Global Intel Hub -- Zero Hedge Exclusive -- Charlotte, NC 10/16/2020

Groundbreaking analysis of property destruction has been released by highly credible whistleblower and global macro investment analyst Catherine Austin Fitts. In a draft release on the Solari Report, they detail beyond coincidence correlations between Fed districts and destructive riots:

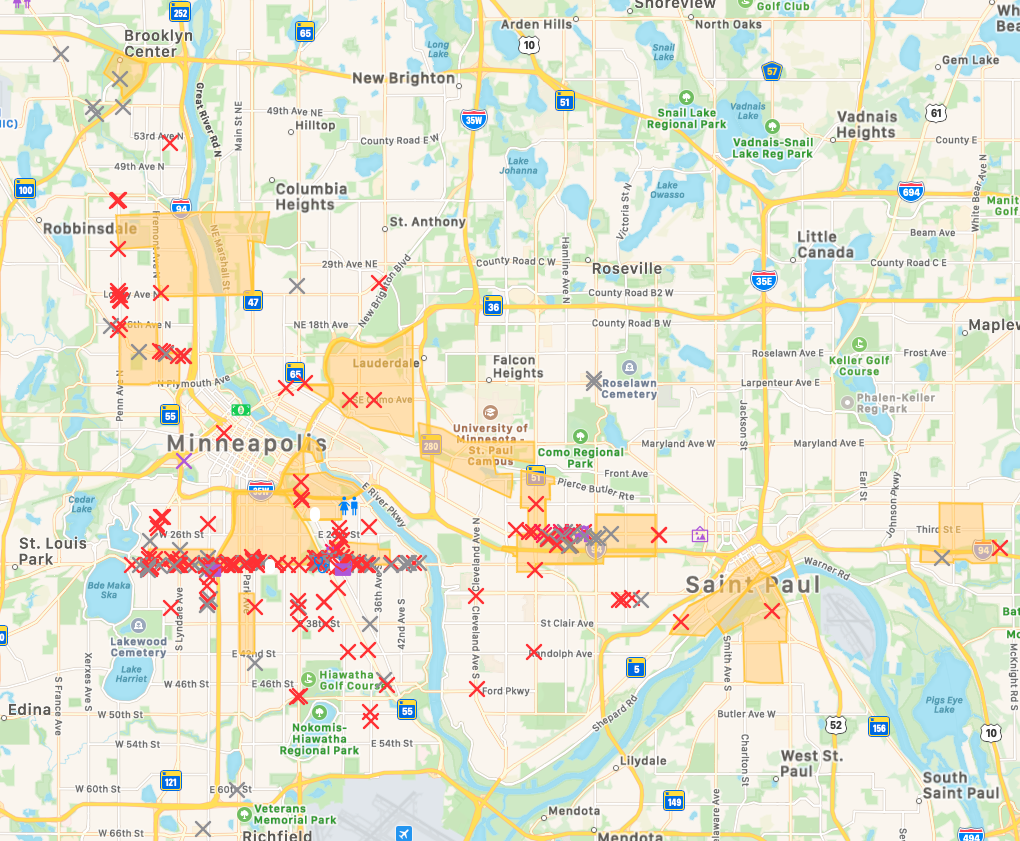

We used an Internet-available list of Minneapolis / St. Paul Metro Area riot damage and mapped the data via a Mac app called “Ahoy Maps.”

Map Key:

- Red X’s represent local / regional chain stores.

- Grey X’s represent national / international stores.

- Purple icons represent damaged schools, libraries, post offices, local food coops, community health clinics, etc.

- The Green dollar icon is the Federal Reserve Branch of Minneapolis (north-northwest of most damage).

- The Blue PD icon is the MNPD 3rd Precinct, which was destroyed by fire.

- Yellow polygon areas are the intersections of MN Opportunity Zones and riot damage. Note: There are several other Opportunity Zones that had no riot damage. See link below to view all Opportunity Zones in Minneapolis.

Total Devastation Area:

If you currently live in Minneapolis / St. Paul and you’d like to share riot-related information, please do so. I lived in Minneapolis for about a year during the 1st Tech Sector Bubble, so I’m familiar with the area. The majority of the riot damage appears to have been along the Lake Avenue Opportunity Zone corridor, where many a small minority business was laid to waste. The next cluster of damage appears to have been along the St. Paul University St. Opportunity Zone corridor. The damage here raises numerous questions. Note the apparent symmetry of the damage in some areas.

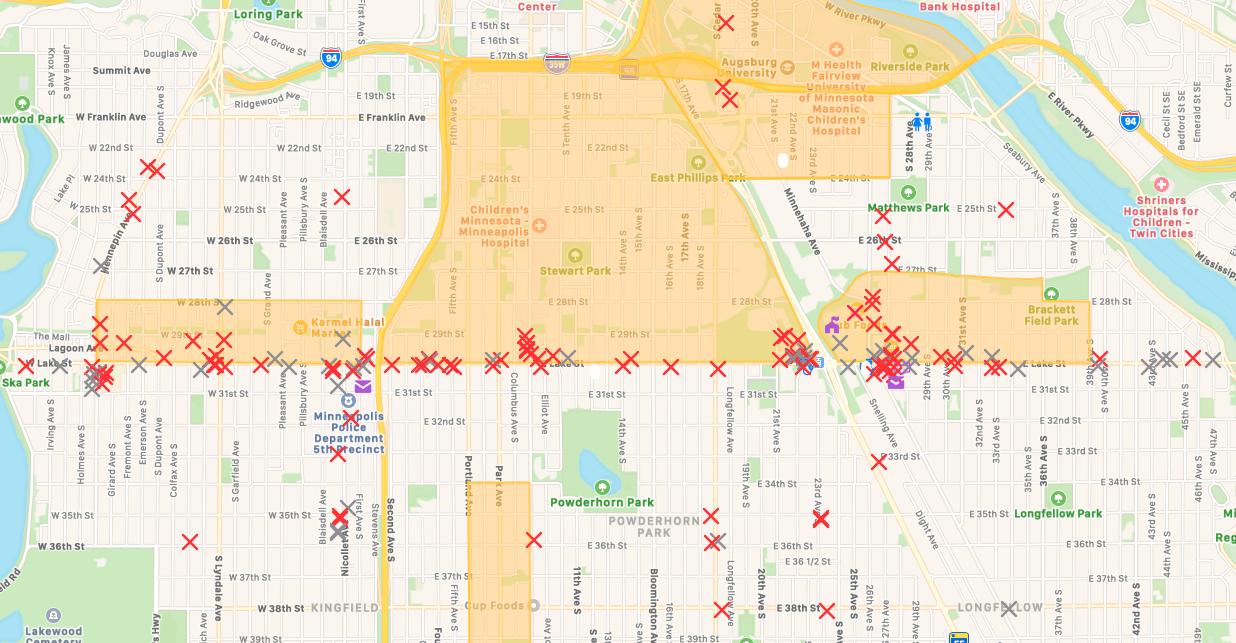

Lake St. Damage – A Closer Look:

Lake St. is one of the older parts of town. An associate who is a MN native said that the houses here are roughly from the 1920s. Note the Red X’s: The majority of the damaged shops and businesses were definitely minority / small business / family operations that serviced a very multicultural part of town.

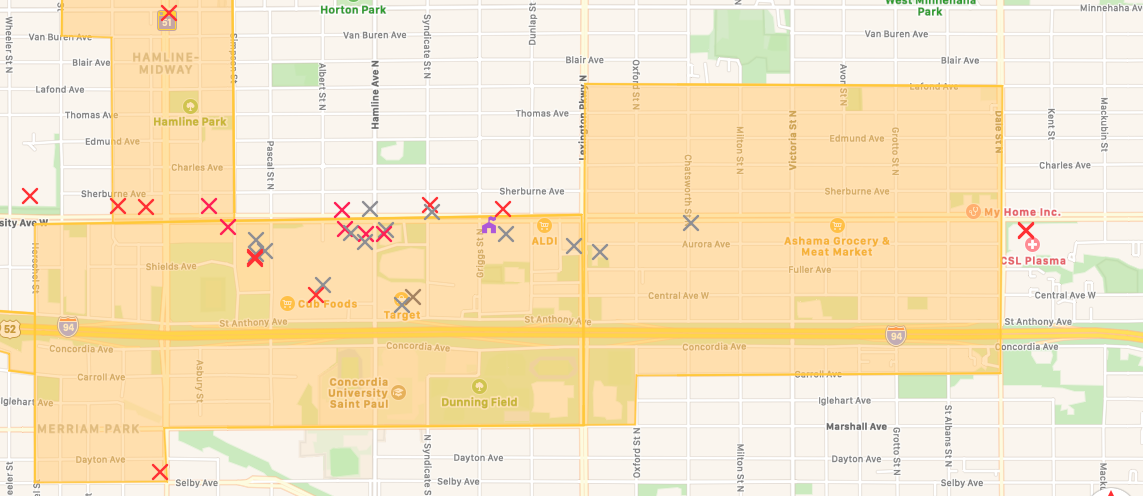

University Street, St. Paul – A Closer Look:

The St. Paul University St. Opportunity Zone had more national chains and fewer minority-owned businesses. However, the majority were still in the small local business category.

For those of you who don't know what an opportunity zone is, here's an explanation from the IRS:

Opportunity Zones are an economic development tool that allows people to invest in distressed areas in the United States. Their purpose is to spur economic growth and job creation in low-income communities while providing tax benefits to investors. Opportunity Zones were created under the Tax Cuts and Jobs Act of 2017 (Public Law No. 115-97(link is external)). Thousands of low-income communities in all 50 states, the District of Columbia and five U.S. territories are designated as Qualified Opportunity Zones.

Taxpayers can invest in these zones through Qualified Opportunity Funds.

You can support economic development in Qualified Opportunity Zones and temporarily defer tax on eligible gains when you invest in a Qualified Opportunity Fund.

Whoever is organizing this destruction, just think about this fact. Investors are going to buy properties burned, blown up, and abandoned by small businesses that failed. On top of the huge discount to value they are going to get - they are going to get special tax breaks! Finally, riots are violent in 34 out of 37 Fed cities (cities where the Federal Reserve has offices). Here is the Fed asset chart for the last 10 years:

As ZH readers well know, it's not the people that gets this QE, it's the big banks and funds. They are no doubt beating the war drums to deploy this fresh QE at bargain prices. Of course, this is also an opportunity to bury power lines, built IoT 'smart' cities with sensors everywhere, all in parallel with a global digital dollar rollout. It's a global technological upgrade. And COVID provides the perfect catalyst. Microsoft downloaded software to your computer in the 90s. In the next 20 years, Microsoft software will be downloaded to your body via Bill & Melinda gates sponsored vaccines with nano technology inside, i.e. Darpa made 'hydragel' and chip implants.

And that's not all that's happening in the real estate market. Nearby communities are seeing depressed prices, just look at this example of a Brentwood townhouse with a recent price cut.

Everyone has seen evidence in some form that these 'protests' which are actually riots have been planned with military precision. Whether it's the training programs, the pallets of Lowes bricks being placed right near hot zones, and literally videos on social media circulating of masked agit props literally handing out $100 bills to young people and telling them to 'break that window'. But it's hard for most Americans to accept that there are rich Democrats out there so crazy that they would do something like burn down their own country - what's the real motive? What everyone is missing is this data we have exposed here on Zero Hedge which might be the biggest fixed auction right out of a gangster movie. It's not about politics at all - it's about money. Politics is the distraction - just as it always has been. To be critical of Trump for a moment, he hasn't stopped this shadow power from rolling out it's global order agenda. On the surface, we see what we see. But if we dig deeper, we see all the signs. The "Coronavirus" (Which means Crown) is really about BLM - Bankers Lives Matter. You see dear reader, populism is sweeping the Globe, and it didn't start in USA in 2016. In the UK, the people supported Brexit, which is good for people and bad for the global elite. The same political landscape is playing out in USA and this is their response. It's about buying up burned down communities at fire sale prices (pun intended) and rebuilding 'smart cities' with IoT (Internet of Things). Meanwhile, if they can bankrupt tons of small businesses that would otherwise compete with Big Tech, that's a huge bonus. Anyway, local bookstores have been struggling to stay in business and have even called this the "Amazon effect". From a Federal / Global perspective, small business poses an existential risk to a single global currency and economic system. So this can literally kill multiple birds with a single stone, and groups like Blackstone will make a pile of money buying up entire blocks of NYC, LA, Chicago, and other downtowns at firesale prices and get huge tax breaks!

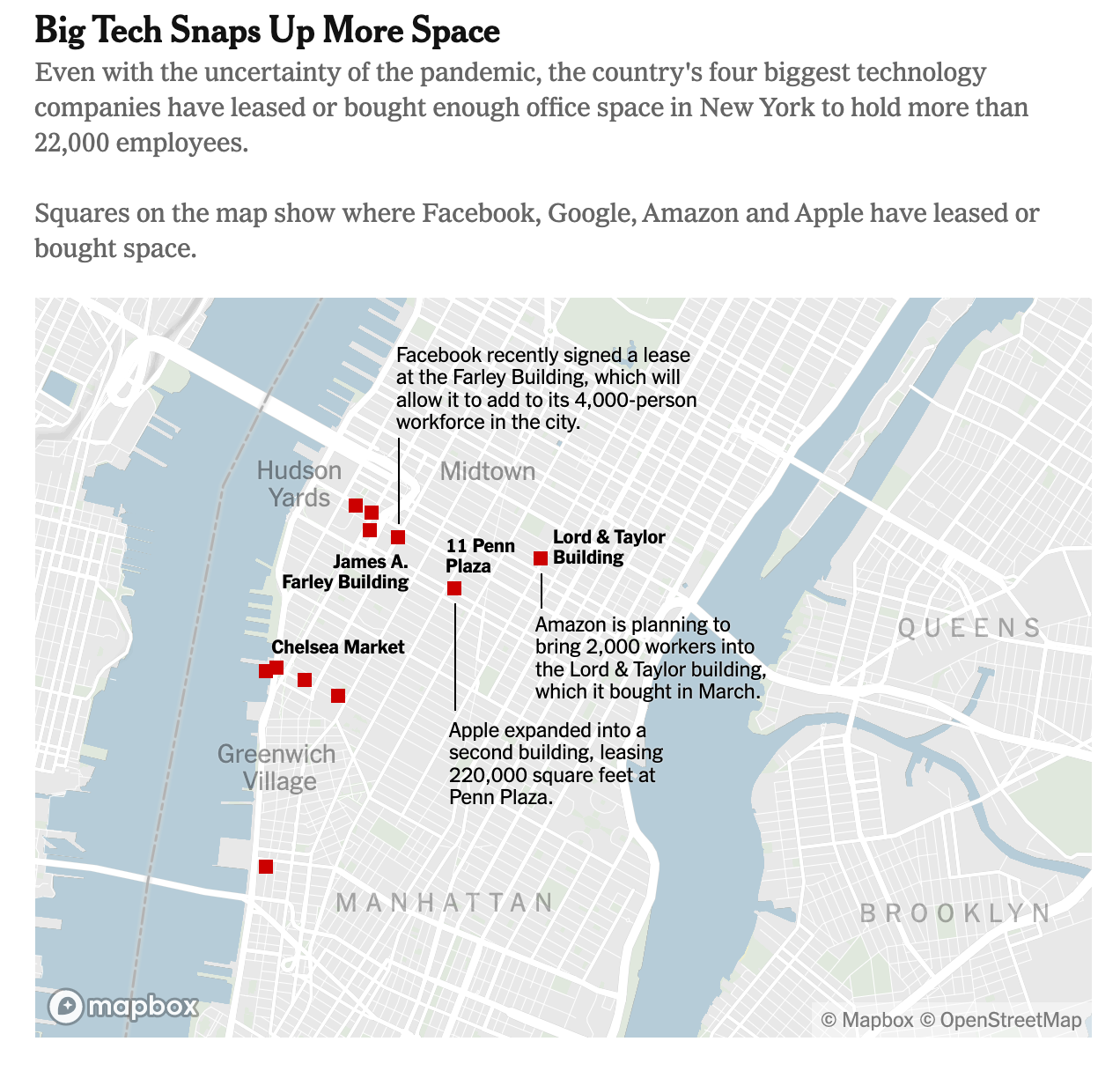

For example, see how the digital mafia is already foaming at the mouth:

As Manhattan Commercial Real Estate Slumps, Big Tech Sees Golden Opportunity

Big tech is making a risky bet on NYC commercial estate amid the virus-induced downturn that has crushed the city's local economy. Many offices across Manhattan are deserted and likely not to return workers until sometime in 2021. Commercial real estate firm CBRE, who manages roughly 20 million square feet in the city, said approximately 12% of office workers in Manhattan had returned back to work.

As some say, "strike while the iron is hot" - and that is precisely what big tech companies are doing - they're acquiring some of the highest quality office spaces on the market for a fraction of the price. As we noted in August, top property owners in the city are begging companies to return their employees to work because remote working has stalled the recovery.

NYT points out, while NYC commercial real estate sours, "Apple, Amazon, and Facebook have gobbled up more than 1.6 million square feet of office space since the start of the year, most of which was leased or bought during the pandemic. Before the pandemic, Google added about 1.7 million square feet of office space as part of a corporate campus rising along the Hudson River in Manhattan."

This is how Monopoly traditionally works. If you have a competitor, burn down their factories. Mom and pop businesses are going bankrupt, but big companies are able to scale and fill the gaps where local shops are closed and/or bankrupt. They're even profiting from the situation, and can adapt easily. It's a power grab, a real estate grab, and more. For a detailed breakdown of how the financial system operates, you may want to watch this interview.