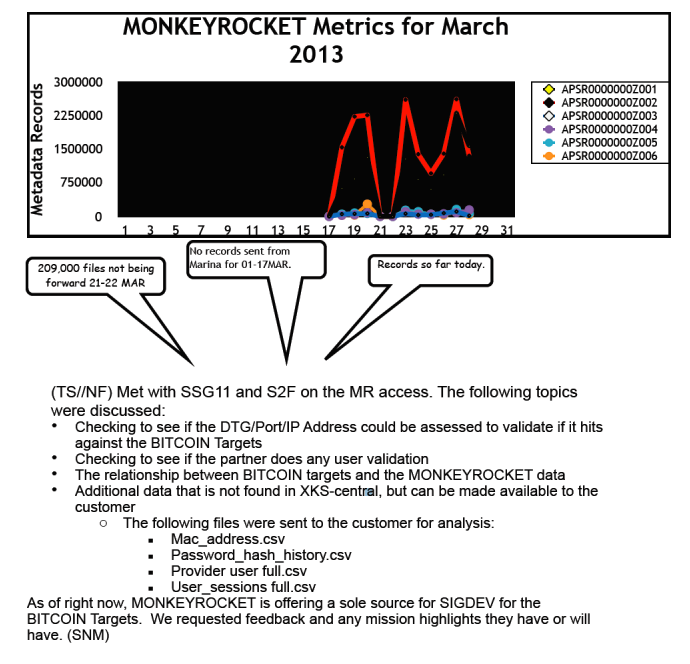

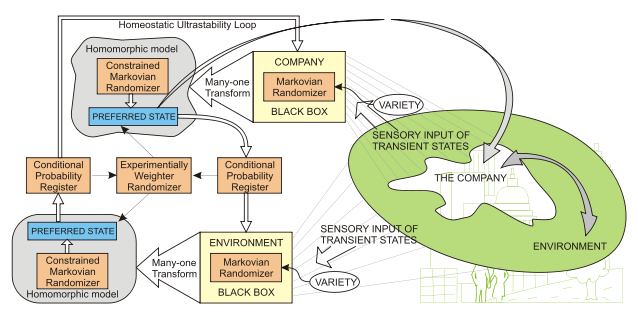

(Bloc10 4/29/2018) -- This is a macro-deep-analysis of how Crypto can create a new parallel system by feeding off the old carcass of the dying fiat central banking model.As we explain in our book Splitting Pennies – the financial world is not as it seems. Gurus from many, non-correlated financial disciplines have been predicting for years that the current financial system is going to collapse. But just like Planet X that never came, and the false alarm of the Y2K bug, it seems that collapse has been postponed. There’s an answer for this, that isn’t being reported in the financial media. We must look at the whole picture here, so think macro, think global, and read carefully. First let us state plainly that this collapse theory is all based on solid data – the debt bubble, over leveraged banks like DB who is 50:1, growing stagnant economic growth, etc. the list of apocalyptic economic data goes on and on – so what’s keeping the system afloat? Greed? There is one difference and it’s a big difference, a huge one, that all the doom and gloomers need to consider. It’s not a ‘this time it’s different’ argument, but we have to consider global system dynamics and how they were different in Rome and other ‘empire collapse’ metaphor scenarios; today there are powerful Artificial Intelligence systems that are so powerful, they can out think any opponent 10 moves ahead. Perhaps it is this intelligence that suggested the creation and proliferation of Bitcoin to replace the economic position that traditional fiat banks failed to provide? If you look at the system as a whole, Bitcoin is an extremely intelligent solution to economic decay that Quantitative Easing alone cannot solve (and QE has proven to be impotent). Facebook is at the end of it’s use cycle. Perhaps the most important Fakebook article here on ZH is this one:"Every part of this has made me sadder and sadder and sadder. I feel like my baby has turned out to be something horrible, and these people I trusted and helped along have forgotten where they came from," he said in a conversation with Kevin Delaney, Quartz’s editor-in-chief. McNamee has become an outspoken critic of the company, comparing its role in the 2016 US election to "the plot of a sci-fi novel" while at the same time admitting that he has "profited enormously" by backing Facebook early on. The organization he helped found, the Center for Humane Technology, has made it a mission to expose Facebook’s multiple flaws, and to try to fix them.How is Fakebook related to Crypto? You should have read Michael Lewis’ The New New Thing – A MUST READ. These ideas are not dated. Silicon Valley, Wall St., and DC still operate in this way. Fakebook created a massive bubble out of nothing, 462 Billion as of today. Facebook isn’t anything, they don’t build anything, they are just programming the minds of the less gifted and in the process keeping tabs on what their neighbors feed their dogs. Here’s what one Fakebook insider had to say:During his talk, he echoed criticisms by early Facebook executive, Chamath Palihapitiya, who compared Facebook to “Internet crack” and said it’s “ripping apart the social fabric of how society works.”Fakebook did it’s job. It ripped apart the social fabric of how AMERICAN society works. While Facebook is a global app, it doesn’t have the same significance in other countries. Perhaps a few US friends like UK, Australia, etc. are in the same boat – but most countries not. Facebook is from the beginning an intelligence collection apparatus and means of social control, first and foremost. Incidentally, investors made a bundle on it and it’s a darling of Wall St. (until recently). Let’s be practical, without InQTel behind it, Fakebook would have never got off the ground. The CIA needed a slimy weasel like Suckaburger to do their electronic bidding as the spy game globally and domestically was moving to an electronic paradigm. Don’t forget that the military created the internet, it wasn’t developed by 2 dudes in their mom’s garage. The internet has always been and perhaps always will be a military communications system used by the public. There’s a price to pay for ‘free’ networks! Now of course, there are groups of private networks who have setup peer to peer encrypted communications systems and their own private social networks and chat systems like Telegram, but that represents a small percentage of the overall population which is irrelevant. If we look at Facebook on the surface, for what it is – a pump and dump scheme backed by the Military sold by Wall St. to Main St. to control them and suck more of their hard earned dollars from them, meanwhile keeping tabs on their every move, and making a buck for America’s owners – Bitcoin is the same thing! Let’s call a kettle a kettle. Bitcoin is popular for one reason – some people made millions on it. And the people who made millions on Bitcoin are mostly average folks, mostly advanced or above average technical people. With a few exceptions like Mike Novogratz, few Wall St. types, few Elite aristocrats (if any). Sound familiar? Remember Fakebook in 2007, 2008 even before the massive control systems, the gamed news feeds, before things just ‘vanished’ like if you write something they didn’t like (disappearing sentences, accounts, etc.) There was a time before Fakebook went ‘viral’ that it was ‘hip’ and only for ‘techies’ not the ‘main stream’ and then suddenly it ballooned. So there are some obvious technical differences here, just like there are differences between Fakebook and the Real Estate / Sub Prime pump and dump scam, and Bitcoin, and the scams before it. Scam is a harsh word but the fraud is so elaborate and malicious that much more harsh words are called for. Fakebook literally can be credited with destroying the social fabric of America. Some would argue that’s a good thing – but it’s another topic. Bitcoin is a Crypto Currency but like any investment, it has a lot of features like social media. The interesting link here is that Social Media made Bitcoin popular. For years the price stagnated, and it didn’t get much attention. Once the price started going up – then it went viral. People love making money! It was an alternative investment for the masses. You could buy Bitcoin with as little fiat money as you had. This, and the fact that it was digital, and global, gave it the mass appeal finally shooting the price to stratospheric levels. So hold on to your horses in case you don’t know this and you start screaming and spook them – As we explain in our book Splitting Bits – we believe based on available public evidence that the creator of Bitcoin was the NSA, either as a sub-unit or an individual working for the NSA. We have no smoking gun evidence – but no one else does as far as any alternative creator. Our scenario is simply the most plausible – it’s not necessarily the facts. There is not 100% fact showing the real face of the creator of Bitcoin. And the NSA will not confirm or deny it’s involvement, but it will provide a statement to an FOIA request that it will not confirm nor deny if such information would be or would not be classified (of course). But what’s interesting is that, the NSA is reportedly monitoring Bitcoin transactions under a program called MONEYROCKET: For instance, one memo from the NSA, the report cited, suggested the agency has collected private information such as bitcoin user passwords, internet activity and device identifiers.According to the report, the NSA has been monitoring the internet activities of bitcoin users since 2013 through a program with codename as OAKSTAR. And yet the new leak suggested that with MONKEYROCKET, another sub-program under OAKSTAR, the NSA may be moving closer to pinpoint users who initiate a cryptocurrency transaction."SSG11 analysts have found value in the MONKEYROCKET access to help track down senders and receivers of bitcoin," one memo reads.If these memos are real, and there is no reason to believe they are not, they are likely an indicator of what’s really going on, such a program would likely involve a team of people, millions of dollars, and hundreds or thousands of documents. NSA didn’t setup MONKEYROCKET to track down a few money launderers. It’s not their job, really.. Going back to the Facebook analogy, we have to consider 1) how Bitcoin goes up and 2) how Bitcoin is primarily a grassroots movement from the fringe. Crypto is the next bubble, we can ride the bubble – but here we will make a bombastic claim: Bitcoin is the MySpace. Bitcoin isn’t ‘the bubble’ actually Bitcoin is a poorly designed currency and remember that for Bitcoin there was no ICO. This ICO terrible idea was popularized mostly by quasi criminals who were ineligible for registration. We’re referring to financial criminals, the new mafia (they have evolved from the days of protection insurance, etc.), fraudsters, Ponzi scammers, and other similar elements the Crypto world has attracted. Bitcoin is the social media of finance. But instead of sharing photos of old friends and breakfast choices, Bitcoin enabled a higher element of socialization, i.e. ‘hey I just made 10,000% return on my money, you might want to check this out.” It’s like the .com boom on steroids, and it was global (Bitcoin isn’t a US product per se). In order to ‘spend’ Bitcoin it was necessary for early adopters to engage in viral marketing to make Bitcoin viable. The concept of fully electronic money is not new, but in 1989 David Chaum’s DigiCash failed, for a number of reasons but the most likely was the fact that the internet didn’t have the penetration in 1990 as it did in 2010. Social Media and the internet was a conduit for Bitcoin. And Bitcoin quickly gave birth to Ethereum, and now there are more than 2,000 crypto currencies being built and developed on an exponential pace. Ironically though, there is only one regulated futures contract at the CME, Bitcoin Futures, and only 1 regulated ICO – the tZERO ICO (*it is ‘registered’ not ‘regulated’ but the point here is that tZERO has followed SEC guidelines, and they are a regulated company – they aren’t based in BFE with a bunch of John Doe’s as their Advisors). Our point here is that Bitcoin did what it set out to do – start a race of development which is fueled by the mania created by the 1,000,000% BTC/USD chart. Something like a million percent return never happened, and likely will never again. The group that created Bitcoin whoever they are, know very well that the large banks control the system and there is no hope of creating a ‘parallel’ system without the blessing of Wall St. and DC, this was most notably proven with Chile’s Project Cybersyn:Project Cybersyn was a Chilean project from 1971–1973 during the presidency of Salvador Allende aimed at constructing a distributed decision support system to aid in the management of the national economy. The project consisted of four modules: an economic simulator, custom software to check factory performance, an operations room, and a national network of telex machines that were linked to one mainframe computer.[2]Project Cybersyn was based on viable system model theory and a neural network approach to organizational design, and featured innovative technology for its time: it included a network of telex machines (Cybernet) in state-run enterprises that would transmit and receive information with the government in Santiago. Information from the field would be fed into statistical modeling software (Cyberstride) that would monitor production indicators (such as raw material supplies or high rates of worker absenteeism) in real time, and alert the workers in the first case, and in abnormal situations also the central government, if those parameters fell outside acceptable ranges. The information would also be input into economic simulation software (CHECO, for CHilean ECOnomic simulator) that the government could use to forecast the possible outcome of economic decisions. Finally, a sophisticated operations room (Opsroom) would provide a space where managers could see relevant economic data, formulate responses to emergencies, and transmit advice and directives to enterprises and factories in alarm situations by using the telex network.The project was so head of its time, what a desktop computer can calculate was 10x more powerful than warehouses full of computers in 1971. But the idea had to be squashed and Allende was taken out and replaced with a US friendly regime. The timing of this dismantling of the world’s first AI economic management system, coinciding with Nixon’s creation of the floating FX regime, perhaps the opposite of intelligence, should be noted. Analysis & Conclusion So here’s the deal with Bitcoin and Crypto. The big wave, the paradigm shift – it’s going to be in the regulated coin space – the Dollar Cryptos, Fedcoin, Crypto Rubble, and Crypto securities. When you can buy and sell Crypto on regulated exchanges – then you’re going to see a real paradigm shift. And that’s coming – but slowly.Over the past year, Lund says he’s met with 20 central banks exploring the potential benefits of issuing their own fiat cryptocurrency on a blockchain. Specifically, he described the “most durable digital asset” as one that is “issued by a central bank that represents a claim on fiat deposits in the real world,” but still maintains “some semblance of monetary policy.” Though he wouldn’t reveal the names of most of the central banks with which he’s meeting, he described them as largely comprised of banks from the G20, an international forum with members including China, Russia, the U.S. and the EU. Lund further described the central banks as “clients in some capacity.” Based on these conversations, he said he expects the first central banks to issue a fiat currency on a blockchain will be “the smaller ones” with a high concentration of interest in Asia and North America.Is Bitcoin going to 50,000? Probably not. But Bitcoin’s rise to 20,000 surprised many, so it would not be surprising if it went to 100,000. Just remember one thing – the only thing that makes Bitcoin go up is buying and no selling. Selling pressure from Mt. Gox trustees put sell side pressure on Bitcoin as they unloaded Billions of USD worth of Coins on the market. Bitcoin whales that control a huge chunk of available supply could sell. The only thing that can make Bitcoin go up to 50,000 are billions in USD worth of buy orders. There is a physical limit to the price of Bitcoin based on how much fiat currency there is in the world. For example if every available US Dollar, Euro, and all other fiat currencies converted ALL of themselves to Bitcoin it would go very high, and we can calculate what that number might look like. But it is a number it is not infinite. The same can be said for stock, real estate, or other bubbles – this is bubble dynamics 101 something that the Bitcoin crowd mostly misses. Here’s the demotivational speech. So we are claiming that Bitcoin is the MySpace and the “Facebook” of Bitcoin is still to be developed. Just like in the pre-IPO space, investors are looking at in the best case 20x – 100x returns if they catch it. Of course, it will not be easy to know WHICH of the 10,000 new coins is going to be the next Facebook. But likely it will be one backed by Goldman Sachs, it will be made in Silicon Valley or in Berlin, and it will be regulated. Regulated Crypto is the future. 10 years from now probably all assets will be Crypto assets – only because of the security and efficiency features. The global FX markets for example, something Crypto stands to revolutionize, are really outdated, and didn’t really change their model since FX was created by Richard Nixon in 1971. Even until 2007 banks engaged a majority of their volume on ‘voice orders’ ! The global financial system has been ripe for an upgrade, and what Bitcoin did it said this to the world. It sent a message which was well received by Main St. investors, Wall St. financial engineers, and politicians alike. Now, they are pedal to the metal coding and designing around the clock. The first coin in the class we are referring to here is Basis, backed by Wall St. and Silicon Valley and cooked up in a frat room at Princeton, perhaps the most Elite of the finance schools depending on who you are debating.Investors apparently love what Basis is cooking up. The upstart is announcing today that it has raised a somewhat stunning $133 million in funding from Bain Capital Ventures, GV, longtime hedge fund manager Stan Druckenmiller, one-time Federal Reserve governor Kevin Warsh, Lightspeed Venture Partners, Foundation Capital, Andreessen Horowitz, WingVC, NFX Ventures, Valor Capital, Zhenfund, Ceyuan, Sky Capital, Digital Currency Group and others.The coin idea here is a ‘Stable Coin’ – which isn’t a unique idea, it is more of a sub-movement in the Crypto community. While Bitcoin got the world’s attention, it is a poor spending currency, certainly not a store of value, and the Blockchain technology behind Bitcoin is basic, although stable, does not represent the best of what Blockchain can do, as many other coin startups have pointed out. How this will save the financial system? It is a transition to a new global financial regime. Crypto Currency itself is not such an amazing development. In Scandinavian countries they have been using digital electronic money for years. What’s the difference really between Bitcoin in your wallet or your 100,000 USD at the bank? The banking system has become bloated, inefficient, and in great need of reform. New markets will open up which are Crypto-denominated. Trading strategies will evolve that were not before possible. The establishment will not be destroyed, by design – Bitcoin requires vast amounts of electricity to be mined. So unless the next ICO is going to raise $10 Billion to build ‘clean’ Thorium nuclear reactors, Bitcoin is not so different than the Petro Dollar as it must pay it’s utilities in USD from mining. Of course that’s just one model as shown by Bitcoin – but there are others – countless others. Bitcoin started a chain of events (pun intended) that will lead to the next ‘paradigm’ of currency.Document Information This deep analysis report was commissioned by Bloc10 authored by Global Intel Hub. 4/29/2018 for the 'Blogosphere'Bloc10 update Bloc10 released recently Total Cryptos Android App (Free) , the Desktop Website @ www.totalcryptos.com and soon will release an Apple App. Coming soon: Machine Learning Engine to predict the price of Crypto Currencies (paid service) and Blockpad, the world’s first secure Notepad for Crypto investors, Blockchain developers, and intelligence operatives. To stay tuned on further developments in the Crypto space plugin to Bloc10 @ www.bloc10.com/joinLinks: NSA MONKEYROCKET DOCUMENTS: Global Intel Hub Libraryhttps://wp.me/P6ZQKC-4X New New Thing Book

Sunday, April 29, 2018

ALERT: Bitcoin, NSAs MONKEYROCKET, is going to save the old financial system from collapse

Thursday, April 19, 2018

Deutsche Bank "Mistakenly" Sends $35 Billion Out The Door

Back in the summer of 2015, Deutsche Bank mistakenly paid $6 billion to a hedge fund client in a “fat finger” trade on its foreign exchange desk. The embarrassed bank recovered the money from the US hedge fund the next day, and quickly accused a junior member of the bank’s forex sales team of being responsible for the transfer while his boss was on holiday; as the bank further explained, instead of processing a net value, the person processed a gross figure: "That meant the trade had too many zeroes" a staffer helpfully explained.

Fast forward to today when Germany's largest bank has done it again.

According to Bloomberg, a routine payment at Deutsche Bank "went awry" (or as the article notes "was flubbed") last month when the bank with the €48 trillion in derivatives...

... mistakenly sent 28 billion euros ($35 billion) to an exchange as part of its daily derivatives margin transfers.

While the error was quickly spotted and no financial harm was suffered by the bank which has made clusterfucks into its business model, it represents a terrific case study why one should never confuse gross and net derivative exposure: as Bloomberg adds, the "errant" transfer occurred about a week before Easter as Deutsche Bank was conducting a daily collateral adjustment. The delighted - if only for a short time - recipient of the massive transfer was the Deutsche Boerse AG’s Eurex clearinghouse, in whose account the sum landed.

“This was an operational error in the movement of collateral between Deutsche Bank’s principal accounts and Deutsche Bank’s Eurex account,” Charlie Olivier, a spokesman for Deutsche Bank, wrote in an emailed statement. “The error was identified within a matter of minutes, and then rectified. We have rigorously reviewed the reasons why this error occurred and taken steps to prevent its recurrence.”

Of course, Deutsche Bank vowed the same "rigorous" review took place after the 2015 FX transfer fiasco and clearly nothing changed. Actually no, what changed is that Deutsche Bank has been a chronic underperformer, its stock crashed in 2016 to levels below the financial crisis amid speculation about its solvency, and just last week the bank's latest CEO was fired for what really amounted to incompetence.

Surely a pattern is emerging.

Indeed, as Bloomberg adds, "the episode raises fresh questions about the bank’s risk and control processes, at a time when lenders are faced with increased scrutiny from regulators. It’s another embarrassment for Deutsche Bank at a time when it is undergoing a change of leadership in the wake of its third straightannual loss."

And while the "glitch" took place during the last days of now ex-CEO John Cryan's tenure, it will surely be seen as another wrinkle for the bank's new chief executive Christian Sewing who even before this news already had a mountain to climb, as Deutsche Bank is the worst performing member of the Stoxx 600 banks index this year, with the shares having fallen 26% YTD.

Also, in light of the latest debacle, one wonders if the transfer had anything to do with the recent ouster of bank COO Kim Hammonds, who reportedly called Deutsche Bank "the most dysfunctional company" she’d ever worked for.

Finally, adding insult to injury, as we reported over the weekend Deutsche Bank was asked by the ECB to simulate a "crisis scenario" and an orderly wind-down of its trading book, making the German lender the first European bank to receive such a request from the ECB, which is reportedly using Europe’s largest investment bank as a "guinea pig" before it sends similar requests to other banks.

Then again, other European banks don't have €48.3 trillion in derivatives they would need to wind-down overnight.

Sunday, April 15, 2018

ALERT: Syria first strike in World War 3 - Deep Analysis

From www.globalintelhub.com 4/14/2018

Syria has been bombed which calls for a deep analysis of what's going on here. As we explain in our book Splitting Pennies - what really backs the US Dollar is BOMBS. Wall Street and the MIC (Military Industrial Complex) are inextricably intertwined, whether you are an armchair intellectual or an investor it's important to understand this economic relationship.

The latest action in Syria is that policy in action. Let's take a step back and understand this critical but boringly predictable development in Syria, the players involved, their respective relevant histories, and what markets can expect.

First let's look at War Inc. or the Military as a business, or as we have outlined in a detailed article "Cult of War" (a good primer read if you're not up on this topic). With 800 Billion + per year and a likely real spend of well over a Trillion USD, the US taxpayer needs to get something for their money. The Military is in a constant state of self-justification. The US outspends the enemy by such a large figure, there are stockpiles of bombs, planes, tanks, guns, logistic supplies, boats, aircraft carriers, satellites, and just millions of expensive assets getting dusty. The US could fight World War 2 on 2 fronts and a war in Space and still have assets left over. There are hundreds of military bases, millions of personnel, it has become just a massive super entity above Presidents, above the Elite, above Governments. By itself, as a form of Artificial Intelligence, the Military will do anything to prove the need it serves and survive. The glaring problem - no enemies! The number of real enemies is dwindling. But Syria has been on the CIA's hit list for some time, controlling key Oil transport sites and other resources. Not to mention Israel has wanted to destroy the unfriendly regime for a long time. Cult of War needs to create conflicts of any size, it's a 'use it or lose it' mentality. There's no better training drill than the real thing.

The False Flag

False Flag operations are when a government or other body will secretly stage an event to make it look like it was the enemy, thus providing justification for war. False flag operations obviously need to be handled with laser like precision (ideally, but in reality such as in 911 they are botched). One of the first significant False Flags in American modern history is the sinking of the Lusitania, staged apparently by warmonger Winston Churchill in an attempt to bring the ruffian Americans into World War I:

The Lusitania set sail for Liverpool on May 1st, 1915 from New York harbor. It was carrying millions of rounds of ammunition and shrapnel. The previous captain Daniel Dow had resigned because of mixing civilian passengers with munitions. The ship was to have a British battleship escort called the Juno but was recalled before the rendezvous in spite of the knowledge that a Uboat was active in the path of the Lusitania.

False Flag operations are nothing new, Hitler burned down the government building and claimed to be able to catch the terrorists and restore order in Germany, finally naming himself Chancellor. Every powerful regime has a False Flag that they 'own' in order to justify their 10 year run in power. Their time is limited, people forget, so a new event is necessary every few years, custom tailored to the situation.

This false flag was planned and executed by MI5 (British Intelligence), although the details of the operation are as yet unclear. What is clear is that it is a Hollywood style staged event which was put together in the last minute with many mistakes and inconsistencies (they didn't have a script supervisor!) as pointed out by countless fact-based witnesses and other governments:

Speaking with EuroNews, Russia's ambassador to the EU, Vladimir Chizov, said "Russian military specialists have visited this region, walked on those streets, entered those houses, talked to local doctors and visited the only functioning hospital in Douma, including its basement where reportedly the mountains of corpses pile up. There was not a single corpse and even not a single person who came in for treatment after the attack.""But we've seen them on the video!" responds EuroNews correspondent Andrei Beketov."There was no chemical attack in Douma, pure and simple," responds Chizov. "We've seen another staged event. There are personnel, specifically trained - and you can guess by whom - amongst the so-called White Helmets, who were already caught in the act with staged videos." "All these facts show... that no chemical weapons were used in the town of Douma, as it was claimed by the White Helmets." “All the accusations brought by the White Helmets, as well as their photos… allegedly showing the victims of the chemical attack, are nothing more than a yet another piece of fake news and an attempt to disrupt the ceasefire,” said the Russian Reconciliation Center.

Of course, US warmongers will say that the Russians are protecting the Assad regime. There's plenty of video and other evidence for internet sleuths to sort through in the coming days. But we have seen this so many times before we can guess the outcome fairly easily. It was a false flag, done by the British, in a sad and pathetic last attempt to save what remaining Elite aristocrats have over the masses, post Brexit. Although actual war is unavoidable in Syria now, one possible outcome of this is a populist movement against such politics, as is happening in Hungary.

Support of the US Dollar

So what's the real reason the US chooses Syria to bomb and not Greenland for example?

1. The Petrodollar (via comment on The Gateway Pundit):

“The Chinese have recently issued the gold backed Yuan, which they, and others, have vowed to use to sell/purchase oil (amongst other things). The last two nations that tried to introduce a currency to compete against the petrodollar were Libya and Iraq. The US needs that pipeline through Syria even more than ever now, especially if they are to compete for European gas/oil markets (presently controlled by Russia and their pipeline) and the Chinese Yuan. But i’m sure none of that has anything to do with it…”

Syria is not only close to the Chinese they are also working closely with Russia. All of this is a non-USD system they are building, not controlled by DC. So of course, it has to be destroyed. This is outlined in great detail in the book Splitting Pennies.

It's not only about Syria itself, you see. The GDP of Syria won't make a difference on the USD. It's about stopping a revolution. If Syria uses a Russian - Chinese financial and energy system perhaps it will spread to Jordan, Lebanon, and who next? If half the world is suddenly using a Yuan denominated trading market, it would threaten US hegemony. So all alternatives need to be stopped in their tracks, period. That isn't an opinion it is the policy in DC based on research by companies like RAND.

Trump Politics

Trump seems to be a victim of the international cabal that was a step ahead of him the whole time. In the opinion of this author, Trump is not a 'plant' from the beginning meant to deceive the voters. The UK is the master planner of this operation, including but not limited to the false flag. When domestic attempts by the deep state to derail Trump failed, they realized a coordinated effort from abroad was a better approach, one that Trump would be defenseless against, as his experience in international politics is zero (before getting into the White House). Hence, Trump's involvement in this quagmire is meant to ensnare him in a series of decisions that will weaken his domestic position, alienate his base, while achieving goals of the War Party, Zionists, the Oil industry, and other interests in this confluence. Trump was forced with a choice: pick sides, choose the Russian facts (there was no chemical attack) or the British lies. Being attacked by the domestic media by idiotic yet influential forces, staging a dangerous trade war, and coming to the conclusion of a Russian collusion investigation, backed Trump into a corner. If he had chosen to side with Russia, it could have backfired and blown up in his face. Democrats, Leftists, and other Trump enemies would have pounced on the issue accusing him of being Putin's lap boy all along. Being that this is Trump's first rodeo, he doesn't have the complex knowledge base or pool of advisers to deal with this strongly and independently. In fact he hasn't been able to build a strong team of advisers independent of deep state snakes working against him. This is not his fault, it is just the reality of how intertwined everything is in DC. "Drain the Swamp" is a great marketing slogan, and a noble idea - but implementing it may prove impossible. And on the surface, everyone loves the hero story - an evil monster gassed innocent people, and we are 'saving' them. This is a great excuse to spend billions on bombs we don't need and use them. He bought the party line of the MIC "We have to bomb the village to save it":

“The United States will be a partner and a friend, but the fate of the region lies in the hands of its own people.”“Tonight, I ask all Americans to say a prayer for our noble warriors and our allies as they carry out their missions. We pray that God will bring comfort to those suffering in Syria.”

God will bring comfort to those we are bombing? Really? Can he be any more offensive?

This is the beginning of a series of events that Trump cannot dig himself out of. The MIC won't stop until the majority of Syria is destroyed and key resources are controlled by US forces. Some of us remember in the 90s there was 'chatter' that the NeoCons were planning a false flag in a major US City that was 'nuclear' - whether that was 911 or an event that never happened we'll never know. But one thing is clear - they have the weapons, so they will kill all that stand in their way. Whether he is one of theirs or is being manipulated by them is irrelevant for his base which was largely anti-establishment and anti-war, anti-globalist, which he has proven to be the opposite.

World War 3

With the ascent of Russia, China, and smaller states building their armed forces without reason, it is only inevitable that they are used. War between China, Russia, the US and allies is inevitable. But wait - it's not what you are thinking! There will not likely be strikes on US, Chinese, or Russian soil. Rather, as in the Hunger Games, war games will be played in theaters such as the South China Sea, Syria, and other hotspots.

World War 3 will likely last 50 - 100 years, like the cold war, it will be an going unresolved war in places like Syria. Flare ups and skirmishes will be the extent of the action. Nukes may be used but tactical nukes in a limited, regional capacity. PROBABLY. Of course, it could completely spiral out of control. But deep analysis indicates not. There needs to be just enough war to justify the military and not enough to destroy it. In the same way the MIC needs a war to justify its own existence, a complete obliteration of a major player would also be an endgame (including but not limited to a humanitarian outcry if a major city was destroyed in one bombing such as London or Berlin.)

Remember folks there was only one country that has used nuclear bombs to kill millions and that country is the United States of America.

The War Inc. model - 2 new players

China and Russia are both copying the War Inc. model from the United States. Both countries do not have any real threats (except from the United States, but as a game) with the exception of terrorism. Japan has no army and is not a threat to China. China has destroyed all the regional competitors and has no real major state enemy. Domestic politics may be a bigger threat to China than any foreign military (as China was once a chaotic, multi-state region). China is a little bit like the Soviet Union, but through the prism of their culture of course. The point is multi-ethnic super states usually collapse given enough time, as there are competing domestic interests at play. That is China's focus not to be a military power, their external show of force is to play the American game. America needs an enemy. The China 'copy and paste' model, a threat to the IP of US tech companies, is also at play with War Inc.

Russia MIC

Russia is an interesting case here. During the Soviet Union Russia was a defense oriented country that did little in foreign countries outside of the Iron Curtain. After decades of high quality propaganda, at a cost of tens of billions of dollars, Russia realized that if they wanted to be a major player in the world and participate in the new growing economic power center they needed to switch to Capitalism, which they did in 1991. This was a hard shift, it is difficult for those outside Communist countries to understand what it means to 'switch' from a state controlled economy to 'free market' economy. Russia's markets were so free in the 90s it led to massive growth by organized crime which was borderline legit business (they were like the Robber Baron's of the industrial age in USA). Basically Russia is 80 years behind the US, socially. Since 1991 Russia has taken all the advice given to them by their Western economic advisers. They have implemented a stock market, there are entrepreneurs in Russia starting businesses on a daily basis, they even have a Silicon Valley style incubator in Moscow Skolkovo (and others - see more info on starting a venture in Russia here). Russia has implemented many reforms in their plan to make Russia a market leader. They have a long way to go, their manufacturing standards have become a joke when Putin opened the door of a Russian car and the handle came off. But the world seems to forget that this was the 'Communist' country that the West sold on a better, capitalist life. One of the trimmings of a Capitalist society is War Inc. The partnership between Syria and Russia is a natural one; there are critical oil pipeline routes in Syria and Syria is a Christian foothold in a predominantly Muslim region. Russia didn't invent the War Inc. model however it is now operating it based on a business plan that was sent to them by Washington during the Cold War. It should come as no surprise that they are doing what they were convinced to do by Capitalist Generals in Washington. Billions upon billions were spent on Hollywood produced propaganda programs including films, radio (Air America), Television programs, news, and later internet campaigns. They are influenced by reports such as "What the bombing of Syria means for your 401k" and other reports. Russia is playing the role of War Inc. - a model copied directly from US interventions in Iraq and other places (Iraq is most similar). There is no real skin in the game for either country, Syria is just a proxy state to be used and abused for the war profiteers. This is the first time Russia is playing this role and it is playing it well. It wouldn't be surprising if Russian and US generals were exchanging encrypted communications on their competing computer game theory simulations while contemplating their next moves with each others open feedback.

Vacuum dirt analogy

Why are vacuum cleaning manufacturers honest and politicians are not? Because when you buy a vacuum, you immediately see how it works (the dirt and particles are caught in the transparent tank). If a vacuum didn't work or had poor suction it would be immediately apparent and people would return them or complain. Politicians control the information flow, especially during war, because they have power. This is especially true of government employees who are publicly elected. In private business there is a lot of oversight and ultimately you will fail or succeed, you can't lie to investors quarter after quarter.

Armchair Intellectuals and the Great American Hobby

Finally, there is this class in America not sure how to describe them, perhaps "Saturday Night War Experts" - they support any show of US force. They are mostly middle aged males with health issues, mostly on multiple prescriptions, they enjoy watching infographics explaining the differences between cruise missiles and smart bombs, right after their 5th glass of Merlot. This class isn't completely handicapped, but they choose to spend their free time sitting in Lazyboy chairs watching Fox News and other sources during wartime. When they're not tuned in, they enjoy to debate with their friends different methods how the US could use its arsenal to completely destroy Syria or "Make it GLASS" as I'm sure all readers have heard someone say once. This grotesque hobby is what gives those in DC power to enact such measures. You don't read headlines that Norway has unilaterally destroyed Sweden. In New Zealand for example there is a ban on Nuclear anything.

The info trade

During the last Iraq was there was an interesting correlation between US strikes, war actions and info, and the US Dollar. It was caused by speculators not real money flows. War is information and the markets live on information. All markets will be impacted by this war, it can even be a trading strategy by itself. Defense stocks will have a boost on successful missions. Key victories will lead to USD being bid up. It's a busy time and there's a lot happening. War traders must be tuned in 24/7 as the smallest bit of info that hasn't hit the wires yet can cause markets to move. Traders need to become information junkies.

Don't skip over the obvious facts that are staring us in the face. This is the beginning of World War 3 - but don't worry - it's good for the economy. Game on!

To read about the inner workings of this system checkout Splitting Pennies. Support great journalism and shop at www.ubuy.me and invest at www.alphazadvisors.com You read this quality analysis free - please share this article especially to friends with a TV!

Reference articles

Subscribe to:

Comments (Atom)