National borders may be mere human constructs, but they are powerful ones.

Russia, Canada, the U.S., and so on - it’s easy to focus on the countries with the largest landmasses and seemingly endless borders. Their sheer size makes them hard to ignore, and their natural resources are often vast.

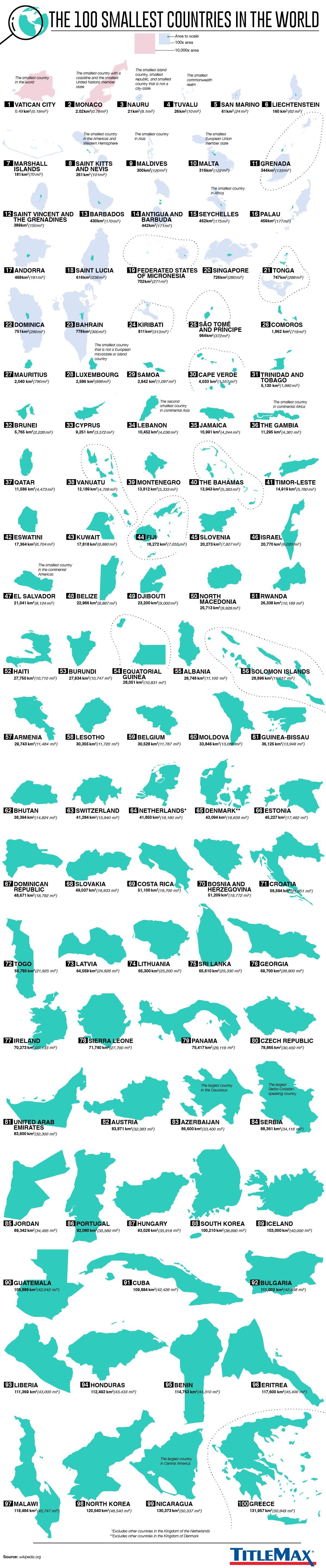

But with the graphic below from TitleMax, we can focus on the power of small.

As Visual Capitalist's Therese Wood notes, from economic might to religious influence, many of the smallest countries in the world are surprisingly powerful. Let’s take a closer look at the world’s 100 smallest countries and their spheres of influence.

Although several of the national borders shown above may be contested, the graphic gives us a clear overview of the globe’s smallest nations.

The Power of Small

Small size doesn’t mean less power. In many cases, it’s the contrary.

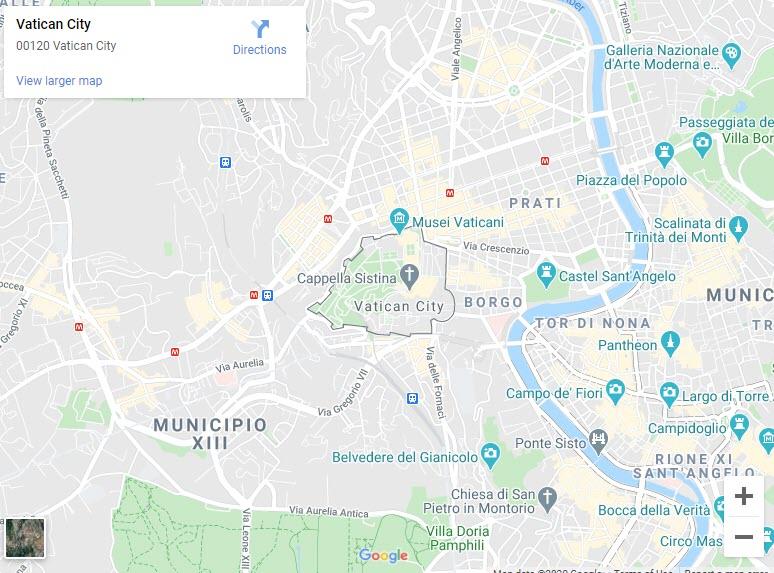

The Vatican—the smallest country on Earth at 0.19 square miles—is renowned for its leader and main inhabitant, the Pope. As leader of the Catholic Church, the pontiff and his papal staff make up a sizable part of the country’s tiny population of 825. Most of the Church’s 219 Cardinals, its leading dignitaries, live in their respective dioceses.

With more than 1.2 billion Roman Catholics in the world, the Vatican’s sphere of influence is of course far larger than its small physical size. Although the walls of the Vatican are situated inside the city of Rome, Italy, its centuries-old influence spans continents.

Nearly 40% of Roman Catholics live in the Americas, while the fastest-growing Catholic population can be found in Africa—home to more than 17% of the world’s Catholics.

Purchasing Power

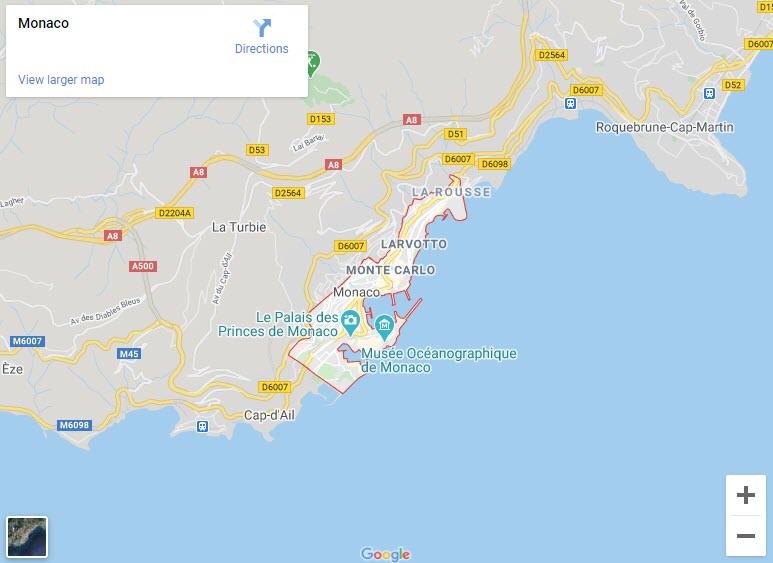

Where the Vatican’s power lies in religion, plenty of spending power is held by the tiny country of Monaco, the second smallest country on Earth.

Situated along the French Riviera, Monaco is surrounded entirely by France—but it also sits fewer than 10 miles from the Italian border.

At 0.78 square miles, Monaco could be compared to the size of a large farm in the U.S. Midwest. Despite its small size, Monaco has a GDP of nearly US$7.2 billion, and boasts over 12,000 millionaires living within one square mile.

Along with Luxembourg and Liechtenstein—both of which are included in the smallest countries list—Monaco is one of the only countries globally with a GDP per capita higher than $100,000.

Switzerland and the Netherlands, both found in this graphic at ranks 63 and 64, also hold large shares of the global economy given their size. These two nations rank 20th and 17th in the world in economic output, respectively.

Similarly, Singapore is the 20th smallest country on the planet, but it ranks in the top 10 in terms of GDP per capita ($65,233) and sits in 34th place globally in terms of nominal GDP.

Perspective is Everything

To give us a better idea of just how small the tiniest countries are, let’s take a look at some simple size comparisons:

Monaco could fit inside New York City’s Central Park, with room to spare

Brunei is roughly the same size as Delaware

Nicaragua, the largest country in Central America, is similar in size to the state of Mississippi

Nauru is the smallest island nation, and smaller than Rhode Island

North Korea is roughly the size of Pennsylvania

“Small,” of course, is a qualitative factor. It depends on your vantage point.

As of September 2020, there are 195 countries on Earth. Although this graphic shows the smallest countries in the world, it is worth noting that a list of the world’s 100 largest countries would also include some of the same countries on this list, including North Korea, Nicaragua, and Greece.

Is It A Small World Afterall?

Viewed from space, there are no borders on our tiny blue dot. But from ground level, we know how much power national borders hold.

Although globalization may make our world feel smaller, our nations significantly impact our lives, societally and economically.

And, as this chart shows, power comes in all sizes.