Authored by Peter Garnry, head of Equity Strategy for Saxo Bank,

Summary:

In today's equity update we are following up on our analysis of the Tesla-Bitcoin-Ark risk cluster showing an updated positions analysis, cross-correlations in the flagship Ark Innovation ETF, and an drawdown analysis. Yesterday, was another bad session for this risk cluster and Ark Invest had a day with outflows across all their ETFs highlighting that risk sentiment has changed. With the founder's bold move to increase the position in Tesla during the week the risk has gone up that this risk cluster could turn into an ugly forced selling dynamic causing pain in not only Tesla, Bitcoin, and Ark funds, but also US biotechnology stocks where Ark Invest is a major holder with high ownership in selected names.

A little over a month ago we first flagged the Tesla-Bitcoin-Ark risk cluster as something to take note off as short-term correlation between Tesla and Bitcoin was shooting up. A survey from Charles Schwab also confirmed our suspicion that there is a big overlap as these two instruments are among the top five holdings by millennials. Our analysis quickly led us to Ark Invest with its famous Ark Innovation ETF which had a big position in Tesla and its charismatic founder Cathie Wood is a big believer in the so-called disruptive innovation culture of Silicon Valley. This class of people believe firmly in technology as mainly good for society in all its aspects and that Bitcoin is a protection against future wealth confiscation which is most likely inevitable due to historically high wealth inequality.

This disruptive innovation culture is powerful. It is presented by some of the wealthiest people of this planet. Endless presentation about innovation and institutions like the Singularity University promote these views. Behind Bitcoin you find a huge online marketing machine sucking ordinary people into the game. Recently wealthy people such as Elon Musk has openly supported Bitcoin, first in writing and later in action adding $1.5bn to Tesla’s balance sheet and thereby significantly increasing its earnings volatility. The triangle of Tesla-Bitcoin-Ark and their respective momentum has reinforced each other creating a positive feedback loop luring more investors into these instruments. As we have seen this week the ‘tower of risk’ is beginning to show cracks.

Ark position update and Cathie Wood’s bold move and the risk to biotechnology

This week Tesla-Bitcoin-Ark all came under pressure from negative voices in governments over Bitcoin and beginning noise over real competition for Tesla in the coming years. The risk cluster was clearly moving together, and correlations started rising. On Tuesday, volatility picked up across the board and at one point Cathie Wood felt it was necessary to go public supporting her funds and said that she had increased their position in Tesla using big numbers in the future to justify increasing the risk. This is a bold move, but it increases the risk considerably. When you are at risk of seeing sizeable outflows, you should start reducing the most illiquid positions first while you can control the situation. Because if you are forced to do it by redemptions the game changes dramatically.

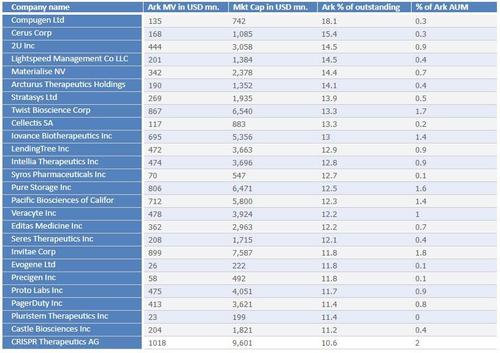

The tables below show updated Ark Invest positions as of yesterday’s close. There are still 26 stocks where Ark Invest holds more than 10% of the outstanding shares. This could become a serious problem if Ark Invest is suddenly caught in a negative feedback loop together with Tesla and Bitcoin. But also note how US biotechnology stocks are overrepresented in this list of stocks with high ownership in percentage of outstanding shares. If Ark Invest suddenly experience across the board outflows, like it did yesterday, then they can suddenly be the forced seller in US biotechnology stocks where they are the whale. This could cascade into the overall US biotechnology segment although the group is diverse.

Stocks held by Ark Invest funds with combined ownership above 10% of outstanding shares

Source: Ark Invest, Bloomberg, and Saxo Group

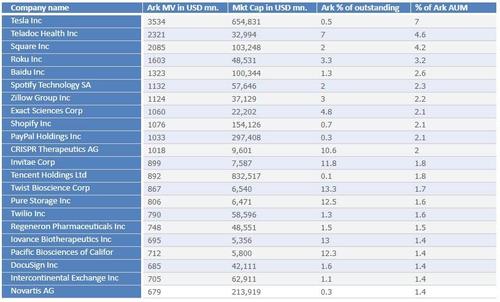

The table below shows the largest positions across all funds. Here Tesla has now jumped to 7% of AUM and the first five positions now account for 21.6% of AUM. The five biggest stocks are Tesla, Teladoc Health, Square, Roku, and Baidu. Square just recently reported disappointing Q4 earnings and announced the purchase of $170mn of Bitcoin increasing the risk and feedback loop further in this risk cluster. In the Ark Innovation ETF itself, Tesla is now 10.2% of assets and together with Roku (6%) and Square (5.4%) these three stocks represent 21.6% of assets. If you look at the 10 largest positions in the Ark Innovation ETF then the red thread is that they all come with very high equity valuations and thus low implied equity risk premiums. They are all also mostly equity financed, except for Tesla, which means that the WACC, cost of capital, predominantly come from the cost of equity. With low implied equity risk premiums, the risk-free rate dominates much more than for a company such as say Microsoft or Apple. This means that the rising interest rates could suddenly cause a huge shift in equity valuations. Not because the future is different but because the cost of capital has changed.

Top positions in terms of Ark Invest AUM across all funds

Source: Ark Invest, Bloomberg, and Saxo Group

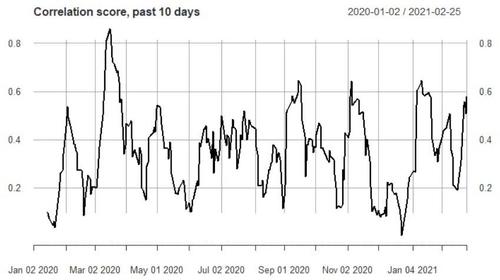

Correlations on the rise and drawdown outlier

The best sign of risk going haywire is always fast rising cross-correlations whether it is on asset classes or single stocks. The chart below shows the 10-day moving cross-correlation in the Ark Innovation ETF since early 2020. It has recently moved to around 0.6 and while it is not a new record the direction is up and has been fast coming from only 0.2 from a few weeks ago. The next week will be critical for the Tesla-Bitcoin-Ark risk cluster as negative feedback loops can be violent and very unpredictable in their outcome.

Source: Bloomberg and Saxo Group

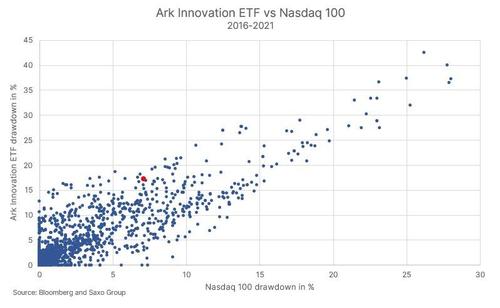

Another way of looking at risk is by plotting Ark Innovation ETF drawdowns against that of Nasdaq 100 since December 2015. The ETF has typically experienced a drawdown that is 1.22 times larger than that of Nasdaq 100. As of yesterday, the ratio stands at 2.44 and thus illustrates that something idiosyncratic is taking place at Ark Innovation ETF.

If outflows continue today and Tesla comes under pressure again then this indicator could very well hit a new record in terms of being an outlier signaling a negative feedback loop on risk has started.

* * *

See below for links to our research notes on the Tesla-Bitcoin-Ark risk cluster:

It is time to get cautious on the Tesla-Bitcoin-Ark connection – 22 January 2021

The Tesla-Bitcoin-Ark syndrome revisited – 9 February 2021

Tesla-Bitcoin-Ark positions have entered a dangerous tailspin scenario – 23 February 2021