Another week, another massive inflow into equity funds... just as the Nasdaq was about to get hammered with a painful 10% correction.

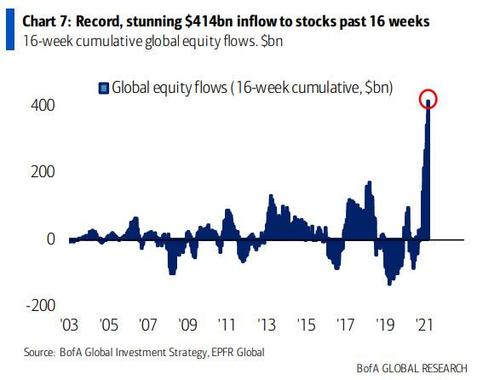

According to BofA Chief Investment Strategist Michael Hartnett's latest Flow Show note, $22.2Bn in new money flowed into equities last week, following the previous week's massive $46.2Bn inflow which was the 3rd biggest on record, bringing the total 16 week inflow to $436BN, a stunning outlier as shown in the chart below.

Addressing this massive tide of money, Wayne Wicker, chief investment officer at Vantagepoint Investment Advisers said that "Investors are looking at the market today and saying, ‘Wow, this is going to come back faster than I thought. I need to position myself accordingly. There’s a fear of missing out, of being under-invested."

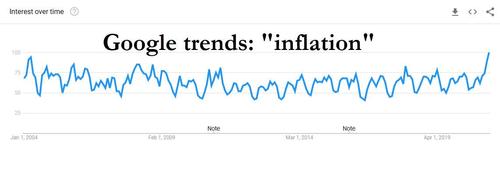

“We’ve seen for many reasons that people have been trained to buy the dips,” Kim Forrest, chief investment officer of Bokeh Capital Partners, told Bloomberg. “Just about every economist out there thinks the U.S. GDP is going to be 6% or above and that says growth. And yes, there’s some specter of inflation that may bubble up,” but, she said, “people are not afraid of inflation because we haven’t had that horrible really life-changing inflation.”

“We would admit to still seeing some pockets of speculative excess out there,” said Leo Grohowski, chief investment officer at BNY Mellon Wealth Management. “When we reach levels of maximum bullishness, that is usually a better time to pare back,” he added. “Market pullbacks like we’ve had this week serve as wake-up calls for investors that buy first and ask questions later.”

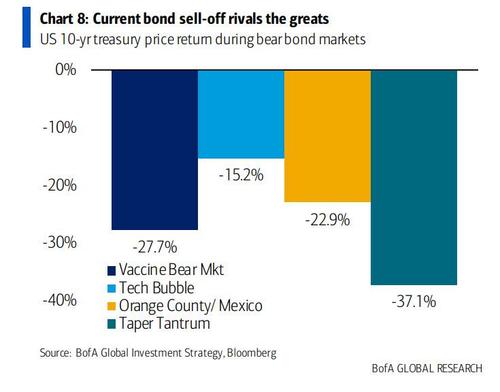

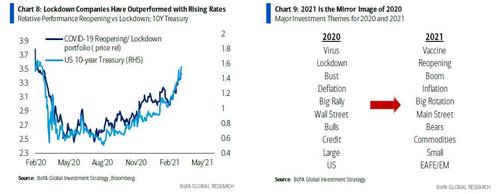

And yet, it's very likely that next week this massive inflow won't be repeated. In fact, it's far more likely that next week we will see a massive outflow because as Hartnett notes, "the price is now right": he points to the >100bps rise in 10Y TSY yields since Aug 4th low - as a reminder the plunge in 10Y prices since last March has been the 2nd worst bear market for bond in recent history...

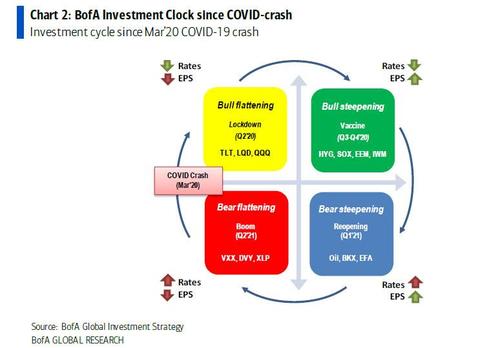

... with credit (LQD, EMB) and tech (NDX -11%, SOX -15% from highs) having been hammered. The result is a sharp drop in froth (TAN -32%, TSLA -33%) while at the same time inflation assets are increasing sharply (oil 37%, banks 33%). And pointing to the chart below, Hartnett says that his "investment clock" says once inflation visible = yield curve bear flattens = +ve volatility, dividend-yielders, defensives.

As an aside demonstrating the tremendous inflationary pressures which the Fed simply refuses to acknowledge as St Louis Fed Chair James Bullard idiotically commented on earlier when he said that " Commodity price inflation does not equal sustained inflation", Hartnett points out a price increase notification to CA real estate developer which said that

“Our worldwide supply chain, and ability to provide products and services to you, is being significantly impacted by increased prices resulting from labor and raw material shortages, escalating raw material prices, manufacturing delays and transit interruptions. Stated directly, our costs are increasing and are much more volatile than in the past.”

Someone please forward this to Bullard.

But going back to Hartnett, it's what he said next that was stunning. In the weekly note aptly titled "Throwing in the Powell"...

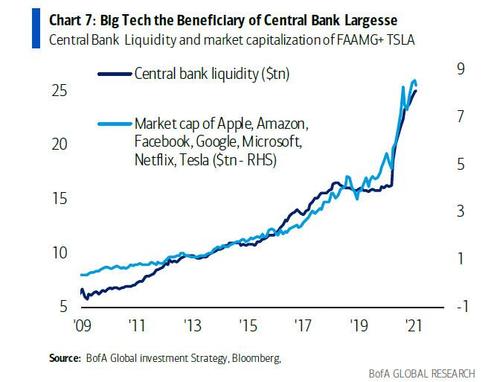

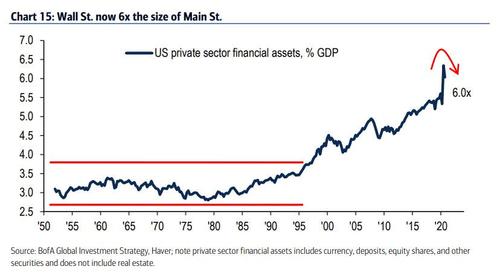

... Hartnett calmly lays it out that "debt deflation + 982 rate cuts and $21tn QE since Lehman = financial repression = low and stable interest rates = bull market in credit & stocks 2009-2021." But the epochal policy panic of past 12 months ($29tn global fiscal/monetary stimulus)

... has created an addictive Wall St-Fed dependency culture (everyone bullish) and beginning of Main St-Treasury dependency culture, which will spiral higher with $8tn US govt spending for stimulus checks, welfare, financed by $8tn Fed balance sheet.

This pernicious combination means that asset price inflation is mutating into Main Street inflation...

... and more importantly according to the rates strategist, means that rates are no longer “anchored”; Indeed, the best measure of interest rate uncertainty is 10-year Treasury term premium and it has surged by 120bps in the past 12 months...

... staring "a new era of volatility."

Which brings us to the punchline of the Hartnett report: what will the Fed do? As Hartnett notes, the 10-year Treasury yield low was just 0.51% on Aug 4th with bonds looking "big, fat & trendy." However this has changed and "the immediate outlook is excess fiscal stimulus + “boom” data (10% GDP, 30% EPS, 4% CPI in Q2) + subservient Fed + social/political desire for more inflation & less inequality."

As a result, BofA predicts that the bond bear is likely not over and that markets will now likely push the Fed via higher yields (i.e. 10Y rising above 2%) into Yield Curve Control policy announcement, something we have been pounding the table on for months...

... but first bond yields have to go even higher and stocks lower. Conveniently, Hartnett also lays out the key trigger to watch to determine if the current 10% tech correction will turn into a bear market:

XHB<$55, HYG<$80 could turn tech correction into deeper 10-20% correction of equities (SPX<3600, CCMP <12,000) which this time would likely include cyclicals (e.g. small cap, banks, energy, EM).

It's at this point that the Fed, facing the stark reality of being unable to let market drop as financial assets represents 600%+ of global GDP...

... will - in Hartnett's words - inevitably move to YCC. Some math:

- a 1% rise in US Treasury yields (as occurred past 6 months) increases deficit in 12 months (interest payments) by amount equivalent 2X budget for NASA;

- a 1% rise in yields above CBO baseline adds a remarkable $9.7tn to deficit between 2021-30 (10X the annual US defense budget of $0.9tn).

That's why the Fed's next step is clear.

So one Powell does launch YCC, BofA believes that it will trigger:

- Asset Volatility - all historic government policies to fix asset prices end with hubris, leverage, abnormal valuations; YCC (as Australia is learning) is new ERM (Europe’s failed Exchange Rate Mechanism of 80s/90s); era of speculative assaults on central bank policy has begun. BofA's reco: "own volatility"

- Dollar Debasement - while the US dollar may rally in advance of YCC (EM vulnerable short-term – see BRL), the YCC announcement "will likely trigger start of great bear market in US dollar."

Which all brings us to the conclusion, namely BofA's look at the regime shift between 2020 and the rest of the decade... and what to do ahead of the Fed's historic nationalization fo the entire bond market.

First, a look back at 2020:

Bigger picture secular low point for both inflation & interest rates; coming years will be marked by bigger government (public sector monopolistic), smaller world (globalization to localization), dollar debasement (inflation solves debt), a populist electorate (voting for UBI & MMT); all in an attempt to fight the War on Inequality (taxes, regulation, redistribution); "buy humiliation, sell hubris" = inflation assets to beat deflation in coming years.

And finally, Hartnett's views on the rest of the 2020s:

- We expect low, volatile, clustered, 3-5% long-run returns, like 1970s;

- We say optimal AA is 25/25/25/25in bond/stock/cash/commodities and/or in growth/yield/quality/inflation in 2020s;

- While we worry in very short-term inflation overpriced, we still think AA need to raise inflation hedges as US dollar weakens medium-term (commodities, gold, real assets, TIPS, small cap value, volatility);

- Tech leadership is over, but YCC should provide good entry point into small cap tech.