It's a quietish day in Nattie futures - down just over 2% but coming back a little now...

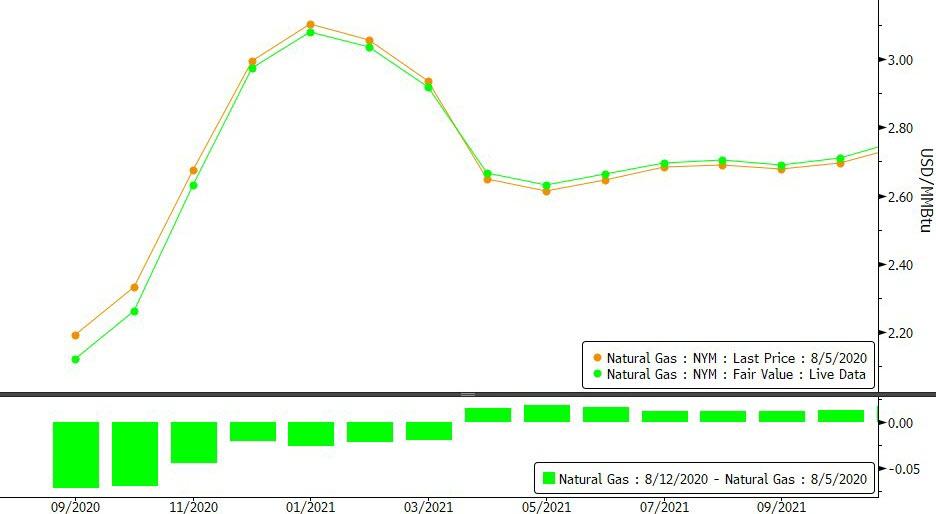

The NatGas term structure is 'normal'...

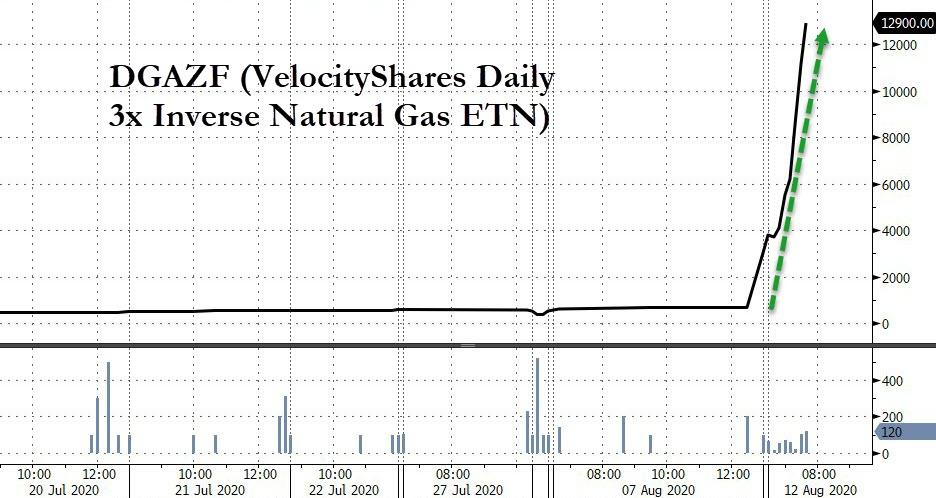

But you wouldn't know that if you are "invested" in the VelocityShares Daily 3x Inverse Natural Gas ETN...

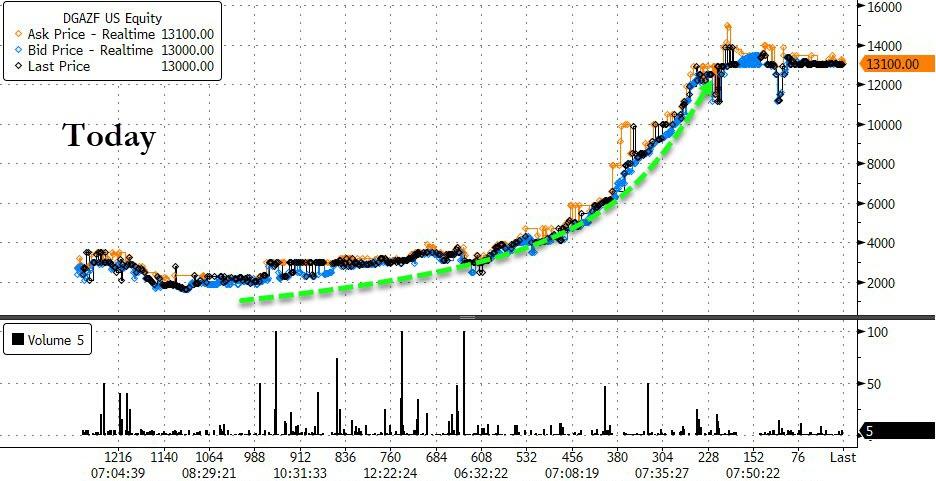

For some context, this is a $12,000-plus surge in the price... as one market watcher exclaimed "something's f**king broken."

Did someone just get "Cordier"-ed?

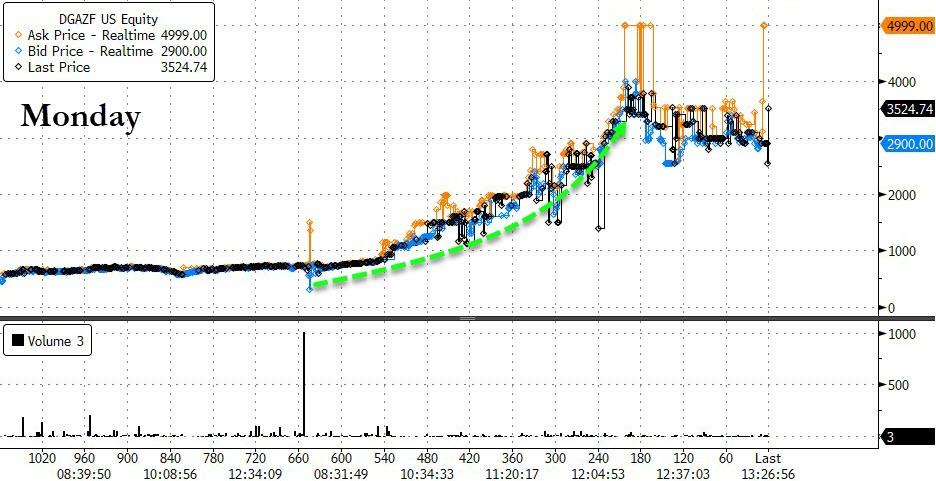

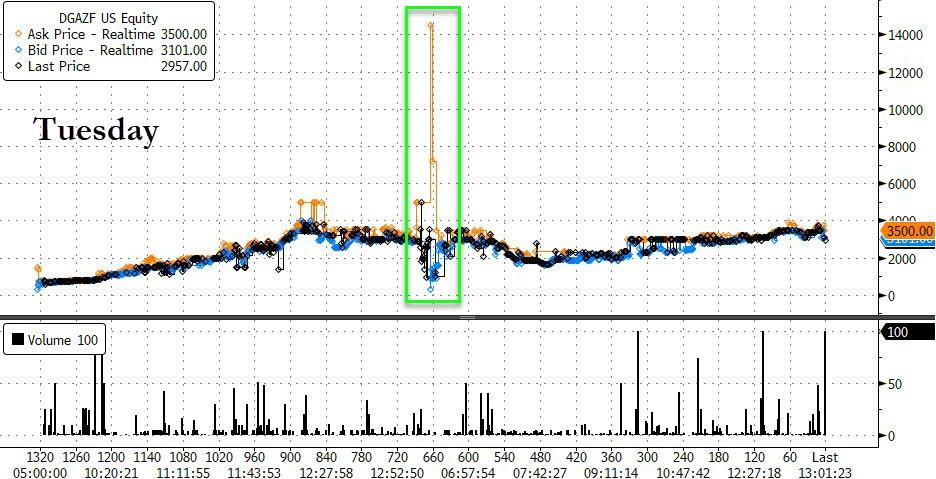

For some color, the last three days have been extremely chaotic with manic runs likely driven by HFT algos...

Monday started the chaos...

Then Tuesday saw a major ask spike in the middle of the day but no trade at that level...

Then there's today...

And all the moves were on tiny volumes again suggesting this was not Robinhood'rs or retail malarkey.

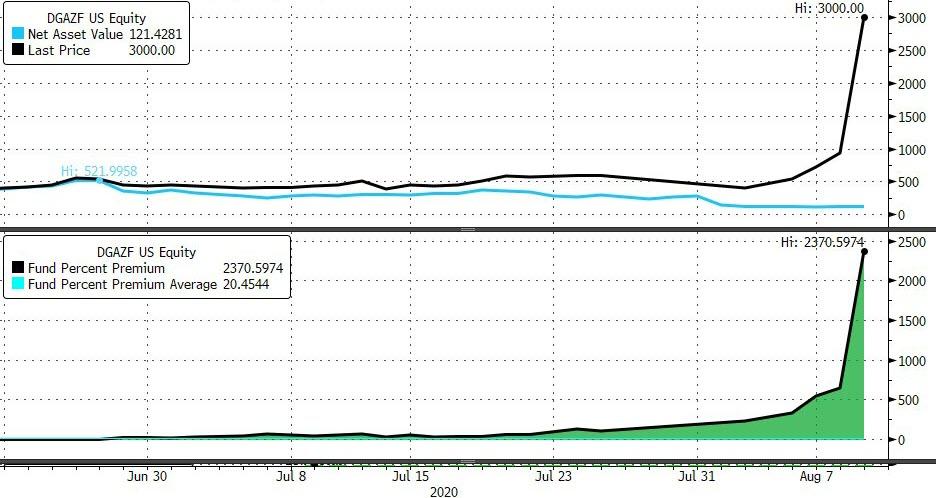

As Bloomberg's ETF analyst, James Seyffart, notes, Credit Suisse may need to consider shuttering the (DGAZF), after pricing broke down and the exchange-traded note closed with a 645% premium to net asset value yesterday, and it traded as much as 3,900% above NAV because market makers lack the ability to create new shares to meet demand.

Can we get a better market!!??