One month ago, we said that the beginning of the end of the covid pandemic would mysteriously coincide with the Biden inauguration, and sure enough that's precisely what has just happened. As BofA's Ethan Harris writes overnight in his daily COVID news wrap, "with COVID cases falling and vaccines accelerating, this is probably the beginning of the end of the COVID crisis", echoing similar notes from a variety of other banks published today.

What has sparked BofA's optimism? Harris explains:

- Renewed restrictions and the end to the holiday season seem to be bending the cases curve.

- The vaccine rollout should continue to accelerate as new resources and effort is put into the project.

- There is one major caveat: new more contagious strains have arrived in the US. Bending the curve

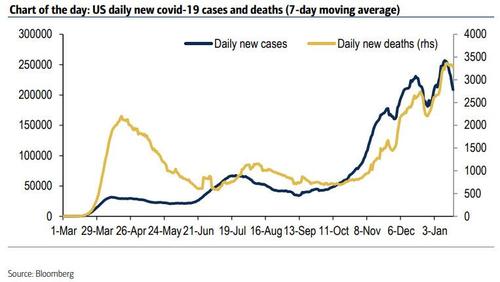

The BofA economist then argues this point with his chart of the day, which shows that the US is now clearly over the hump, with 142,000 COVID cases in the US on Monday, down 32% from the prior Monday.... the seven day average has also dropped, to 209,000, down 16% from the peak on January 8th. In another good sign, Harris notes that "testing is increasing and the share of tests that come back positive is falling" and cheerfully adds that "It seems clear that an end to the holiday season, a modest increase in restrictions and a small increase in herd immunity is bending the COVID curve."

To be sure, while deaths are still trending higher with the 7-day moving at 3,300 as of yesterday, this is a lagging trend, and BofA says that "this is up only 1.5% from a week ago, so we may soon see a flattening of the fatalities curve."

The key reason for BofA's cautious euphoria is the same one we flagged a month ago: as Harris notes next, "after a very slow start, vaccinations are picking up speed. The seven day average has accelerated from roughly 200,000 per day initially to 800,000 yesterday and continues to rise. Looking ahead, we think they will be able to ramp up shots to more than a million a day for an extended period."

We see four reasons for optimism. First, after months of fiddling and diddling there is federal money to support local distribution efforts. Second, there is a learning process going on. Slow states can learn from fast states. Experience has shown that it is better to not hold back second doses. Third, resistance to getting the vaccine is likely to continue to ease especially if there is an effective and transparent public information campaign. Fourth, as COVID cases and hospitalizations ease, it will free up medical resources for the vaccination effort.

What does this declaration of victory mean for the economy? As a result of what BofA now sees an gradual return to normal, the bank sees upside risks to its above-consensus forecast:

We think the vulnerable population will be inoculated by March/April, cutting hospitalizations dramatically, and allowing a partial reopening. Michelle Meyer and team have already boosted their GDP forecast for 2021 from 4.6% to 5.0% based on a somewhat earlier and bigger stimulus package. Moreover, like most forecasters they have not incorporated the impact of a second package. Indeed, as we will write more about, the proposed $1.9tr on top of $0.9tr would almost match the stimulus last spring, at a time when the economy is already posed to surge.

Just ignore the inflationary conflagration that could follow the combination of trillions in new stimulus hitting at the same time as the economy returns to normal.

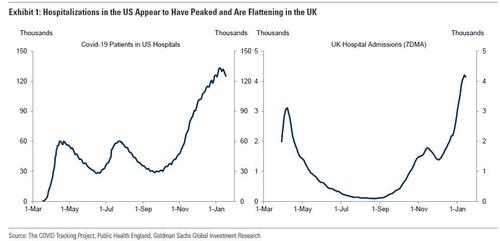

There's more, however, because it was not just BofA that is on the cusp of declaring victory. In a note also published overnight from Goldman's top economist Jan Hatzius, he writes that "a vaccine-driven reduction in hospitalizations is likely to kick off the growth rebound through relaxed restrictions and some reductions involuntary consumer social distancing." The bank smodel the vaccine impact on hospitalizations in the US, where they appear to have peaked – consistent with what we published a month ago– and in the UK, where they are are now flattening.

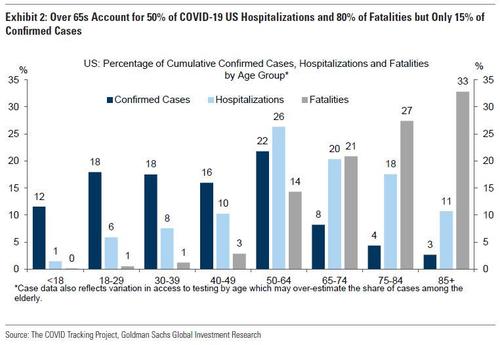

Goldman then repeats its core thesis, that vaccinations targeting the most at-risk group is what has tipped the tide: in the US, over 65s account for 50% of Covid-19 hospitalizations and 80% of fatalities but only 15% of confirmed cases. As a result, Goldman says that vaccination campaigns across the globe have prioritized these high-risk groups to front-load public health benefits.

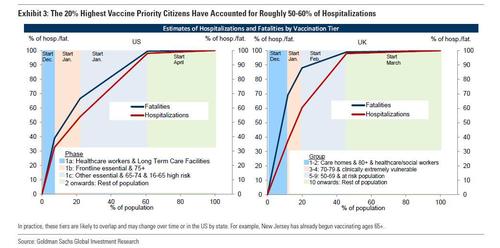

Furthermore, Goldman estimates that the 20% highest vaccine priority citizens in the US and UK have accounted for roughly 50-60% of hospitalizations so far. Moreover, in the UK, where age more than occupation determines priority, the 20% highest vaccine priority citizens have accounted for nearly 90% of fatalities compared to roughly 65% in the US.

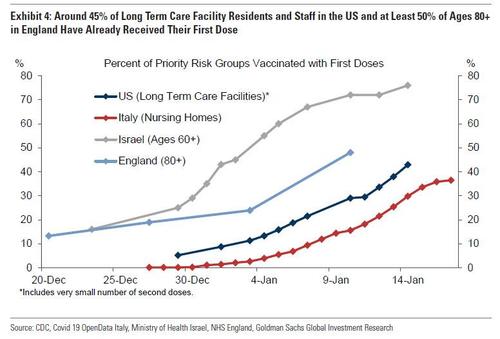

Putting these numbers in context, so far around 45% of long term care facility residents and staff in the US and at least 50% of ages 80+ in England have already received their first dose.

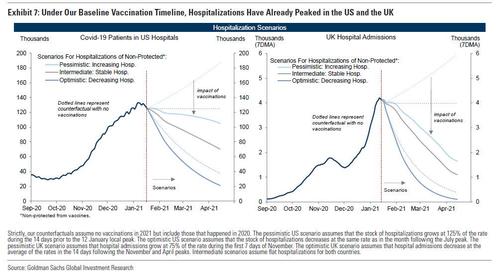

Next, Goldman picks up on its analysis from mid-December, laying out its revised hospitalization scenarios. Pointing out that according to its estimates, vaccinations so far have likely lowered US and UK hospitalizations by 2% and 7%, (by comparing actual hospitalizations and hypothetical hospitalizations if there had been no vaccinations) the bank then estimates that through April, vaccinations should reduce hospitalizations by nearly one-half in the US and three-quarters in the UK relative to counterfactuals assuming no vaccinations (Exhibit 7).

More importantly, Goldman now estimates that hospitalizations have likely already peaked in both the US and the UK, "even under the pessimistic scenario where hospitalizations among the non-vaccinated far surpass their already record high levels."

Finally, Goldman estimates that hospitalizations, which are currently still very elevated, are likely to remain above their early November levels for much of Q1 although these should drop to almost zero by the summer (Goldman's projected declines in hospitalizations are smaller in the US than in the UK, due to the less rapid US vaccination timeline).

Details aside, Goldman's optimistic conclusion is that US and especially UK hospitalizations decline significantly in coming months in most scenarios (that said, while recent hospitalization trends are encouraging, slower vaccine distribution, lower demand among priority groups, accelerated virus spread from new strains, and potentially reduced vaccine efficacy pose significant downside risks).

And while there are the usual cautionary statements, Goldman - like BofA - is now confident that we have now seen the worst of the covid crisis, and is also why Goldman is comfortable with its baseline view that vaccine-driven reductions in hospitalizations will contribute to annualized Q2 growth reaching 10% in the US. Oh, and yes, that this "new covid dawn" coincides with Biden's inauguration is not lost on anyone.