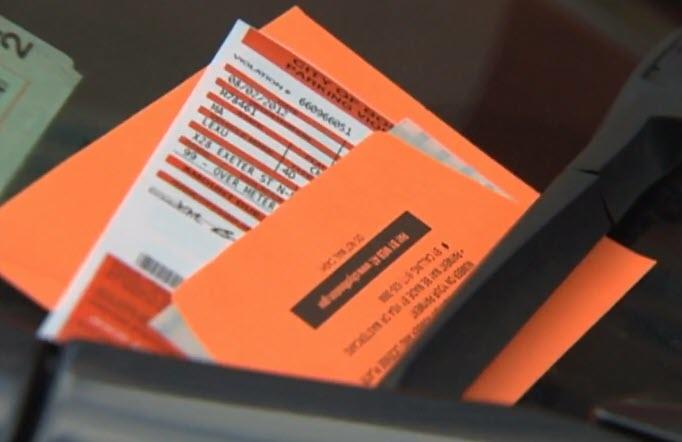

The Boston City Council is considering a new system for parking tickets that would set the amount paid by violators based on their income. The proposal newly elected city councilor at-large Julia Mejia would implement the system of income-adjusted fines — a system that could trigger some novel legal and political questions.

Mejia has declared that she is “introducing legislation on income-adjusting parking tickets so low-income families don’t have to decide between paying a parking ticket or putting food on their table.”

[ZH: Or maybe not breaking the law?]

28 people are talking about this

However, it also means that the wealthier citizens will be charged more for the same offenses. The implications of such a system is fascinating for those of us who have complained (as recently as this week) of cities using parking and traffic tickets as a form of revenue. This proposal would seem to reinforce the concept of tickets as a revenue-generating source. The alternative model is the tradition one. Historically, the amount of tickets was not defended as a revenue source but a reflection of the costs of such violations for the cities. Under that approach, citizens are paid the amount that the city deems as reflective of the misconduct and its costs.

If we treat these tickets as a revenue source (adjusted like taxes for wealth levels), the question is what other areas should also be adjusted. How about environmental fines or housing fines or misdemeanor fines? Tickets are imposed for conduct that could have been avoided in compliance with the law. There are a host of similar fines for such violations.

The legal dimension is rather fluid and uncertain.

Charging wealthier citizens for the same acts can raise equal protection and other concerns. However, wealth is not a suspect classification. Thus, the courts would likely review such a proposal under a rational basis test, which is easily satisfied. Yet, this is a highly novel proposal that could lead to equally novel case law. There is an alternative approach to an income-adjusted fine system, which raises troubling issues. Instead, if Boston wants to protect low-income families, it could leave the fines as uniform and have a special program for deferred payments or even public support for low-income citizens. That would leave the tickets as “priced” at the cost of the offense or violation while allowing for public support of families. That system would also more clearly and directly show the costs of such a system.

One other concern with this approach is that it will only accelerate the trend toward using tickets for revenue. Once uncoupled from the expectation of uniformity or the inherent costs of violations, Boston would be free to redefine tickets as a taxing mechanism. Such predatory measures are already out of hand in our cities like Washington, D.C. and Chicago. The Mejia proposal would reduce the political costs of such alternative tax techniques.

For those reasons, I have serious reservations about the Mejia proposal from both legal and economic perspectives.