Europe’s failure twice plunged the world into war. In today’s globalized economic world, Europe’s failure to resolve its financial crisis could plunge the world into economic chaos. This is a global crisis — not a euro-zone crisis — and we must take international action to deal with it.

http://www.nytimes.com/2012/08/16/opinion/the-global-not-euro-zone-crisis.html

Thursday, August 16, 2012

Wednesday, August 15, 2012

Russ Wasendorf Sr. indicted

Peregrine Financial Group Inc. CEO Russ Wasendorf Sr. could face up to 155 years in prison if convicted on all counts, prosecutors said. His attorney didn’t immediately return a phone message Monday, and the date for an arraignment, where Wasendorf will enter a plea, has not been set. Peregrine operated as PFGBest.

Wasendorf, 64, a major player in Chicago’s futures industry, was arrested last month while hospitalized in Iowa City following a failed suicide attempt outside Peregrine’s office in Cedar Falls. Authorities said Wasendorf left a detailed suicide note in which he confessed to a 20-year scheme to commit fraud and embezzle customer funds.

For any PFG Best Customer, in case you have not seen this:

Important Message for Customers of Peregrine Financial Group and Peregrine Asset Management - Updated on August 3, 2012

As you aware, PFG filed for liquidation in a U.S. bankruptcy court in Chicago and the U.S. Trustee appointed Ira Bodenstein to act as trustee for PFG and its assets, including customer property. On July 13, the bankruptcy court authorized the trustee to continue to operate PFG's business for a limited time in order to (among other things) prepare and distribute final customer statements, and record transactions related to customer accounts. At this time, it is not clear how long it will take to complete these processes or when the trustee will be authorized to release any funds to customers.

The trustee has established a website, www.PFGChapter7.com, that contains information about the PFG case. The website was created to assist the trustee in providing information to customers and to receive comments or questions from customers. According to the website, the Trustee has not yet determined whether PFG customers will need to prepare a claim form. Customers are encouraged to visit the site regularly for updates from the Trustee regarding customer claims.

Tuesday, August 14, 2012

Knight Trading Loss Said To Be Linked To Dormant Software

Once triggered on Aug. 1, the dormant system started multiplying stock trades by one thousand, according to the people, who spoke anonymously because the firm hasn’t commented publicly on what caused the error. Knight’s staff looked through eight sets of software before determining what happened, the people said.

Knight, based in Jersey City, New Jersey, hasn’t explained in detail what caused the trading losses, which depleted its capital and led to a $400 million rescue that ceded most of the company to a group of investors led by Jefferies Group Inc. (JEF) The 45-minute delay in shutting down the malfunction has confused some securities professionals, who say that trading programs can typically be disabled instantly.

http://www.bloomberg.com/news/2012-08-14/knight-software.html

http://www.bloomberg.com/news/2012-08-14/knight-software.html

Monday, August 13, 2012

Capital flows signal new storm in Europe

Investors are losing confidence in the single currency and seeking havens for their cash outside the euro area asEurope’s debt crisis drags on in its third year. That has forced the Swiss National Bank to buy euros to prevent the franc from appreciating, and prompted the Danish central bank to charge for the use of its deposit facility while yields on U.K. two-year notes are less than 0.14 percent.

“Now there are growing signs that the crisis of confidence in the euro zone has assumed a new dimension,” Kressin wrote. “Whereas initially investors fled to the safety of the euro zone’s core, now they are taking their capital out of the euro zone altogether.”

The Swiss central bank’s sales of the euro to rebalance its reserves are “reinforcing” pressure on the single currency, according to Kressin. Its purchases of top-rated Europeangovernment bonds, particularly bunds, are also forcing down yields on those securities, he said.

Saturday, August 11, 2012

U.S. banks told to make plans for preventing collapse

(Reuters) - U.S. regulators directed five of the country's biggest banks, including Bank of America Corp and Goldman Sachs Group Inc, to develop plans for staving off collapse if they faced serious problems, emphasizing that the banks could not count on government help.

The two-year-old program, which has been largely secret until now, is in addition to the "living wills" the banks crafted to help regulators dismantle them if they actually do fail. It shows how hard regulators are working to ensure that banks have plans for worst-case scenarios and can act rationally in times of distress.

Officials like Lehman Brothers former Chief Executive Dick Fuld have been criticized for having been too hesitant to take bold steps to solve their banks' problems during the financial crisis.

Friday, August 10, 2012

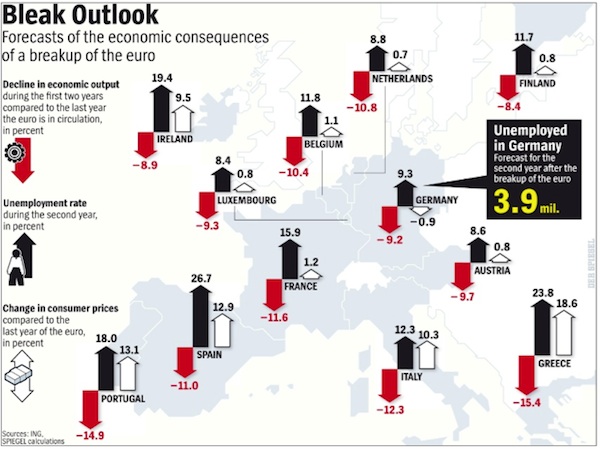

Otmar Issing says Eurozone will break up

BRUSSELS - Former European Central Bank (ECB) chief economist and German central banker Otmar Issing has warned that the eurozone may split up - another voice in the chorus talking about a Greek exit from the common currency.

"Everything speaks in favour of saving the euro area. How many countries will be able to be part of it in the long term remains to be seen," Issing wrote in his latest book, entitled: "How we save the euro and strengthen Europe."

Thursday, August 9, 2012

Out-of-money Greece now prints its own euros

Alas, August 20 is the out-of-money date. September is irrelevant. Because someone else turned off the spigot. Um, the ECB. Two weeks ago, it stopped accepting Greek government bonds as collateral for its repurchase operations, thus cutting Greek banks off their lifeline. Greece asked for a bridge loan to get through the summer, which the ECB rejected. Greece asked for a delay in repaying the €3.2 billion bond maturing on August 20, which the ECB also rejected though the bond was decomposing on its balance sheet. It would kick Greece into default. And the ECB would be blamed.

But the ECB has a public face, President Mario Draghi. He didn’t want history books pointing at him. So the ECB switched gears. It allowed Greece to sell worthless treasury bills with maturities of three and six months to its own bankrupt and bailed out banks. Under the Emergency Liquidity Assistance (ELA), the banks would hand these T-bills to the Bank of Greece (central bank) as collateral in exchange for real euros, which the banks would then pass to the government. Thus, the Bank of Greece would fund the Greek government.

Precisely what is prohibited under the treaties that govern the ECB and the Eurosystem of central banks. But voila. Out-of-money Greece now prints its own euros! The ECB approved it. The ever so vigilant Bundesbank acquiesced. No one wanted to get blamed for Greece’s default.

Read more: http://www.testosteronepit.com/home/2012/8/8/greece-prints-euros-to-stay-afloat-the-ecb-approves-the-bund.html#ixzz235XoK0bz

Wednesday, August 8, 2012

Tuesday, August 7, 2012

Dark Pools

I picked up Dark Pools by Scott Paterson on Friday evening and finished Sunday afternoon. That ought to say something for the book's readability. I recommend it to anyone that trades, especially equities traders.

The structure of the stock market is far more complicated than I ever expected. Trading at Interactive Brokers, I always noticed that the execution venue would vary between different acronyms like ISLAND, ARCA and BATS. I knew that they were ECNs, but I never really understood what linked them together.

The stock market is not an exchange in the sense of a centralized location where all transactions occur. It is more like a listing entity where public companies go to list their shares. Actual trading occurs on any network plugged into the system.

The "exchange" is really a complex network of networks with varying degrees of favoritism shown to high volume clients.

Electronic Communication Networks ("ECN") originally started in the mid 1980s with the idealistic goal of eliminating the corrupt practices of the NASDAQ floor specialists and market makers. These guys were notorious (and later heavily fined) for colluding to artificially widen spreads on stocks for their own profits. ECNs would cut out the hated middle man while reducing errors, increasing transparency and dramatically decreasing execution time.

As one can imagine, the ECNs took off rather quickly. Not only did they offer much faster execution, but they were also about 60% cheaper to execute a trade.

They corruption that ECNs sought to eliminate inadvertently replaced one problem with another. Networks looking for liquidity offered trading rebates for limit orders that added orders into the system. The setup, which came to be known as maker-taker, created perverse trading incentives for participants. The more trades executed, the more the profits would add up.

Firms sought to become something like Walmart is to wide screen TVs. The more you sell, the more you make. The liquidity providers started fighting aggressively for inside placement of the spread to facilitate ever more trades.

The system spun out of control in two ways. It created a computing arms race where firms focused on purchasing cutting edge technology that shaves microseconds off of calculation time. Firms with the deepest pockets could literally buy an advantage through their computing hardware over the average Joe.

More importantly, the system itself bred its own corruption. The ECNs grew addicted to the liquidity fees. The more trades that fired off, the more money they made. They naturally started catering to their most important clients.

How they did it, though, is what sickens me as a trader. The ECNs started creating order types that were effectively secret. They allowed high speed firms to jump in line over retail chumps using vanilla limit orders. The ECNs offered colocation access at exorbitant fees to give the machines an edge. They allowed the creation of dark liquidity where some players could literally hide orders for execution while others displayed theirs 100% of the time. It makes a complete mockery of the idea of a level playing field.

Artificial intelligence played a big role in how the algorithms operate. What encouraged me, however, was how Patterson chose to wrap up the book. Many of the funds covered near the end start out as relatively small fish working with various types of AI to build predictive trading systems. Their initial results appear encouraging.

One of our biggest projects here is to use various models of fractal markets to build an automated trading system on behalf of the client that I go visit in Ireland so often. Andy and I meet on a near daily basis to discuss our genetic algorithm and how best to encourage the network to behave as we want it to. We are about a month from running our first predictive tests with our in house model. Reading this book encourages me that we are blazing down the right path.

The structure of the stock market is far more complicated than I ever expected. Trading at Interactive Brokers, I always noticed that the execution venue would vary between different acronyms like ISLAND, ARCA and BATS. I knew that they were ECNs, but I never really understood what linked them together.

The stock market is not an exchange in the sense of a centralized location where all transactions occur. It is more like a listing entity where public companies go to list their shares. Actual trading occurs on any network plugged into the system.

The "exchange" is really a complex network of networks with varying degrees of favoritism shown to high volume clients.

Electronic Communication Networks ("ECN") originally started in the mid 1980s with the idealistic goal of eliminating the corrupt practices of the NASDAQ floor specialists and market makers. These guys were notorious (and later heavily fined) for colluding to artificially widen spreads on stocks for their own profits. ECNs would cut out the hated middle man while reducing errors, increasing transparency and dramatically decreasing execution time.

As one can imagine, the ECNs took off rather quickly. Not only did they offer much faster execution, but they were also about 60% cheaper to execute a trade.

They corruption that ECNs sought to eliminate inadvertently replaced one problem with another. Networks looking for liquidity offered trading rebates for limit orders that added orders into the system. The setup, which came to be known as maker-taker, created perverse trading incentives for participants. The more trades executed, the more the profits would add up.

Firms sought to become something like Walmart is to wide screen TVs. The more you sell, the more you make. The liquidity providers started fighting aggressively for inside placement of the spread to facilitate ever more trades.

The system spun out of control in two ways. It created a computing arms race where firms focused on purchasing cutting edge technology that shaves microseconds off of calculation time. Firms with the deepest pockets could literally buy an advantage through their computing hardware over the average Joe.

More importantly, the system itself bred its own corruption. The ECNs grew addicted to the liquidity fees. The more trades that fired off, the more money they made. They naturally started catering to their most important clients.

How they did it, though, is what sickens me as a trader. The ECNs started creating order types that were effectively secret. They allowed high speed firms to jump in line over retail chumps using vanilla limit orders. The ECNs offered colocation access at exorbitant fees to give the machines an edge. They allowed the creation of dark liquidity where some players could literally hide orders for execution while others displayed theirs 100% of the time. It makes a complete mockery of the idea of a level playing field.

Artificial intelligence played a big role in how the algorithms operate. What encouraged me, however, was how Patterson chose to wrap up the book. Many of the funds covered near the end start out as relatively small fish working with various types of AI to build predictive trading systems. Their initial results appear encouraging.

One of our biggest projects here is to use various models of fractal markets to build an automated trading system on behalf of the client that I go visit in Ireland so often. Andy and I meet on a near daily basis to discuss our genetic algorithm and how best to encourage the network to behave as we want it to. We are about a month from running our first predictive tests with our in house model. Reading this book encourages me that we are blazing down the right path.

Bernanke Says Economic Data May Mask Individual Suffering

Bernanke didn’t address the outlook for monetary policy or the economy, or expand on the Fed’s Aug. 1 statement. His remarks, focused on economic measurement, will be delivered via prerecorded video.

The 58-year-old Fed chief, a former Princeton professor, said economists should “increase the attention paid to microeconomic data, which better capture the diversity of experience across households and firms.” Also, researchers should “seek better and more-direct measurements of economic well-being, the ultimate objective of our policy decisions.”

He said interesting projects include the Organization for Economic Co-operation and Development’s Better Life Initiative, which aims at measuring quality of life in different countries, and the Gross National Happiness index compiled by Bhutan.

EES: UUP: U.S. Dollar Long-Term Buy Of 2012

Since the Euro's existence, it has been debated by analysts that the U.S. Dollar is losing its place as the only reserve currency in the world. In other words, the age of U.S. Dollar hegemony was coming to an end. Central Banks such as Bank of Russia have started diversifying into reserve currencies other than the U.S. Dollar, most recently theAustralian Dollar. This is the effect of a global sentiment that the U.S. Dollar outlook is extremely bearish. A number of factors including low interest rates, a weakening U.S. economy, a perceived shift to emerging markets by multinational corporations, a rising China and India, and other factors, make the U.S. Dollar look weak-- especially with new choices such as the Euro (FXE), Chinese Renmimbi, and others.

http://seekingalpha.com/article/782881-uup-u-s-dollar-long-term-buy-of-2012

http://www.reddit.com/r/finance/comments/y1x8a/uup_us_dollar_longterm_buy_of_2012_seeking_alpha/

http://seekingalpha.com/article/782881-uup-u-s-dollar-long-term-buy-of-2012

http://www.reddit.com/r/finance/comments/y1x8a/uup_us_dollar_longterm_buy_of_2012_seeking_alpha/

Thursday, August 2, 2012

Knight Capital Group Inc. (KCG) trading algorithm error costs $440 Million, rattles markets

Knight Capital Group Inc. (KCG) has “all hands on deck” and is in close contact with clients and counterparties as it tries to weather trading errors that cost it $440 million, Chief Executive Officer Thomas Joyce said.

Joyce said it’s “hard to comment” on discussions with creditors as Knight stock extended a two-day plunge to 70 percent and the firm explored strategic and financial alternatives following a loss almost four times its annual profit. The problems were triggered by what Joyce called “a bug, but a large bug” in software as the company, one of the largest U.S. market makers, prepared to trade with a New York Stock Exchange program catering to individual investors.

Knight Capital Group Inc. (KCG) said losses from yesterday’s trading breakdown are $440 million, almost quadruple its 2011 net income and more than some analysts had estimated, and the firm is exploring strategic and financial alternatives. Its stock has lost 66 percent in two days.

Knight said it will continue its trading and market-making today as it considers its options. Yesterday’s issue was related to the installation of trading software and resulted in the company sending “numerous erroneous orders,” the Jersey City, New Jersey-based firm said today. The stock tumbled 50 percent to $3.46 at 9:36 a.m. New York time today.

Wednesday, August 1, 2012

Asia's Rich fire their money managers, bankers

Clinton Ang, the grandson of a gunny- sack seller who emigrated last century from China to Singapore, oversees a fortune valued at almost $80 million for himself and three siblings.

That makes him a target for wealth managers in Singapore, the private-banking capital of Asia. Yet the 39-year-old managing director of Hock Tong Bee Pte, which evolved from his grandfather’s sacks and foodstuff supplier into a purveyor of $6,000 Grand Cru wines, has already fired two bankers and prefers mostly to manage the money himself.

“I am very open to private banks for their propositions, but I want them to be relevant,” said Ang, who’s cut the amount of his family’s money managed by professionals to less than 5 percent from 25 percent three years ago. “We felt we could do better ourselves.”

Disillusionment with investment products and returns has made Asian millionaires such as Ang take greater control of their wealth than rich Europeans. Managers at Credit Suisse Group AG (CSGN), Citigroup Inc. and other banks in Asia have full discretion over clients’ portfolios for just 4 percent of assets under management, according to a June report from Boston Consulting Group. That’s down from 7 percent in 2006. In Europe, it’s 23 percent, rising from 18 percent six years ago.

“Asia’s wealthy lost a lot of trust in their private banks and private bankers during the 2008 financial crisis,” said Peter Damisch, a Zurich-based BCG partner and managing director who co-authored the report.

Subscribe to:

Comments (Atom)