Crediblock.com Second Sight Markets Analysis 11/24/2020

Summary

- LabCorp provides genetic tests which always name the father who is named in the legal document, not based on science.

- This creates a massive liability for LabCorp, as the results are used in legal cases and for other means.

- This liability alone is enough to significantly impact their future growth.

- New competitors in the field are providing legitimate science based tests.

We have done deep forensic research into LabCorp (LH) specifically on their paternity tests. The conclusion is shocking; any mother who fills out a form naming John Doe as the father will be substantiated by a 'test' which is evidence in court. The bottom line, these tests are providing women the opportunity to name any male the genetic father of their child, which locks the 'dad' into paying child support. Failure to pay child support is the only known financial obligation that can land you in jail, in the United States. All of this, based on a test that doesn't name the dad genetically, in a statistically significant way.

The faulty tests

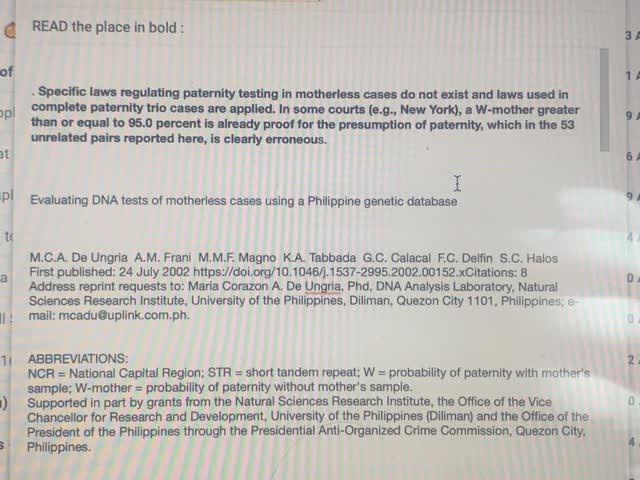

First of all, the tests provided are 'motherless' tests which means without the DNA sample of the mother. Without understanding anything about genetic science, it's logical to understand why you would need all 3 samples of DNA to provide a statistically significant result (mother, alleged father, and child).

So what are some documented examples where the tests have been proven in court to be faulty? This is perhaps the most interesting case refuting the LabCorp tests, of another doctor that actually fathered 75 children with artificial insemination:

But defense attorney David Axelson asked Stuhlmiller whether some genetic markers he did not test for might have excluded Jacobson, and whether if Jacobson had a twin it would have been impossible to distinguish between the two. Stuhlmiller acknowledged those two scenarios might be correct. And he agreed with Axelson that if one of Jacobson’s genetic markers were incorrectly analyzed it could create a problem.

Then there are the many cases where someone takes 9 different tests and gets 7 different results - how is that possible with solid science?

Another is the significant case of Andre Chreky, who had to sue and fight his way to prove himself not the father, and in the process discredit the LabCorp tests.

The Andre Chreky Case

Celebrity hairstylist Andre Chreky was sued by a woman claiming that he was the father of her child, and thus was liable to pay child support. Chreky knew he was right, because he was never with the woman, so he sued. After years and $800,000 spent, he finally won. The reason? Shoddy work:

In the case of Chreky, the judge ruled that LabCorp, one of the largest paternity labs in the country, had performed "shoddy" work. An employee testified that during his 10-hour shift, he issued an average of one paternity report every four minutes. Mislabeling, misinterpretation, and switched samples are not factored into the probabilities.

There are hundreds of other cases, most of which will never see a courtroom, as the demographic of the typical victim doesn't have the resources to stage a complex defense. In the courtroom, LabCorp results are seen as irrefutable evidence, unless challenged. Most would not dare challenge a piece of paper with the signature of a scientist on it. Our assumption is that they know best. But the facts state otherwise.

Other famous cases include Hollywood celebrities, a Missouri case which was overturned during a reality show "Paternity Court", and a 2018 case Powell v. Lab Corp, stating:

Specifically, plaintiff seeks the following relief and alleges the following claims against the specific defendants: (1) LabCorp: twenty-five million dollars for "paternity fraud, illegal random testing, and conspiracy"; (2) NYSUCS: ten million dollars for "paternity fraud, false arrest, conspiracy, omitting evidence from transcript, denial of justice, defamation of character, unsigned and unstamped dismissal for a DNA test for my son, and speedy trial";

Relationship Reports

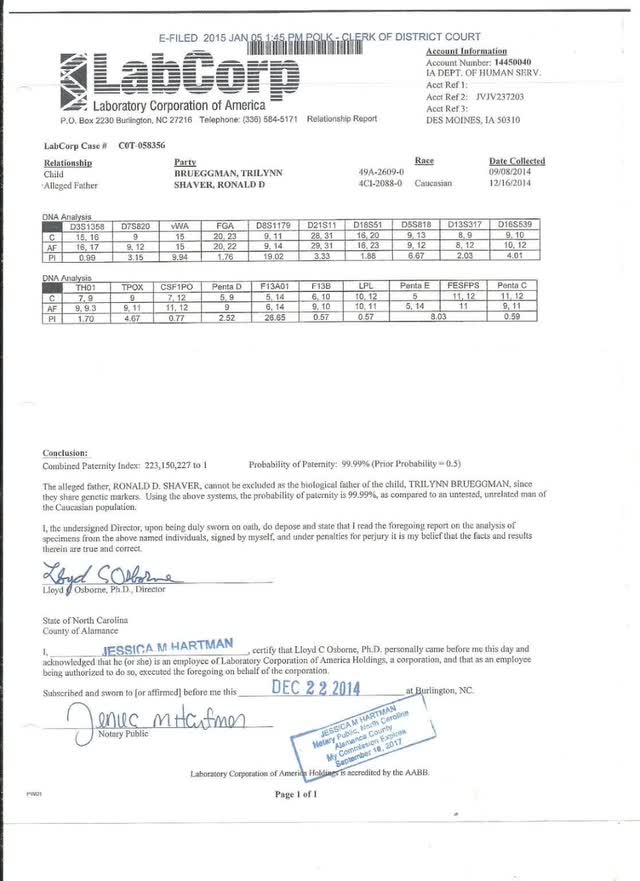

To illustrate how obvious this is, LabCorp doesn't call these paternity tests, they call them 'relationship reports' - that's because whoever is named as the father in the document mothers fill out, is going to be 99.99% the father, according to the test. See this example:

Ask yourself, if this is a real DNA identification test, why is it called a 'relationship report' and not 'DNA test' - the answer is in the liability and insurance.

Ask yourself, if this is a real DNA identification test, why is it called a 'relationship report' and not 'DNA test' - the answer is in the liability and insurance.

Insurance Policies

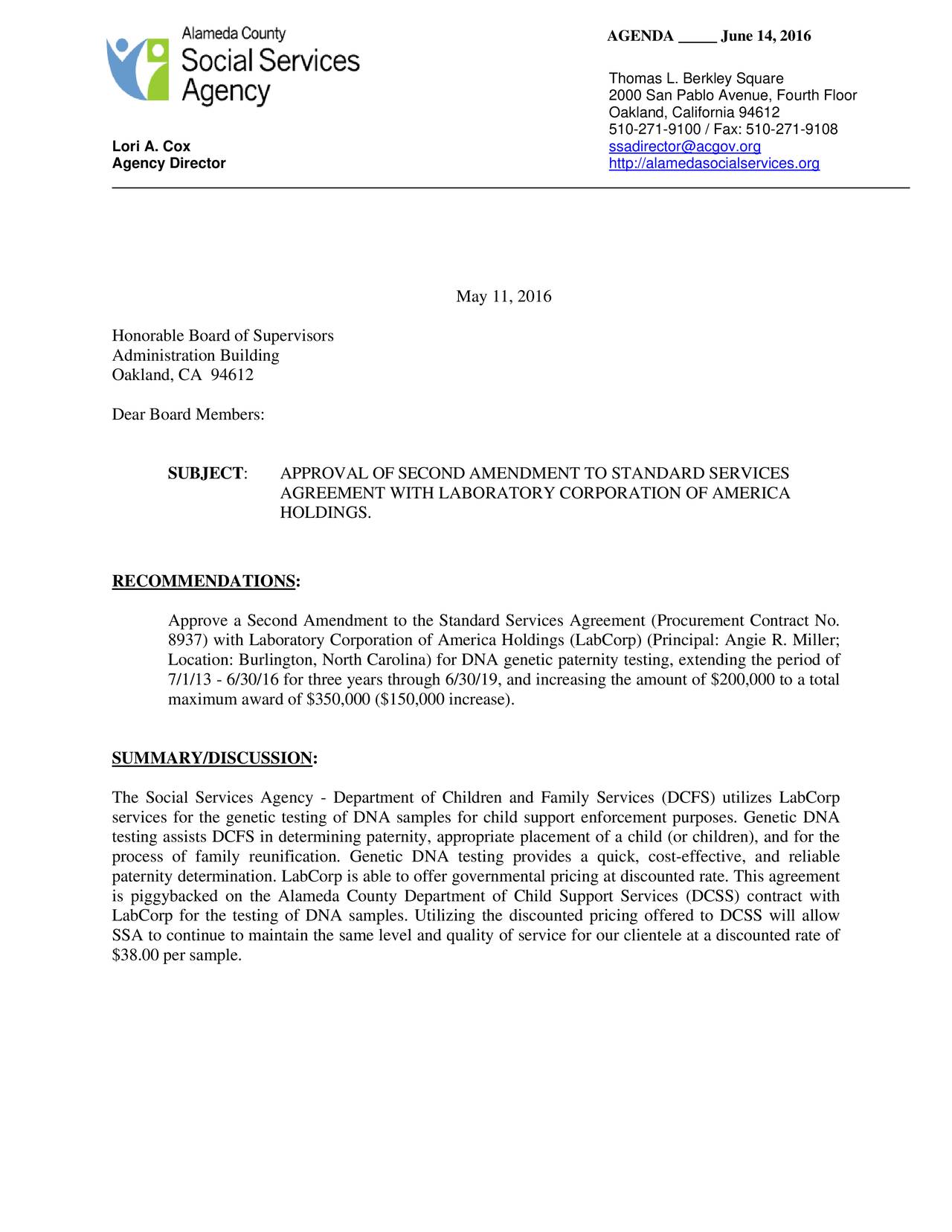

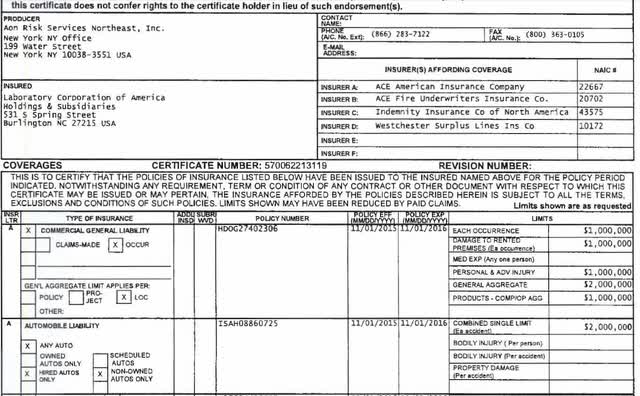

As you can imagine, LabCorp carries large insurance policies for liability on these tests. The premiums paid are in the millions but the potential liabilities are in the billions and/or are incalculable. Every case which was based on a LabCorp test would need to be revisited. Here is an example policy from a contract with Alameda County, CA:

18

Click to enlarge

You can download a copy with this link.

There are a number of policies, with a $1,000,000 limit for each occurrence.

There are a number of policies, with a $1,000,000 limit for each occurrence.

From LabCorp's own site, they claim to have performed more than 2 Million DNA tests for paternity. Simple math multiplication shows $2 Trillion in potential liability. Obviously that's a huge number, but it does show the gravity of the liability problem LabCorp faces. And they have charged as low as $25 per test (now they are charging individuals $210 per DNA test).

And that's not all.

When you get a LabCorp DNA test they keep your DNA in a database, to be used for potential third party uses down the road. Competitors like Ancestry.com and 23andMe have been sued and investigated by the FTC for this privacy violation practice. Many consumers don’t realize that their personal info may be shared with third-party companies (or used internally) and there have been complaints raised that the companies’ terms of service are not always clear about their unique policies in these matters.

Reports of inaccurate tests from unrelated sources

Based on our research, LabCorp is not the only provider of the faulty tests, there are even websites and user forums dedicated to this topic. Articles such as "Problems with Home DNA Testing" explain some of the issues we have mentioned in this article. We do not have evidence that LabCorp is maliciously providing fake tests as part of a criminal conspiracy - it may be human error, stupidity, or lack of testing standards. Perhaps LabCorp just didn't evolve with the changing times. For example, Abbott Labs (ABT) was able to deliver a cheap and fast COVID-19 test, beating LabCorp in a market where they traditionally dominate. Reports on local news such as this ABC10 talk about 'heartbreaking' results of faulty tests:

The family is suing the two companies involved in the original 2001 DNA test, Bio-Synthesis, Inc. and DNA Testing Centre. In court filings, the family alleges the two companies that took their DNA samples and analyzed them were "negligent in obtaining, labeling, handling, testing, and reporting tests results."

So this clearly is a pattern in the DNA testing industry. Perhaps this science is just too new to be trusted? But even if that is the case, what is the liability for companies like LabCorp that may need to revisit thousands of tests done for court cases in the past?

The law and regulation

What is the law surrounding this issue? The short answer is there is none.

Scientific Testing is regulated by the AABB, a private organization that charges members $270 per year. But who regulates the regulators? Like on Wall St. that is a problem. And genetics is far outside the scope of the scientific domain of AABB, an acronym that stands for American Association of Blood Banks. Collecting blood and testing for white blood cells is far different than genetic testing, a new science that was really only started circa 2000.

Scientific Testing is regulated by the AABB, a private organization that charges members $270 per year. But who regulates the regulators? Like on Wall St. that is a problem. And genetics is far outside the scope of the scientific domain of AABB, an acronym that stands for American Association of Blood Banks. Collecting blood and testing for white blood cells is far different than genetic testing, a new science that was really only started circa 2000.

The Grandparent element

In most cases, grandparent tests are performed to determine paternity—whether or not the biological son of a tested individual is the biological father of a child—in situations where the possible father is deceased, incarcerated, unwilling or otherwise unavailable to participate in a paternity test. The issue is that this weak genetic link is being abused by would be scammers. Here is the testimony of one case worker we interviewed about this petty scam:

"Mothers bring in an obituary from the news paper claiming the alleged father was deceased. We would often figure out the conception time period and find it was impossible for the person named to be the father."

https://socialwork.utah.edu/research/reports/posts/learning-from-the-front-lines.pdf

Another version..

Bait elderly recently lost their son into a defective test which will place the parents into an awkward and dangerous position

(1) Denial calling the female a fraudster

(2) After the test - This dynamic flips as the parents are “falsely told" that they cannot be excluded as Grandparents” and that the only way of seeing their “so called “grandchild “ is through this mother they just accused of fraud.

(3) Get Money

Why would anyone do this?

Reap the financial rewards both short and long term, such as:

- Social Security from fake father (including disability, or other due benefits)

- Estate from fake grandparents

- Everything in between

SCIENCE: The simulated grandparentage test indicates that commercially available test batteries containing the 13 CODIS STR loci are typically sufficient to achieve acceptable levels of exclusionary power in grandparentage analyses when the mother of the child in question is tested. In contrast, an almost untenable number of genetic markers is required to achieve similar levels of confidence when the mother is not tested.

Conclusion: Only a test that involves the mother, father, and child is statistically significant to a sigma level as to determine with 99.999% probability parentage.

Orchid Cellmark

Then there is the unusual case of Orchid Cellmark. This was a DNA testing company that was acquired by LabCorp in 2011.

In 2004 they fired a scientist for falsifying results:

Many of the cases were performed for the Los Angeles Police Department. The alleged tampering has prompted the Los Angeles County public defender's office to begin reviewing all pending cases involving Cellmark.

"What [the employee] did was commit fraud," said Jennifer Friedman, a forensic science coordinator for the Los Angeles County public defender's office. "We now need to figure out ways ... that we and our experts can help to detect these types of problems that we never imagined would exist." Some of the 20 tests were performed for the FBI. Special Agent Ann Todd, a spokeswoman for the FBI lab at Quantico, Va., would not comment on the matter, and it could not be determined where those cases originated.

Why would LabCorp acquire a company with such a history? What's interesting in the SEC report, Orchid Cellmark says that claims of testing fraud do not have a material impact on their bottom line:

We may be held liable for any inaccuracies associated with our services, which may require us to defend ourselves in costly litigation.

We provide forensic, family relationship and agricultural testing services. Claims may be brought against us for incorrect identification of family relationships or other inaccuracies. Litigation of these claims in most cases is covered by our existing insurance policies. However, we could expend significant funds during any litigation proceeding brought against us and litigation can be a distraction to management. If a court were to require us to pay damages that are not covered by our existing insurance policies, the amount of such damages could significantly harm our financial condition, and even if covered, damages could exceed our insurance policy coverage limits. We currently maintain professional liability insurance with a maximum coverage limitation of $10 million. We have been named a defendant in a number of minor suits relating to our DNA testing services, including claims of incorrect results. None of the outcomes of these suits have had a material adverse effect on our business to date.

The point here is that this isn't just connecting the dots - when you begin to research this topic there is an overwhelming preponderance of evidence. And remember also that unless circumstances warrant it, most false fathers would not have the knowledge, resources, or understanding to take such a case to court (they may believe the test, that they are the father, or not understand how a test can be faked - people believe in Science and what they see on TV over facts). But as science advances, and more accurate DNA tests become widely used, the faulty LabCorp tests will have more chance of being exposed. Once lawsuits and complaints reach a critical mass, that's when the stock is going to drop.

LabCorp stock and ownership

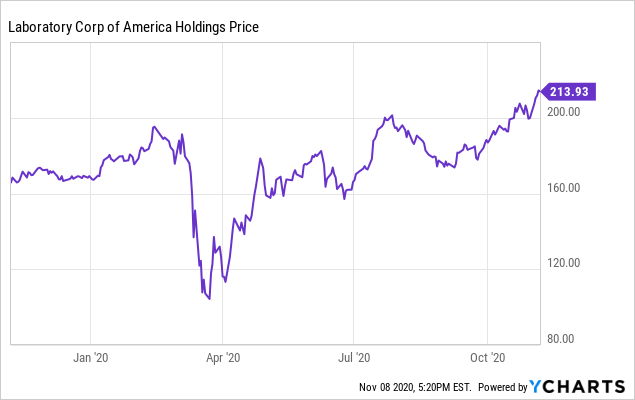

The LabCorp stock chart last few months

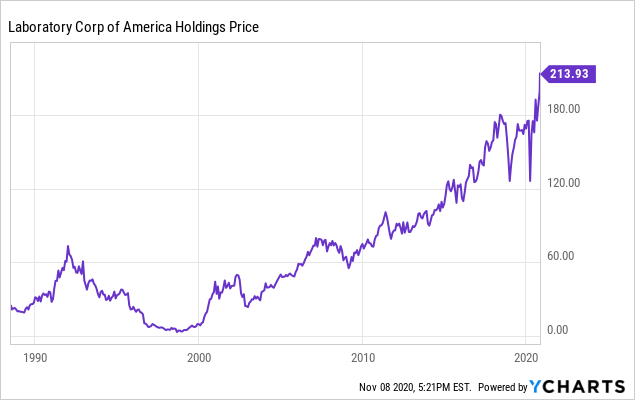

LabCorp chart last few years

Institutional ownership of LabCorp is high, here is the breakdown according to NASDAQ.com:

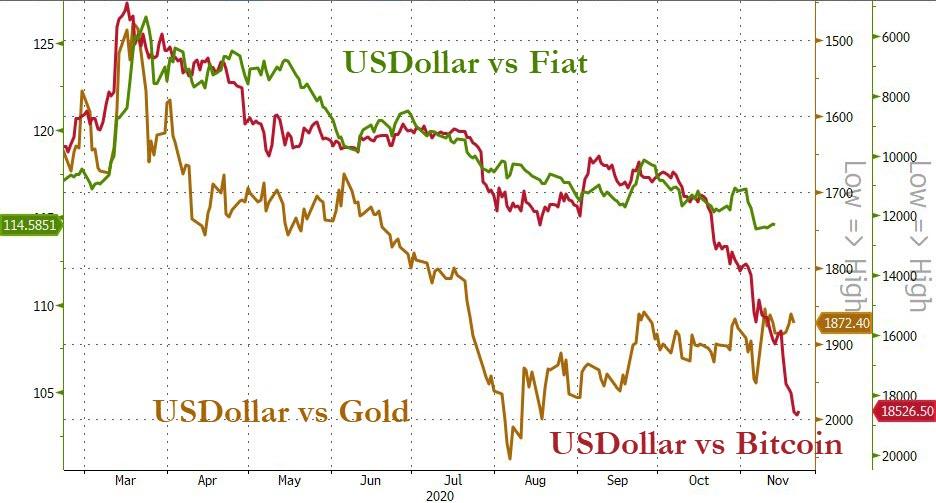

According to retail broker-dealer https://www.levelx.com, the average trading volume is about 800,000 shares a day. The stock has moved up recently as a COVID-19 positive play, but we don't see that at all. Other Seeking Alpha authors agree - this is a head fake.

According to retail broker-dealer https://www.levelx.com, the average trading volume is about 800,000 shares a day. The stock has moved up recently as a COVID-19 positive play, but we don't see that at all. Other Seeking Alpha authors agree - this is a head fake.

Paternity tests are not LabCorp's core business, they are a testing provider from things ranging from common blood work, to pregnancy related testing, and hundreds of other things (literally). But if the paternity tests were seen to be invalid in even a percentage of cases (such as 1% or 3%) that would mean thousands of lawsuits, case re-openings, and other factors which would create a ripple effect for their liability. This would have the psychological impact on the company and it's brand - if the paternity tests are inaccurate - what else is inaccurate?

Conclusion

LabCorp is a short. The only thing that is driving the test issues being exposed is awareness, and that doesn't happen overnight. In fact, it can take a long time. We aren't saying this is going to happen tomorrow or next week. But the liability is there waiting for one case to take it over the top. Once awareness of the issue reaches a critical mass, ultimately, it will be exposed. That may be a celebrity case such as the Hunter Biden paternity case, or another contested paternity situation.

We can't say how low it might go as it's impossible to accurately forecast how such liability might impact the company and/or how they may deal with it. Revlon (REV) looks like it's on it's way to zero. It is possible for a once blue chip company to fall from grace. Perhaps it's simply that firms like LabCorp failed to evolve to meet a new challenging environment. In any case, with LabCorp reaching highs recently, this is a great opportunity to short.

Additional Research

Assessing exclusionary power of a paternity test involving a pair of alleged grandparents

Marco A. Scarpetta Rick W. Staub David D. Einum

First published: 22 January 2007 Assessing exclusionary power of a paternity test involving a pair of alleged grandparentsCitations: 2

David D. Einum, Sorenson Genomics, 2495 So. West Temple, Salt Lake City, UT 84115; e‐mail: deinum@sorensongenomics.com or davideinum@hotmail.com

[This work was funded entirely by Orchid Cellmark, Inc.]

For more articles like this, checkout Global Intel Hub and see Crediblock Second Sight Market Analysis