Last September, at a law firm overlooking San Francisco Bay, Andrew Penney, a managing director at Rothschild & Co., gave a talk on how the world’s wealthy elite can avoid paying taxes.

His message was clear: You can help your clients move their fortunes to the United States, free of taxes and hidden from their governments.

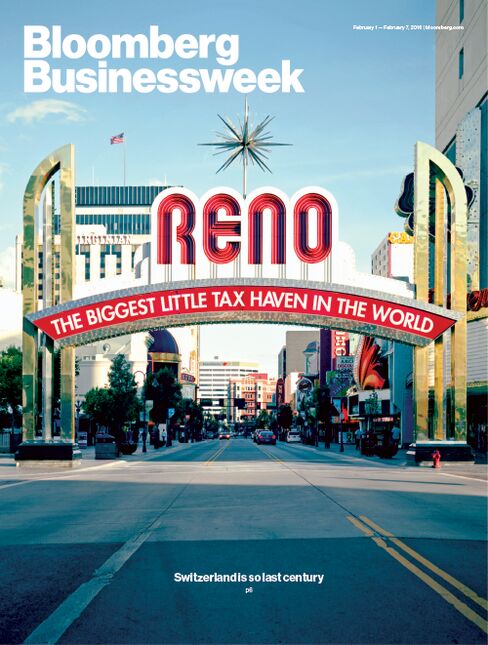

Some are calling it the new Switzerland.

After years of lambasting other countries for helping rich Americans hide their money offshore, the U.S. is emerging as a leading tax and secrecy haven for rich foreigners. By resisting new global disclosure standards, the U.S. is creating a hot new market, becoming the go-to place to stash foreign wealth. Everyone from London lawyers to Swiss trust companies is getting in on the act, helping the world’s rich move accounts from places like the Bahamas and the British Virgin Islands to Nevada, Wyoming, and South Dakota.

After years of lambasting other countries for helping rich Americans hide their money offshore, the U.S. is emerging as a leading tax and secrecy haven for rich foreigners. By resisting new global disclosure standards, the U.S. is creating a hot new market, becoming the go-to place to stash foreign wealth. Everyone from London lawyers to Swiss trust companies is getting in on the act, helping the world’s rich move accounts from places like the Bahamas and the British Virgin Islands to Nevada, Wyoming, and South Dakota.

“How ironic—no, how perverse—that the USA, which has been so sanctimonious in its condemnation of Swiss banks, has become the banking secrecy jurisdiction du jour,” wrotePeter A. Cotorceanu, a lawyer at Anaford AG, a Zurich law firm, in a recent legal journal. “That ‘giant sucking sound’ you hear? It is the sound of money rushing to the USA.”

Rothschild, the centuries-old European financial institution, has opened a trust company in Reno, Nev., a few blocks from the Harrah’s and Eldorado casinos. It is now moving the fortunes of wealthy foreign clients out of offshore havens such as Bermuda, subject to the new international disclosure requirements, and into Rothschild-run trusts in Nevada, which are exempt.

The firm says its Reno operation caters to international families attracted to the stability of the U.S. and that customers must prove they comply with their home countries’ tax laws. Its trusts, moreover, have “not been set up with a view to exploiting that the U.S. has not signed up” for international reporting standards, said Rothschild spokeswoman Emma Rees.

Others are also jumping in: Geneva-based Cisa Trust Co. SA, which advises wealthy Latin Americans, is applying to open in Pierre, S.D., to “serve the needs of our foreign clients,” said John J. Ryan Jr., Cisa’s president.

Trident Trust Co., one of the world’s biggest providers of offshore trusts, moved dozens of accounts out of Switzerland, Grand Cayman, and other locales and into Sioux Falls, S.D., in December, ahead of a Jan. 1 disclosure deadline.

“Cayman was slammed in December, closing things that people were withdrawing,” said Alice Rokahr, the president of Trident in South Dakota, one of several states promoting low taxes and confidentiality in their trust laws. “I was surprised at how many were coming across that were formerly Swiss bank accounts, but they want out of Switzerland.”

Rokahr and other advisers said there is a legitimate need for secrecy. Confidential accounts that hide wealth, whether in the U.S., Switzerland, or elsewhere, protect against kidnappings or extortion in their owners’ home countries. The rich also often feel safer parking their money in the U.S. rather than some other location perceived as less-sure.

“I do not hear anybody saying, ‘I want to avoid taxes,’ ” Rokahr said. “These are people who are legitimately concerned with their own health and welfare.”

No one expects offshore havens to disappear anytime soon. Swiss banks still hold about $1.9 trillion in assets not reported by account holders in their home countries, according to Gabriel Zucman, an economics professor at the University of California at Berkeley. Nor is it clear how many of the almost 100 countries and other jurisdictions that have signed on will actually enforce the new disclosure standards, issued by the Organisation for Economic Co-operation and Development, a government-funded international policy group.

There’s nothing illegal about banks luring foreigners to put money in the U.S. with promises of confidentiality as long as they are not intentionally helping to evade taxes abroad. Still, the U.S. is one of the few places left where advisers are actively promoting accounts that will remain secret from overseas authorities.

Illustration: Steph Davidson

Rothschild’s Reno office is at the forefront of that effort. “The Biggest Little City in the World” is not an obvious choice for a global center of capital flight. If you were going to shoot a film set in Las Vegas circa 1971, you would film it in Reno. Its casino hotels tower above the bail bondsmen across the street, available 24/7, as well as pawnshops stocked with an array of firearms. The pink neon lights at casinos like Harrah’s and the Eldorado still burn bright. But these days, their floors are often empty, with travelers preferring to gamble in Las Vegas, an hour’s flight away.

The offices of Rothschild Trust North America LLC aren’t easy to find. They’re on the 12th floor of Porsche’s former North American headquarters building, a few blocks from the casinos. (The U.S. attorney’s office is on the sixth floor.) Yet the lobby directory does not list Rothschild. Instead, visitors must go to the 10th floor, the offices of McDonald Carano Wilson LLP, a politically connected law firm. Several former high-ranking Nevada state officials work there, as well as the owner of some of Reno’s biggest casinos and numerous registered lobbyists. One of the firm’s tax lobbyists is Robert Armstrong, viewed as the state’s top trusts and estates attorney, and a manager of Rothschild Trust North America.

The trust company was set up in 2013 to cater to international families, particularly those with a mix of assets and relatives in the U.S. and abroad, according to Rothschild. It caters to customers attracted to the “stable, regulated environment” of the U.S., said Rees, the Rothschild spokeswoman.

“We do not offer legal structures to clients unless we are absolutely certain that their tax affairs are in order; both clients themselves and independent tax lawyers must actively confirm to us that this is the case,” Rees said.

The managing director of the Nevada trust company is Scott Cripps, an amiable California tax attorney who used to run the trust services for Bank of the West, now part of French financial-services giant BNP Paribas SA. Cripps explained that moving money out of traditional offshore secrecy jurisdictions and into Nevada is a brisk new line of business for Rothschild.

“There’s a lot of people that are going to do it,” said Cripps. “This added layer of privacy is kicking them over the hurdle” to move their assets into the U.S. For wealthy overseas clients, “privacy is huge, especially in countries where there is corruption.”

One wealthy Turkish family is using Rothschild’s trust company to move assets from the Bahamas into the U.S., he said. Another Rothschild client, a family from Asia, is moving assets from Bermuda into Nevada. He said customers are often international families with offspring in the U.S.

For decades, Switzerland has been the global capital of secret bank accounts. That may be changing. In 2007, UBS Group AG banker Bradley Birkenfeld blew the whistle on his firm helping U.S. clients evade taxes with undeclared accounts offshore. Swiss banks eventually paid a price. More than 80 Swiss banks, including UBS and Credit Suisse Group AG, have agreed to pay about $5 billion to the U.S. in penalties and fines.

Those firms also include Rothschild Bank AG, which last June entered into a nonprosecution agreement with the U.S. Department of Justice. The bank admitted helping U.S. clients hide income offshore from the Internal Revenue Service and agreed to pay an $11.5 million penalty and shut down nearly 300 accounts belonging to U.S. taxpayers, totaling $794 million in assets.

The U.S. was determined to put an end to such practices. That led to a 2010 law, the Foreign Account Tax Compliance Act, or Fatca, that requires financial firms to disclose foreign accounts held by U.S. citizens and report them to the IRS or face steep penalties.

Inspired by Fatca, the OECD drew up even stiffer standards to help other countries ferret out tax dodgers. Since 2014, 97 jurisdictions have agreed to impose new disclosure requirements for bank accounts, trusts, and some other investments held by international customers. Of the nations the OECD asked to sign on, only a handful have declined: Bahrain, Nauru, Vanuatu—and the United States.

“I have a lot of respect for the Obama administration because without their first moves we would not have gotten these reporting standards,” said Sven Giegold, a member of the European Parliament from Germany’s Green Party. “On the other hand, now it’s time for the U.S. to deliver what Europeans are willing to deliver to the U.S.”

The Treasury Department makes no apologies for not agreeing to the OECD standards.

“The U.S. has led the charge in combating international tax evasion using offshore financial accounts,” said Treasury spokesman Ryan Daniels. He said the OECD initiative “builds directly” on the Fatca law.

For financial advisers, the current state of play is simply a good business opportunity. In a draft of his San Francisco presentation, Rothschild’s Penney wrote that the U.S. “is effectively the biggest tax haven in the world.” The U.S., he added in language later excised from his prepared remarks, lacks “the resources to enforce foreign tax laws and has little appetite to do so.”

Firms aren’t wasting time to make the most of the current environment. Bolton Global Capital, a Boston-area financial advisory firm, recently circulated this hypothetical example in an e-mail: A wealthy Mexican opens a U.S. bank account using a company in the British Virgin Islands. As a result, only the company’s name would be sent to the BVI government, while the identity of the person owning the account would not be shared with Mexican authorities.

The U.S. failure to sign onto the OECD information-sharing standard is “proving to be a strong driver of growth for our business,” wrote Bolton’s chief executive officer, Ray Grenier, in a marketing e-mail to bankers. His firm is seeing a spike in accounts moved out of European banks—“Switzerland in particular”—and into the U.S. The new OECD standard “was the beginning of the exodus,” he said in an interview.

The U.S. Treasury is proposing standards similar to the OECD’s for foreign-held accounts in the U.S. But similar proposals in the past have stalled in the face of opposition from the Republican-controlled Congress and the banking industry.

At issue is not just non-U.S. citizens skirting their home countries’ taxes. Treasury also is concerned that massive inflows of capital into secret accounts could become a new channel for criminal money laundering. At least $1.6 trillion in illicit funds are laundered through the global financial system each year, according to a United Nations estimate.

Offering secrecy to clients is not against the law, but U.S. firms are not permitted to knowingly help overseas customers evade foreign taxes, said Scott Michel, a criminal tax defense attorney at Washington, D.C.-based Caplin & Drysdale who has represented Swiss banks and foreign account holders.

“To the extent non-U.S. persons are encouraged to come to the U.S. for what may be our own ‘tax haven’ characteristics, the U.S. government would likely take a dim view of any marketing suggesting that evading home country tax is a legal objective,” he said.

Rothschild says it takes “significant care” to ensure account holders’ assets are fully declared. The bank “adheres to the legal, regulatory, and tax rules wherever we operate,” said Rees, the Rothschild spokeswoman.

Penney, who oversees the Reno business, is a longtime Rothschild lawyer who worked his way up from the firm’s trust operations in the tiny British isle of Guernsey. Penney, 56, is now a managing director based in London for Rothschild Wealth Management & Trust, which handles about $23 billion for 7,000 clients from offices including Milan, Zurich, and Hong Kong. A few years ago he was voted “Trustee of the Year” by an elite group of U.K. wealth advisers.

In his September San Francisco talk, called “Using U.S. Trusts in International Planning: 10 Amazing Feats to Impress Clients and Colleagues,” Penney laid out legal ways to avoid both U.S. taxes and disclosures to clients’ home countries.

In a section originally titled “U.S. Trusts to Preserve Privacy,” he included the hypothetical example of an Internet investor named “Wang, a Hong Kong resident,” originally from the People’s Republic of China, concerned that information about his wealth could be shared with Chinese authorities.

Putting his assets into a Nevada LLC, in turn owned by a Nevada trust, would generate no U.S. tax returns, Penney wrote. Any forms the IRS would receive would result in “no meaningful information to exchange under” agreements between Hong Kong and the U.S., according to Penney’s PowerPoint presentation reviewed by Bloomberg.

Penney offered a disclaimer: At least one government, the U.K., intends to make it a criminal offense for any U.K. firm to facilitate tax evasion.

Rothschild said the PowerPoint was subsequently revised before Penney delivered his presentation. The firm provided what it said was the final version of the talk, which this time excluded several potentially controversial passages. Among them: the U.S. being the “biggest tax haven in the world,” the U.S.’s low appetite for enforcing other countries’ tax laws, and two references to “privacy” offered by the U.S.

“The presentation was drafted in response to a request by the organizers to be controversial and create a lively debate among the experienced, professional audience,” Rees said. “On reviewing the initial draft, these lines were not deemed to represent either Rothschild’s or Mr. Penney’s view. They were therefore removed.”

—With assistance from David Voreacos and Patrick Gower