Sunday, September 16, 2012

Swiss banks seek new model as secrecy gone

With their long-cherished secrecy practices increasingly under attack, Swiss banks are scrambling for a new way to attract wealthy foreign clients.

Saturday, September 15, 2012

Japan Hints at Possible Yen Intervention

The yen tumbled as Japan looked increasingly likely to intervene to weaken its currency, which had soared to a seven-month high against the dollar earlier this week.

Japanese Finance Minister Jun Azumi strongly hinted Friday that market intervention to tackle the strong yen may be imminent and urged the Bank of Japan to act, as the currency's strength increasingly threatens to worsen the country's economic slowdown.

The dollar traded ¥78.36 Friday afternoon in New York, up from ¥77.49 late Thursday, its strongest close since Feb. 8, and the seven-month low of ¥77.13 earlier that day. Traders with Citigroup said the dollar began to rise and the yen to fall Thursday after the Bank of Japan inquired with market participants about trading activity in the yen, a move known in the market as a rate check and which can serve as a final warning before an intervention. Japan last intervened in the market in October, when the dollar traded as low as ¥75.31.

http://online.wsj.com/article/SB10000872396390444709004577650632272233176.html

TOKYO—A Japanese ruling-party heavyweight said the government must intervene in the currency markets if the yen's rise accelerates sharply, adding to the level of jawboning aimed at controlling the currency's moves and its impact on the economy.

"It will be imperative for [the government] to take steps such as intervention," if the yen surges to threaten Japan's export-reliant economy, Hirohisa Fujii, a former finance minister and current tax policy chief of the ruling Democratic Party of Japan, said in an interview Wednesday.

"I believe that the yen's current high levels are out of line with the real economy," he said

http://online.wsj.com/article/SB10001424052702303879604577407743768560590.html

US cannot continue the endless sugar rush

America’s central bank is to launch a third round of “quantitative easing”, Fed chairman, Ben Bernanke, announced, while extending the length of its pledge to keep interest rates at rock-bottom. On cue, global equities surged, as confidence grew that the world’s leading central banks have “finally taken decisive action” to buttress both the US and European economies.

Bernanke’s move, of course, followed news in early September that the European Central Bank is to engage in “unlimited” buying of the sovereign bonds of “peripheral” eurozone members. This encouraged the belief that monetary union is less likely to crumble, which cheered up global equity markets just before last weekend.

Many traders are celebrating this weekend too, following Bernanke’s words on Thursday, which caused the S&P 500 to extend a rise that has now pushed the index to its highest level since 2007. European shares also reached highs not seen for over a year.

Specifically, Bernanke said that rather than buying US Treasuries, this round of QE will focus on mortgage-backed securities (MBS) – financial instruments linked to bundles of loans previously extended to home-buyers.

Friday, September 14, 2012

US Credit rating cut to AA - as Fed increases QE

Ratings firm Egan-Jones cut its credit rating on the U.S. government to "AA-" from "AA," citing its opinion that quantitative easing from the Federal Reserve would hurt the U.S. economy and the country's credit quality.

http://www.cnbc.com/id/49037337

http://www.marketoracle.co.uk/Article36525.html

The Fed’s launch of QE3 looks more than a tad desperate. If you believe the central premise of the Fed’s action, that propping up asset price gains would have enough effect on consumptions to lift the economy out of stall speed, it would seem logical to sit back a bit and let the recent stock market rally and the (supposed) housing market recovery do their trick. But the Fed has finally taken note of the worsening state of the job creation in an already lousy employment market and has decided it needed to Do Something More.

Read more at http://www.nakedcapitalism.com/2012/09/the-feds-qe3-no-exit.html#Gv1iHbCxHdDBXjPh.99

http://www.cnbc.com/id/49037337

Perma-QE: Lessons from Bernanke's Latest Splurge

http://www.marketoracle.co.uk/Article36525.html

The Fed’s launch of QE3 looks more than a tad desperate. If you believe the central premise of the Fed’s action, that propping up asset price gains would have enough effect on consumptions to lift the economy out of stall speed, it would seem logical to sit back a bit and let the recent stock market rally and the (supposed) housing market recovery do their trick. But the Fed has finally taken note of the worsening state of the job creation in an already lousy employment market and has decided it needed to Do Something More.

Read more at http://www.nakedcapitalism.com/2012/09/the-feds-qe3-no-exit.html#Gv1iHbCxHdDBXjPh.99

Global stock markets have risen after the US Federal Reserve moved to kick-start recovery by pumping more money into the economy.

It followed the Fed's decision on Thursday to inject $40bn (£25bn) a month into the US economy.

Wednesday, September 12, 2012

Complex Systems Theorists predict global riots in one year

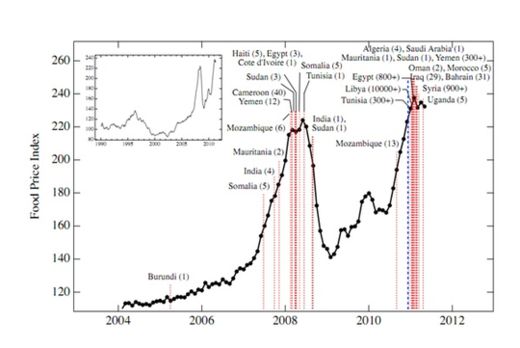

What's the number one reason we riot? The plausible, justifiable motivations of trampled-upon humanfolk to fight back are many - poverty, oppression, disenfranchisement, etc - but the big one is more primal than any of the above. It's hunger, plain and simple. If there's a single factor that reliably sparks social unrest, it's food becoming too scarce or too expensive. So argues a group of complex systems theorists in Cambridge, and it makes sense.

In a 2011 paper, researchers at the Complex Systems Institute unveiled a model that accurately explained why the waves of unrest that swept the world in 2008 and 2011 crashed when they did. The number one determinant was soaring food prices. Their model identified a precise threshold for global food prices that, if breached, would lead to worldwide unrest.

The MIT Technology Review explains how CSI's model works: "The evidence comes from two sources. The first is data gathered by the United Nations that plots the price of food against time, the so-called food price index of the Food and Agriculture Organisation of the UN. The second is the date of riots around the world, whatever their cause." Plot the data, and it looks like this:

In a 2011 paper, researchers at the Complex Systems Institute unveiled a model that accurately explained why the waves of unrest that swept the world in 2008 and 2011 crashed when they did. The number one determinant was soaring food prices. Their model identified a precise threshold for global food prices that, if breached, would lead to worldwide unrest.

The MIT Technology Review explains how CSI's model works: "The evidence comes from two sources. The first is data gathered by the United Nations that plots the price of food against time, the so-called food price index of the Food and Agriculture Organisation of the UN. The second is the date of riots around the world, whatever their cause." Plot the data, and it looks like this:

Germany Can Ratify ESM Fund With Conditions, Court Rules

Germany’s top constitutional court rejected efforts to block a permanent euro-area rescue fund, handing a victory to Chancellor Angela Merkel, who championed the 500 billion-euro ($645 billion) bailout.

http://www.bloomberg.com/news/2012-09-12/germany-can-ratify-esm-bailout-fund-with-conditions-court-rules.html

http://www.bloomberg.com/news/2012-09-12/germany-can-ratify-esm-bailout-fund-with-conditions-court-rules.html

Saturday, September 8, 2012

EES: Short-Term Euro To Breakout Higher, Then Its Time To Short

Based on the financial crisis in Europe, we wrote an article about a euro shorting opportunity, "Sell the euro on spikes." On Friday, the euro (FXE) reached recent highs above $1.28. This is clearly a spike. However, the euro may be in for a short-term rally, so traders should wait until the momentum subsides before shorting. It seems the spike is not over.

http://seekingalpha.com/article/854961-short-term-euro-to-breakout-higher-then-its-time-to-short

http://seekingalpha.com/article/854961-short-term-euro-to-breakout-higher-then-its-time-to-short

Friday, September 7, 2012

EUR/USD nears 1.28 on ECB bond buying program

FXstreet.com (San Francisco) - The Euro has accelerated in the last hour against the Dollar and following the US employment data the EUR/USD has jumped around 100 pips from 1.2685 to reach highest level since May 22nd at 1.2775.

http://www.fxstreet.com/news/forex-news/article.aspx?storyid=66e94ca2-c527-48a4-b1f0-65243a38740e

The euro has strengthened to a two-month high against the US dollar, as the European Central Bank's bond-buying plans continued to please the markets... http://www.bbc.co.uk/news/business-19516323

http://www.fxstreet.com/news/forex-news/article.aspx?storyid=66e94ca2-c527-48a4-b1f0-65243a38740e

The euro has strengthened to a two-month high against the US dollar, as the European Central Bank's bond-buying plans continued to please the markets... http://www.bbc.co.uk/news/business-19516323

Since there have been tens of thousands of lawsuits filed internally in Germany with its constitutional court alleging the ESM is illegal, it was only a matter of time before the Germans decided to sue the ECB as well for its "unlimited" bond buying. The time has arrived. From Bloomberg:

- TILLICH SUPPORTS LEGAL STEPS AGAINST ECB BOND BUYING: WELT

- TILLICH SAYS ECB BOND BUYING SIGNALS EFSF, ESM NOT ENOUGH: WELT

- TILLICH: ECB MANDATE SHOULD NOT INCL. UNLIMIT. BOND BUYING:WELT

Perhaps all those rumors of the Bundesbank's death were, as we expected, rather exaggerated.

Thursday, September 6, 2012

EUR/CHF breaks away from 1.20 peg

FXstreet.com (Barcelona) - EUR/CHF is currently moving higher printing fresh 3-month highs at 1.2058, last at 1.2054, a +0.36% higher from previous Asia-Pacific open yesterday, on the back of mounting rumors of SNB rising the peg to 1.22 in the first place.

According to Commerzbank's strategist Peter Kinsella , as reported by Clare Connaghan for DowJones: "ECB bond purchasing basically removes tail risk of a euro-zone breakup," the analyst says, as reflection of previous Franc strength based on fears of a euro area breakup. Rising the peg could bring many positive effects for Switzerland, but according to Citi, it could also bring extra risks as the foreign currency reserves might reach as high as 100% of its GDP, making the country very vulnerable to Euro exposure in case can't be able to sustain the peg, reported Ira Iosebashvili for DowJones.

Immediate resistance to the upside for EUR/CHF comes at recent session and 3-month highs at 1.2058, followed by March 27 highs at 1.2069, and May 24 highs at 1.2075. For the downside, nearest term support shows at yesterday's highs 1.2046, followed by Feb 27 lows/June 29 highs at 1.2038, and Aug 02 highs at 1.2029.

http://www.fxstreet.com/news/forex-news/article.aspx?storyid=ebaa98d8-19b6-43dd-93dc-e6df7b16733f

http://seekingalpha.com/article/816681-is-the-snb-going-to-unpeg-the-eur-chf

According to Commerzbank's strategist Peter Kinsella , as reported by Clare Connaghan for DowJones: "ECB bond purchasing basically removes tail risk of a euro-zone breakup," the analyst says, as reflection of previous Franc strength based on fears of a euro area breakup. Rising the peg could bring many positive effects for Switzerland, but according to Citi, it could also bring extra risks as the foreign currency reserves might reach as high as 100% of its GDP, making the country very vulnerable to Euro exposure in case can't be able to sustain the peg, reported Ira Iosebashvili for DowJones.

Immediate resistance to the upside for EUR/CHF comes at recent session and 3-month highs at 1.2058, followed by March 27 highs at 1.2069, and May 24 highs at 1.2075. For the downside, nearest term support shows at yesterday's highs 1.2046, followed by Feb 27 lows/June 29 highs at 1.2038, and Aug 02 highs at 1.2029.

http://www.fxstreet.com/news/forex-news/article.aspx?storyid=ebaa98d8-19b6-43dd-93dc-e6df7b16733f

http://seekingalpha.com/article/816681-is-the-snb-going-to-unpeg-the-eur-chf

Tuesday, September 4, 2012

EES: Europe's problems much deeper than Euro currency

While traders are bearish on the euro we need to remember the greater context of Europe and the origins of the euro currency. The euro as an economic union was built on a similar U.S. model, that of a Federal State comprised of individual "united" states. However, Europe is much different than the U.S. historically, demographically, and geopolitically.

http://seekingalpha.com/article/845531-europe-s-crisis-much-deeper-than-euro-currency

http://seekingalpha.com/article/845531-europe-s-crisis-much-deeper-than-euro-currency

Moody’s Changes Euro Zone Rating Outlook to ‘Negative’

Moody's Investors Service has changed its outlook on the Aaa rating of the European Union to “negative,” warning it might downgrade the bloc if it decides to cut the ratings on the EU's four biggest budget backers: Germany, France, the U.K., and the Netherlands.

http://www.cnbc.com/id/48888752

http://www.cnbc.com/id/48888752

Spaniards Pull Out Their Cash and Get Out of Spain

After working six years as a senior executive for a multinational payroll-processing company in Barcelona, Spain, Mr. Vildosola is cutting his professional and financial ties with his troubled homeland. He has moved his family to a village near Cambridge, England, where he will take the reins at a small software company, and he has transferred his savings from Spanish banks to British banks.

“The macro situation in Spain is getting worse and worse,” Mr. Vildosola, 38, said last week just hours before boarding a plane to London with his wife and two small children. “There is just too much risk. Spain is going to be next after Greece, and I just don’t want to end up holding devalued pesetas.”

Monday, September 3, 2012

Eurozone manufacturing PMI falls again in August

Manufacturing output across the 17-country eurozone shrank again in August, according to a widely-watched survey.

The Purchasing Managers Index (PMI) showed the region's manufacturing sector contracted despite factories cutting prices.

Markit's final PMI was 45.1, above July's three-year low of 44.0.

However, the figure was the 13th month in a row that it was below the 50 mark that indicates growth.

The latest figures from China showed its manufacturing activity fell, too, to a nine-month low in August, adding to fears that its economy is slowing faster than estimated.

China's PMI fell to 49.2, the lowest reading since November 2011.

Meanwhile, in the UK, the downturn in manufacturing unexpectedly eased last month as domestic orders boosted output, with its PMI rising to a four-month high of 49.5 in August from a downwardly revised 45.2 in July.

Subscribe to:

Comments (Atom)