Submitted by Nicholas Colas of DataTrek

A recently published NBER working paper shows that many public companies are changing how they communicate in order to appeal to algorithmic analysis of their financial filings and quarterly investor conference calls.

* * *

We came across an interesting academic study in the NBER’s “Working Paper Series” titled “How to Talk When a Machine Is Listening: Corporate Disclosure in the Age of AI”. There is a link below (the paper costs $5 to download), but here are the 3 takeaways we found most thought provoking:

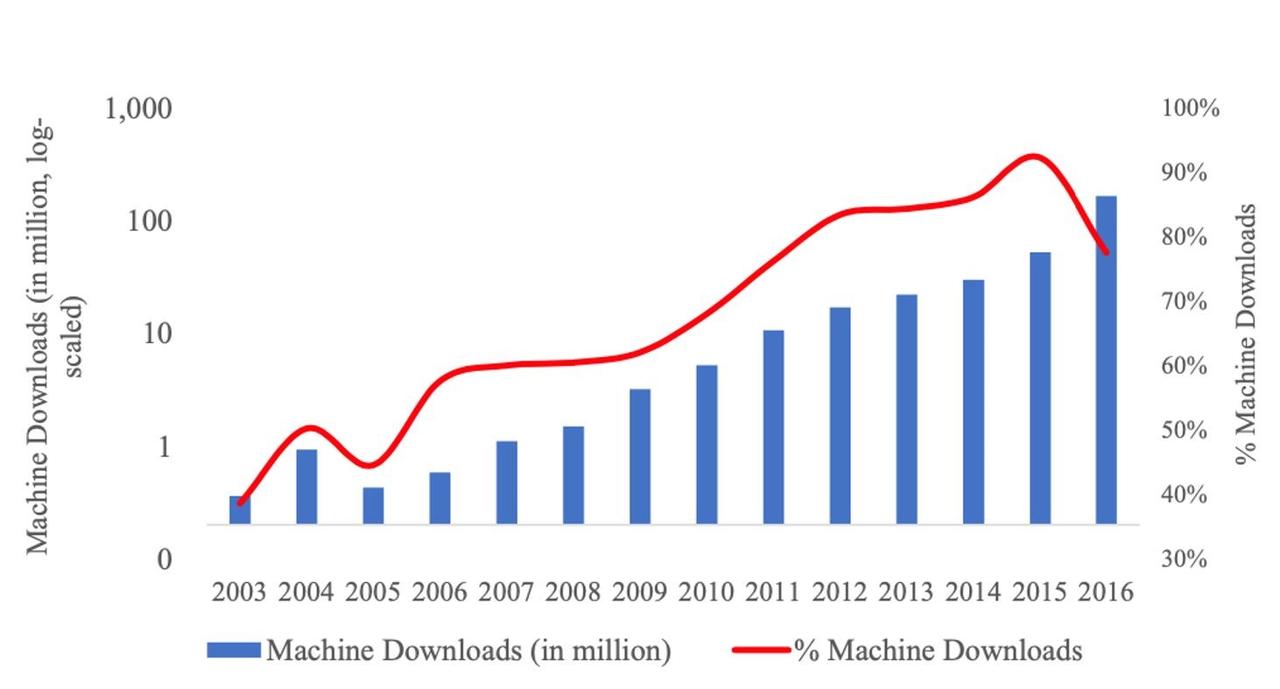

First, financial statement analysis has become heavily automated. This is a chart from the paper which shows the number of downloads from the SEC’s Edgar database since 2003 and the percent of those information requests which came from automated systems. In 2016, for example, there were over 100 million Edgar downloads and the vast majority were computer (not human) generated (ZH: it begs the question if humans even read 10Qs anymore).

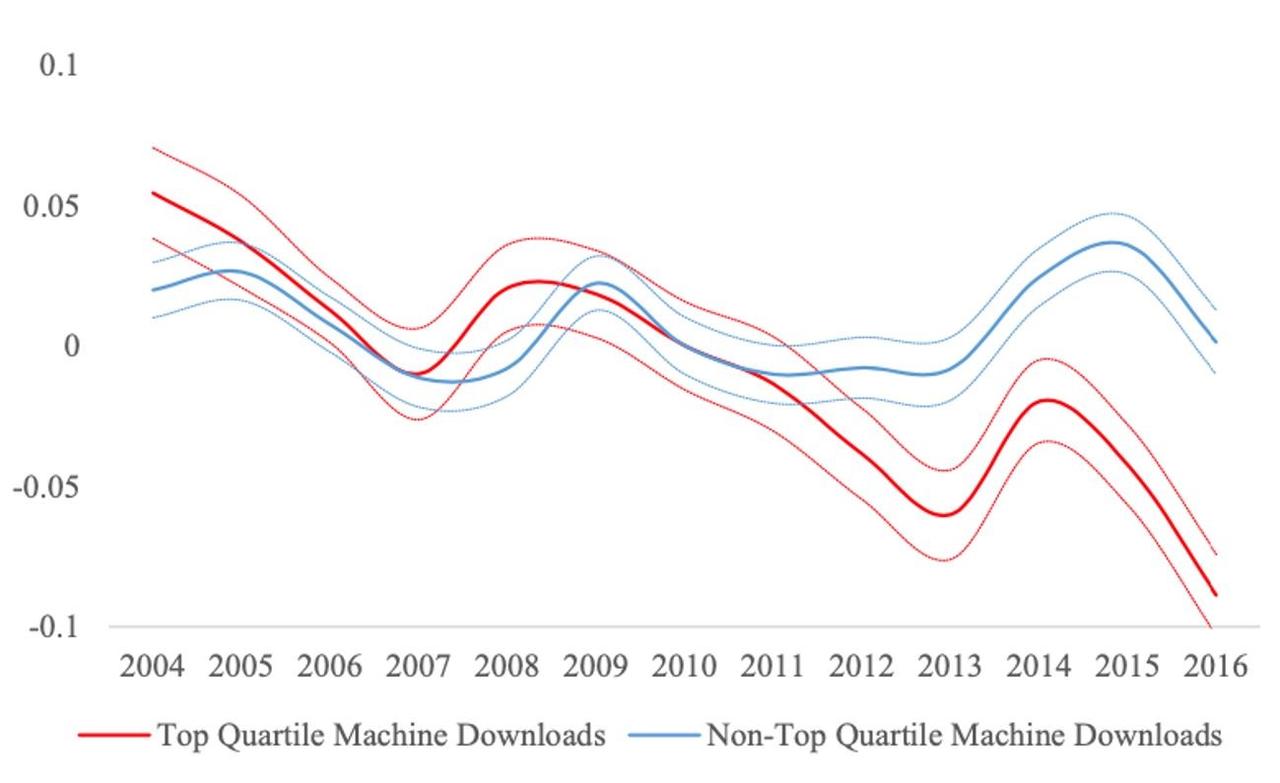

Second, companies that see significant automated download interest in their SEC filings have been changing the language they use in these documents so the algorithms (presumably) like what they are “reading”. Back in 2011 finance researchers published a qualitative list of “good” and “bad” words commonly used in SEC filings. This has become the backbone of the algorithms that score how positive/negative these filings are in terms of management’s take on their company’s present and future.

The chart below shows that companies which are in the top quartile of machine downloads (the red lines represent the mean and 95 percent confidence intervals for these) have been using fewer of those “bad” words since the list came out in 2011. The y-axis scores their frequency of usage. The blue line shows the same data for companies that don’t see as much automated download interest in their filings. They, not illogically, have not bothered to change the words they use.

Finally, while there is no chart for this, the paper’s authors found that managements of companies which see high levels of download demand for their SEC filings also changed how they spoke on quarterly financial reporting conference calls. Simply put, they tried to sound more upbeat so voice analysis software listening to the call would read their emotions as positive.

Summing up: both written and spoken word public company financial disclosure is adapting to the disruptive innovation of algorithmic trading. Not surprising, we suppose, but interesting to see it quantified.

Source:

NBER Paper (Cao, Jiang, Yang, Zhang): https://www.nber.org/papers/w27950