Summary

- QYLD provides investors with exposure to what is essentially QQQ, but with a massive yield.

- Covered calls can generate huge income, particularly during volatile market periods.

- This is in exchange for upside potential, but for income investors, it can be worth giving up the upside.

Investors in tech and growth stocks have been whipsawed in recent weeks as the sudden rise of long-term interest rates has taken its toll on valuations of certain groups of stocks. That has caused some very sharp moves in both directions in high flyers, but overall direction for these stocks has been down since February.

The big one is obviously the Nasdaq 100 ETF (QQQ), a $150 billion behemoth that has been pummeled since it hit new highs a little over a month ago. I won’t pretend to have a crystal ball on interest rates or anything else that will move the price of growth and tech stocks, so I cannot tell you with certainty where QQQ will go next. However, for a market that is jittery, and may end up going sideways or down some more before it rises again, I believe there is a good solution.

Enter the Global X Funds - Global X NASDAQ 100 Covered Call ETF (QYLD). This is a fund that owns the stocks in the Nasdaq 100 – the same as the QQQ – but follows a covered call strategy, rather than owning the stocks outright. This is sometimes also referred to as a “buy-write” strategy but essentially, the fund buys shares of the companies in the index, and then sells calls against those positions as a hedge, and to generate income. The stated objective of the fund is to provide results that correspond to the price and yield performance of the CBOE Nasdaq-100 BuyWrite V2 Index.

Source: Fund website

Why would somebody want to do this? QYLD has some important advantages over simply owning shares of the companies in the index, which is what QQQ does. The main advantage of the fund is that it generates extremely high levels of income, which we’ll come onto in just a bit. But for investors executing some version of the covered call strategy, income is usually high on the list of priorities.

The fund produces income by selling call positions against underlying shares, so the fund receives the premium from the call buyer. For a more detailed explanation of what a covered call strategy is, see here.

This generates income, but of course, it limits upside because if the underlying shares move past the call strike price, shares are called away, or the fund must buy back the call at a loss. Either way, it caps upside potential in exchange for the hedging and income properties of selling the call.

Another advantage of QYLD is that it generates monthly income, which isn’t all that common in the world of ETFs, even among other covered call funds. For investors looking to generate income to live off of, this is a big advantage.

Finally, QYLD allows investors to take the guess work out of executing a covered call strategy, and the fund does it for them. In addition, with QYLD, you get a diversified basket of stocks, rather than picking 10 or 20 to execute on your own.

The downside

QYLD sounds like a dream come true for many investors, and it might be. But before you rush out and YOLO your live savings on QYLD, let’s take a look at the downside.

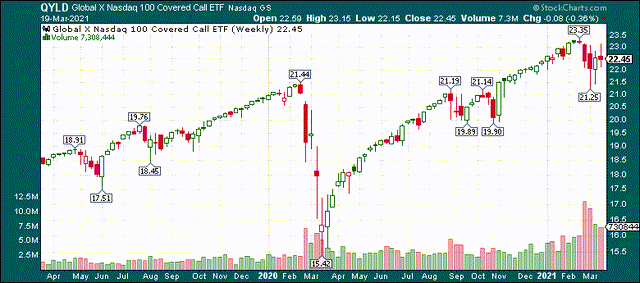

Source: StockCharts.com

Here’s a two-year weekly chart of QYLD, and you can see that it looks much the same as any other major index chart; there’s a steady rise into the COVID crisis, a very sharp decline, and then a massive recovery rally. In this way, QYLD isn’t necessarily that different at first glance. However, the chart below may shed some additional light on a very important way QYLD is different to QQQ.

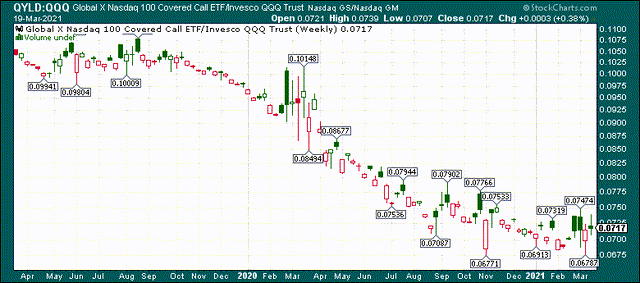

Source: StockCharts.com

This is the same chart, but with QYLD against QQQ. A price that is moving up means QYLD is outperforming QQQ, but that is not what we see. Periods of downturns see QYLD very briefly outperform, but during the bull stages, QQQ is the clear winner.

This makes sense given covered calls take away potential upside, as I explained above. That’s what you’re giving up by generating income with covered calls. During raging bull markets, you give up the upside QQQ is going to have. However, during sideways or down periods, QYLD outperforms.

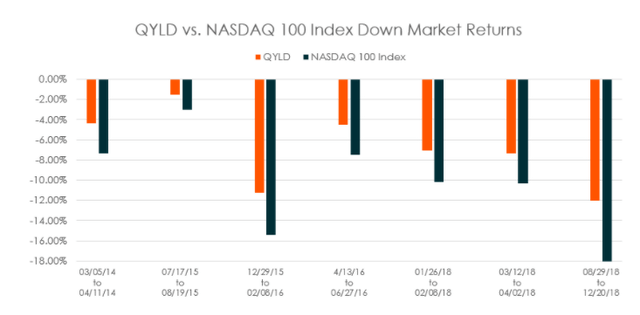

Indeed, this set of examples below shows how QYLD is favorable to QQQ during down periods.

Source: Fund website

The data here is old but the principal is exactly the same; during periods of turmoil, QYLD will decline less than QQQ. Of course, the recovery rally will see QQQ leave QYLD in the proverbial dust, but for investors looking for lower volatility and high levels of income, QQQ simply won’t do; you need QYLD.

About that yield…

I keep mentioning the yield as a huge draw, and I’m not kidding; QYLD’s distributions are huge.

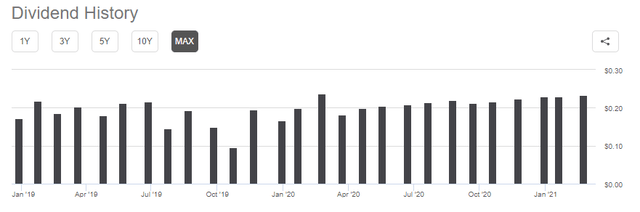

Source: Seeking Alpha

The amount you receive can differ each month depending upon a variety of factors, not the least of which is volatility in the underlying names of the index. When volatility is high, option premiums rise, and QYLD can generate more income. The opposite is true when volatility is low.

Even so, QYLD has consistently generated monthly distributions of 20 cents or more for the past year, so its yield is massive.

Source: Seeking Alpha

This is a one-year chart of the yield, and while it has moved around, it’s always in the double-digits. You typically have to go to the riskier parts of the REIT or BDC worlds to generate yields this high, but QYLD allows you to do so with 100 of the largest tech-oriented names in the market. For this reason, I see QYLD as a superior income vehicle.

Final thoughts

The main draw of QYLD is obviously the enormous distributions one receives from the fund, and on a monthly basis to boot. However, it provides other benefits, such as a measure of downside protection, and upside relative to QQQ during sideways market periods.

Of course, you trade upside potential for these benefits, but given the QQQ has had such a massive run and is quite choppy these days, maybe that’s more appealing than it would have been a year ago.

Another consideration is that QYLD’s tax policy is complicated, and may not be for everyone. I won’t go into it because every investor’s tax situation is different, and if you’re worried about it, hold QYLD in a tax-advantaged account like an IRA. Everything you need to know is in the link.

Expense ratio is just 60bps, so while you can certainly find index funds for less than that, QYLD has to pay for the active management of its covered calls; you won’t find a covered call fund with an expense ratio of 7bps or something like that, which you get with pure index funds. The 60bps does detract from the yield's attractiveness, but only very slightly given how large the yield is.

QYLD has paid $2.56 in distributions in the past twelve months by my count, good for a yield of 11.4% over the past twelve months. You’ll struggle to find another income fund with that kind of consistent, monthly yield, and for that reason, I think QYLD is a great option for income investors, and particularly those that can hold QYLD in a tax-advantaged account.