From Zero Hedge:

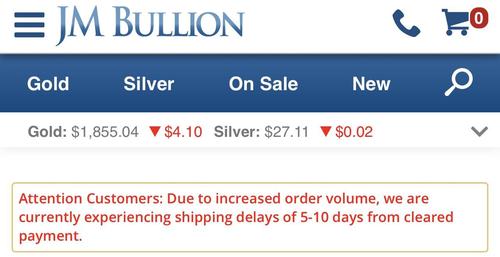

Update (1100ET): For some background on just how unprecedented this weekend's action in silver markets is, Tyler Wall, the CEO of SD Bullion writes the following (emphasis ours):

In the 24 hours proceeding Friday market close, SD Bullion sold nearly 10x the number of silver ounces that we normally would sell in an entire weekend leading to Sunday market open.

In a normal market, we normally can find at least one supplier/source willing to sell some ounces over the weekend if we exceed our long position (the number of ounces we predict we will sell over the weekend).

However, everyone we talk to is afraid of a gap up at Sunday night market open.

This is about ready to get really interesting as there was very little inventory left from suppliers/mints going into Friday close.

Our direct AP supplier informed us after close on Friday that the "US Mint will be on allocation for the remainder of Type 1" (Current Silver Eagle Design).

Our sales for the month of January exceeded any one month last year during the heart of the pandemic. It was an all-time record month in our company history.

And, perhaps most importantly, as QTR tweets so succinctly, "this is a red pill moment for many, and it's beautiful."

Additionally, there are also signs of a notable regime shift, as Bloomberg points out, investors are holding onto silver they own, rather than trying to take profits.

“Now we’re seeing nothing, no single offer, which is scary,” Peter Thomas, senior vice president at Zaner Group, said by phone from Chicago.

“Whatever we sell, people are holding it. There’s no inflow of metal at all.”

* * *

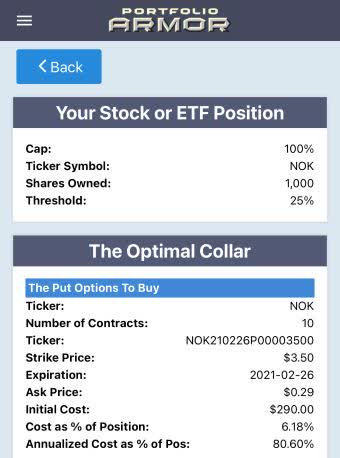

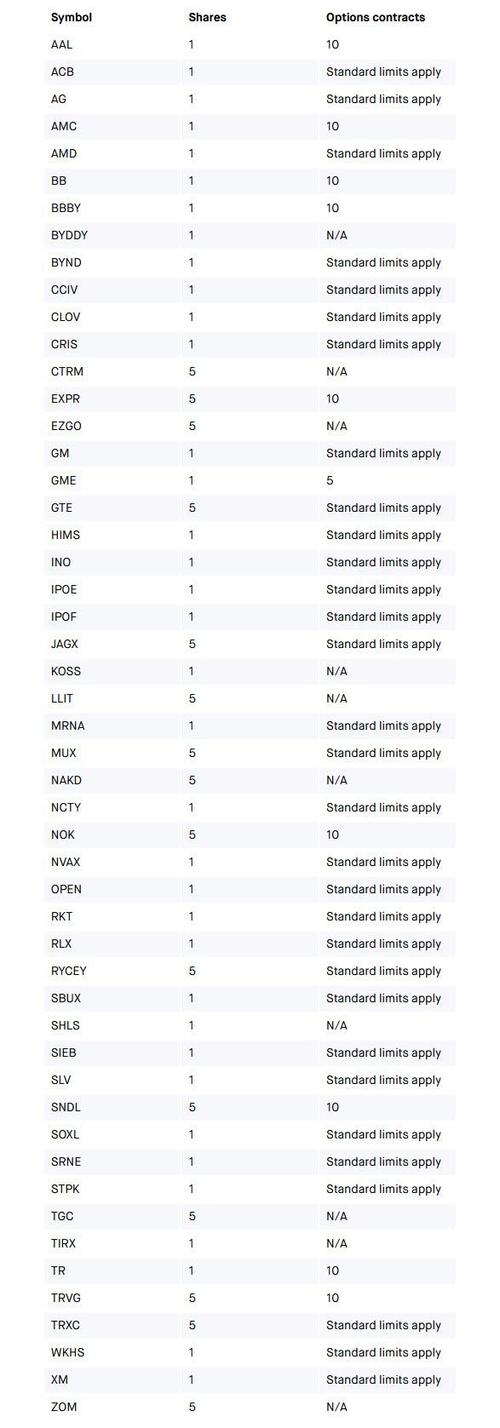

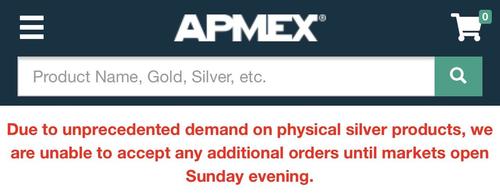

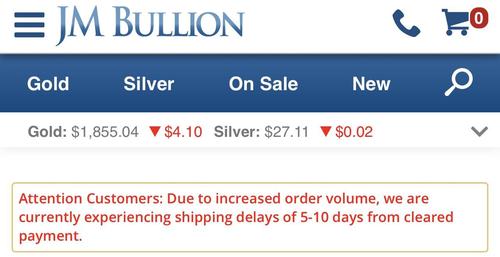

Update (1030ET): It would appear the run on silver has begun. With the market closed, traders have rushed to secure some exposure to silver ahead of what WSB suggests could be "the world's biggest short squeeze" and that has left bullion dealers

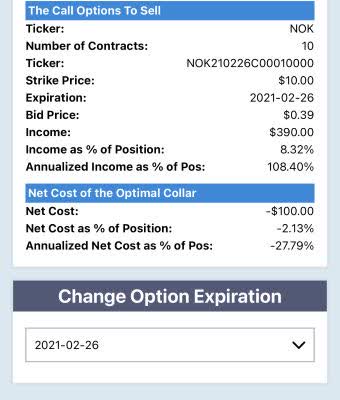

As we noted below, the premium for physical silver had soared late Friday and into Saturday (after the massive flows into SLV), but as Sunday rolled around, bullion dealers are now facing massive shortages of physical coins.

Source: APMEX

Source: JMBullion

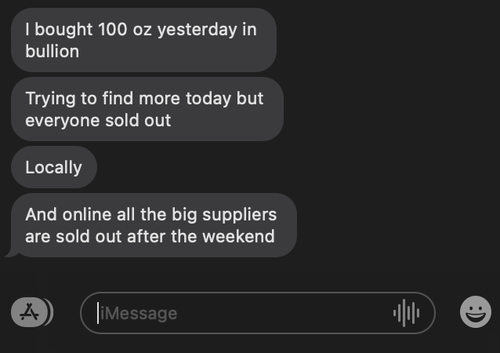

Source: SDBullion

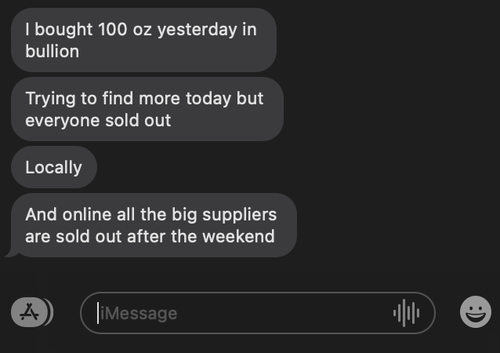

And as one investor noted, the shortages are widespread...

We can only imagine where SLV will open after this.

* * *

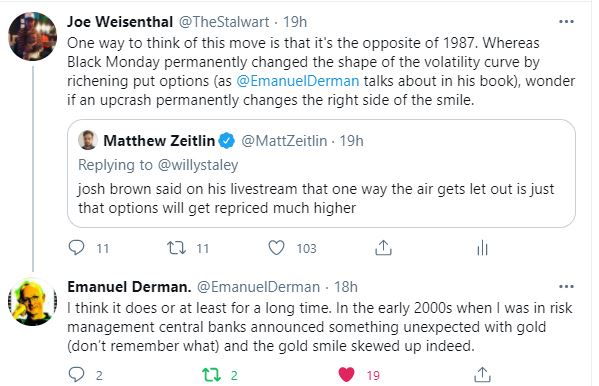

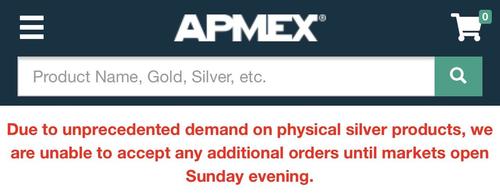

While all eyes have been focused on GameStop and a handful of other heavily-shorted stocks as they exploded higher under continuous fire from WallStreetBets traders igniting a short-squeeze coinciding with a gamma-squeeze, the last few days saw another asset suddenly get in the crosshairs of the 'Reddit-Raiders' - Silver.

On Thursday, we asked "Is The Reddit Rebellion About To Descend On The Precious Metals Market?" ... One WallStreetBets user (jjalj30) posted the following last night:

Silver Bullion Market is one of the most manipulated on earth. Any short squeeze in silver paper shorts would be EPIC. We know billion banks are manipulating gold and silver to cover real inflation.

Both the industrial case and monetary case, debt printing has never been more favorable for the No. 1 inflation hedge Silver.

Inflation adjusted Silver should be at 1000$ instead of 25$. Link to post removed by mods.

Why not squeeze $SLV to real physical price.

Think about the Gainz. If you don't care about the gains, think about the banks like JP MORGAN you'd be destroying along the way.

...

Tldr- Corner the market. GV thinks its possible to squeeze $SLV, FUCK AFTER SEEING $AG AND $GME EVEN I THINK WE CAN DO IT. BUY $SLV GO ALL IN TH GAINZ WILL BE UNLIMITED. DEMAND PHYSICAL IF YOU CAN. FUCK THE BANKS.Disclaimer: This is not Financial advice. I am not a financial services professional. This is my personal opinion and speculation as an uneducated and uninformed person.

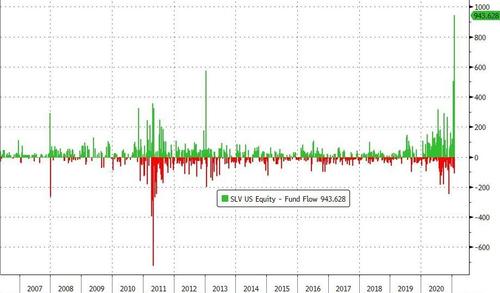

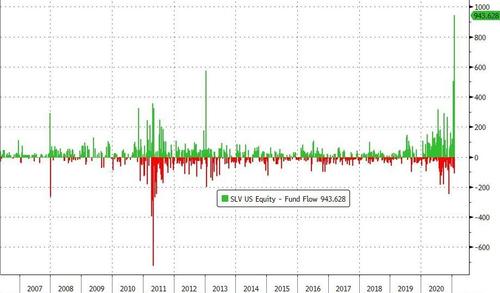

...and judging by the unprecedented flows into the Silver ETF (SLV) they just got started...

SLV saw inflows of almost one billion dollars on Friday, almost double the previous record inflow for this 15 year-old ETF.

Source: Bloomberg

Which helped prompt a spike in SLV off Wednesday's lows of over 11% (and note that every surge in price was mimicked by gold, but gold was instantly monkey-hammered lower after the spike).

Source: Bloomberg

And judging by the asset flow, SLV has room to run here...

Source: Bloomberg

Just as short-interest in the ETF has been building...

Source: Bloomberg

This surge came after Reddit user 'TheHappyHawaiian' posted the following thesis on buying silver noting that "the worlds biggest short squeeze is possible and we can make history."

'TheHappyHawaiian' cites two reasons to buy - The Short Squeeze and Fundamentals.

The short squeeze:

Buy SLV shares (or PSLV shares) and SLV call options to force physical delivery of silver to the SLV vaults.

The silver futures market has oscillated between having roughly 100-1 and 500-1 ratio of paper traded silver to physical silver, but lets call it 250-1 for now. This means that for every 250 ounces in open interest in the futures market, only 1 actually gets delivered. Most traders would rather settle with cash rather than take delivery of thousands of ounces of silver and have to figure out to store and transport it in the future.

The people naked shorting silver via the futures markets are a couple of large banks and making them pay dearly for their over leveraged naked shorts would be incredible. It's not Melvin capital on the other side of this trade, its JP Morgan. Time to get some payback for the bailouts and manipulation they've done for decades (look up silver manipulation fines that JPM has paid over the years).

The way the squeeze could occur is by forcing a much higher percentage of the futures contracts to actually deliver physical silver. There is very little silver in the COMEX vaults or available to actually be use to deliver, and if they have to start buying en masse on the open market they will drive the price massively higher. There is no way to magically create more physical silver in the world that is ready to be delivered. With a stock you can eventually just issue more shares if the price rises too much, but this simply isn't the case here. The futures market is kind of the wild west of the financial world. Real commodities are being traded, and if you are short, you literally have to deliver thousands of ounces of silver per contract if the holder on the other side demands it. If you remember oil going negative back in May, that was possible because futures are allowed to trade to their true value. They aren't halted and that's what will make this so fun when the true squeeze happens.

Edit for more detail: let’s say there’s one futures seller who gets unlucky and gets the buyer who actually wants to take delivery. He doesn’t have the silver and realizes it’s all of a sudden damn difficult to find some physical silver. He throws up his hands and just goes long a matching number of futures contracts and will demand actual delivery on those. Problem solved because he has now matched the demanding buyer with a new seller. The issue is that the new seller has the same issue and does the exact same thing. This is how the cascade effect of a meltup occurs. All the naked shorts trying to offload their position to someone who actually has some silver. My goal is to ensure that I have the silver and won’t sell to them until silver is at a far higher price due to the desperation.

The silver market is much larger than GME in terms of notional value, but there is very little physical silver actually readily available (think about the difference between total shares and the shares in the active float for a stock), and the paper silver trading hands in the futures market is hundreds of times larger than what is available. Thus when they are forced to actually deliver physical silver it will create a massive short squeeze where an absurd amount of silver will be sought after (to fulfill their contractually obligated delivery) with very little available to actually buy. They are naked shorting silver and will have to cover all at once and the float as a percentage of the total silver stock globally is truly miniscule.

The fundamentals:

The current gold to silver ratio is 73-1. Meaning the price of gold per ounce is 73 times the price of silver. Naturally occurring silver is only 18.75 times as common as gold, so this ratio of 73-1 is quite high. Until the early 20th century, silver prices were pegged at a 15-1 ratio to gold in the US because this ratio was relatively known even then. In terms of current production, the ratio is even lower at 8-1. Meaning the world is only producing 8 ounces of silver for each newly produced ounce of gold.

Global industry has been able to get away with producing so little new silver for so long because governments have dumped silver on the market for 80 years, but now their silver vaults are empty. At the end of WW2 government vaults globally contained 10 billion ounces of silver, but as we moved to fiat currency and away from precious metal backed currencies, the amount held by governments has decreased to only 0.24 billion ounces as they dumped their supply into the market. But this dumping is done now as their remaining supply is basically nil.

This 0.24 billion ounces represents only 8% of the total supply of only 3 billion ounces stored as investment globally. This means that 92% of that gold is held privately by institutions and by millions of boomer gold and silver bugs who have been sitting on meager gains for decades. These boomers aren't going to sell no matter what because they see their silver cache as part of their doomsday prepper supplies. It's locked away in bunkers they built 500 miles from their house. Also, with silver at $23 an ounce currently, this means all of the worlds investment grade silver only has a total market cap of $70 billion. For comparison the investment grade gold in the world is worth roughly $6 trillion. This is because most of the silver produced each year actually gets used, as I have mentioned. $70 billion sounds like a lot, but we don’t have to buy all that much for the price to go up a lot.

**If the squeeze happens, it would be like 40 years worth of their gains in 4 months **

The reason that only 8 ounces of silver are produced for every 1 ounce of gold in today's world is because there aren't really any good naturally occurring silver deposits left in the world. Silver is more common than gold in the earth's crust, but it is spread very thin. Thus nearly every ounce of silver produces is actually a byproduct of mining for other metals such as gold or copper. This means that even as the silver price skyrockets, it wont be easy to increase the supply of silver being produced. Even if new mines were to be constructed, it could take years to come online.

Finally, most of this newly created silver supply each year is used for productive purposes rather than kept for investment. It is used in electronics, solar panels, and jewelry for the most part. This demand wont go away if the silver price rises, so the short sellers will be trying to get their hands on a very small slice of newly minted silver. The solar market is also growing quickly and political pressure to increase solar and electric vehicles could provide more industrial demand.

The other part of the story is the faster moving piece and that is the inflation and currency debasement fear portion. The government and the fed are printing money like crazy debasing the value of the dollar, so investors look for real assets like precious metals to hide out in, driving demand for silver. The $1.9 trillion stimulus passing in a month or two could be a good catalyst. All this money combined with the reopening of the economy could cause some solid inflation to occur, and once inflation starts it often feeds on itself.

What to buy:

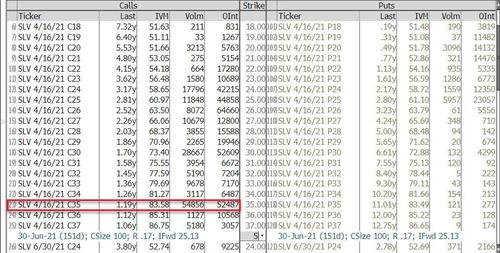

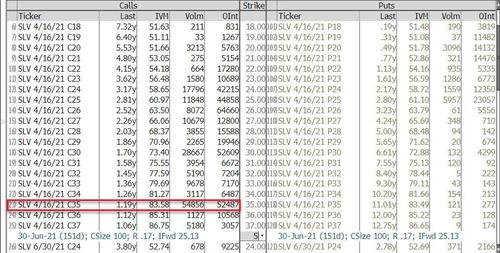

I will be putting 50% directly into SLV shares, and 50% into the $35 strike SLV calls expiring 4/16.

This way the SLV purchase creates a groundswell into silver immediately that then rockets through a gamma squeeze as SLV approaches $35.

Price target of $75 for SLV by end of April if the short squeeze happens.

Edit: for the part of your purchases going into shares, some people recommend PSLV because they think SLV might start lying about having the silver in their vault. Or that the custodian will be double counting, ie claiming that the same silver belongs to multiple people (banking on the fact that people wont all try to get their silver at once). So if you buy SLV shares and calls, that's great. But I think it could be prudent for us to buy options in SLV (no options on PSLV) and shares in PSLV. It all depends on how paranoid you want to be. There is a lot of paranoia in the precious metals world.

Alternate options:

buying physical silver; this also works but you pay a premium to buy and sell so its less efficient and you take fewer silver ounces off of the market because of the premium you pay

going long futures for February or March; if you are a rich bastard and can actually take physical delivery of 1000s of ounces of silver by all means do so. But if you simply settle for cash you are actually part of the problem. We need actual physical delivery, which is what SLV demands and is why SLV is the way to go unless you are going to take delivery

miners; I don’t recommend buying miners as part of this trade. Miners will absolutely go up if SLV goes up, but buying them doesn't create the squeeze in the actual silver market. Furthermore, most silver miners only derive 30-50% of their revenue from silver anyways, so eventually SLV will outperform them as it gets high enough (and each marginal SLV dollar only increases miner profits by a smaller and smaller percentage)

Details on SLV physical settlement:

When SLV issues shares, the custodian is forced to true up their vaults with the proportional amount of silver daily. From the SLV prospectus:

"An investment in Shares is: Backed by silver held by the Custodian on behalf of the Trust. The Shares are backed by the assets of the Trust. The Trustee’s arrangements with the Custodian contemplate that at the end of each business day there can be in the Trust account maintained by the Custodian no more than 1,100 ounces of silver in an unallocated form. The bulk of the Trust’s silver holdings is represented by physical silver, identified on the Custodian’s or, if applicable, sub-custodian's, books in allocated and unallocated accounts on behalf of the Trust and is held by the Custodian in London, New York and other locations that may be authorized in the future."

'TheHappyHawaiian" ends with a call to (financial) arms:

Join me brothers. Lets take silver to the moon and take on the biggest and baddest manipulators in the world.

Please post rocket emojis in the comments as desired.

Disclaimer: do your own research, make your own decisions, everything here is a guess and hypothetical and nothing is guaranteed, not a financial advisor, I have ADHD and maybe other things too.

Bear case: silver does tend to sell off if the broader market plunges so it’s not immune to broad market sell off. It’s also the most manipulated market in the world so we are facing some tough competition on the short side

Interestingly, 'TheHappyHawaiian' dropped this update on 1/29:

Due to the manipulation and collusion of citadel, hedge funds, and brokers to change the rules and rig the game in their favor. Who likely knew ahead of time and bought puts right before and calls at the bottom, GME is too important to abandon still. SLV is still my next play but GME needs to go to $1000 and these people need to go to jail.

However, judging by the massive physical premiums for silver we are seeing this weekend at APMEX...

... JM Bullion...

... and SD Bullion.

...there are more than a few who are already rotating to SLV from GME.