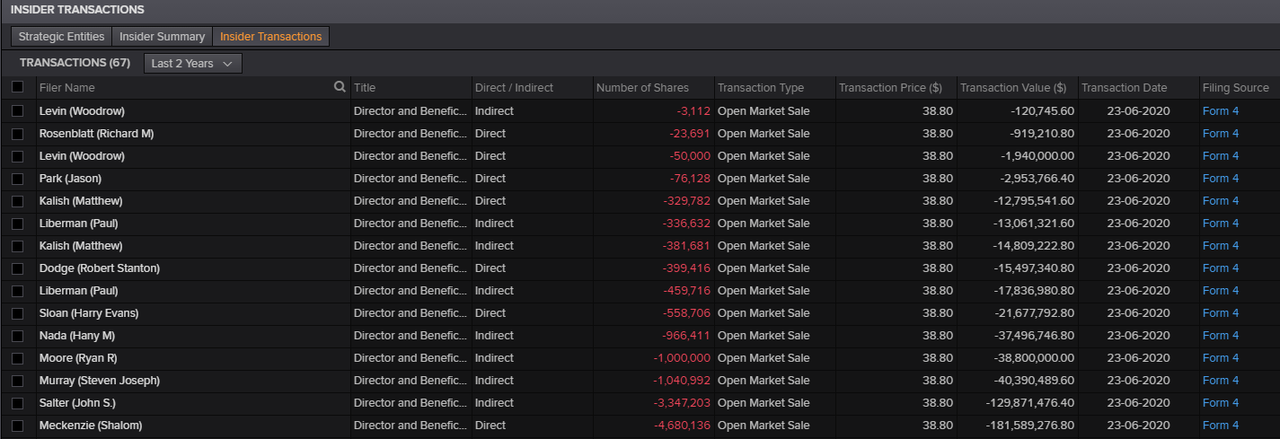

DraftKings Inc. filed several Form 4s with the Securities and Exchange Commission this week regarding insider selling by the president of the company, Paul Liberman, and others.

Insider Transactions

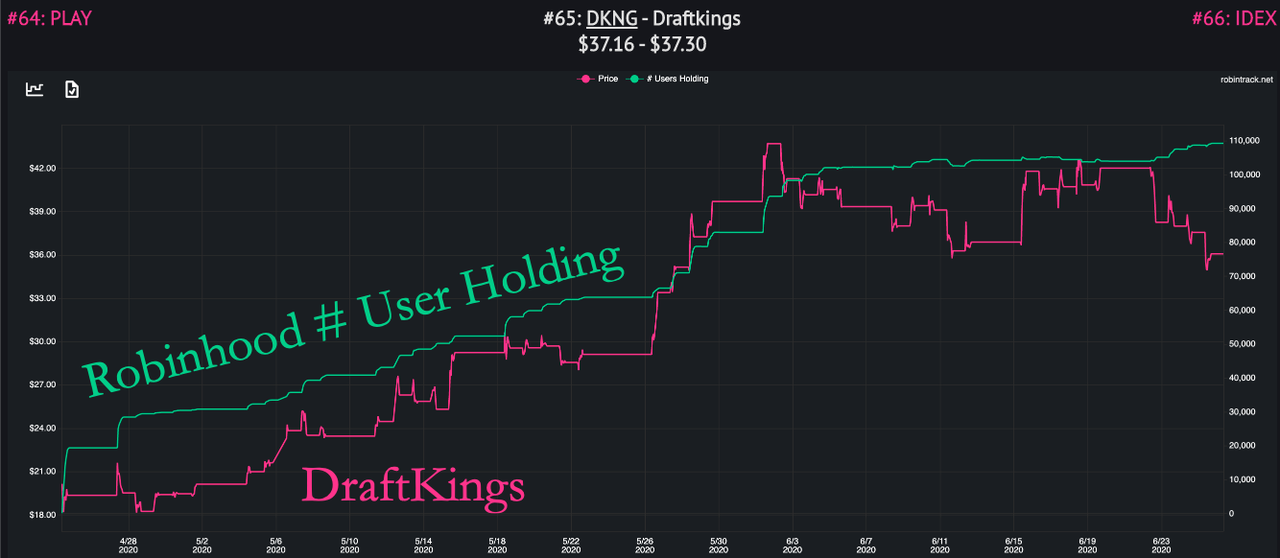

It turns out, as more than 100,000 Robinhood daytraders panic bought DraftKings since its Nasdaq debut in April, soaring 237% in months - Liberman and other insiders dumped a whopping $596 million worth of shares.

Robinhood Track

On the pump, Liberman sold $31 million worth of stock, with about $15 million left. CEO Jason Robin sold $70 million worth of stock, while director Hany Nada liquidated $37 million.

Clearly, by now, readers should understand the parabolic rise in DraftKings' shares was nothing more than a spectacular pump - as what comes next is likely the dump.

But wait, there are more insiders dumping stock: Director Steven Joseph Murray sold $40 million worth of shares, while directors Shalom Meckenzie and John Salter sold collectively around $125 million.

Howard Lindzon, the co-founder of StockTwits, recently noted the meteoric rise in DraftKings share price happened at a time when most sporting events were canceled because of the virus pandemic:

"The chart of the day is Draft Kings, which has quadrupled to $12 billion now since it reverses merged into a shell and then changed ticker to $DKNG...unbelievable outcome considering the long regulated road and the fact that NO SPORTS !? Face with tears of joy."

What goes up must come down: Robinhood traders will soon learn a painful lesson on gravity.