TSLA shares are exploding higher once again today as it appears another hedge fund pukes its shorts into this exponential run.

As short interest is eviscerated...

The catalysts for this latest move - according to the narrative machine - are numerous...

Earlier today, Panasonic, which makes batteries for Tesla at its jointly operated battery plant in Nevada, said the business turned profitable in the quarter ended Dec. 31. The rapid increase in Tesla’s output helped push that business into the black, Panasonic Chief Financial Officer Hirokazu Umeda told reporters in Tokyo on Monday, declining to give specific figures.

Another boost came from Argus analyst Bill Selesky, who raised his price target on Tesla to a Street-high of $808 from $556, reflecting revenue growth from the legacy Model S and Model X cars, as well as strong demand for the new Model 3, which accounted for more than 80% of fourth-quarter production.

“Despite past production delays, parts shortages, labor cost overruns, and other difficulties, we expect Tesla to benefit from its dominant position in the electric vehicle industry and to improve performance in 2020 and beyond,” the analyst wrote in a note to clients. Selesky reiterated a buy rating.

Also, over the weekend, ardent Tesla bull Catherine Wood of ARK Investment Management said in an interview with Bloomberg that the stock is still “incredibly undervalued.” According to ARK’s latest note, published on Jan. 31, its 2024 expected value per share for Tesla is $7,000.

It seems TSLA is the new AOL!!

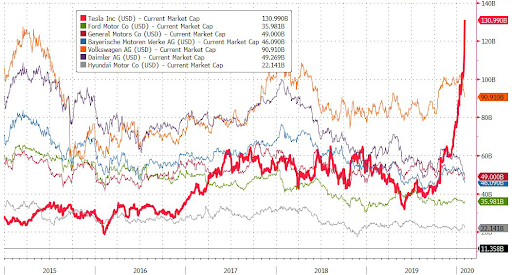

Tesla is now 40% bigger than Volkswagen...(and bigger than Ford, GM and BMW combined).

Source: Bloomberg

VOW made 10.8MM cars in 2019, TSLA expects to make 500,000 cars this year.