A massive pullback in international buyers purchasing US real estate has been seen in the last several years, resulting in the softening of housing markets across South Florida, reported The Palm Beach Post.

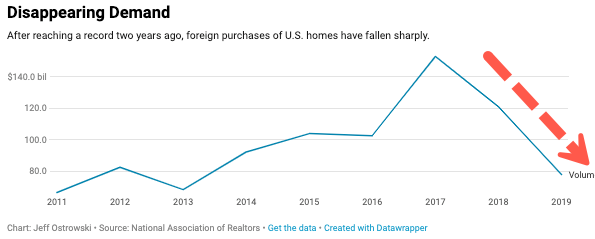

Foreign buyers purchased a $153 billion in US homes from April 2016 to March 2017, total sales of homes to international buyers dropped to $121 billion for the year ending in March 2018, then plunged to $77.9 billion for the year ending on March 2019, the National Association of Realtors (NAR) said in its latest report.

Florida transactions involving foreign buyers fell to 36,000 in the year ending in March 2019, down from 50,000 the previous year, and 60,000 in the year ending March 2017.

"The magnitude of the decline is quite striking, implying less confidence in owning a property in the US," NAR Chief Economist Lawrence Yun said in a statement.

South Florida is a top destination for foreign buyers, accounting for 20% of the 183,100 international transactions nationwide over the past year.

Capital flight from Latin America over the past decade has driven at least a quarter of Florida's real estate market, but new trends today suggest foreigners are abandoning US markets with home prices in bubble territory.

"It takes a lot more pounds to buy an American property than it did a few years ago," said John Mike, an agent at RE/MAX Prestige Realty in Royal Palm Beach.

Mike said a stronger dollar that stated to rise in 2014 had deterred many buyers from Britain and Europe who are now increasingly buying vacation homes in Spain and the Bahamas rather than Florida.

Mike said President Trump's crackdown on immigration and a dangerous trade war with China had hampered demand. He added that international buyers "don't feel welcome" in America anymore because of President Trump's policies - so they are going elsewhere.

The exodus of foreign buyers and crashing sales explains why homes in South Florida are experiencing the most significant percentage of price cuts in some time, that has led to properties staying on the market for longer, and has tipped the overall market to buyers. All of this suggests that a top could be near.