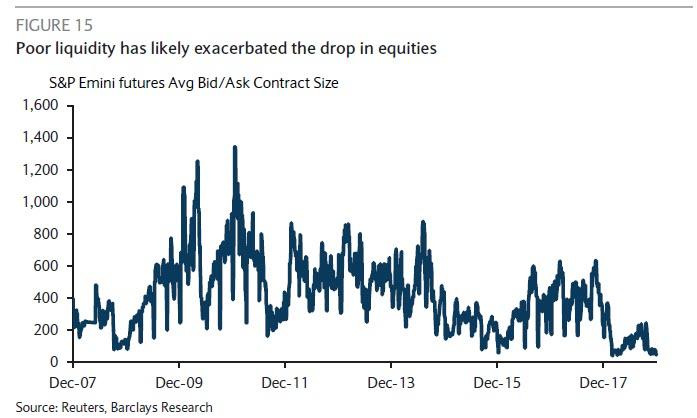

While there were countless argument offered to explain December's near-record market drubbing, we said on several occasions last month that the simplest reason for last month's plunge was also the simplest one: faced with a mountain of redemption requests, hedge funds were forced to sell their holdings into a market that had never been more illiquid, which meant hitting each and every bid and culminating with the brief, December 24th bear market.

We now have confirmation, because according to Hedge Fund Research, investors fled hedge funds as markets plunged in the fourth quarter (or is that markets plunged as investors fled hedge funds), pulling a massive $22.5 billion, the most in more than two years. The exodus added to the total withdrawals of $34 billion in 2018, or about 1% of hedge fund industry assets, the largest quarterly outflow since Q4 2016 when investors redeemed about $70 billion.

Large fund outflows were concentrated in several firms which closed and returned capital to investors, with approximately two dozen firms experiencing net asset outflows of greater than $500 million for the quarter. Despite the overall negative trends on flows and performance, but reflecting the trend of larger hedge fund relative outperformance, approximately one dozen firms received net asset inflows of greater than $500 million for the quarter.

Flows by firm size also showed net outflows across all firm sizes, with firms managing greater than $5 billion experiencing outflows of $15.6 billion. Mid-sized firms managing between $1 and 5 billion saw outflows of $2.8 billion for the quarter, while firms managing less than $1 billion saw outflows of $4.1 billion.

"Hedge fund outflows in 4Q were driven by several factors, most notably investor reaction to steep losses in traditional asset investments and the sharp spike in equity market volatility leading to redemptions" stated Kenneth J. Heinz, President of HFR.

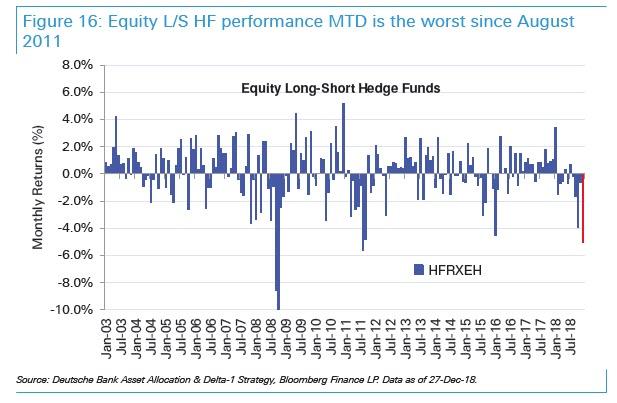

The spike in redemptions came as hedge funds suffered their worst performance since 2011 in a year marked by two corrections, a bear market, and a spike in year-end volatility.

Additionally, as Bloomberg notes, several big names exited the industry last year, including T. Boone Pickens, Leon Cooperman and Philippe Jabre, while virtually everyone else struggled to generate any alpha (with a few exceptions ). "Outflows also included several large fund closures," said HFR President Kenneth Heinz in the quarterly report, including instances of family office conversions and orderly, manager-initiated returns of investor capital.

Broken down by strategy, equity hedge funds suffered the biggest outflows, with investors pulling $16.8 billion in the quarter and a total of about $23 billion for the year, according to HFR. Hedge funds in this group fell 5.9% on an asset-weighted basis in 2018, the worst performers of all strategies tracked by HFR. Confirming that the redemptions were liquidity and not performance driven, even the year’s top performing macro managers, up 1.6%, ended 2018 with outflows of $12.3 billion.

There was a silver lining: event-driven (ED) funds brought in $6.4 billion in the quarter - the only strategy to see inflows - and $6.9 billion for the year, although performance weakness decreased total ED capital to $819 billion from the prior quarter. ED sub-strategy flows were driven by Distressed/Restructuring and Special Situations funds, which experienced inflows of $6.5 billion and $1.4 billion, respectively.

Fixed income-based Relative Value Arbitrage (RVA) strategies led industry performance in 2018, as the HFRI Relative Value Index (Asset Weighted) added +0.5 percent for the year, while the HFRI Relative Value (Total) Index posted a narrow decline of -0.2 percent for 2018. In 4Q18, RVA strategies experienced outflows of $5.4 billion, decreasing total RVA capital to $835 billion from the prior quarter.

"Trends in Macro, CTA, and RVA/Credit Multi-Strategies, and stronger relative outperformance of larger funds were all favorable throughout the intense market dislocations of December and 4Q. While the overall investor flows and performance trends were negative, it is likely that discriminating institutional investors which experienced or observed areas of strong performance through the most difficult equity and commodity trading environment in a decade will factor these positive dynamics into portfolio allocations for 2019."

With volatility set to return with a vengeance once this algo-driven bear market rally ends, 2019 promises to be just as challenging for the 2 and 20 crowd.