We first documented that Citadel was suing British hedge fund GSA Capital in January of this year, after GSA attempted to hire a senior Citadel trader, Vedat Cologlu, allegedly in hopes of accessing the quant secrets at the core of Citadel's "ABC" automated trading strategy.

Citadel is seeking around $40 million over claims that GSA was able to obtain information on the strategy via texts and WhatsApp, according to Bloomberg.

As the case progresses in a London court, Citadel is now arguing that GSA "can't unsee" and can't forget the information that was taken from Citadel's secret algorithm. Citadel is also moving to try and block GSA from using their trading model. GSA has argued that they found no "secret sauce" from a high-level description of the structure of a trading algorithm.

David Craig, a lawyer for Citadel Securities, argued this week: “GSA’s most senior managers now know where and how Citadel makes hundreds of millions of dollars in annual revenues. They cannot forget that information, or put it out of their minds.”

He noted that only 15 of Citadel's 3,000 employees ever had access to the "strategic logic" of the strategy. One of those employees was Vedat Cologlu, a 2007 Wharton grad and self-described "stat arb trader", who helped operate and administer the models whose "returns were notably high given the low level of risk it took on."

Citadel has claimed its "ABC" quant strategy cost more than $100 million to develop. In its lawsuit, Citadel alleged that the UK fund wanted Cologlu to hand over confidential information about the strategy:

GSA asked for sensitive information on his equity-trading including his profits and the speed of the trades. And then Cologlu handed over a plan that Citadel argues was based on its own confidential model, including the way the algorithm made predictions.

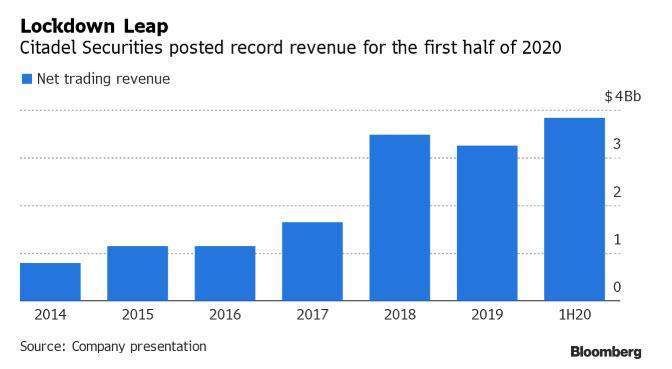

And there's good reason for the information to be coveted. Citadel Securities has been wildly profitable: it generated $3.84 billion of revenue in the first six months of 2020, more than the $3.26 billion it made for all of 2019. Net income was $2.36 billion in the first six months of 2020, more than double the $982 million for the same period a year earlier.

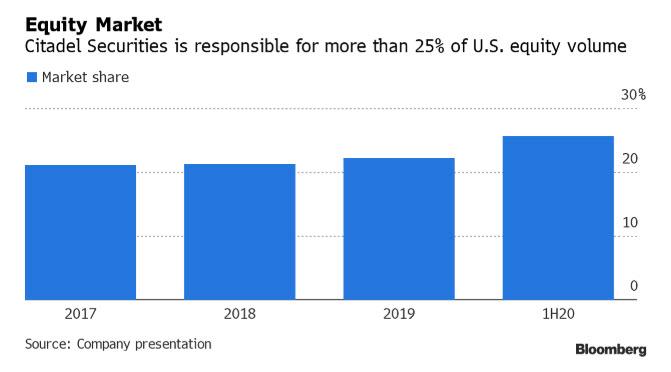

As we noted in September, Citadel has continued to increase its market share, and in the U.S. options market, it climbed to 32% from 27%. In the three months through August, 28% of U.S. equity volume went through Citadel, up from 22% in 2019.

The Citadel securities trading arm started as a high-frequency market-maker in options before pushing into equities. For an extended profile of Citadel Securities, read the following Bloomberg profile.

Today, the firm dominates that realm and has had a very close relationship with the likes of the millennials' favorite trading platform, Robinhood. We documented back in September that Citadel now controls 41% of all retail trading.

GSA was spun out of Deutsche Bank AG in 2005 and manages around $7.5 billion. Citadel’s legal filing names GSA founder and majority owner Jonathan Hiscox as a defendant, alongside other officials including the chief technology officer.

Back in January 2020, we noted the full details of Citadel's lawsuit. Damages likely won't be decided until a trial, expected to take place in 2022.