We all know in hindsight that it's so easy to sit on Bitcoin, Amazon or Microsoft stock, but how do we know in the future which assets will return like that? We all know that some Pre IPO company is going to be the next Palantir. We don't, so we are left to stock picking (or asset picking if you will). But actually stock picking is not so hard - what's hard is what any trader will tell you, and that's picking entries and exits. For example, there certainly were those who bought BTC in the early days. This author bought some below $1. Guess what happened? Got hacked at Mt.Gox. Then I know about the group that bought Bitcoin at $1 and sold it at $80 for a whopping 80x return on their money (and it was a lot of money). The point is that, picking the asset is not hard, timing the entry and the exit is. Doing that is not easy, here is one suggested method:

LOOK FOR DISRUPTION.

Palantir is very disruptive. It took the market years to realize that. First they needed to manifest an IPO. Now that Palantir is public, it's doing great. Palantir solves a problem that frankly no other company in the world solves.

Lyft and Uber are NOT disruptive. They are apps that replaced the Taxi manager. There is little profit in delivery, particularly food delivery. If you look past the hype, the gig economy is just an advanced form of modern slavery.

Airbnb is different, because if you compare it to companies like Uber, it's not just replacing the hotel - it's unlocking new markets. Airbnb is much as a real estate play as it gets. How many Airbnb hosts are huge stock holders? How much property has been purchased and refurbished to host guests? The traditional Hotel industry will always have it's core customers, but like restaurants, the industry grew fat and inefficient. Airbnb cut that out. Now hotels try to be like Airbnb. It's all about the presentation and the business model. The question is - did Airbnb get people to travel more? Of course! Also, the margins are much higher in the hotel industry. Companies like Rubrik, these are the next Snowflake's.

Brokers are popping up left and right offering access to private markets, such as LevelX. But as with any hot market, so does the fraud. Sources tell us that there are multiple SEC investigations into fraudulent "Pre IPO" shops selling fake shares, selling naked, and other fraudulent practices. In one example, a customer sent funds in for a Pre IPO investment, only to have the funds returned 6 months later - minus a fee! A fee for 'trying.'

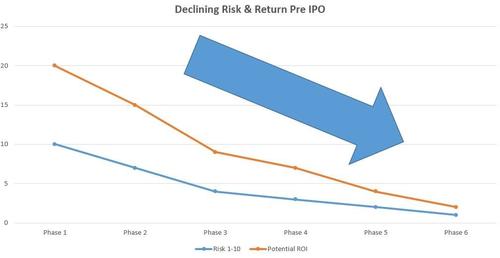

Pre IPO is not the only place to find disruption of course, but it's a good start. Early stage companies still have many bugs to be worked out and have not proven themselves. For many investors, Pre IPO unicorns are the perfect mix of risk and reward, as seen in this chart:

(Source: Preiposwap.com)

The math works over a wide range of investments being studied. All types of risk decline over time - the older a company is, the more credibility it has. Exceptions to the rule include situations like Enron, Madoff, MF Global, Refco, and others. It's rare to see a big firm implode due to fraud or other reasons. Typically, big firms simply fail to adapt to changing circumstances, such as we have seen with Revlon (REV) Kodak (KODK) and others.

Earlier seed stage companies, as depicted in Phase 1 on the above chart, simply have too much risk. Venture Capital is a very unique thing. You invest in 100 companies knowing that 99 will fail and the 1 that works is going to earn a 100x return or 1000x return. It's really a very special part of capitalism. Venture Funds try to spread this out by offering funds that invest in 50, 100, or 200 deals. Sadly, the only reason that many companies succeed is because the backers have so much capital to throw at problems they almost never let a deal fail (but it does happen).

Pre IPO seems to be the best mix for the search for disruption.

What about Crypto?

Crypto is also very disruptive, but the issue is credibility. Crediblock.com was founded on the idea of brining credibility to financial technology. Some Crypto projects such as xSigma, that are backed by public companies, at least have some substance of what you would call due diligence. Many however, are created by anonymous founders, and no one knows where the money is going.

There are disruptive investments, such as Crypto arbitrage, that we can't reference here with a link because they are all dark investments (meaning, they don't solicit investors, they don't have a website).

The most disruptive companies though can be local. While small businesses are being attacked, many of them are getting creative. Solutions will emerge and new industries will form. Dark kitchens are the future of restaurants.

Advertising is going to evolve, as users boycott crap platforms like Facebook. Take a look at how Wrapify is paying people to drive around with ads on their cars.

A company from Los Angeles called QLess has literally ended waiting in line! See QLess Crunchbase.

We're not going to mention the 2 taboo topics for fear of our authorship and personal life- voting systems and COVID. But we're going to see massive disruption there.

According to Zanbato.com, Pre IPO sectors that are hot and cold, according to their reports, are:

Reported Holdings as of August 31st, 2020:

- For a third consecutive month, reporting holders marked up their private portfolios. August’s advance of 6.8% was lower than July’s 7.6% appreciation, despite a better than 2:1 advance-decline ratio.

- Sentiment up:

- Private Companies: Freenome96.1% Farmers Business Network 91.7% Seismic89.6% Snowflake81.1%

- Sectors: Payments, Artificial Intelligence, Delivery Services

- Sentiment down:

- Private Companies: Intarcia Therapeutics-85.7% Magic Leap-70.7% Yumanity-44.8% 23andMe-31.6%

- Sectors: Gaming & Entertainment, Healthcare, Consumer Goods & Services

This data is old, but the point remains - companies will provide opportunities to disrupt. Either find the companies and invest in them, or found one. This is the opportunity of a lifetime.

It's true, all these 'conspiracies' are really true. A small group of rich people is trying to take over the world and install a global Monopoly regime. But these are business guys, they are not 'Communists' that's just a red herring for idiot Democrats. They are hardcore business guys, and this is a great opportunity for business.

Of all the scenarios that may come of the next 60 days there is one that few are talking about. USA can split up into multiple countries, each managed by a regional Fed. This would be a bonanza for business, just like if the EU was broken up. Superstates don't work, and that's why this author does not believe the Elite will succeed in their plan. Ultimately, there are going to be too many black swans that you can't hedge against, and the system will implode. That's what happened to the Soviet Union. And to this day, Russia sucks (to live in).

Capitalism works, and what drives Capitalism is Entrepreneurs, investing, and risk.

Monopoly, what 'they' want to create - it just doesn't work. But in the process of creating the global Monopoly they want, they need to create massive opportunities as the rules of the game are changing, assets are shifting hands, and they are really pushing their agenda hard.

2021 is the year of Game On.

Trade stocks free (but don't get front-run) with LevelX, a real disruptor. Also buy/sell private markets, if you are accredited.