Traders Beware: The Crypto Tax Compliance Crackdown Has Arrived

US cryptocurrency traders, investors, and other market participants may think that assets like Bitcoin and Ethereum are so anonymous as to be untaxable, and some are about to get a painful lesson on how the technology really works. There is no identifying information in transaction or token data inscribed onto the ledger, sure, but you’re only truly anonymous if you’ve mined your cryptocurrency, bought it with cash, and transacted through dApps exclusively. This describes only the smallest fraction of crypto enthusiasts.

For the rest of us who have (for good reason) traded on larger and more centralized exchanges which also allow fiat depositing, it’s a sobering reminder that these friendlier platforms only exist because financial watchdogs allow them to. One condition of this tentative approval is that your crypto wallet must be associated with your real identity, due to KYC (Know Your Customer) and AML (Anti-Money Laundering) laws. For many traders, centralized exchanges reside at the root level of their crypto portfolio, and now that this nut has been cracked global tax authorities are completely plugged into the sector.

This is why so many in the US—over 10,000 in fact—are recent recipients of a letter from the IRSwhich says in so many words, “We see you, now pay up.”. Fresh on the heels of the recent G20 summit, where major global markets all agreed to follow the same set of FATF (Financial Action Task Force) rules, the IRS is now beginning a campaign to clamp down on US residents who have transferred or transacted cryptocurrency in virtually any way, shape, or form.

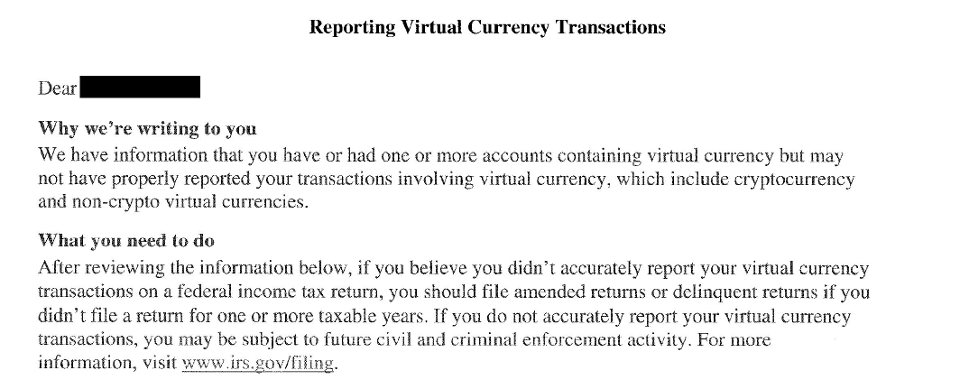

An Early Look at the IRS Letter

Those who already received the letter are familiar with its contents, but for those who will soon find it in their mail as the IRS digs its heels in, it’s good to get a preview of Letter 6174 and Letter 6173—both entitled Reporting Virtual Currency Transactions. The IRS is a bellwether for the tax climate worldwide on cryptocurrency, and to see it act so quickly, out of reporting season and with such a broad scope is a clear warning sign; market participants worldwide need to start considering the tax impact of their trades and transactions. While this standard will help pave the way for further integration with fiat money markets, the IRS’s tax scheme is also fairly comprehensive and requires negligent traders to do a burdensome amount of detective work.

Crypto traders must sort out which exchanges are relevant to the IRS (assume they all are) and the coins they have transacted in or held, classify these transactions and their respective realized gains (or losses) and then report them properly. You’ll have a mere one-month window to get compliant, the result for failure is an external review and fitting punitive action. Recipients of the more serious 6173 letter need to get in touch with an IRS agent within one day. Even for those who didn’t receive the letter and have a relatively short history dabbling in DeFi, the legwork required to prepare for the coming crackdown is daunting.

Prepare for Your Impending Token Taxes

If you have not accounted for cryptocurrency in your taxes, then the time to do so was yesterday. You may not have been in the first round of letters, but regardless if you’re included in the second or third rounds, collecting the requisite data now will save an enormous headache. The IRS is acting retroactively, so this recent event applies to everyone including those who have reported already. These traders should ensure that they’ve covered the full range of years required and have included transactions that might not have been considered taxable at the time. Many had previously only reported when they had bought into or out of fiat, and this is indeed relevant, as are transactions of crypto to purchase goods (real or digital), other crypto assets, and even stablecoins like USDC or Tether.

Basically, if any amount of Bitcoin, for example, is at any point anything other than Bitcoin then the IRS wants to know. These transactions are classified into Schedules and are quite intricate, covering ideas such as contractor payments in crypto, tax losses, assets sold for cryptocurrency, transfers between wallets and a dizzying array of other ideas. Accordingly, getting it right requires immense legwork, either done by yourself or by an accountant who you’ve paid big bucks to decipher countless exported exchange spreadsheets.

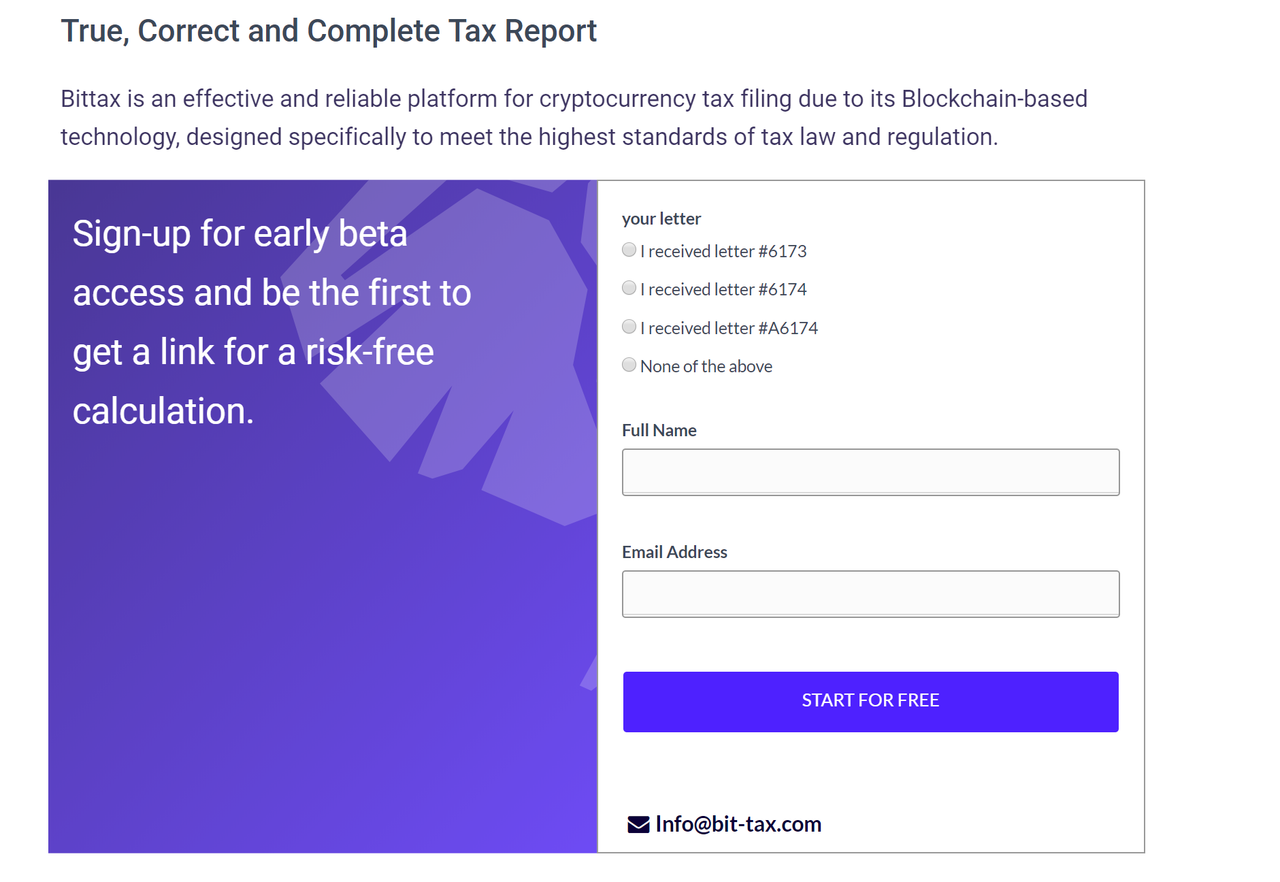

Better is to use of a service such as Bittax, which shoulders the full burden of tax compliance and reporting for cryptocurrency traders and investors across all their accounts. Bittax’s software uses blockchain to trace a user’s entire history of currency activity from day one, and it provides alerts on incomplete information for retrieval plus addresses that may have been forgotten. In what is essentially a turnkey tax solution for crypto, Bittax runs the full gamut of IRS-related activities including wallets, arenas, ICOs, and even goes so far as to issue one comprehensive report on the relevant years of activity, charged for each year separately.

A solution like Bittax is currently one of the most purposeful use cases for blockchain, as its utility provides tangible valuable, either in time saved or in the penalty of noncompliance. With ledger-based transparency that’s able to prove each trader has reported and signed the required affidavits, Bittax also gives crypto traders the ability to be confident in their compliance and focus on the market.

Your Stake is at Stake

The widespread and enthusiastic campaign by the IRS leaves little excuse even for traders who believe they’re in good standing to neglect a checkup. Though it begins in the US, to understand how much global volume goes through centralized exchanges in G20 countries is also to realize how many millions of people need to get compliant before their own personal crackdown occurs. This may be an opportune time to lock in some holdings for network staking or a long-term investment, or for at least a year to avoid the higher capital gains tax bracket.

Overall the letter signals to investors that the IRS has finally created a template for crypto to exist in tandem with traditional finance, at least where taxes are concerned. This is typical of government, to first determine how a new idea should be taxed before it should be supported or even defined, but at least it’s a step in the right direction.

This post sponsored by Discount Currency Transfers