Alternatively, if Washington is looking for money, then they could start looking where the real greenbacks are going, apart from being thrown out of the helicopter [17] to the people down below at the banks, it should be added with haste.

[18]

Washington: Offshore Profits?

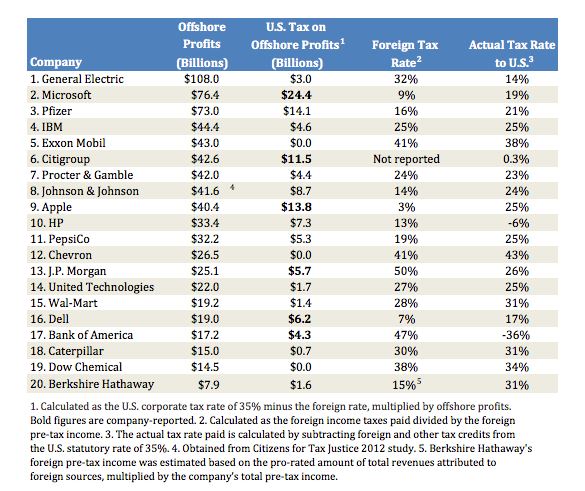

Top 20 US Companies

The real money is in the havens, but none of the lawmakers or the politicians would ever dare mention that word for fear of alienating the few bucks that are left here in the USA.The top 20 US companies listed in Fortune 50 have set aside some $743 billion in profits in accounts located in offshore tax havens [19]. According to Nerdwallet Taxes that would bring in about$119 billion extra for the Treasury if the money were in the US in accounts.

Tax-haven talk only gets little more than a few Twitter comments that fall into oblivion or a televised debate at 3 a.m. in the morning that nobody watches. The companies with the offshore accounts have the politicians tied to them, since they are the ones that will make and break their political careers. Hardly going to bite the hand that feeds you, are you?

The US budget deficit stands at $642 billion. That could be reduced if the guys in Washington had the gumption to stand up and be counted and get the companies to pay taxes here in the US.

- 88% of the companies listed on the Fortune-50 list use tax havens to avoid paying taxes in their home country.

- 68% of offshore profits are generated by the top 10 companies on Fortune 50.

- General Electric for example has $108 billion in foreign earnings.

- Coming back to the US would bring in at least $3 billion in income tax for the US.

- Microsoft earns $76.4 offshore.

- Estimates show that it might pay anything around $24 billion in income tax to the Internal Revenue Service in the USA.

- Pfizer would end up paying $14.1 billion in tax to the IRS on its $73 billion in offshore profits.

- IBM pays $3 billion to foreign governments in taxation.

- It earns $44 billion in offshore profits and would end up paying an estimated $5 billion in the US.

[20]

Fortune 50 Companies Tax Havens

That money is offshore today and not in the USA. It is of no benefit to the country whatsoever being overseas, improving just the financial status of the companies and not the US economy. Certainly, the US budget deficit is far from their worries. But it amounts to 10% of Gross Domestic Product of the USA that is sitting somewhere in offshore profits for companies. That’s more than there should be at a time like this. In economic times of prosperity maybe it’s acceptable to do this sort of thing (but even that’s debatable).

- It’s not just the companies either; it’s private individuals and the world’s rich that have an estimated stash of $21 trillion hidden away in offshore accounts.

- By comparison, this is by far the greatest worry concerning the flight of capital from our home economies towards tax havens.

- That’s the conservative figure, since some estimate that it could be worth up to $32 trillion.

- That’s obviously more than the GDP of the USA and Japan added together.

- It’s only some 10 million people that have that money hidden away too.

- It’s not the shady banks and the wheeler-dealers of the finance world that have that money in their accounts either.

- It’s the bone fide banks of the world.

- The top banks such as Crédit Suisse and Goldman Sachs.