JP Morgan silver price rigging accusations go way back to when the world's largest G-SIB took over bankrupting Bear Stern's alleged losing naked short silver position in March 2008. All along the way, blogosphere silver analysts like Ted Butler have been publically making allegations against JP Morgan's silver market trading actions.

Having now almost become fully synonymous with a consortium of alleged financial market riggings. Allegations that JP Morgan has been rigging precious metals markets are now not just some supposed tin-foil ZeroHedge hat wearers domain, some 12 years on.

Rather JP Morgan silver rigging is now the freaking US Department of Justice's allegation purvue. The US DoJ states that JP Morgan broke various financial laws in the precious metals markets for almost a full decade, acting as a Racketeer Influenced and Corrupt Organization.

The nutty coincidence is that in middle September 2019, the ongoing Not-QE4 Federal Reserve REPO Loan ramp got underway at the same time that the US Department of Justice threw the RICO Act at JP Morgan's allegedly crooked precious metals trading desk.

JPMorgan Silver Manipulation Saga 2008-2020

Could it be Jaime Dimon & Co. wants to show the US Government who is not only too big to fail but also unprosecutable given that JP Morgan is the Bank for International Settlements' Financial Stability Boards' largest Globally Systematically Important Bank?

Brazen might be the fact that if the US prosecutes JP Morgan directors criminally, the mega-bank may merely throw the global economy into a tailspin in retaliation.

Why have we allowed JP Morgan to have this much power over our global economy?

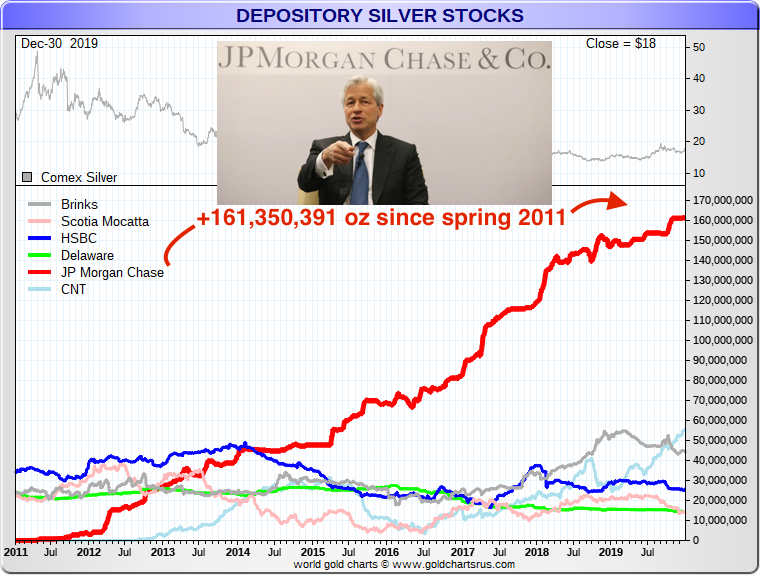

Why does JP Morgan Chase & Co. likely hold the most silver bullion in the world currently?

If global financial threats and bailout blackmail have become commonplace since the 2008 Global Financial Crisis.

How much longer will 6 Bail-In-Able Mega-Banks in the USA be allowed to own about 1/2 of +5,200 US bank sectors' financial assets under ownership?

Given the facts and allegations ongoing, why would a sane person do any business with these mega-bank 'patriots'?