Tuesday, September 30, 2014

Russia could ditch US dollar in 2-3 years – head of Russia's #2 bank

wo to three years would be enough time for Russia to switch to international settlements to the ruble, Andrey Kostin, head of Russia’s second-biggest bank VTB, said.

US Stocks Slide, Ruble Plunges As Russia Prepares Capital Controls

Just days after Ukraine began discussing capital controls, and Russian lawmakers passed a bill enabling asset freezes, it appears Russia has reached its limit.

- *RUSSIA SAID TO WEIGH CAPITAL CONTROLS IF NET OUTFLOWS INTENSIFY

The Ruble is plunging towards 40 to the USD (CB intervention levels), US equity futures gapped lower, and European stocks are sliding.

As Bloomberg reports,

Russia’s central bank is weighing the introduction of temporary capital controls if the flow of money out of the country intensifies, according to two officials with direct knowledge of the discussions.Such measures would be preventative and used only if net outflows rise significantly, the people said, who asked not to be identified because no decision has been made. They didn’t give a timeline or a level that may force such a move, saying they are looking at all possible scenarios.The discussions are the latest sign that U.S. and European sanctions are hurting Russia and rethink policies the central bank has sought to avoid. The Economy Ministry last week raised its estimate for this year’s outflows to $100 billion from $90 billion. Russia hasn’t had a net inflow of private capital since 2007, the year after lifted restrictions.Central bank Chairman Elvira Nabiullina, a former economic aide to President Vladimir Putin, said in an address to the government on Sept. 25 that “introducing capital controls doesn’t make sense.”Still, if trades restrictions -- such as the U.S. and EU sanctions and Russia’s retaliatory measures -- are prolonged and the tax burden rises, capital outflows will intensify. That will push the regulator to shift its focus more toward ensuring financial stability from fighting inflation and use various instruments “including non-standard” means, Nabiullina said.The central bank’s press service declined to comment. The Finance Ministry isn’t discussing such measures, Svetlana Nikitina, a spokeswoman, said by text message.

US equities gapped lower...

And the Ruble plunged...

- *RUBLE WEAKENS TO BOUNDARY OF RUSSIA CENTRAL BANK'S TRADING BAND

- *RUBLE WEAKENS TO LEVEL WHERE CENTRAL BANK SAYS WILL INTERVENE

Open a Forex Account

Monday, September 29, 2014

Yuan to Start Direct Trading With Euro as China Pushes Usage

China will start direct trading between the yuan and the euro tomorrow as the world’s second-largest economy seeks to spur global use of its currency.

The move will lower transaction costs and so make yuan and euros more attractive to conduct bilateral trade and investment, the People’s Bank of China said today in a statement on its website. HSBC Holdings Plc said separately it has received regulatory approval to be one of the first market makers when trading begins in China’s domestic market.

The euro will become the sixth major currency to be exchangeable directly for yuan in Shanghai, joining the U.S., Australian and New Zealand dollars, the British pound and the Japanese yen. The yuan ranked seventh for global payments in August and more than one-third of the world’s financial institutions have used it for transfers to China and Hong Kong, the Society for Worldwide International Financial Telecommunications said last week.

“It’s a fresh step forward in China’s yuan internationalization,” said Liu Dongliang, an analyst with China Merchants Bank Co. in Shenzhen. “However, the real impact on foreign exchange rates and companies may be limited as onshore trading volumes between yuan and non-dollars are still too small to gain real pricing power.”

Transactions exchanging yuan for dollars totaled 12.2 trillion yuan in the first half of 2014, dwarfing the 110.4 billion yuan worth of trades for euros and the 251.7 billion yuan for yen, the PBOC said in a monetary policy report last month.

Trading Ties

China’s trade with European Union nations grew 12 percent from a year earlier to $404 billion in the first eight months of 2014, according to data from the Asian nation’s customs department. That compares with just $354 billion with the U.S. during the period.

French and German companies lead among countries outside of greater China in the use of the yuan, according to a July report by HSBC that was based on a survey of 1,304 businesses in 11 major economies that have ties with mainland China. Some 26 percent of French corporates and 23 percent of German companies were using the currency to settle trade, the highest proportions apart from mainland China, Hong Kong and Taiwan.

Last One

China appointed yuan clearing banks this year in Frankfurt, Paris and Luxembourg, and Germany’s financial capital as well as Paris were awarded quotas under the Renminbi Qualified Foreign Institutional Investor program to invest the currency raised offshore in China’s domestic capital markets.

“Given the appointments of renminbi clearing banks in Frankfurt and Paris, today’s announcement is largely expected,” Australia & New Zealand Banking Group Ltd.’s economists led by Liu Li-gang wrote in a research note today. The agreement marks a “significant milestone” in yuan internationalization as the euro is the only G3 currency that has not had direct conversion with the yuan, Liu said.

The European Central Bank is able to draw on a maximum 350 billion yuan ($57 billion) swap line from the People’s Bank of China under the terms of an agreement signed in October 2013. The PBOC can access 45 billion euros ($57 billion) under the terms of the currency swap.

Friday, September 26, 2014

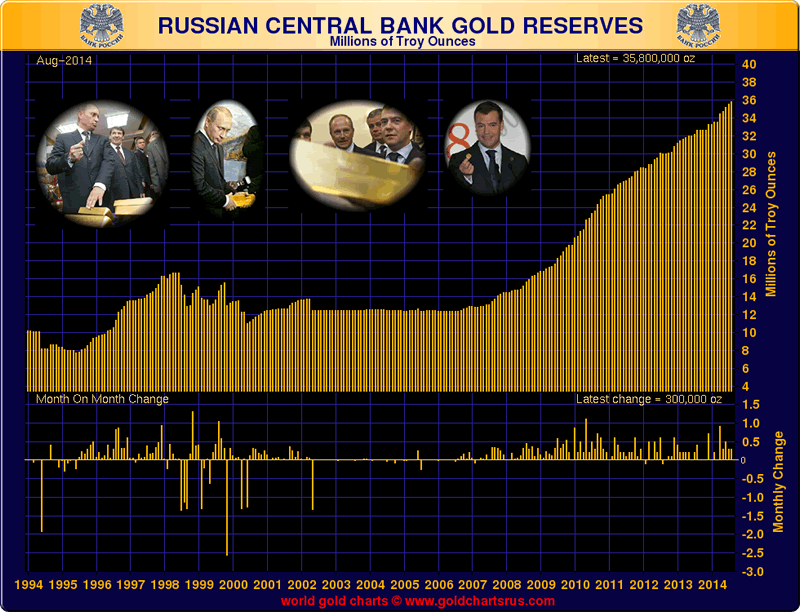

Currency Wars Deepen - Russia, Kazakhstan Buy Very Large 30 Tons Of Gold In August

Russia and ex Soviet States Kazakhstan, Kyrgyz Republic and Azerbaijan continued to accumulate significant gold reserves in August in a trend that we highlighted last month.

Latest official gold reserve data from the International Monetary Fund (IMF) shows that Russia again added to its gold reserves in August, with the Central bank of the Russian Federation purchasing 232,510 ozs (7.23 tonnes) and bringing its total gold reserves to 35.769 million ozs or 1,112.5 tonnes.

Likewise, the National Bank of Kazakhstan purchased a massive 795,213 ozs or 24.7 tonnes in August bringing its total gold reserves to 5.848 million ozs (181.9 tonnes).

Turkey was also a gold buyer in August and the Turkish central bank adding 96,783 ozs (3 tonnes) to bring its total official gold reserves to 16.45 million ozs (511.6 tonnes), which is the world's 12th largest official gold holding.

According to the IMF data, other countries which added to their gold reserves in August included the central banks of Azerbaijan and Ukraine.

With the ongoing conflict in Ukraine, its not clear where the official Ukrainian are now stored. There had been reports in March that the Ukrainian gold was flown out of Kiev to the Federal Reserve Bank of New York, but neither central bank would comment on this issue at the time.

Kazakhstan now has the world's 23rd largest holdings, just behind the Philippines which has 194.4 tonnes of gold reserves.

With 1,112.5 tonnes, Russia remains the world's 6th largest official gold holder, ahead of China (1,054.1 tonnes) and Switzerland (1,040 tonnes).

The Swiss National Bank (SNB) has not been a gold buyer recently but this may change if a Swiss gold referendum to be held in November goes through, which would force the SNB to maintain 20% of its reserves in gold and to repatriate all gold held abroad back to Switzerland. It is widely believed that China's gold reserves are understated and as David Marsh of the Official Monetary and Financial Institutions Forum (OMFIF) said last week "over the past six or seven years the Chinese authorities probably have been adding to their holdings in different ways."

As we pointed out last month, as well as being a reserve diversification strategy, the ongoing gold accumulation trend by both Russia and Kazakhstan could be part of a coordinated monetary policy since the two countries are members of the Eurasian Customs Union along with Belarus.

Next year the three countries plan to turn this Eurasian Customs Union into a more formal Eurasian Economic Union. Coordinated accumulation of gold reserves would make sense in this context.

Russia, Kazakhstan and Belarus are also members of larger regional cooperation organisations, namely the Eurasian Economic Community and the Shanghai Cooperation Organisation (SCO). It will be interesting to see what a pooled gold holdings total for Russia, China, Kazakhstan, and other SCO members will look like when China finally does provide the world with an update on its official gold holdings.

UK Treasury plans to criminalise benchmark manipulation

Yesterday, the UK Treasury announced a consultation review into widening UK financial benchmark legislation and make manipulation of key currency, precious metals, and interest rate benchmarks a criminal offence. The only benchmark that is currently regulated is the interest rate LIBOR benchmark. HM Treasury plan to add a further seven key benchmarks to the legislation.

These benchmarks are the WM/Reuters 4pm London fix (currency), ISDAFix (interest rate), the London Gold Fixing benchmark, the new LBMA Silver Price benchmark, the ICE Brent futures contract (crude oil), and two index swap benchmarks called the Sterling Overnight Index Average (SONIA) and the Repurchase Overnight Index Average (RONIA).

The London Gold Fixing process is in disarray after multiple claims of manipulation and the prosecution of Barclays by the Financial Conduct Authority (FCA) last May for manipulating the gold price in the fixing auction. The London Gold Market Fixing Company (LGMFL) and the London Bullion Market Association (LBMA) are now attempting to 'circle the wagons' on regulatory compliance and investor litigation by moving to a new LBMA Gold Price process modelled on the recently introduced LBMA Silver Price.

The LBMA Silver Price auction has not really evolved in any way since being introduced on August 15, and its current 'phase 2' stage, by design, only allows bullion banks and brokers to participate due to the lack of a central clearing counterparty and limitations on bi-lateral credit lines for auction participants.

However, this has not stopped the LBMA ploughing ahead with a similar plan for the gold fixing process which still has the CME Group and Thomson Reuters as the leading contender.

Following up today on the news of the Treasury's benchmark consultation, Bloomberg contacted the four London Gold Fixing banks and the LBMA seeking comment, but reported this morning that "Representatives of the banks that contribute to the London gold fixing declined to comment or didn't immediately return calls and emails seeking comment. The LBMA wasn't immediately available."

With the London gold fixing process being so central to the determination of the world gold price, any moves by the UK authorities to criminalise manipulation of the gold fixing price are welcome.

MARKET UPDATE Today’s AM fix was USD 1,210.50, EUR 950.61 and GBP 742.05 per ounce. Yesterday’s AM fix was USD 1,224.00, EUR 952.87 and GBP 746.11 per ounce.

Gold fell $5.70 or 0.47% to $1,217.20 per ounce and silver slipped $0.10 or 0.56% to $17.70 per ounce yesterday.

Spot bullion in Singapore slipped 0.3% to $1,213.60 an ounce by 0043 GMT, after losing 0.5% in the earlier session. Gold is close to an 8 1/2 month low of $1,208.36 reached earlier in the week.

U.S. Mint September American Eagle gold coin sales are almost 50,000 ounces, nearly twice its sales in August, with heightened geopolitical risk and a cheaper bullion price contributing to the interest from investors.

If further bullish U.S. economic data comes out this week it will strengthen the U.S. dollar and weaken gold’s appeal, as investors think the U.S. Fed will react with an earlier than expected interest rate hike.

by Ronan Manly , Edited by Mark O’Byrne

Monday, September 22, 2014

Ukraine Introduces Capital Controls

A few days ago we showed how when Obama said there would be "costs" for Moscow in the Ukraine-Russian conflict, he got the recipient country of said costs woefully wrong, as confirmed by the economic data released by Ukraine which showed its Industrial Production crater at a pace on par with the Lehman collapse, confirming the Ukraine economy was on the verge of a spectacular implosion just in time for the harsh, Gazprom-free winter to finish off what little economic activity is left.

The resulting selloff in the Hryvnia and Ukraine bonds, was therefore, hardly surprising.

Which probably means the news reported by Bloomberg moments ago, which cites Ukraine's Unian news service, that the Ukraine central bank just instituted restrictions on Hryvnia use, i.e., capital controls, should also not come as a surprise, yet for all those expecting Russia to crater first under the weight of western sanctions, to see said cratering take place in western-backed (and IMF guaranteed) Ukraine is probably just a little unpleasant.

The details:

Central Bank forbids companies completing FX payments on import contracts if they don’t actually bring goods into Ukraine, Unian reports, citing Central Bank decree that comes into effect tomorrow.

- FX payments on imports also prohibited if customs registration of goods takes more than 180 days

- Foreign investors forbidden to receive investment return from selling Ukraine securities beyond stock exchange, except govt bonds

- Foreign investors forbidden to receive dividend return on Ukrainian shares not traded in stock exchanges

- Central bank also forbids FX transactions using individual FX licenses, except placing money by cos. on accounts in foreign banks

In other words, the money concentration into a select few government-approved (and controlled) asset classes has begun. For those who are unsure what happens next, please google "Cyprus and March 2013."

Sunday, September 21, 2014

Russia FinMin Calls For Shift Away From US Treasurys Into BRIC Bonds, Settlement In Non-Dollar Currencies

It is no secret that Russia has had enough of the Petrodollar, and in light of ongoing western sanctions - which many view not so much as a reaction to events in Ukraine bur merely as an attempt to halt the Russian revolution against the Petrodollar status quo, crushing its economy before the momentum grows and more countries join Moscow - is constantly thinking of ways it can ditch the dollar as a medium of exchange as fast as possible. The problem is that when it comes to retaliating against the West, Russia - short of declaring an embargo on USD payments for its commodities - has little control over what currency its western trading partners will pay in. So instead it is focusing on its net exporting peers, aka the BRICS, with whom as previously reported, Russia had launched a "bank" alternative to the IMF when it comes to backstop and bailout funding, one that avoids reliance on the SDR, the USD, and on Western empathy.

It is the same BRICs that, Russia's Prime Minister Dmitry Medvedev, told Rossiya TV in an interview earlier today, should conduct transactions in national currencies, bypassing cross-rates with the US Dollar, adding that "we can easily make mutual settlements directly," and the mechanism should be beneficial to both sides of transactions.

And if it wasn't clear by now, Russia pivot away from the west and toward China is pretty much complete. Medvedev also said that "our collaboration with China is of strategic importance. We have great, brilliant political contacts, we have excellent economic relations. [China] is our strategic partner, and we are interested in expanding the volume of cooperation. We are not afraid of collaborating because we are confident that this is equal, friendly and mutually beneficial collaboration in all areas."

Meanwhile, regarding escalating Western tensions, the PM said that sanctions have created a bad situation for Russian banks on financial markets, all sources of liquidity are frozen. "We regard this as a senseless and ugly decision toward Russia, but we’ll manage without it." So does that mean that China will step in to provide the required FX reserves as Russia minimizes its USD exposure? Perhaps, but not entirely: Medvedev did add that "Asia, other markets “unlikely fully” to compensate for frozen European financing."

The PM also said that Russia passed through similar squeeze in 2008-2009 and can manage with central bank resources, adding that Europe is still important market for Russia, if EU members "make no absurd decisions to squeeze us out of this market, we’ll stay there, it’s interesting for us."

But while Medvedev was the good cop today, it was Russia's finance minister Anton Siluanov who was the designated "bad guy", and as the WSJ reported, Russia is considering diversifying its debt portfolio away from countries that have imposed sanctions on Moscow and into the papers of its BRICS partners.

Speaking on the sidelines of an annual investment forum in the Black Sea town of Sochi, Mr. Siluanov said the Finance Ministry wants to diversify its investment basket, and is looking for higher yields without too much risks. He said the ministry will consider buying papers issued by Brazil, India, China and South Africa, which along with Russia are known collectively as the Brics countries."[We would like to] walk away from investing in papers of the countries that impose sanctions against us," Mr. Siluanov said, adding that the reshuffle would be carried out gradually. He didn't elaborate on when the first purchases of Brics debt may take place.

The good news for the US, now that Russia appears set on either rapidly or slowly selling off its US Treasury exposure, is that Kremlin has possession of only $115 billion in US paper, which happens to be more than the $100 billion it reported in May when the first shock of a Russian bond sell off hit the market, and both of which happen to be amounts the Fed can easily monetize into its record big balance sheet (which, taper or no taper, just grew by $28 billion in the past week alone) in just over a month.

But at the end of the day it is not what Russia does, but what its other BRIC peers and US Treasury holders do. Because while Moscow may be in possession of just over $114.5 billion in US paper, China, Brazil and India share among them some $1.6 trillion in US Treasurys, better known as "leverage" in every sense of the word, or an amount that not even the Fed could monetize on short notice without sending a massive shockwave through the global capital markets.

In other words, while the US pushes Russia hard, it may be careful not to push it too hard, and in the process start an avalanche that leads to a BRIC bond avalanche, which may well be one possible endgame as the world is forced to transition from the US Dollar as a reserve currency in the coming years.

Never gonna happen?

Considering that none other than Obama's own former chief economic advisor, Jared Bernstein, is advocating dropping the USD as the global reserve currency, we would be careful with using the word "never" in this specific case...

Wednesday, September 17, 2014

iScotland would be forced to create its own currency, says top economist

A YES vote in tomorrow's referendum would force a newly independent Scotland to create its own currency, one of the country's leading economists has warned, after a damning report concluded Alex Salmond's fallback plan to keep the pound would collapse within a year.

In a separate study yesterday a major European bank raised fears of a stock market slump and a scramble to withdraw savings from Scottish bank branches on Friday morning if there is a Yes vote.

Dr Angus Armstrong, of the National Institute for Social and Economic Research (NIESR), said "a Yes vote is a vote for Scotland's own currency," after the think-tank published a scathing assessment of the First Minister's apparent "Plan B" in the event the UK rejected his preferred option of sharing the pound in a formal currency union.

Mr Salmond insists a currency union would be agreed but, if not, has suggested an independent Scotland would use the pound informally, a process known as "sterlingisation," while refusing to pay its share of the UK's £1.4 trillion national debt.

The NIESR has previously argued that sterlingisation would be unstable and damage the Scottish economy as financial institutions moved their headquarters south of the Border.

In a report yesterday, it argued that refusing to pay a share of the UK's debt would cause serious additional problems.

Walking away from the debt, argued Dr Armstrong and the report's co-author Monique Ebell, would be "seen as a default" by the money markets, leaving an independent Scotland struggling to borrow and facing "unprecedented austerity" in the form of spending cuts.

The move would also be likely to leave Scotland out the EU, as Germany sought to protect its interests and blocked the newly independent state's membership, the report warned. It argued Europe's biggest creditor would fear a default by Spain, whose finances would come under pressure if Catalonia also became independent without paying its debts.

Dr Armstrong said: "A Yes vote is a vote for Scotland's own currency. It seems to be the only option that makes sense.

"If Scotland votes for independence I think it would end up with its own currency. There's a question of how it gets there, but it gets there."

He said the transition to a new currency could be managed stably within the 18-month negotiation period that would follow a Yes vote.

Meanwhile Swiss bank UBS, which predicts a No vote, warned yesterday of a three per cent slump in the FTSE 100 index and a three per cent drop in the pound against the dollar on Friday if Scots choose instead to leave the UK.

Paul Donovan, global economist at UBS, said bank accounts could be moved from Scottish branches, despite assurances savers would continue to be protected by the Bank of England as independence negotiations took place.

"I wouldn't like to predict it, but we may get Friday off," he said, suggesting a bank holiday may have to be called.

Dr Armstrong played down speculation that a Yes vote would trigger panic on Friday morning if Scots vote to leave the UK.

He said a clear statement from the Prime Minister, stressing Scotland's continued place in the UK until 2016, would limit the pound's losses on the currency markets and prevent a run on the banks.

The UK Government and Labour opposition have ruled out Mr Salmond's proposal for a currency union, arguing it would be too risky for the UK and impose too many constraints on an independent Scotland's economic policy-making.

Mr Salmond has claimed they are "bluffing". He has said the prospect of Scotland walking away from its share of the debts, worth about £5 billion per year in repayments to the Treasury, and the loss of exports such as oil and whisky from the UK's balance sheet, would force a currency union to be agreed.

Tuesday, September 16, 2014

Russia Central Bank Responds To Domestic Dollar Shortage, Starts Currency Swaps

With the Ruble hitting record lows once again today against the USDollar, it appearsconcerns over USD liquidity are growing in Russia. The Russian central bank has unveiled an FX swap operation, allowing firms to borrow dollars in exchange for Rubles for a duration of 1 day (at a cost of 7%p.a.). Of course, this squeeze on USD funding - driven by Western sanctions - will, instead of isolating Russia, force Russian companies (finding USD transactions prohibitively expensive) into the CNY-axis, thus further strengthening the Yuanification of world trade and the ultimate demise of the USD as reserve currency.

USDRUB at record lows...

And funding sanctions appear to have driven the Central Bank to supply USDollar liquidity into an apparently squeezed market...

As Bloomberg reports,

"Sanctions and closed access to foreign-exchange liquidity from the West” is feeding demand for dollars, Dmitry Polevoy, chief economist ING.Foreign-exchange liquidity has “virtually dried out,” with volumes sinking to about $100 million per day, compared with $1 billion to $2 billion previously, according to Natalia Orlova, the chief economist for OAO Alfa Bank in Moscow....Companies have $22 billion in dollar-denominated payments to make in September and local banks are “anticipating demand for hard currencyfrom retailers and accumulating additional dollar liquidity,” Abdullaev said.

And as WSJ reports, the central bank has responded...

The Bank of Russia said Tuesday it introduced one-day currency swaps to aid banks "better management of the their short-term liquidity".Russian banks, unable to borrow abroad, are experiencing a shortage of currency liquidity."We see, naturally, some distortion on the (currency) swap market, which shows a structural deficit of dollars," Russia's Deputy Finance Minister Alexei Moiseev said Tuesday.

Russia will create a multi-billion dollar anti-crisis fund in 2015 of money destined for the Pension Fund and some left over in this year's budget to help companies hit by sanctions, Finance Minister Anton Siluanov was quoted as saying on Monday....Siluanov was quoted as saying by Russian news agencies that the decision to stop transferring money to the Pension Fund would hand the budget an extra 309 billion roubles ($8.18 billion US).He said not all of that sum would go into the anti-crisis fund, but that it would also receive at least 100 billion roubles of money left over in this year's budget."This 100 billion roubles will be added to the [anti-crisis] reserve next year, which will allow us to help our companies," RIA news agency citied Siluanov as saying."We are planning to create a reserve of a significant size."It was not clear how big the fund would be...."When a series of our partners, if they can be called that, test Russia's strength through sanctions and all kinds of threats, it is important not to succumb to the temptation of so-called easy solutions and to preserve and continue the development of democratic processes in our society, our state," Medvedev said in a televised speech.

* * *

Increasingly making it prohibitively expensive for Russian firms to transact in USDollars...

Increasingly making it prohibitively expensive for Russian firms to transact in USDollars...

Which will merely serves to drive those firms to look for Chinese counterparts and further into the CNY-axis of de-dollarization (as UK Chancellor Osborne recently confirmed).

4 C’s That Could Change The Financial World As We Know It, Again

Those 4 C’s are: Confirmation, Crisis, Contagion, Catastrophe.

What type of confirmation could send the financial markets into such turmoil it could rock the very bastions of finance as we now know it?

First: Scotland votes yes to leave the U.K. If this turns out to be so, it could send shock-waves throughout the markets that run the world. i.e., Forex or World currencies.

No one with any financial acumen can look seriously at the markets as they stand at the time of this writing, and seriously argue the markets are prepared for such a resolution happening this Thursday.

If Scotland truly does vote Yes and confirms independence from the U.K. the initial shock-waves in my opinion that will hit the markets will be akin to the video we’ve all seen 1000 times when a nuclear device is unleashed with a house being obliterated. Or, the one where trees are bent over near flat to then reverse back the same.

In my humble opinion this could be a metaphor of what could take place. The reason is simple: By proof of the markets as they stand today, it is proof prima facie that everyone (especially so-called “smart crowd”) thinks it won’t happen. And the odds via polling alone show it to be the equivalent of a coin toss!

If this happens it will also confirm something just as real, and quite possibly far more instructive: With both a Federal Reserve meeting being held just days prior to such an event, the language out of this meeting could not be more important.

If it’s some revised boilerplate “till conditions improve, extended period, blah, blah, blah” based press release and conference, it will again confirm what many believed from the start, The Fed is both deaf, blind, and ill prepared to handle what might be an event such as this. An event that has the potential to make the crisis of 2008 the equivalent of a firecracker as opposed to what might be unleashed if Scotland does indeed secede.

The ramifications are truly unknown, unquantifiable, and what might be worse – unmanageable.

Then we move to crisis.

Just how does the Federal Reserve handle such a dilemma of this scale? I use the word “scale” for good reason. As many may know the Forex markets dwarf what the lovingly referred to as “mom and pop investor” believe it to be.

The saving of the “stock market” (aka the Equity Markets) in 2008 vs a Forex market crisis is the equivalent of bailing out a local bingo hall as compared to dealing with such a crisis on the scale of Las Vegas casino.

If the Forex market suddenly gets rocked with a clear fundamental breakdown and breakup of everything now known as the E.U. Along with all the tentacle entangled carry trades? Crisis might be an understatement.

Contagion across the Forex exchanges will not only wreak havoc from within it will also spread directly to the Bond markets. (which many don’t realize is also considerably larger themselves than the equity markets)

Such sweeping turmoil will most assuredly plunge the equity markets themselves into complete and utter chaos as money managers, market makers, margin executives and more decree: “Sell Everything, Close Everything, Now!”

What chaos might also be unleashed as the High Frequency Trading (HFT) algos are set loose selling anything and everything into a market where it’s suddenly revealed via news reading computers that the jig is up?

Or, what no one (and I mean no one!) thought possible till this week. What if this was the week HFT decides to not skirt the laws, but to now – obey them?! i.e., CME Rule 575 as explained by ZeroHedge: These Kinds Of Market-Rigging “Practices” Will No Longer Be Allowed On The CME

This could make the current Ebola crisis and concerns about the speed and severity of contagion look like the sniffles in a kindergarten class.

The panic, fear, mistrust, alienation, ___________(fill in the blank) that holders of what once believed were liquid assets on their books will find out rather quickly nothing runs quicker down the drain than paper gains and wealth.

If all this plays out, what will follow will be a blow to the IPO market and all it has morphed into these last few years with “free money.” So much so that one will think they actually saw Thor’s Hammer. Alibaba™ stands to be “the” poster child for top ticking headlines like never before.

Friday their stock hits the market in what has been touted as one of the most sought after and highly demanded offerings. So much so that they were able to wrap their road show early.

All this in an era of low if not non-existent GDP figures of recent memory. Along with real unemployment, and other metrics screaming recession, however these are adjusted, tweaked or adulterated so much so – it would make a vocal harmonizer jealous.

If Alibaba finds itself trying to release an IPO in this potential melee it will have ramification not only for its own offering, but for every single current high flyer in the markets from now until who knows when. The issue is not just if this happens, but what happens for everything else -if?

A catastrophe is quite possibly in the making. But it is still all in the hands of nothing more than the odds in a flip of a coin. We’ll know more Thursday when Scotland votes. Until then what we truly know is less about what if, and more about – if not.

However we do know a couple of things today that we didn’t know just 5 years ago.

First is, we understand the markets are not what people think they are. Second, the Fed is not as omnipotent as most believe. Third, 70% to 80% of what the “mom and pop” 401K holders think are trades in the markets, is an illusion. Fourth: Everyone, including many of the very professionals that work and breathe Wall Street have learned absolutely nothing since the Lehman crisis.

And what’s maybe more important than all of those combined?

They believe the chances of it repeating are not only nil, they’re betting it wont. Besides they still believe: “The Fed’s got their back!”

Problem is – will the Fed be able to save its own rear end if it does happen? Let alone theirs.

We’ll know soon enough.

Moscow warns against panic as ruble plunges to historic lows

The national currency fell to 38.82 rubles per dollar after weakening on Monday to below 38 against the dollar for the first time.

It also broke through the symbolic level of 50 rubles per euro for the first time in several months.

The ruble has slumped as investors fret about the impact of ever more stringent Western sanctions on the economy, which is already teetering on the verge of recession.

Ordinary Russians said they were concerned that a weaker ruble would drive up inflation and make foreign trips and foreign currency-denominated purchases an increasingly unaffordable luxury.

Deputy Finance Minister Alexei Moiseyev sought to put on a brave face, saying authorities were taking steps to curb inflation.

"Don't panic," he said.

http://news.yahoo.com/ruble-plunges-sharply-against-euro-dollar-110647010.html

China Launches CNY500 Billion In "Stealth QE"

It has been a while since the PBOC engaged in some "targeted" QE. So clearly following the biggest drop in the Shanghai Composite in 6 months after some abysmal Chinese economic and flow data in the past several days, it's time for some more. From Bloomberg:

- CHINA’S PBOC STARTS 500B YUAN SLF TODAY, SINA.COM SAYS

- PBOC PROVIDES 500B YUAN LIQUIDITY TO CHINA’S TOP 5 BANKS: SINA

- PBOC PROVIDES 100B YUAN TO EACH BANK TODAY, TOMORROW WITH DURATION OF 3 MONTHS: SINA

Just as expected, the Chinese "derivative" currency, the AUD, goes vertical on the news, and the S&P 500 goes vertical alongside:

For those confused what the SLF is, here is a reminder, from our February coverage of this "stealth QE" instrument.

* * *

The topic of China's inevitable financial crisis, and the open question of how it will subsequently bail out its banks is quite pertinent in a world in which Moral Hazard is the only play left. Conveniently, in his latest letter to clients, 13D's Kiril Sokoloff has this to say:

http://www.zerohedge.com/news/2014-09-16/china-launches-cny500-billion-stealth-qeWill the PBOC’s Short-term Lending Facility (SLF) evolve into China’s version of QE? While investor attention has been fixated on China’s deteriorating PMI reports and fears of a widening credit crisis, China’s central bank is operating behind the scenes to prevent a wide-scale financial panic. On Monday, January 20th, 2014, when the Shanghai Composite Index (SHCOMP, CNY 2,033) fell below 2,000 on its way to a six-month low and interest rates jumped, the central bank intervened by adding over 255 billion yuan ($42 billion) to the financial system. In addition to a regular 75 billion yuan of 7-day reverse repos, the central bank provided supplemental liquidity amounting to 180 billion yuan of 21-day reverse repos, which was seen as an obvious attempt to alleviate liquidity shortages during the Chinese New Year. However, it is worth noting that this was the PBOC’s first use of 21-day contracts since 2005, according to Bloomberg. Small and medium-sized banks were major beneficiaries of this SLF, as the PBOC allowed such institutions in ten provinces to tap its SLF for the first time on a trial basis. A 120 billion yuan quota has been set aside for the trial SLF, according to two local traders.The central bank also said it will inject further cash into the banking system at regularly-scheduled open market operations. This is a very rare occurrence, as it is almost unprecedented for the central bank to openly declare its intention to inject or withdraw funds at regularly-scheduled open market operations. Usually, these operations only come to light after the fact.The SLF was created as a brand new monetary tool for the central bank in early 2013 and was designed to enable commercial banks to borrow from the central bank for one to three months. Since its creation, however, the SLF program has been used with increasing frequency by the central bank.The latest SLF is remarkable for two reasons: First, as mentioned earlier, this SLF was expanded to allow provincial-level small- and medium-sized banks, for the first time, to tap liquidity from the central bank. As local financial institutions are usually both the major issuers and holders of local government debt, the expansion of the SLF to include local financial institutions opens a new channel for liquidity to flow from the central bank to local governments. This may suggest that the central bank, which is now on high alert for systemic risk, is willing to share some of the burden of local government, though on a very selective and non-regular basis.The second key reason is embodied in the following central bank announcement: “[we will] explore the function of the SLF in setting the upper band of the market interest rates.” In other words, in the event that interest rates spike higher due to a systemic crisis, the central bank can intervene, via the SLF, to bring rates back down if it so desires. In addition, the PBOC did not disclose any set cap on the SLF, implying that unlimited liquidity could be provided as long as the market’s rate spike exceeds the bands set by the PBOC....Most important, the SLF appears to represent the PBOC’s strategy to avert China’s widely-publicized local government debt and banking-system problems. It is worth noting that even though local government debt amounts to 30% of GDP and is growing at an alarming rate, China’s central government is relatively underleveraged, with a debt-to-GDP ratio of only 23%, which is significantly lower than the emerging-market average. Therefore, Beijing has considerable unused borrowing capacity to share some of the debt burden taken on by local governments, which would have the additional positive impact of lowering borrowing costs for those governments.

Trade the Yuan - Open a Forex Account

Monday, September 15, 2014

Will The Swiss Vote to Get Their Gold Back?

On November 30th, voters in Switzerland will head to the polls to vote in a referendum on gold. On the ballot is a measure to prohibit the Swiss National Bank (SNB) from further gold sales, to repatriate Swiss-owned gold to Switzerland, and to mandate that gold make up at least 20 percent of the SNB's assets. Arising from popular sentiment similar to movements in the United States, Germany, and the Netherlands, this referendum is an attempt to bring more oversight and accountability to the SNB, Switzerland's central bank.

The Swiss referendum is driven by an undercurrent of dissatisfaction with the conduct not only of Swiss monetary policy, but also of Swiss banking policy. Switzerland may be a small nation, but it is a nation proud of its independence and its history of standing up to tyranny. The famous legend of William Tell embodies the essence of the Swiss national character. But no tyrannical regime in history has bullied Switzerland as much as the United States government has in recent years.The Swiss tradition of bank secrecy is legendary. The reality, however, is that Swiss bank secrecy is dead. Countries such as the United States have been unwilling to keep government spending in check, but they are running out of ways to fund that spending. Further taxation of their populations is politically difficult, massive issuance of government debt has saturated bond markets, and so the easy target is smaller countries such as Switzerland which have gained the reputation of being "tax havens." Remember that tax haven is just a term for a country that allows people to keep more of their own money than the US or EU does, and doesn't attempt to plunder either its citizens or its foreign account-holders. But the past several years have seen a concerted attempt by the US and EU to crack down on these smaller countries, using their enormous financial clout to compel them to hand over account details so that they can extract more tax revenue.

The US has used its court system to extort money from Switzerland, fining the US subsidiaries of Swiss banks for allegedly sheltering US taxpayers and allowing them to keep their accounts and earnings hidden from US tax authorities. EU countries such as Germany have even gone so far as to purchase account information stolen from Swiss banks by unscrupulous bank employees. And with the recent implementation of the Foreign Account Tax Compliance Act (FATCA), Swiss banks will now be forced to divulge to the IRS all the information they have about customers liable to pay US taxes.

On the monetary policy front, the SNB sold about 60 percent of Switzerland's gold reserves during the 2000s. The SNB has also in recent years established a currency peg, with 1.2 Swiss francs equal to one euro. The peg's effects have already manifested themselves in the form of a growing real estate bubble, as housing prices have risen dangerously. Given the action by the European Central Bank (ECB) to engage in further quantitative easing, the SNB's continuance of this dangerous and foolhardy policy means that it will continue tying its monetary policy to that of the EU and be forced to import more inflation into Switzerland.

Just like the US and the EU, Switzerland at the federal level is ruled by a group of elites who are more concerned with their own status, well-being, and international reputation than with the good of the country. The gold referendum, if it is successful, will be a slap in the face to those elites. The Swiss people appreciate the work their forefathers put into building up large gold reserves, a respected currency, and a strong, independent banking system. They do not want to see centuries of struggle squandered by a central bank. The results of the November referendum may be a bellwether, indicating just how strong popular movements can be in establishing central bank accountability and returning gold to a monetary role.

Dr. Ron Paul

Project Freedom

Project Freedom

Congressman Ron Paul of Texas enjoys a national reputation as the premier advocate for liberty in politics today. Dr. Paul is the leading spokesman in Washington for limited constitutional government, low taxes, free markets, and a return to sound monetary policies based on commodity-backed currency. He is known among both his colleagues in Congress and his constituents for his consistent voting record in the House of Representatives: Dr. Paul never votes for legislation unless the proposed measure is expressly authorized by the Constitution. In the words of former Treasury Secretary William Simon, Dr. Paul is the "one exception to the Gang of 535" on Capitol Hill.

Dr. Ron Paul Archive

|

Open a Forex Account

Sunday, September 14, 2014

Tuesday, September 9, 2014

EES: Russia and China to impact Forex market dynamics

In response to sanctions, Russia is seeking non-USD trade deals, most notably with China. How will non-USD transactions impact the Forex market? Already, US based intellectuals are calling for an end to the Dollar Hegemony:

The free-floating Forex system we have today was in fact created by the US (Nixon Shock) but since no standards were ever established, now it's an unknown unknown how the BRICs will evolve the Forex market, but certainly it will be changed forever. And certainly we can expect extreme volatility in the years ahead, even on the majors.

Russia and China are agreeing to settle more trade in Rubles and Yuan. From Reuters:Note that as long as the dollar is the reserve currency, America’s trade deficit can worsen even when we’re not directly in on the trade. Suppose South Korea runs a surplus with Brazil. By storing its surplus export revenues in Treasury bonds, South Korea nudges up the relative value of the dollar against our competitors’ currencies, and our trade deficit increases, even though the original transaction had nothing to do with the United States.This isn’t just a matter of one academic writing one article. Mr. Austin’s analysis builds off work by the economist Michael Pettis and, notably, by the former Federal Reserve chairman Ben S. Bernanke.

China has an explosive Forex market, and is negotiating swap arrangements with other central banks. Retail demand for Forex in China is also exploding. Although the US Forex market is not developed as in Europe, Asia, and the UK, the USD has been the global reserve currency since World War 2. How will new players such as Russia and China impact the Forex market, and values of other currencies? Certainly, they will not take the same view as the US.(Reuters) - Russia and China pledged on Tuesday to settle more bilateral trade in rouble and yuan and to enhance cooperation between banks, Russia's First Deputy Prime Minister Igor Shuvalov said, as Moscow seeks to cushion the effects of Western economic sanctions. Shuvalov told reporters in Beijing that he had agreed an economic cooperation pact with China's Vice Premier Zhang Gaoli that included boosting use of the rouble and yuan for trade transactions. The pact also lets Russian banks set up accounts with Chinese banks, and makes provisions for Russian companies to seek loans from Chinese firms. "We are not going to break old contracts, most of which were denominated in dollars," Shuvalov said through an interpreter. "But, we're going to encourage companies from the two countries to settle more in localcurrencies, to avoid using a currency from a third country."

The free-floating Forex system we have today was in fact created by the US (Nixon Shock) but since no standards were ever established, now it's an unknown unknown how the BRICs will evolve the Forex market, but certainly it will be changed forever. And certainly we can expect extreme volatility in the years ahead, even on the majors.

Subscribe to:

Comments (Atom)