Elon Musk, whose company is valued at around $400 billion as a result of what continues to appear to be interesting options activity and continued quarterly profits due to EV credit sales, growing accounts receivable and other interesting accounting anomalies, has now become the world's fourth richest person.

It's a fitting development for a capital market system that has, thanks to the Federal Reserve and a lack of action by the SEC, turned into nothing more than a running joke.

Musk's aggregate compensation from a pay plan put into place only about three years ago has been $11.8 billion. Musk's latest award comes as a result of Tesla reaching milestones for "adjusted EBITDA" (yes, there was a multi-billion dollar compensation plan award for an adjusted number) and market cap.

Musk's total fortune has more than quadrupled this year, to over $100 billion.

As a reminder, the pay plan that has netted Musk more than $10 billion had a 10 year runway. Somehow, Musk has been able to cash in on the plan in about 40% of the time allocated for him to do so.

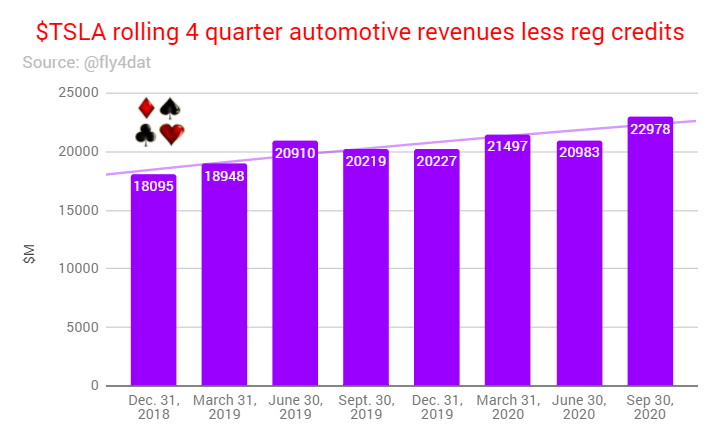

And it certainly doesn't appear to be due to robust growth for the company. As we noted a couple days ago after Tesla's earnings, it is bizarre that a company valued more than most other automakers in the world combined on its prospective growth, and is larger than both the entire US and European auto sector, shows muted growth ex-regulatory credits:

While superficially, Tesla reported a fifth consecutive quarter of profits, an earnings streak which could add momentum for Tesla’s inclusion in the S&P 500 Index, as noted below a sizable $397MM (up 197% Y/Y, and just under 50% of non-GAAP Net Income) was from the sale of regulatory credits. The amount was fractionally below the record $428MM reported last quarter.

Putting this number in context, TSLA reported GAAP Income of $331MM which were entirely due to the $397MM in regulatory credits.

Musk's compensation goals - as was pointed out by many in early 2018 - have little to do with GAAP profitability and consistent cash flow and instead are focused on 12 market capitalization milestones and 16 revenue and/or EBITDA milestones; the easiest figures to manipulate, should one be so inclined to do so.

Many who were critical of Musk's compensation plan said it offered little incentive for the company to reach profitability, only to grow in size of market cap. Back in 2018, even the New York Times called Musk hitting his pay plan goals "laughably impossible".

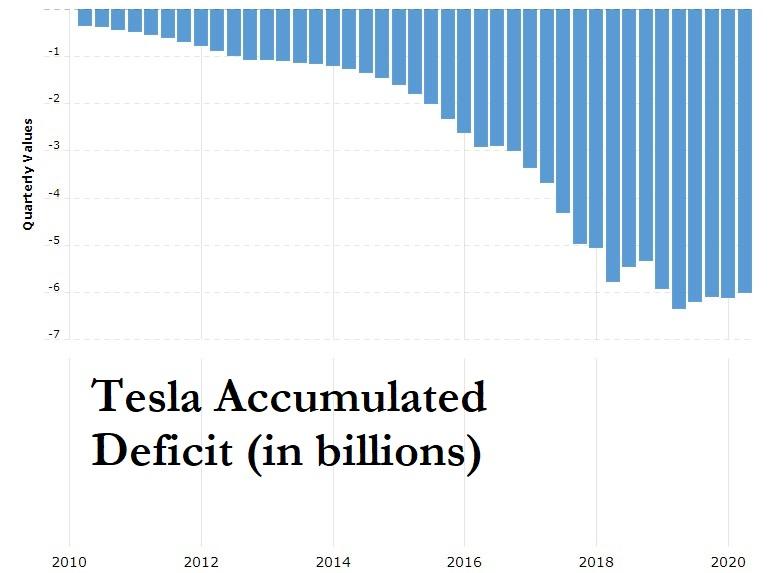

But instead, Musk did it. And he did it in less than three years. For a stunning comparison, while Musk was working his way to $11.8 billion in compensation, Tesla was was working on a $5.6 billion accumulated deficit, as per the company's last 10-Q.