The money-laundering scandal sweeping across the Scandinavian banking system reached another milestone on Wednesday. The Organized Crime and Corruption Reporting Project, an organization that helped break the story, has dropped another bombshell report about Sweden's Swedbank.

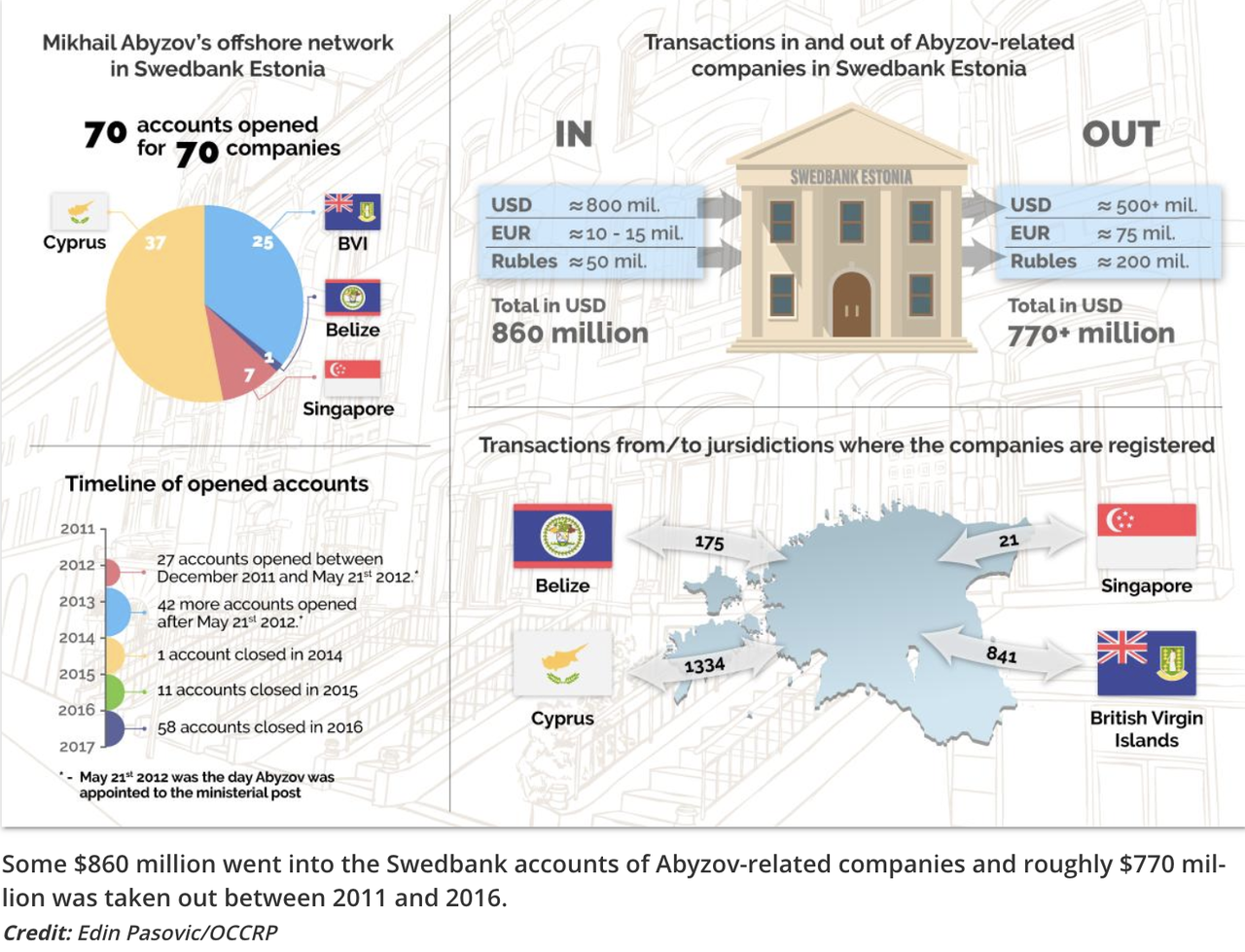

The report describes how one Russian oligarch and ex-government minister managed to hide his wealth via a network of 70 shell companies situated all over the world. The companies had one thing in common: They all had accounts with Swedbank's Estonian branch.

The oligarch in question was former energy magnate Mikhail Abyzov, who was accused of being part of Russian organized crime a few years back, and allegedly used his network of shell companies to shuffle millions of dollars stolen from business partnerships and other businesses safely to Europe.

The report goes on to accuse Swedbank of tacitly aiding Abyzov via mysterious insider employees within the bank who seemed to help his companies avoid the bank's due diligence. Over the years, roughly $860 million flowed into these accounts, and only $770 million flowed out.

Since the questionable transactions involved dollars, it's possible that the Treasury could decide to investigate after reading the OCCRP report. That could create problems for Swedbank.

But the bank said on Wednesday that it was not aware of any violations of US sanctions on Russia, like the above-mentioned report alleged, and said that it would continue to investigate accusations of money laundering made by these reporters.

In a statement, the bank said it is unaware of any violations.

"The Bank is not aware of any OFAC (Office of Foreign Asset Control) violations arising out of the continuing internal investigation," Swedbank said in a statement.

The bank did, however, leave open the possibility that an employee acting as an insider could have done something wrong.

"How individual employees have acted in different situations is also part of the ongoing internal investigation," Swedbank said. "If there has been unethical behavior as described in Uppdrag Granskning, we should of course get to the bottom of it.""It is a good thing that the bank is being investigated and I welcome Uppdrag Granskning’s reporting,” CEO Jens Henriksson added.

The bank's internal investigation, which has been ongoing for some time now, is expected to wrap early next year.