The Jamaican stock exchange, unknown to most of the world and which is open for trading only three and a half hours a day, was 2018's best performing stock market.

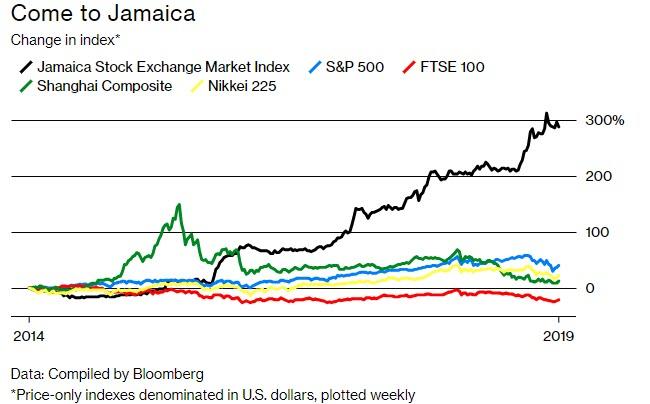

The exchange - which started 50 years ago, by Edward Seaga, a Jamaican Harvard graduate who worked as a record producer in the 1950s and 1960s - saw its main index up 29% during 2018, the most among 94 national benchmarks according to Bloomberg . Over the last five years, Jamaica's impressive market returns are even more pronounced: Jamaican stocks are up almost 300%, more than quadrupling the next national benchmark and outperforming the S&P 500 nearly seven times.

The blistering ascent of the local stock market took place despite real growth in Jamaica averaging less than 1% over the last four years; in 2018, growth in Jamaica was expected to come in at 1.7%. However, the small size of the local market has kept it relatively insulated from the broader economy, and helped Jamaican equities move as quickly as they have. As a result, the total value of the 37 stocks on the main index is less than $11 billion.

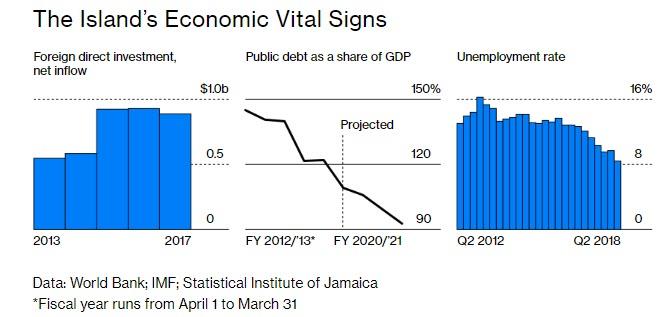

And now, capital is starting to trickle into Kingston as it tries to reinvent itself as a financial hub. Paul Simpson, a 36-year-old banker and investor in Kingston told Bloomberg: “Clearly, capital goes where it’s comfortable. To see capital coming here means people must be comfortable." That, or they are simply hoping to recreate past returns.

The financial industry in the country is located mostly in the neighborhood of New Kingston. It isn’t a tourist destination like Negril and it isn't impoverished, like Trench Town. Instead, it’s an area where you’ll find Porsche dealerships and Starbucks.

Similar to China, over the past decade, the country's financial sector assets have tripled and its number of financial institutions have multiplied by a factor of eight.

It gets better: the World Bank now ranks Jamaica as the sixth best nation for ease of starting a business. Economist Uma Ramakrishnan, the IMF’s Jamaica mission chief said that "If I could hold a megaphone and tell investors now’s the time, I’d do it."

Still, before US hedge funds start arriving with dreams of massive alpha, the limitations of local stocks are pronounced, especially when one considers the small size of the market. Additionally, the shares available to the public are limited as many of the companies are mostly owned by large institutions and conglomerates. Like with Japanese government bonds, it is commonplace for some stocks not to trade for days and the number of unchanged stocks on a daily basis often outnumbers both gainers and losers.

In other words, in a world desperate for liquidity, Jamaica may not be your best bet.

Which is also why the managing director of the exchange, Marlene Street Forrest, is working on improving its logistics. Trades now settle in two days instead of three to comply with international standards and the exchange is looking to introduce market making this year. Margin accounts and short selling are both also on the agenda for the coming year - yes, there is no way to short stocks right now, and in a throwback to more normal times there are no HFTs or ETFs (there are no Jamaican stocks in U.S. ETFs, even those tracking “frontier” countries such as Kazakhstan, Sri Lanka, and Vietnam, the most emerging of the emerging markets).

Still, the market is growing: there are 20 new IPOs scheduled for this year, and while the exchange evolving, as things often go in the islands, it's doing it at its own pace.

“We ensure that we are going to get it right before we move,” Street Forrest said.