The Crypto Market isn't all it's cracked up to be. Last year we wrote a book on this topic, Splitting Bits (you can get it here). But the book was written in October, before the huge rise in price in November and December. Just like with traditional markets - investors only seem interested in the winners. When we said that 90% of ICOs are frauds - did anyone really hear that? Or were they just 'listening' ?

As the digital money frenzy of the past few years cools, the crypto coin graveyard is filling up. Dead Coins lists around 800 tokens that are bereft of life, while Coinopsy estimates that more than 1,000 have bought the farm.The carnage is mostly the consequence of failed projects from the thousands of startups that used initial coin offerings to raise billions in funding, and a global regulatory crackdown on questionable practices and scams. Names like CryptoMeth, Droplex and Roulettecoin may have been a clue to the coins’ dim prospects.“There has obviously been a lot of fraud and hype in the ICO market,” Aaron Brown, a business author and investor who writes for Bloomberg Prophets, said in an email. “I accept figures I have seen that 80 percent of ICOs were frauds, and 10 percent lacked substance and failed shortly after raising money. Most of the remaining 10 percent will probably fail as well.”

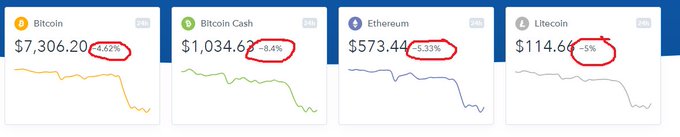

While everyone is watching Bitcoin, many forget about the thousands of failed projects, frauds, and other failed ICOs that didn't meet the mark.

While this may seem like an obvious statement, with all the hype - some need a reminder of this. As they say in Israel, most projects are 'shitcoin.' Oh you think this is another joke, do you? No no no... no no no .. it's not.

This is a great example of what comprises the majority of the Crypto Market. Now of course, not all coins are shit coins - in fact many show signs of promise. And also, not all ICOs are crap, there are those that actually have an underlying technology which look very promising, such as Sky Desks, Cornucopia, and others. Some from the 'real world' are finding no trouble raising money, that is - coins that actually have viable business models - such as Box Bit. Consulting companies are popping up everywhere.

But going back to SHIT, it really is wide spread. So few ICOs are regulated, in fact there is only one 'official' regulated ICO and it's not an ICO it's an STO (Securities Token Offering) tZERO.

It seems that there is only one coin, that everyone agrees (at least the market) is good - and that's Bitcoin. But yet, we don't know who created Bitcoin, even though the NSA said they can't say if they created it as this is classified (classic!).

Millions of people around the world are trying to start their own coins. Platforms like Waves allow you to do this in a few minutes after paying the ETH fee. But what value does a coin have which can be created in the equivalent of Microsoft Money?

You know that many of us were not born yesterday, so we're not falling for the banana in the tailpipe.

It can be you! Just liquidate your 401k and invest in the next 'Bitcoin' - which you probably have a friend who told you what it's going to be. WARNING - THIS IS SARCASTIC HUMOR. CRYPTO INVESTING IS RISKY AND YOU SHOULD ONLY INVEST FUNDS IN WHICH YOU PLAN ON LOSING IN ORDER TO OFFSET YOUR MASSIVE TAX BILL ON YOUR BITCOIN GAINS YOU HAVE CARRIED FORWARD SINCE 2017.

To track the growing number of new Crypto Currencies, Checkout Total Cryptos. For a refreshing technology planning on a token sale, checkout Sky Desks @ www.skydesks.io