In our preview of today's job's report, we remarked that the only thing that was certain about the June payrolls number is just how uncertain it was: dropping the top and bottom 10% of payrolls forecasts still leaves a range of 1.65-5.00 million jobs, "an extremely wide band that reflects the multiplicity of shocks hitting US labor markets", according to Steven Englander. Art Cashin echoed just how much confusion there was by noting that "most traders are somewhat sceptical of all payroll data, feeling that the sharp reopenings and then reopening rollbacks have distorted the data."

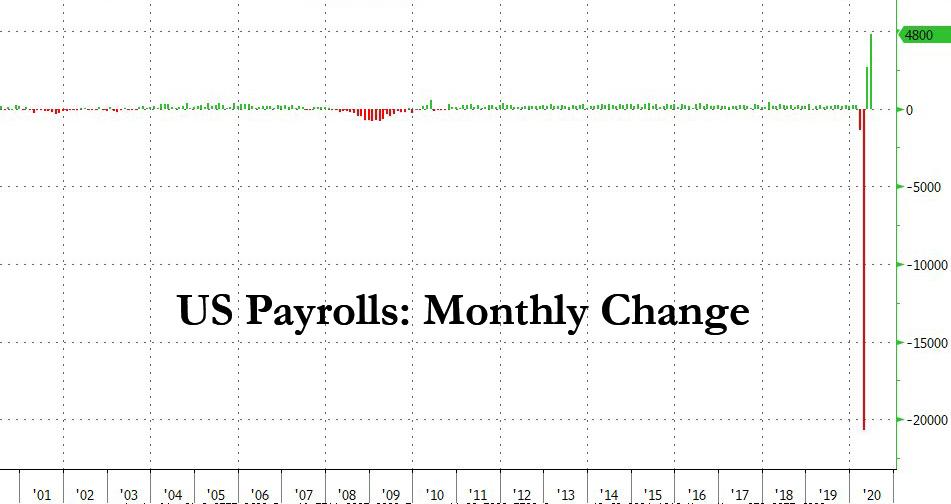

So with much confusion out there, and nobody really sure what to expect, moments ago the BLS reported that in keeping with the huge band of possibilities, in June the US economy added a whopping - record - 4.767 million jobs, crushing expectations of 3.058 million, and indicating that the V-shaped recovery, if only in the BLS' servers, is well on track.

Somewhat paradoxically, the massive beat took place even as we got another week of initial claims missing, with the latest print of 1.427MM above the 1.35MM expected, while continuing claims of 19.29MM was also above the 19.0MM expected.

The change in total nonfarm payroll employment for April was revised down by 100,000, from -20.7 million to -20.8 million, and the change for May was revised up by 190,000, from +2.5 million to +2.7 million. With these revisions, employment in April and May combined was 90,000 higher than previously reported.

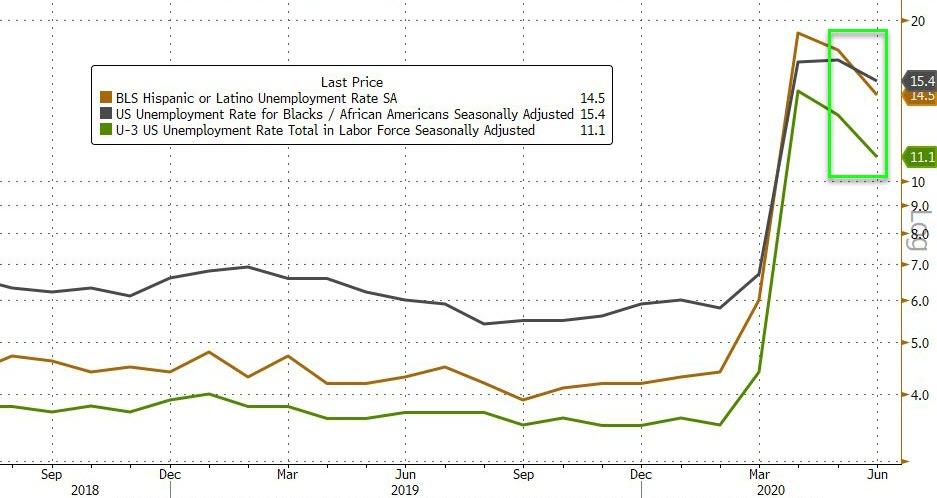

Just as shocking is that the unemployment rate which was expected to surge to a record 19.1% in May from 14.7% in April, actually declined in May to 13.3% and dropped further to 11.1% in June, far better than the 12.5% expected. Both Hispanic and Black unemployment rates dropped.

Commenting on the number, the BLS said that "total nonfarm payroll employment rose by 4.8 million in June, and the unemployment rate declined to 11.1 percent. These improvements in the labor market reflected the continued resumption of economic activity that had been curtailed in March and April due to the coronavirus (COVID-19) pandemic and efforts to contain it. In June, employment in leisure and hospitality rose sharply. Notable job gains also occurred in retail trade, education and health services, other services, manufacturing, and professional and business services."

Total employment, as measured by the household survey, rose by 4.9 million to 142.2 million in June. The employment-population ratio, at 54.6 percent, rose by 1.8 percentage points over the month but is 6.5 percentage points lower than in February. The labor force participation rate increased by 0.7% in June to 61.5%, but is 1.9% points below its February level.

The number of persons employed part time for economic reasons declined by 1.6 million to 9.1 million in June but is still more than double its February level. These individuals, who would have preferred full-time employment, were working part time because their hours had been reduced or they were unable to find full-time jobs. This group includes persons who usually work full time and persons who usually work part time.

The number of persons not in the labor force who currently want a job, at 8.2 million, declined by 767,000 in June but remained 3.2 million higher than in February. These individuals were not counted as unemployed because they were not actively looking for work during the last 4 weeks or were unavailable to take a job.

Continuing last month's trend, the average hourly earnings dropped from April's revised 8.0% to 6.7% in May and to 5.0% in June, below the expected 5.3% print.

According to the BLS, average hourly earnings for all employees fell by 35 cents to $29.37. Average hourly earnings of private-sector production and nonsupervisory employees decreased by 23 cents to $24.74 in June. The decreases in average hourly earnings largely reflect job gains among lower-paid workers; these changes put downward pressure on the average hourly earnings estimates. So how did average hourly earnings rise? Simple: the average workweek for all employees - i.e., the denominator - decreased even more, or by 0.2 hour to 34.5 hours in June, while the average workweek for production and nonsupervisory employees on private nonfarm payrolls fell by 0.2 hour to 33.9 hours. That said, even the BLS admitted that the recent employment changes, especially in industries with shorter workweeks, "complicate monthly comparisons of the average weekly hours estimates."

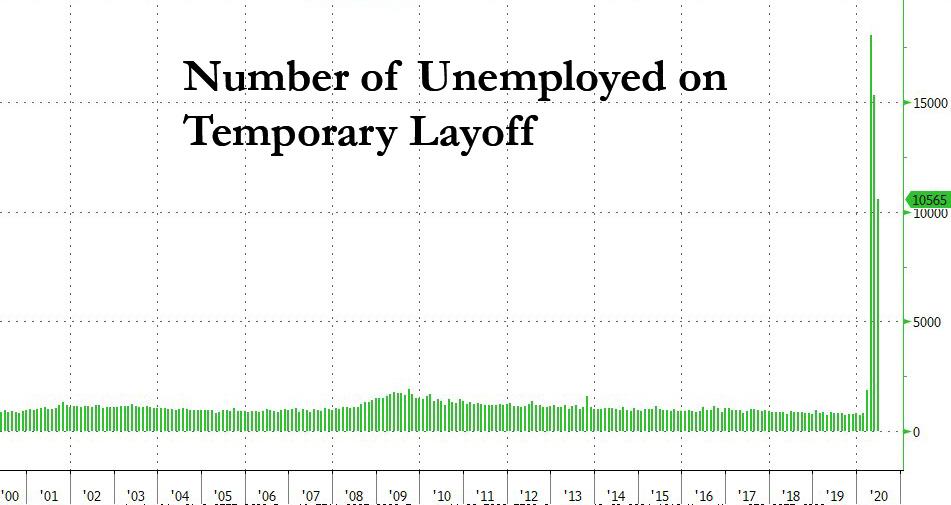

Today's report also noted that the number of unemployed persons who were on temporary layoff decreased by nearly 5 million, to 10.565 million from 15.3 million, a second consecutive decline from 18.1 million in April. Among those not on temporary layoff, the number of permanent job losers continued to rise, increasing by 295,000 in May to 2.3 million.

And one red flag: according to the BLS, the number of permanent job losers continued to rise, increasing by 588,000 to 2.9 million in June. The number of unemployed reentrants to the labor force rose by 711,000 to 2.4 million.

Also in June, the number of unemployed persons who were jobless less than 5 weeks declined by 1.0 million to 2.8 million. Unemployed persons who were jobless 5 to 14 weeks numbered 11.5 million, down by 3.3 million over the month, and accounted for 65.2 percent of the unemployed. By contrast, the number of persons jobless 15 to 26 weeks and the long-term unemployed (those jobless for 27 weeks or more) saw over-the-month increases (+825,000 to 1.9 million and +227,000 to 1.4 million, respectively).

Looking at a breakdown by industry:

- Employment in leisure and hospitality increased by 2.1 million, accounting for about two-fifths of the gain in total nonfarm employment. Over the month, employment in food services and drinking places rose by 1.5 million, following a gain of the same magnitude in May. Despite these gains, employment in food services and drinking places is down by 3.1 million since February. Employment also rose in June in amusements, gambling, and recreation (+353,000) and in the accommodation industry (+239,000).

- Employment in retail trade rose by 740,000, after a gain of 372,000 in May and losses totaling 2.4 million in March and April combined. On net, employment in the industry is 1.3 million lower than in February. In June, notable job gains occurred in clothing and clothing accessories stores (+202,000), general merchandise stores (+108,000), furniture and home furnishings stores (+84,000), and motor vehicle and parts dealers (+84,000).

- Employment increased by 568,000 in education and health services in June but is 1.8 million below February's level. Health care employment increased by 358,000 over the month, with gains in offices of dentists (+190,000), offices of physicians (+80,000), and offices of other health practitioners (+48,000). Elsewhere in health care, job losses continued in nursing care facilities (-18,000). Employment increased in the social assistance industry (+117,000), reflecting gains in child day care services (+80,000) and in individual and family services (+28,000). Employment in private education rose by 93,000 over the month.

- Employment increased in the other services industry in June (+357,000), with about three-fourths of the increase occurring in personal and laundry services (+264,000). Since February, employment in the other services industry is down by 752,000.

- In June, manufacturing employment rose by 356,000 but is down by 757,000 since February. June employment increases were concentrated in the durable goods component, with motor vehicles and parts (+196,000) accounting for over half of the job gain in manufacturing. Employment also increased over the month in miscellaneous durable goods manufacturing (+26,000) and machinery (+18,000). Within the nondurable goods component, the largest job gain occurred in plastics and rubber products (+22,000).

- Professional and business services added 306,000 jobs in June, but employment is 1.8 million below its February level. In June, employment rose in temporary help services (+149,000), services to buildings and dwellings (+53,000), and accounting and bookkeeping services (+18,000). By contrast, employment declined in computer systems design and related services (-20,000).

- Construction employment increased by 158,000 in June, following a gain of 453,000 in May. These gains accounted for more than half of the decline in March and April (-1.1 million combined). Over-the-month gains occurred in specialty trade contractors (+135,000), with growth about equally split between the residential and nonresidential components. Job gains also occurred in construction of buildings (+32,000).

- Transportation and warehousing added 99,000 jobs in June, following declines in the prior 2 months (-588,000 in April and May combined). In June, employment rose in warehousing and storage (+61,000), couriers and messengers (+21,000), truck transportation (+8,000), and support activities for transportation (+7,000).

- Wholesale trade employment rose by 68,000 in June but is down by 317,000 since February. In June, job gains occurred in the durable goods (+39,000) and nondurable goods (+27,000) components.

- Financial activities added 32,000 jobs in June, with over half of the gain in real estate (+18,000). Since February, employment in financial activities is down by 237,000.

- Government employment changed little in June (+33,000), as job gains in local government education (+70,000) were partially offset by job losses in state government (-25,000). Government employment is 1.5 million below its February level.

- Mining continued to lose jobs in June (-10,000), with most of the decline occurring in support activities for mining (-7,000). Mining employment is down by 123,000 since a recent peak in January 2019, although nearly three-fourths of the decline has occurred since February 2020.

* * *

How "political" was today's report? We will leave it to readers to decide especially when moments after the report Trump, who knew the numbers yesterday, praised the "Great Job Numbers" and held a press conference at 930am for a victory lap. That said, it was a modest downgrade from last month's Trump Tweet that "THESE NUMBERS ARE INCREDIBLE."

So does this record jobs report, the second in a row, mean the Fed has to hike soon? Yeah, right.