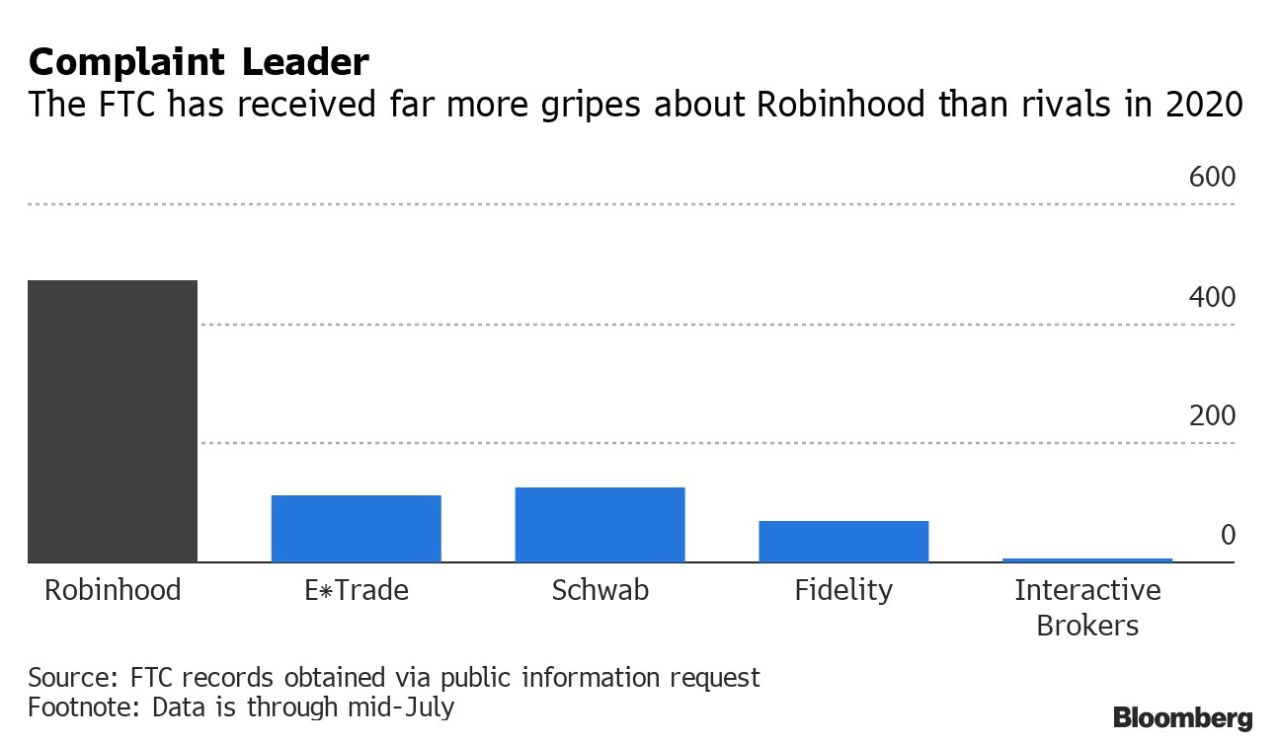

Robinhood's quick rise to the top of the brokerage world hasn't come without speedbumps. To wit, US consumer protection agencies are being flooded with complaints about the app. In fact, four times as many complaints are being filed about Robinhood than other traditional brokerages like Schwab and Fidelity, according to Bloomberg; in 2020 alone more than 400 complaints have been lodged against the "free" daytrading app.

The complaints have featured "novice investors in over their heads, struggling to understand why they’ve lost money on stock options or had shares liquidated to pay off margin loans."

Complaints were also filed when Robinhood's app went down for a full day back in March during the beginning of the coronavirus pandemic. Users complained about losing money and not being able to sell holdings (in retrospect, they should be praising the company for preventing them from dumping just before the Fed nationalized the market and sent the S&P 61% higher from the March lows). They complained about not being able to make money because the app was down. A legitimate grievance: no phone number, or direct contact at Robinhood have been listed, probably because the company still can't afford a client-facing support team.

One complaint unearthed by Bloomberg in a FOIA request stated: “It just says to submit an email. This company’s negligence cost me $6,000.”

Another complaint, from a user who estimated they lost $20,000, said: “I can’t make trades, can’t take my own money and can’t leave their service.”

The complaints are par for the course for a company that has focused solely on growth over the last few years. Robinhood has signed up more than 3 million clients in the first four months of 2020 alone and has become the go-to app for those in quarantine, receiving unemployment and looking for something to do all day.

Regulators have received so many complaints, they have joked that they feel like they have become Robinhood's customer service department (it's funny cause it's true). Both the SEC and FINRA are currently investigating how the company handled its app's outage in March. Their findings and any enforcement action is being watched closely, as it may interfere with plans for an IPO that is widely expected from Robinhood, which is now valued at $11.2 billion after its latest round of funding.

Robinhood has responded by saying it has doubled its customer service representatives this year and is "hiring hundreds more". They have also said that after the March outage, they have strengthened their platform and improved reliability. The company is able to offer free commissions because it sells its order flow, something we have harped on and pointed out numerous times on this site (we exposed that the app was selling its order flow to HFT algorithms as early as 2018).

Meanwhile, Robinhood still appears to be having outage issues, with the app going down as recently as Monday and again this morning.

In response, the company hired former Republican SEC commissioner Dan Gallagher as its top lawyer. Gallagher has years of experience with federal regulation.

“Robinhood is empowering a whole new class of investors, and I think it is critical for us to have a voice in Washington to advocate for our customers and fairer markets,” Gallagher concluded.

Enjoy those IPO shares, Dan. After the Citadel-led IPO of course.