The Swiss population owns 920 tonnes in private gold, next to 1,040 tonnes in official gold reserves. In total, Switzerland likely has the highest amount of gold per capita in the world. This article is part of a series in which we examine how much private gold is located in major economies—information that can be decisive for a monetary reset.

In my previous article, “Europe Has Been Preparing a Global Gold Standard Since the 1970s,” we saw that the world is possibly heading towards a new international monetary system that incorporates gold. In the article I exposed that European central banks have sold monetary gold from the 1990s until 2008 to equalize reserves internationally. The same central banks are currently promoting gold as “the ultimate store of value,” protection against “high inflation” and the possibility “the system collapses.” In case we will return to an international gold standard the distribution of gold is essential, which is why I study the whereabouts of all above ground reserves.

I showed that since 1971 official and private gold reserves have been distributed more evenly across the world on a relative basis. In today’s article the spotlight is on Switzerland.

Swiss Save in Gold as Long-Term Investment

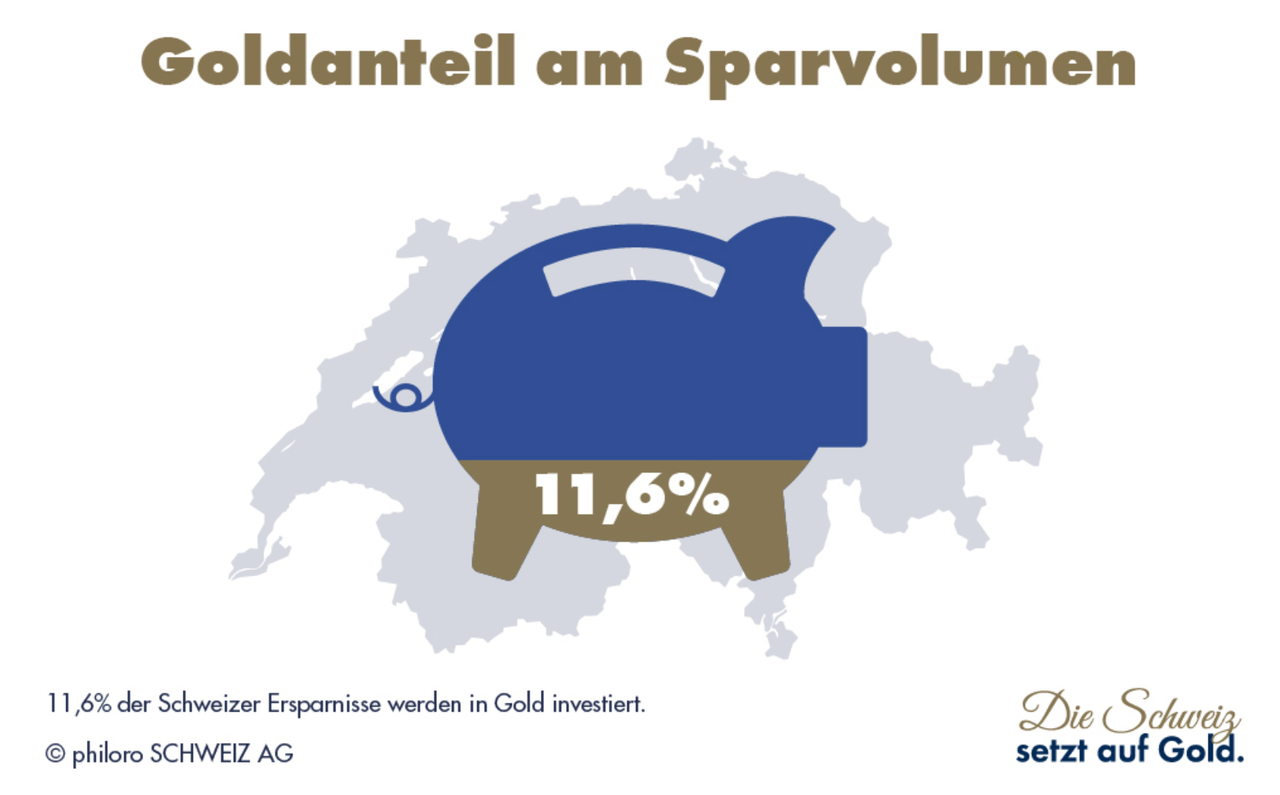

My estimate for private gold ownership in Switzerland is based on a study performed by the Research Center for Trade Management at the University of St. Gallen on behalf of precious metals dealer philoro SCHWEIZ AG in March 2020. The study was done through a survey among 2,286 people from the German, French and Italian-speaking parts of Switzerland.

The main motivation for the Swiss to save in physical gold is as a long-term investment (53%), followed by security reasons (39%), and financial stability (34%). The study shows that in 2019 the Swiss invested 1.42 billion CHF in gold, which equals to a gold savings rate of 11.6%

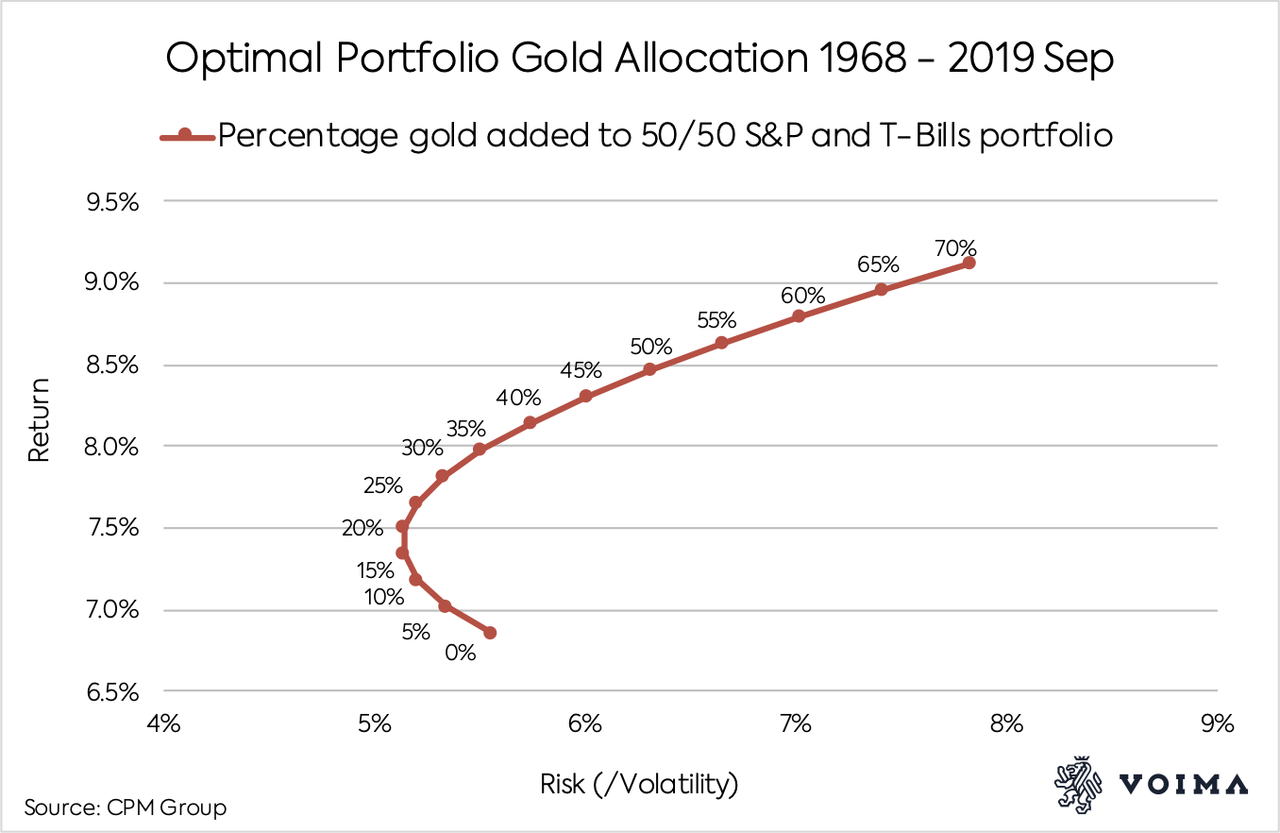

Switzerland's gold savings rate matches what several studies suggest as the best long-term allocation of gold. According to calculations by CPM Group the optimal risk-return balance of an investment portfolio is reached when it includes 20% of gold (next to an equal share of stocks and bonds). But of course timing, risk appetite, and portfolio size can change the optimal allocation.

In total, the Swiss population owns 920 tonnes in private gold. Note, this does not include all the private gold that is stored in Switzerland. Switzerland is known for having the largest precious metals refining capacity in the world, and there are many vaults located in Switzerland that store gold for residents from abroad.

My estimates for private gold ownership in different countries for 2019:

- India 24,500 tonnes.

- China 20,398 tonnes.

- Germany 8,918 tonnes.

- Italy 5,707 tonnes.

- France 4,605 tonnes.

- Switzerland 920 tonnes.

Hopefully more surveys will be conducted so we can get a better view on the distribution of private gold.

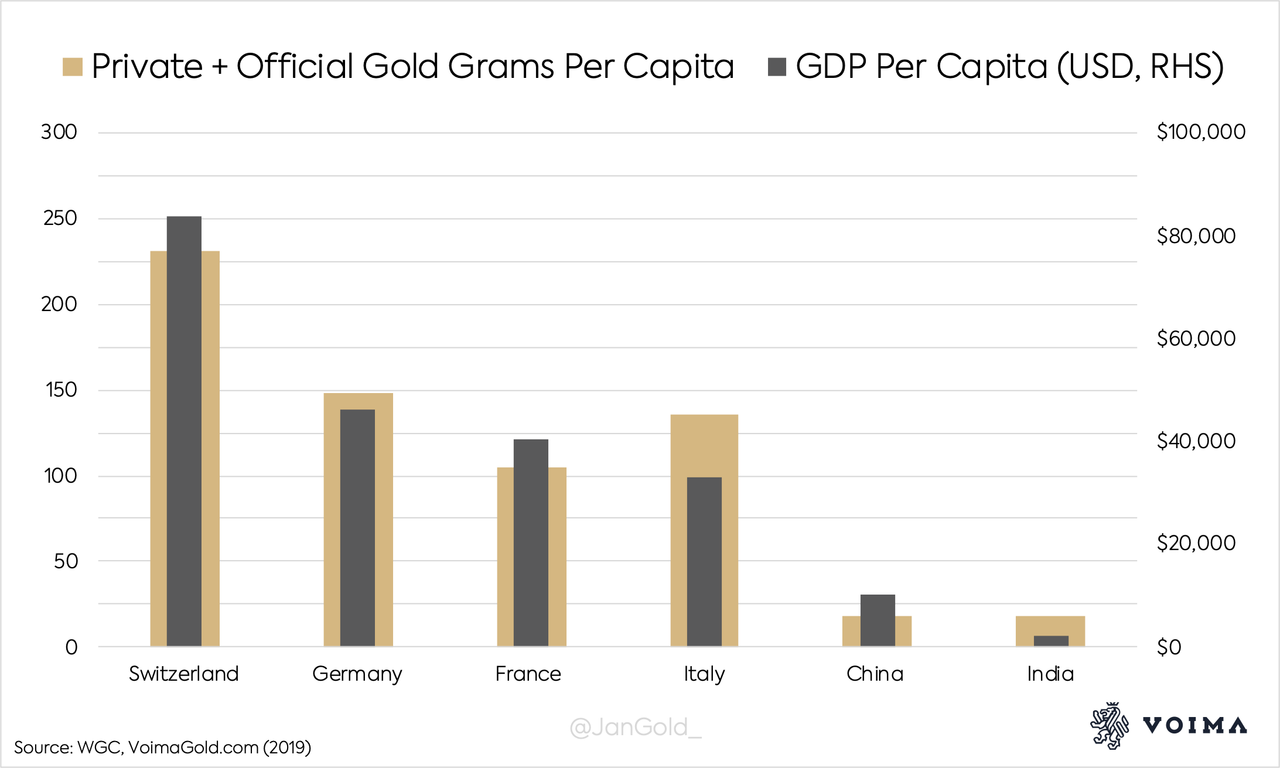

Next to the private gold hoard of 920 tonnes, the central bank in Switzerland holds 1,040 tonnes in official gold reserves. Combined, the Swiss own 1,960 tonnes, which is 231 grams per capita. This is higher than “total gold grams per capita” in India, China, France and even Germany. However, relative to “GDP per capita,” it’s in line with the global mean.

For all the countries I have data of, the amount of gold owned by citizens, directly or via their central bank, approximately equals their economic income (GDP per capita). At a gold price of $10,000 U.S. dollars per troy ounce, that is. We will save the number crunching and economic analysis for a future article.

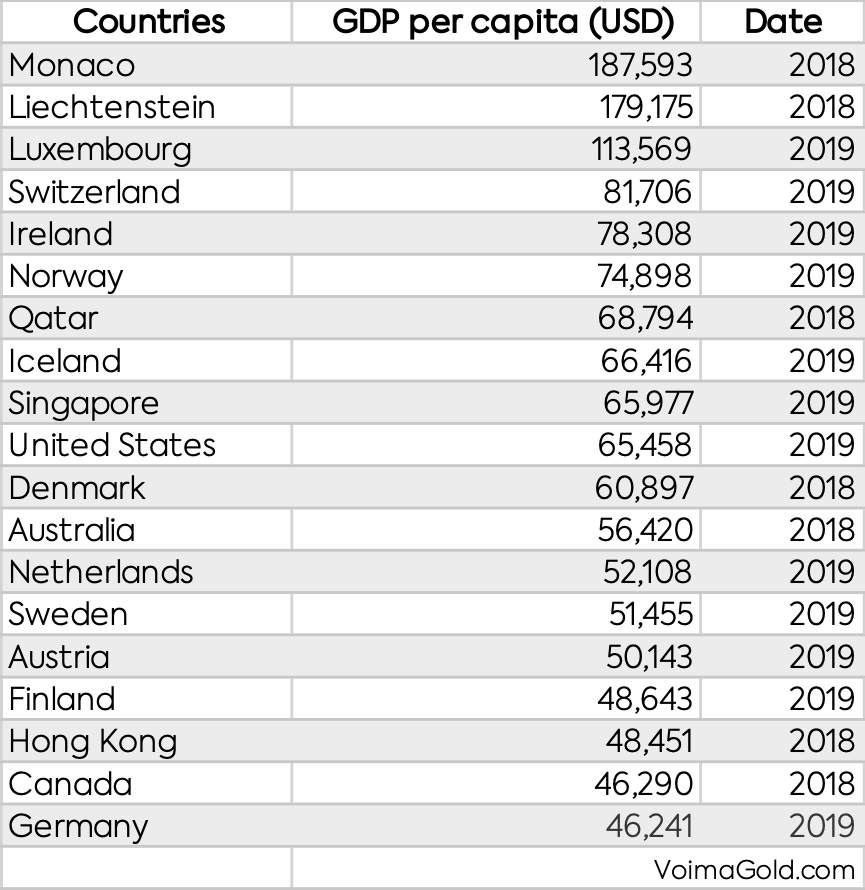

Likely, Switzerland has the highest amount of “total gold grams per capita” in the world. As, there is a correlation between GDP per capita and private gold ownership, and Switzerland ranks very high on the list of GDP per capita.

Only small states with insignificant official gold reserves, like Monaco and Liechtenstein, have a higher GDP per capita. So, it's likely the Swiss have the highest amount of gold per capita.

H/t Mark Valek. All GDP data used in this article is pre-COVID.

Stay up to date, subscribe to Voima Insight—click here. The views expressed on Voima Insight are those of the author(s) and do not necessarily reflect the official views or position of Voima Gold.