Based on an overwhelming bearish negative bias on the euro (FXE) from multiple sources (individuals, banks,

analysts, and fund managers) we believe selling the euro on any run-up is a

viable strategy.

http://seekingalpha.com/article/830411-sell-the-euro-on-spikes

Monday, August 27, 2012

Thursday, August 23, 2012

Euro nears 1.26 on Spain bailout news

The euro climbed to a fresh seven-week high against the dollar on Thursday on news Spain is negotiating with the euro zone over conditions for international aid to bring down its borrowing costs though the country has not made a final decision to request a bailout.

Earlier, the single currency set a fresh seven-week high against the U.S. dollar after Federal Reserve minutes hinted at more monetary easing in the U.S., while French and German business activity surveys were not as bad as feared.

FRANKFURT — New economic data on Thursday bolstered expectations that the euro zone is sliding into recession, adding to the pressure on the leaders of France and Germany as they met to discuss the debt crisis.

http://www.nytimes.com/2012/08/24/business/global/daily-euro-zone-watch.html

http://www.zerohedge.com/news/european-no-action-just-talk-rumor-mill-back

EES Updates Traderstartpage.com

Traderstartpage.com homepage for traders. News, market info, research, and resources.

www.traderstartpage.com

Please bookmark, use as your homepage.

www.traderstartpage.com

Please bookmark, use as your homepage.

Wednesday, August 22, 2012

Analytics must be put centre stage in decision making

In today's volatile business environment, organisations must be ready to reconfigure their strategic priorities at speed, and with certainty.

Crucially, instead of basing major business decisions on intuition, they need to mine the data and information at their disposal to drive rapid decision making.

This is why analytics - the use of data, statistical and quantitative analysis, explanatory and predictive models - has moved centre-stage.

According to market research firm IDC, the market for business analytics software grew 14 percent in 2011 and will hit US$50.7bn by 2016.

Of course, analytics itself is nothing new.

Organisations such as Google, Tesco and Caesars Entertainment are well recognised for their ability to predict market trends, customer behaviours and workforce staffing requirements and turn these into top-line growth and/or bottom line savings.

But for the many other businesses now seeking to take advantage of analytics, there continues to be a lack of clarity around certain fundamental questions.

What is analytics? How can it propel and improve an organisation's competitive positioning or effectiveness?

What does it mean to truly become an analytical organisation? And how does an organisation set out on this critical journey?

Although the development of analytical capabilities and capacity is obviously important, a focus on data, methods and technology alone will not magically deliver the insights needed for competitive edge.

Tuesday, August 21, 2012

Rothschild bets £130m against Euro

Lord Rothschild has taken a near-£130m bet against the euro as fears continue to grow that the single currency will break up.

http://www.telegraph.co.uk/finance/financialcrisis/9484435/Lord-Rothschild-takes-130m-bet-against-the-euro.html

Monday, August 20, 2012

UBS launches quant unit

UBS AG (UBS) is starting a unit aimed at attracting clients among quantitative hedge funds, combining services from its prime brokerage and direct-execution trading businesses.

Scott Stickler in New York will be global head of the operation, called UBS Quant HQ. Strategies across equities, options and futures will be supported with fixed income and foreign exchange to be added later, he said. The business targets startups and established funds with long-short or hedged strategies and those focused on arbitrage.

Investment firms formed as a result of regulations to curb risk-taking within banks are looking for help with technology consulting services, trading and financing, according to Stickler, who was hired in July 2011. The unit began working with more than a dozen hedge-fund clients in the second quarter as it prepared for the Quant HQ introduction, he said.

“One of the trends we’re seeing is a number of startups, folks coming out of big banks because of the Volcker rule and starting their own hedge funds,” Stickler said in a phone interview. “Clients are coming to us who wanted us to be in this business and who want to be able to take advantage of our global presence and our counterparty safety, stock-loan and execution capabilities.”

EES: SNB on unpeg watch

...how would the SNB handle a volatile situation in the event Finland, Greece, or Austria exit the euro?

http://seekingalpha.com/article/816681-is-the-snb-going-to-unpeg-the-eur-chf

http://seekingalpha.com/article/816681-is-the-snb-going-to-unpeg-the-eur-chf

Friday, August 17, 2012

Investors Prepare for Euro Collapse

By Martin Hesse

Otmar Issing is looking a bit tired. The former chief economist at the European Central Bank (ECB) is sitting on a barstool in a room adjoining the Frankfurt Stock Exchange. He resembles a father whose troubled teenager has fallen in with the wrong crowd. Issing is just about to explain again all the things that have gone wrong with the euro, and why the current, as yet unsuccessful efforts to save the European common currency are cause for grave concern.

He begins with an anecdote. "Dear Otmar, congratulations on an impossible job." That's what the late Nobel Prize-winning American economist Milton Friedman wrote to him when Issing became a member of the ECB Executive Board. Right from the start, Friedman didn't believe that the new currency would survive. Issing at the time saw the euro as an "experiment" that was nevertheless worth fighting for.

Fourteen years later, Issing is still fighting long after he's gone into retirement. But just next door on the stock exchange floor, and in other financial centers around the world, apparently a great many people believe that Friedman's prophecy will soon be fulfilled.

Banks, investors and companies are bracing themselves for the possibility that the euro will break up -- and are thus increasing the likelihood that precisely this will happen.

There is increasing anxiety, particularly because politicians have not managed to solve the problems. Despite all their efforts, the situation in Greece appears hopeless. Spain is in trouble and, to make matters worse, Germany's Constitutional Court will decide in September whether the European Stability Mechanism (ESM) is even compatible with the German constitution.

There's a growing sense of resentment in both lending and borrowing countries -- and in the nations that could soon join their ranks. German politicians such as Bavarian Finance Minister Markus Söder of the conservative Christian Social Union (CSU) are openly calling for Greece to be thrown out of the euro zone. Meanwhile the the leader of Germany's opposition center-left Social Democrats (SPD), Sigmar Gabriel, is urging the euro countries to share liability for the debts.

On the financial markets, the political wrangling over the right way to resolve the crisis has accomplished primarily one thing: it has fueled fears of a collapse of the euro.

http://www.spiegel.de/international/business/investors-preparing-for-collapse-of-the-euro-a-849747-druck.html

He begins with an anecdote. "Dear Otmar, congratulations on an impossible job." That's what the late Nobel Prize-winning American economist Milton Friedman wrote to him when Issing became a member of the ECB Executive Board. Right from the start, Friedman didn't believe that the new currency would survive. Issing at the time saw the euro as an "experiment" that was nevertheless worth fighting for.

Fourteen years later, Issing is still fighting long after he's gone into retirement. But just next door on the stock exchange floor, and in other financial centers around the world, apparently a great many people believe that Friedman's prophecy will soon be fulfilled.

Banks, investors and companies are bracing themselves for the possibility that the euro will break up -- and are thus increasing the likelihood that precisely this will happen.

There is increasing anxiety, particularly because politicians have not managed to solve the problems. Despite all their efforts, the situation in Greece appears hopeless. Spain is in trouble and, to make matters worse, Germany's Constitutional Court will decide in September whether the European Stability Mechanism (ESM) is even compatible with the German constitution.

There's a growing sense of resentment in both lending and borrowing countries -- and in the nations that could soon join their ranks. German politicians such as Bavarian Finance Minister Markus Söder of the conservative Christian Social Union (CSU) are openly calling for Greece to be thrown out of the euro zone. Meanwhile the the leader of Germany's opposition center-left Social Democrats (SPD), Sigmar Gabriel, is urging the euro countries to share liability for the debts.

On the financial markets, the political wrangling over the right way to resolve the crisis has accomplished primarily one thing: it has fueled fears of a collapse of the euro.

http://www.spiegel.de/international/business/investors-preparing-for-collapse-of-the-euro-a-849747-druck.html

Germany slowing down?

AFTER a promising May and June, Steffen Knoop has seen his sales dip by 30%. His small Hamburg-based company, Wascut, sells cooling and cleaning oils for big machines, including those that make cars. “I have a pretty good window on the economy,” he says. Mr Knoop wonders whether the dip is caused by people taking extra long summer holidays or something more serious. Others with a broader and more long-term view of the economic landscape are asking the same question.

http://www.economist.com/node/21560601

http://www.economist.com/node/21560601

Only 23% of Greeks want a return to the Drachma

Ask Greek Citizens About Soft (Drachma) Money, And If They Like It

Throughout the past hundred and fifty years or so, especially in U.S. politics, a manipulated currency (“soft money”) was favored by left-leaning interests, in practice the Democratic Party. A gold-standard system (“sound money” or “stable money” or “hard money”) was favored by right-leaning interests and the Republican Party... http://www.forbes.com/sites/nathanlewis/2012/08/16/ask-greek-citizens-about-soft-drachma-money-and-if-they-like-it/print/

Thursday, August 16, 2012

Expert Advisor Development

Building forex trading systems is the reason that this company

exists. Nearly every one of our clients aspires to be a fully automated

trader.

The percentage of clients that succeed over the long run, however, is incredibly small. I don't think that is a big secret. If that is news to you, allow me to be clear. The chances of developing a successful expert advisor over the long term are minimal.

The inevitable next question from new clients is an attempt to pick my brain for some features common to successful systems traders. I decided to outline the traits common to this rare breed and some of the challenges that they encounter.

That's my theory for why the "intellectually challenged" crowd seems disproportionately likely to profit from trading. They see right through the noise to pick out a simple observation that wins more than it loses. Holy grail systems certainly do not come from this group. That's not honestly not the goal. It's about eating cheese more often than going hungry.

The brainy crowd benefits from a heavy dependence on analysis. Ideas usually stem from pet theories, many of which look like the crackpot variety on first glance. The theory shifts and twists as market tests reveal strengths and weaknesses. Logical conclusions instill a robustness and variety into the system. Interestingly, the approach to testing and verifying the systems follows the opposite path of most developers. The ideas tend to get simpler with time rather than more complex.

Emotion does not play a large role in the rationale for developing an expert advisor. Again, the reasons are usually logical. Examples like "I've been trading this system for 20 years and I need to automate it" or "I came up with a way to accurately predict market direction."

It may sound a bit zen, but the systems that make money are the ones that do not set their primary goals as making money. Making money is a totally open ended goal. The potential variables know no limit. The lack of constraint encourages would be EA traders to shoot off on tangents. Unless the wild ride accidentally leads to the pot of gold at the end of the rainbow, they will fail. The limitless bounds make it impossible to measure any progress.

In that same vein, the journey is as important as the destination. Many traders pay lip service to limiting drawdown. Few are able to effectively rein in drawdown, especially within the context of an expert advisor. To a certain extent, limiting drawdown is not possible. My experience with money management makes it clear how much wandering a return can make, even with a heavy advantage.

The easiest way to limit drawdowns is to fight against severe losses. The goal is to obsess over risk and reduce it to the lowest possible point. I want to emphasize this point carefully. Risk always exists. The market chaotically switches from deep slumber to extreme violence. No amount of system engineering eliminates or alters the structure of the market. The most effective way to handle risk that I see is not to prevent it from happening (not possible), but rather how to react when risk eventually flares up.

Approaching system design as a process rather than a destination also encourages global thinking. My old boss would describe it as the 40,000 foot perspective. When a forex trader, for example, emphasizes a system's percent accuracy, it typically comes at the expense of exiting at a better point in the market. A need to win slightly more often actually drags the system away from its optimal performance. A process oriented design watches how changes in the entry method affects the exit efficiency. Clever money management removes the emphasis from entry and exit methods.

Designing these systems takes hundreds of man hours or results from more than a decade of experience. Emotion will certainly enter the equation at some point. The real question is not how to remove it. It is how to appropriately channel it.

Designing an expert advisor quickly takes on the characteristic of an obsessive hobby. If the system's success is measured in quantities of dollars, the emotional roller coaster rises in tune with the account balance. A more appropriate use for the emotion is to take heart in the system working correctly, not profitably. Ideally, correctly also means profitably. They are not the same thing, however. Drawdown and unlucky losing streaks are an inherent part of trading. Gaining satisfaction from the trade behaving as designed rather than as desired makes your emotional well being far less dependent on market performance.

I have been running this company for nearly five years and literally spoken with thousands of traders over that time. In spite of that overwhelming number, I still have yet to speak with anyone that traded a commercial EA successfully for more than a few months.

The successful traders that I know personally all developed their systems and strategies on their own. Maybe that reflects on the abysmal quality of expert advisors for sale on the internet. Maybe it reflects on not-so-expert trading coaches, or perhaps genuine trading coaches and hapless traders unable to follow sound advice. I suspect it's a little of everything. Regardless of the problems, the take away point is that the person doing the succeeding is also the person doing the developing. They take control of the experience from the beginning and lead it into a successful outcome. Systems trading is not a process where you buy your way to success or follow like a sheep to green pasture. You must earn it.

That kind of trajectory puts a number in the trader's mind that is terribly misleading in real life. Steady annual growth of 20% suggests a constant return of 1.67% (20/12). That number 1.67% is a hiccup in a trading account. Many forex traders risk more than that amount on a single transaction. Factoring in the inevitable drawdown or periods of loss, the market makes it impossible to distinguish whether or not the expert advisor is behaving correctly or if it is falling apart.

Uncertainty in the face of risk makes any normal person panic. At the very least, it instills a degree of anxiety over the future. The moment that the machine stops churning out profits is the moment where doubt enters the picture. Doubt feeds on itself, which leads to changing the trading plan in midstream.

I can tell you from experience that the transition from research to execution is huge. A learning curve exists, like with everything. I learn to cope by taking the confidence that I gain through the same debugging techniques used in testing. The same techniques work for comparing live results to backtested results. Does the backtest over the same time period as my real trading match the actual performance? If so, then all is well. If not, it at least gives me as the developer an opportunity to think about specific problems. Execution or forex broker manipulation can cause problems. More often that not, however, is some flaw in the strategy design or code. Developing a methodical, reason based process helps calm nerves and to stay focused. The alternative is a general, undefined worry.

The percentage of clients that succeed over the long run, however, is incredibly small. I don't think that is a big secret. If that is news to you, allow me to be clear. The chances of developing a successful expert advisor over the long term are minimal.

The inevitable next question from new clients is an attempt to pick my brain for some features common to successful systems traders. I decided to outline the traits common to this rare breed and some of the challenges that they encounter.

Traits of a successful EA developer

Expert advisor developers that succeed are either incredibly bright (engineers, Ph.D. holders, etc) or dumber than a sack of rocks. No middle ground exists. A friend/client told me about an experiment that struck me as telling. If you put a mouse in a cage where cheese appears 40% of the time on one side of the box and 60% of the time on the other, all mice eventually pick the side that "wins" 60% of the time. The mice stop guessing and go with what works more often than not.That's my theory for why the "intellectually challenged" crowd seems disproportionately likely to profit from trading. They see right through the noise to pick out a simple observation that wins more than it loses. Holy grail systems certainly do not come from this group. That's not honestly not the goal. It's about eating cheese more often than going hungry.

The brainy crowd benefits from a heavy dependence on analysis. Ideas usually stem from pet theories, many of which look like the crackpot variety on first glance. The theory shifts and twists as market tests reveal strengths and weaknesses. Logical conclusions instill a robustness and variety into the system. Interestingly, the approach to testing and verifying the systems follows the opposite path of most developers. The ideas tend to get simpler with time rather than more complex.

Emotion does not play a large role in the rationale for developing an expert advisor. Again, the reasons are usually logical. Examples like "I've been trading this system for 20 years and I need to automate it" or "I came up with a way to accurately predict market direction."

It may sound a bit zen, but the systems that make money are the ones that do not set their primary goals as making money. Making money is a totally open ended goal. The potential variables know no limit. The lack of constraint encourages would be EA traders to shoot off on tangents. Unless the wild ride accidentally leads to the pot of gold at the end of the rainbow, they will fail. The limitless bounds make it impossible to measure any progress.

In that same vein, the journey is as important as the destination. Many traders pay lip service to limiting drawdown. Few are able to effectively rein in drawdown, especially within the context of an expert advisor. To a certain extent, limiting drawdown is not possible. My experience with money management makes it clear how much wandering a return can make, even with a heavy advantage.

The easiest way to limit drawdowns is to fight against severe losses. The goal is to obsess over risk and reduce it to the lowest possible point. I want to emphasize this point carefully. Risk always exists. The market chaotically switches from deep slumber to extreme violence. No amount of system engineering eliminates or alters the structure of the market. The most effective way to handle risk that I see is not to prevent it from happening (not possible), but rather how to react when risk eventually flares up.

Approaching system design as a process rather than a destination also encourages global thinking. My old boss would describe it as the 40,000 foot perspective. When a forex trader, for example, emphasizes a system's percent accuracy, it typically comes at the expense of exiting at a better point in the market. A need to win slightly more often actually drags the system away from its optimal performance. A process oriented design watches how changes in the entry method affects the exit efficiency. Clever money management removes the emphasis from entry and exit methods.

Designing these systems takes hundreds of man hours or results from more than a decade of experience. Emotion will certainly enter the equation at some point. The real question is not how to remove it. It is how to appropriately channel it.

Designing an expert advisor quickly takes on the characteristic of an obsessive hobby. If the system's success is measured in quantities of dollars, the emotional roller coaster rises in tune with the account balance. A more appropriate use for the emotion is to take heart in the system working correctly, not profitably. Ideally, correctly also means profitably. They are not the same thing, however. Drawdown and unlucky losing streaks are an inherent part of trading. Gaining satisfaction from the trade behaving as designed rather than as desired makes your emotional well being far less dependent on market performance.

I have been running this company for nearly five years and literally spoken with thousands of traders over that time. In spite of that overwhelming number, I still have yet to speak with anyone that traded a commercial EA successfully for more than a few months.

The successful traders that I know personally all developed their systems and strategies on their own. Maybe that reflects on the abysmal quality of expert advisors for sale on the internet. Maybe it reflects on not-so-expert trading coaches, or perhaps genuine trading coaches and hapless traders unable to follow sound advice. I suspect it's a little of everything. Regardless of the problems, the take away point is that the person doing the succeeding is also the person doing the developing. They take control of the experience from the beginning and lead it into a successful outcome. Systems trading is not a process where you buy your way to success or follow like a sheep to green pasture. You must earn it.

Challenges of using a winning expert advisor

The path to achieving a profitable strategy on paper is a long, hard road. The switch from theoretical turns to live trading is a challenge in its own right. Backtests spit out instantaneous results. Traders see something like a 20% annual return, then mentally prepare themselves for the steady accumulation of funds.That kind of trajectory puts a number in the trader's mind that is terribly misleading in real life. Steady annual growth of 20% suggests a constant return of 1.67% (20/12). That number 1.67% is a hiccup in a trading account. Many forex traders risk more than that amount on a single transaction. Factoring in the inevitable drawdown or periods of loss, the market makes it impossible to distinguish whether or not the expert advisor is behaving correctly or if it is falling apart.

Uncertainty in the face of risk makes any normal person panic. At the very least, it instills a degree of anxiety over the future. The moment that the machine stops churning out profits is the moment where doubt enters the picture. Doubt feeds on itself, which leads to changing the trading plan in midstream.

I can tell you from experience that the transition from research to execution is huge. A learning curve exists, like with everything. I learn to cope by taking the confidence that I gain through the same debugging techniques used in testing. The same techniques work for comparing live results to backtested results. Does the backtest over the same time period as my real trading match the actual performance? If so, then all is well. If not, it at least gives me as the developer an opportunity to think about specific problems. Execution or forex broker manipulation can cause problems. More often that not, however, is some flaw in the strategy design or code. Developing a methodical, reason based process helps calm nerves and to stay focused. The alternative is a general, undefined worry.

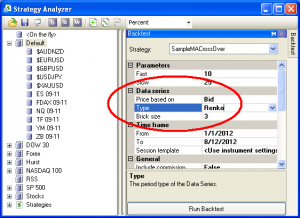

Renko Backtests

Exotic bar types, as NinjaTrader likes to call them, create unique challenges when backtesting strategies. The primary problems is that the backtests are usually bogus. The trader often has no idea that the profitable backtest calculated from errant data.

Renko bars form based on the order of incoming ticks to create specific box sizes. Say, for example, that a trader creates a box size of 5 pips. If the price rises 5 pips from the close price of the last Renko bar, then the chart creates a new bar 5 pips tall. Every 5 pip increment, whether up or down, draws a new Renko bar.

Using increments that easily fall within normal market gaps creates the false impression of trade-able prices where none existed. Minor news events frequently result in 5-10 pip market gaps. In the case of the 10 pip gap, a box size of 5 pips creates 2 Renko bars. The two bars do nothing to communicate the fact that the prices never existed. Their presence merely indicates the direction of a move and eliminates the idea of time altogether. Time, or more specifically the absence of it, strikes me as rather important.

Small box sizes more commonly lead to questions about wildly inaccurate backtests. I received two questions last week inquiring why NinjaTrader showed $19,000 returns in a backtest, but the same forward test lost nearly an identical amount.

The backtests rely on a selected data set to generate the Renko bars used for testing. Users nearly always overlook the data source option in NinjaTrader. It defaults to one minute charts. One tick bid is the only type of data that will form perfectly accurate charts. Any other increment risks creating Renko bars that never existed.

Take an extreme example of one minute chart data drawing Renko bars with a 3 pip box size. Say that the over-all height of the bar is 10 pips, the low is 1 pip from the open and the M1 bar closes 8 pips higher. How many Renko boxes does the chart need to draw? The correct answer is that there is no way of knowing.

Examples:

It's done in good faith, but NinjaTrader is essentially making up Renko data to cover up gaps in the price data. When you're running a backtest, the whole point of the exercise is to eliminate guessing and deliver solid answers.

Most people make the hand waving assumption that it all averages out in the end. The two clients asking me this week about why their Renko backtests came out so screwy, and the reason that I'm writing this post, is that the hypothetical versus real performance was as different as night from day. It most certainly does not average out. Rather, it introduces so many errant points as to make the tests worthless.

Don't make assumptions in your backtest. Get tick data and, if you're using Renko bars, make sure to set the test up properly.

Renko bars form based on the order of incoming ticks to create specific box sizes. Say, for example, that a trader creates a box size of 5 pips. If the price rises 5 pips from the close price of the last Renko bar, then the chart creates a new bar 5 pips tall. Every 5 pip increment, whether up or down, draws a new Renko bar.

Using increments that easily fall within normal market gaps creates the false impression of trade-able prices where none existed. Minor news events frequently result in 5-10 pip market gaps. In the case of the 10 pip gap, a box size of 5 pips creates 2 Renko bars. The two bars do nothing to communicate the fact that the prices never existed. Their presence merely indicates the direction of a move and eliminates the idea of time altogether. Time, or more specifically the absence of it, strikes me as rather important.

Small box sizes more commonly lead to questions about wildly inaccurate backtests. I received two questions last week inquiring why NinjaTrader showed $19,000 returns in a backtest, but the same forward test lost nearly an identical amount.

The backtests rely on a selected data set to generate the Renko bars used for testing. Users nearly always overlook the data source option in NinjaTrader. It defaults to one minute charts. One tick bid is the only type of data that will form perfectly accurate charts. Any other increment risks creating Renko bars that never existed.

Take an extreme example of one minute chart data drawing Renko bars with a 3 pip box size. Say that the over-all height of the bar is 10 pips, the low is 1 pip from the open and the M1 bar closes 8 pips higher. How many Renko boxes does the chart need to draw? The correct answer is that there is no way of knowing.

Examples:

- The market goes down 1 pip, then up 10 pips and settles at the close price. This draws 3 total box with one box in progress.

- The market goes down 1 pip, then up 3 pips, then down 3 pips, then up 10 pips. This draws 5 boxes total with one box in progress.

- The market does down 1 pip, then up 3 pips, then down 3 pips, then up 3 pips, then down 3 pips, then up 10 pips. This draws 7 boxes total with one box in progress.

It's done in good faith, but NinjaTrader is essentially making up Renko data to cover up gaps in the price data. When you're running a backtest, the whole point of the exercise is to eliminate guessing and deliver solid answers.

Most people make the hand waving assumption that it all averages out in the end. The two clients asking me this week about why their Renko backtests came out so screwy, and the reason that I'm writing this post, is that the hypothetical versus real performance was as different as night from day. It most certainly does not average out. Rather, it introduces so many errant points as to make the tests worthless.

Don't make assumptions in your backtest. Get tick data and, if you're using Renko bars, make sure to set the test up properly.

Swiss banks give up names to end DOJ probe

Swiss banks are turning over thousands of employee names to U.S. authorities as they seek leniency for their alleged role in helping American clients evade taxes, according to lawyers representing banking staff.

At least five banks supplied e-mails and telephone records containing as many as 10,000 names to the U.S. Department of Justice, according to estimates by Douglas Hornung, a Geneva- based lawyer representing 40 current and former employees of HSBC Holdings Plc’s Swiss unit,Credit Suisse Group AG (CSGN) and Julius Baer Group Ltd. (BAER) The data handover is illegal, said Alec Reymond, a former president of the Geneva Bar Association, who is representing two Credit Suisse staff members.

“The banks are burning their own people to try and cut deals with the DOJ,” said Hornung. “This violation of personal privacy is unprecedented in the Swiss banking industry.”

Swiss banks want to settle a U.S. tax-evasion probe after the Justice Department indicted Wegelin & Co. on Feb. 2 for allegedly helping customers hide money from the Internal Revenue Service. Credit Suisse, HSBC and Julius Baer, which have said they expect to pay fines to resolve the tax matter, are handing over data to mollify the U.S., according to Hornung.

Credit Suisse said the Swiss government authorized the delivery of staff names and that the “large majority” of employees have nothing to fear. Julius Baer and Zuercher Kantonalbank also said they received authorization. HSBC said it has delivered documents and is cooperating with the U.S.

Subscribe to:

Posts (Atom)