symptoms, all were afebrile on admission. Nasopharyngeal swabs were obtained from 210 of the 211 women (99.5%) who did not have symptoms of Covid-19; of these women, 29 (13.7%) were positive for SARS-CoV-2. Thus, 29 of the 33 patients who were positive for SARS-CoV-2 at admission (87.9%) had no symptoms of Covid-19 at presentation.

Our use of universal SARS-CoV-2 testing in all pregnant patients presenting for delivery revealed that at this point in the pandemic in New York City, most of the patients who were positive for SARS-CoV-2 at delivery were asymptomatic, and more than one of eight asymptomatic patients who were admitted to the labor and delivery unit were positive for SARS-CoV-2. Although this prevalence has limited generalizability to geographic regions with lower rates of infection, it underscores the risk of Covid-19 among asymptomatic obstetrical patients. Moreover, the true prevalence of infection may be underreported because of false negative results of tests to detect SARS-CoV-2.

6. Hypothesis and justification from a Professor of Medical Statistics and Epidemiology at the Milan State University, Italy

The real number of COVID-19 cases in the country could be 5,000,0000 (compared to the 119,827 confirmed ones) according to a study which polled people with symptoms who have not been tested, and up to 10,000,000 or even 20,0000,000 after taking into account asymptomatic cases, according to Carlo La Vecchia, a Professor of Medical Statistics and Epidemiology at the Milan State University.

This number would still be insufficient to reach herd immunity, which would require 2/3 of the population (about 40,000,000 people in Italy) having contracted the virus.

The number of deaths could also be underestimated by 3/4 (in Italy as well as in other countries) [source], meaning that the real number of deaths in Italy could be around 60,000.

If these estimates were true, the mortality rate from COVID-19 would be much lower (around 25 times less) than the case fatality rate based solely on laboratory-confirmed cases and deaths, since it would be underestimating cases (the denominator) by a factor of about 1/100 and deaths by a factor of 1/4.

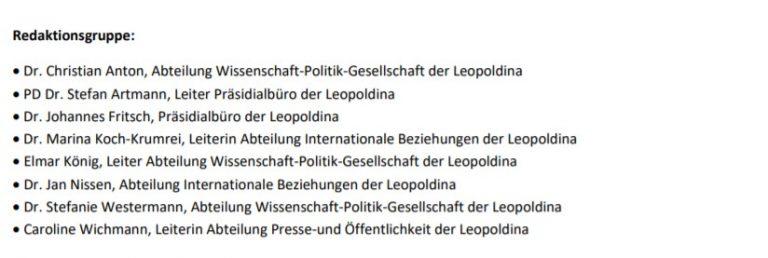

7. SARS-CoV-2 mortality in Italy

As for now, it is a well-known publicly recognized fact that Italy labels anyone who died with a confirmed SARS-CoV-2 infection, regardless of the real causes of death, as the victim of the pandemic. At the same time, the objective fact is the increase of the overall mortality in Italy. According to Istat (Istituto nazionale di statistica), there is a general increase in mortality from all causes ⩾20% from March 1 to April 4, 2020 compared with the average for the same period in 2015-2019. Bergamo is at the top in the growth of mortality among municipalities, + 382.8% of deaths.

However, the mortality grew not only and not so much from the causes associated with SARS-CoV-2 infection.

A few examples:

- Albino town: from February 23 to March 27, 2019 – 24 people died; from February 23 to March 27, 2020 – 145 people (SARS-CoV-2 causes – 30 dead).

- Skandzoroshyate town: from January to March 2019 – 45 deaths; from January to March 2020 – 135 (SARS-CoV-2 – 20 dead).

- San Pellegrino Terme town: March 2019 – 2 deaths, March 2020 – 45 (SARS-CoV-2 – 11 dead).

- These numbers could be explained by the lack of SARS-CoV-2 tests in the specified period.

At the same time, the mortality from other diseases increased significantly in the comparative period of April 1-4, 2020 compared to April 1-4, 2019. The lack of transparence of the Italian system also should be noted. For example, on April 17, Istat said that at that moment it was impossible to draw any conclusions about the increase of the mortality in Italy in general (as well as in regions and provinces) from the data obtained by Istat for the first four months of 2020 and compare it with the same period in 2019. These graphs and tables show statistics:

Click to see the full-size image

8. SARS-CoV-2 mortality in Spain

Spanish Minister of Health Salvador Illa stated that every dead person, that tested positively to SARS-CoV-2, is considered as a SARS-CoV-2 death.

The mathematical model employed by the University of Carlos III in Madrid (Universidad Carlos III de Madrid, UC3M) demonstrates that in the last decade in Spain, an average of 1,150 people die from all causes every day in March. According to the records of acts of civil status, from March 16 (the day quarantine began), the number of daily deaths from all causes began to increase, sometimes reaching 1,400 per day. From March 17 to March 30, 21,243 deaths were recorded in Spain. This is 5,398 more than the prediction based on the extrapolation of data from previous years. The forecasted number for the same period is 15,844 – 34.1% less. At the same time, the total number of deaths from whom SARS-CoV-2 during the period from March 17 to March 30, 2020 was 7,591 people. This is a consequence of the general recognition of SARS-CoV-2 as the cause of deaths regardless of the actual situation. In any case, there is no exponential growth of the overall mortality in Spain or Italy.

Conclusions

In this survey, we demonstrated the researches and approaches of about 100 eminent scientists from around the world. In general, they agree that the current statistical data does not reflect the actual state of affairs, and the publicly distributed media estimates of the mortality rate are at least incorrect, and do not correspond to the actual picture.

The actual number of people with SARS-CoV-2 infection or people that already passed through COVID-19 early-stage or without symptoms is several dozen times higher than the public numbers show.

This is primarily due to the approaches and scope of testing. The public numbers have little to do with science. This is, to a greater extent, either media or politically motivated data. You should also consider the factor of a special picture of the course of the disease, which affects medical statistics (RKI Epidemiological bulletins).

Accordingly, the real mortality rate from SARS-CoV-2 is 25-60 times less than the figures presented to us by MSM and a number of governments.

The number of people with SARS-CoV-2 virus, but without the COVID-19 disease or with a mild form of the disease, according to various estimates, ranges from 85% to 95%. This group, as a rule, does not fall into official statistics, as it is not tested, not hospitalized, and does not seek medical help.

The negative consequences for life and health of people from ill-conceived social measures can at times surpass the threat posed by SARS-CoV-2. There has been a significant increase in the mortality from diseases unrelated to SARS-CoV-2 already.

Countries, whose leadership works closely with scientists, consistently and quickly responds to changes in the situation and the emergence of new data, will receive a huge advantage in the post-COVID-19 world.

The current actions of politicians in a number of countries are difficult to explain with anything other than incompetence or deliberate actions to achieve their personal/clan political ambitions or promote interests of external actors.

Tuesday, April 21, 2020

Jim Simons' Medallion Fund Signals Entry Into Crypto Markets Ahead Of Historic Halving

From Zero Hedge:

Just days after The Wall Street Journal reported on the stellar performance of the greatest hedge fund in history (Renaissance's ultra secretive and ultra lucrative - open only to friend and employees - Medallion fund), the directionally-agnostic, algo-driven system is apparently turning its attention to the crypto markets.

As we recently detailed, since 1988, Medallion has averaged annual gains of 39% after fees, and its best years include 2000 and 2008, difficult years for most investors.

For those unfamiliar, the Medallion fund holds thousands of stocks at any one time, while betting against thousands of other shares and trading currencies, commodities and bond futures, according to people close to the firm.

During market collapses, most investments tend to plummet in unison, which can make it hard for Medallion to profit. That phenomenon may help explain why the fund treaded water in early March. In the aftermath of these difficult periods, and as markets settle, Renaissance’s 35,000 computer processors comb 30 trillion bytes of data each day searching for mispricings.

Ironically, the best hedge fund is the one that not even its managers know what it does:

Renaissance’s predictive models, developed by the firm’s 320 or so string theorists, astronomers and other scientists and mathematicians, are built on more than 10 million lines of computer code and rely on historic prices and other data. Preset algorithms generate all its trades, eliminating human emotion from the investing decision.In fact, because Renaissance’s system employs elements of machine learning and is so complicated, it can be challenging for the firm’s own executives to immediately understand why the firm is doing well or poorly. Some of them believe their gains, at least in part, could result from mistakes rival investors make during challenging markets.“The computer runs itself and we hardly ever interfere, the machine tells us what we should do,” says someone close to the firm. “Every experience we’ve had shows that humans mess up worse than machines.”

Renaissance's chainsmoking, codebreaking founder Jim Simons, who is worth over $23 billion, is working from his Long Island home amid the coronavirus pandemic like many others at the firm, the Journal's Greg Zuckerman reports.

Of course, since the fund basically runs itself, it's unclear why anyone would ever need to show up to the office at all.

Medallion is a “medium-frequency” trading firm, generally holding its investments from “moments to months,” in the words of an employee, rather than milliseconds, like high-frequency firms. Still, Medallion also can benefit from volatile markets like those trading shops.There may be reason to think investors should brace for continued market volatility, at least according to Renaissance’s predictive models. In late March, Medallion’s investors were given the opportunity to put more money in the hedge fund so the firm could expand its size. That move may have been made because the computers anticipate more opportunity for profits - and more volatile and challenging markets - in the months ahead.

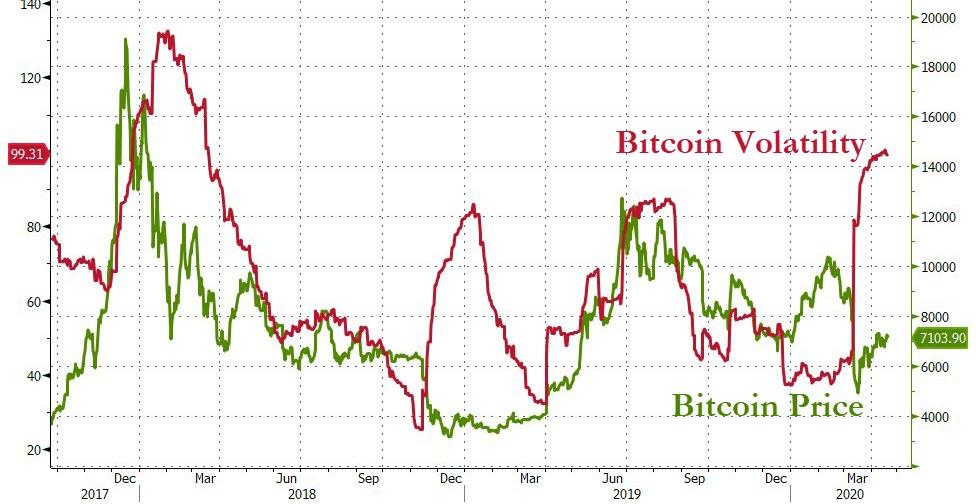

This is one occasion when we will say that the machines are right, hands down, and perhaps that is why the fund is now potentially entering the cryptocurrency markets since volatility has risen dramatically in recent weeks, potentially offering the RenTec algos more profitable trading arenas.

And now, as CoinTelegraph reports, in a brochure originally dated March 30, the United States regulator the Securities and Exchange Commission (SEC) confirmed that Renaissance Technologies’ Medallion Funds now have access to the burgeoning Bitcoin futures scene.

According to the literature, Renaissance will offer access to cash-settled contracts from CME Group, one of the two oldest-running Bitcoin futures providers.

The Medallion Funds are permitted to enter into bitcoin futures transactions, which Renaissance will limit to cash-settled futures contracts traded on the CME.The underlying commodity for these futures transactions, bitcoin, is a relatively new and highly speculative asset.Bitcoin and futures based on bitcoin are extremely volatile, and investment results may vary substantially over time. These instruments involve substantially more risk and potential for loss relative to more conventional financial instruments. Investments of this type should be considered substantially more speculative and significantly more likely to result in a total loss of capital than many other investments.Some of the risks associated with bitcoin are:1) its limited history;2) the absence of any recognition of bitcoin as legal tender by any government;3) the lack of any central authority to issue or control bitcoin;4) its susceptibility to manipulation by malicious actors or botnets;5) its susceptibility to forking;6) its substantial price volatility;7) its possible correlation to the price volatility of other distributed ledger assets;8) the susceptibility of bitcoin spot exchanges to the risk of fraud, manipulation, and other malfeasance;9) the undeveloped and evolving nature of bitcoin regulation;10) the enhanced basis risk in bitcoin futures compared to other types of investment vehicles;11) the possibility of exchanges or FCMs’ imposing other requirements or limitations on bitcoin futures trading; and12) increased regulatory scrutiny of participants in the crypto space. Any of these factors could materially and adversely affect the value of the Fund’s investments.

At the same time, Bitcoin futures have been witnessing a return to form after suffering reduced participation in previous weeks.

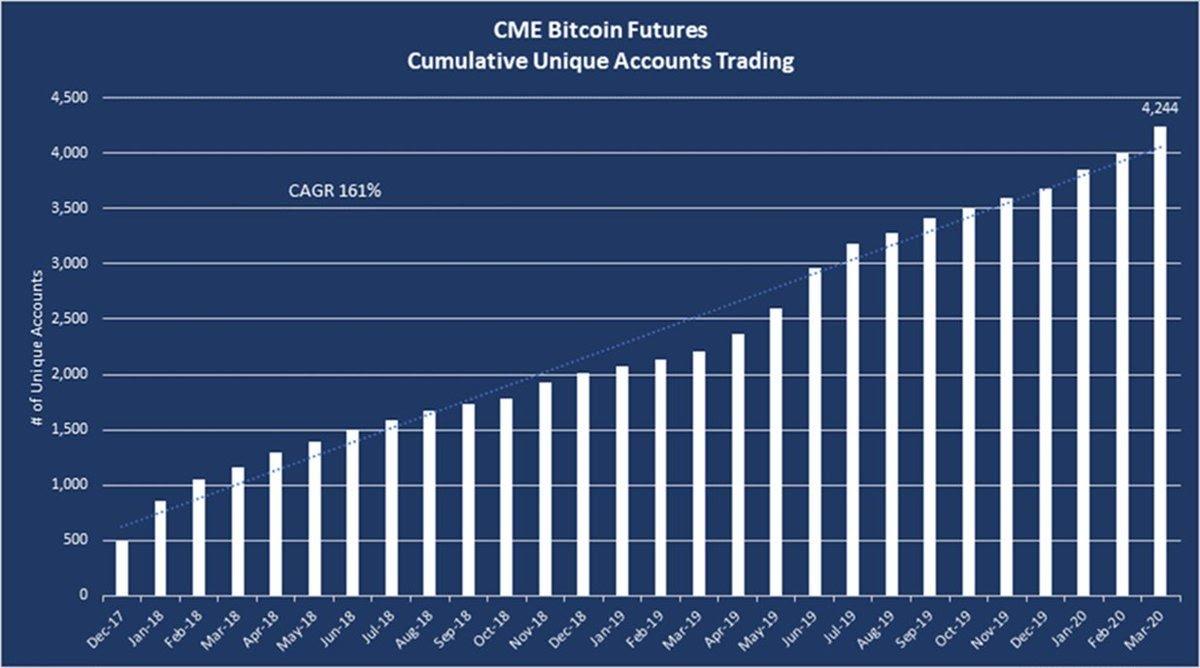

According to the most recent data from CME, its products reached all-time highs in terms of unique accounts last month, a combined annual growth rate of 161%.

CME Bitcoin futures accounts. Source: Hunter Horsley/ Twitter

Nonetheless, reactions to the Medallion Funds announcement underscored continued distrust of institutional investors among Bitcoin supporters. As Cointelegraph reported, suspicions last year focused on futures contract settlements artificially pressuring the Bitcoin price.

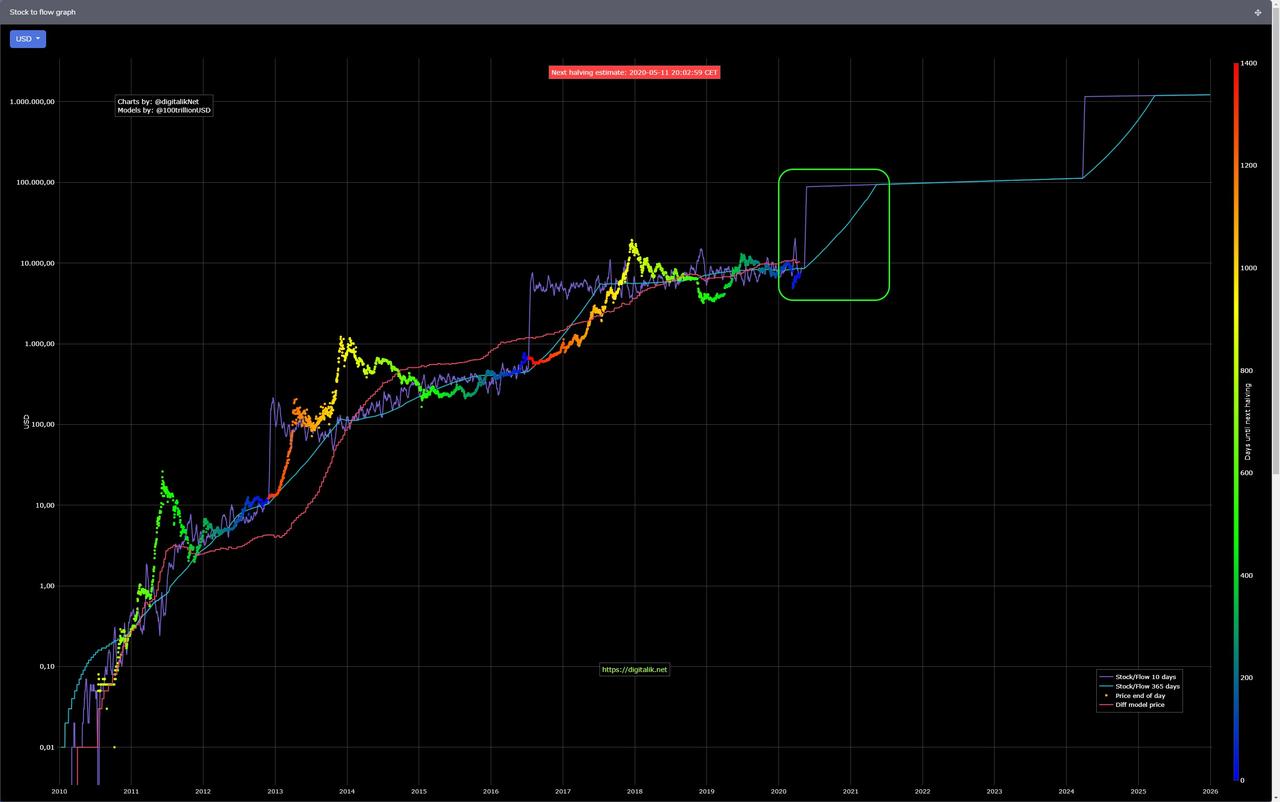

Others, such as stock-to-flow creator PlanB, have publicly refuted the idea that futures are responsible for price manipulation.

As Coindesk.com notes, however, whether Medallion is participating in that market is unknown. The disclosure did not state if Medallion had begun buying bitcoin futures contracts or planned to in the future, and Renaissance, notoriously tight-lipped about its best-performing fund, did not respond to requests for comment.

Additionally, CoinTelegraph's William Suberg notes that RenTec's move towards the crypto markets comes just before the much-watched - and likely volatility-inducing - Bitcoin Halving in May.

The creator of the stock-to-flow (S2F) Bitcoin (BTC) price model says that the upcoming block reward halving will decide if it lives or dies.In a series of tweets on April 16, PlanB said that he is sticking by the Bitcoin price increasing by “an order of magnitude” in the two years after the May halving.Analyst looks for fundamental insights from halving

“(In my opinion) #bitcoin 2020 halving will be like 2012 & 2016. As per S2F model I expect 10x price (order of magnitude, not precise) 1-2 yrs after the halving,” he wrote.“Halving will be make-or-break for S2F model. I hope this halving will teach us more about underlying fundamentals & network effects.”Stock-to-flow measures the issuance of new Bitcoins each block against Bitcoin’s existing supply, a method which has proven highly accurate in charting price performance.According to the model’s latest incarnation, BTC/USD should hit $30,000 by the end of 2020.Bitcoin stock-to-flow chart as of April 17. Source: PlanB/ DigitalikBTC, macro “will not correlate forever”

Continuing, PlanB responded to queries regarding Bitcoin’s correlation to traditional markets. A key concern among many traders is that a repeat of March could still occur, BTC/USD shedding 60% in a day as stocks crashed.Highlighting the Dow Jones, PlanB argued that current correlation was the result of the broader coronavirus crisis, and was not a permanent feature for Bitcoin:“During crisis everything is correlated. What's next is what's interesting. They will not be correlated forever (in my opinion).”Promising to throw out the stock-to-flow model altogether if it fails to deliver as planned, he added that he nonetheless was not nervous about such a scenario occurring.Recently, some well-known cryptocurrency figures have criticized the concept, arguing it is simply too optimistic and has created a “cult” which reinforces its prognosis. As Cointelegraph reported, they include Ethereum co-founder Vitalik Buterin and a Bitcoin whale known as J0E007.“To be clear: I expect S2F-price relationship to hold,” PlanB confirmed.

That 'jump' certainly offers Jim Simons and his machines an opportunity one way or the other.

Finally, we note that hidden deep in the "Material Risks" section of the RenTech brochure is a series of warnings of the potential impacts of COVID-19 on markets' functioning...

Many countries have been susceptible to epidemics, such as severe acute respiratory syndrome, avian flu, H1N1/09 flu, and, currently, COVID-19 (commonly known as the “CORONAVIRUS”), which the World Health Organization has declared to be a pandemic. The epidemic or pandemic outbreak of an infectious disease, together with any resulting restrictions on travel, transportation, or production of goods or quarantines imposed, will likely have a negative impact on the business activity in some if not all of the countries in which a Fund may invest and on the national, regional, or global economy, thereby adversely affecting the performance of the Fund’s investments. A continued escalation in the CORONAVIRUS outbreak could see a continual and drastic decline in global economic growth. CORONAVIRUS has led to significant volatility in the global financial markets, and the CORONAVIRUS and any future outbreak of an infectious disease or any other serious public health concern may lead to additional volatility and illiquidity of a Fund’s investments, the imposition of emergency or extraordinary regulatory restrictions on markets and trading activities, and significant interruption in the normal business activity of Renaissance and the Fund’s other service providers (including financial intermediaries), which could materially harm the Fund’s investments and negatively affect the performance of the Fund.U.S. and other financial markets around the world and their participants, including the financial intermediaries through which the Funds clear or execute their transactions or have contractual relationships with, can be adversely affected by unusual market turmoil such as the ongoing CORONAVIRUS pandemic in 2020. The occurrence of such upheavals and ensuing market, legal, regulatory, reputational, or other consequences is unpredictable, but can be expected to have an adverse effect on the Fund’s business, trading, and profitability and restrict its ability to acquire, sell, or liquidate financial instruments at favorable times or prices (thereby also restricting the Fund’s ability to generate cash to fulfill redemption requests).The prices of securities and of futures, forwards, and other derivatives are subject to unpredictable changes, which can be rapid and substantial. Such changes may result from, among other things, changing supply and demand relationships; changes in interest rates and stock-loan availability; currency fluctuations; government trade, fiscal, and economic policies; and other world events, including without limitation the outbreak of epidemics or pandemics, natural disasters, terrorist attacks, or military conflicts. Governments from time to time intervene in certain markets, often with the intent to influence prices. For example, in response to market conditions resulting from the CORONAVIRUS pandemic, various international regulators have recently imposed limits or prohibitions on engaging in short sales, which can impede a Fund’s ability to fully execute its trading strategy. Governments or applicable regulatory authorities could also, for example, close markets or limit the markets’ hours of trading.

Don't say you were not warned.

Subscribe to:

Posts (Atom)