Monday, October 1, 2012

China shows more signs of slowing down

Sunday, September 30, 2012

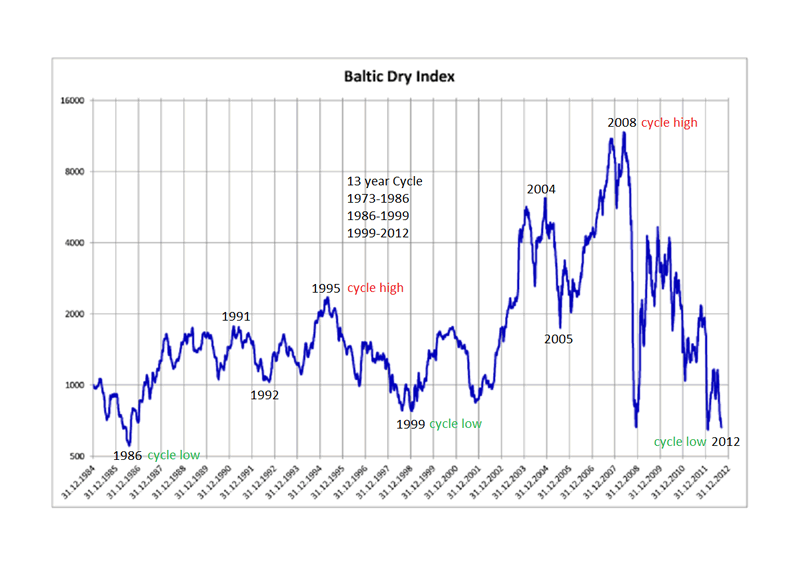

Baltic Dry Index near all time low

http://www.marketoracle.co.uk/images/2012/Sept/baltic_dry_index-1985.png

http://en.wikipedia.org/wiki/Baltic_Dry_Index Most directly, the index measures the demand for shipping capacity versus the supply of dry bulk carriers. The demand for shipping varies with the amount of cargo that is being traded or moved in various markets (supply and demand).

Friday, September 28, 2012

The end of the euro’s Indian summer

THE sugar-rush brought on by the European Central Bank’s pledge to intervene in bond markets to help troubled euro-zone countries—some diplomats call it “Mario Draghi’s ice cream”—was bound to fade at some point. But nobody expected it to fade quite so suddenly this week.

http://www.economist.com/node/21563774/print

At some point, it will get the balance wrong. And then either Spain will be forced out of the euro. Or the Germans will walk. http://blogs.wsj.com/eurocrisis/2012/09/28/europes-never-ending-crisis/tab/print/

Thursday, September 27, 2012

Listen to EES on Traders Radio Network Friday Sept 28th 3pm EST

THE TRADERS NETWORK

BROADCAST LIVE - WEEKDAYS AT 1PM

CLEAR CHANNEL - KFXR/1190-AM - DALLAS

From the fast action of the trading pit...to the power brokers making the headlines...Michael Yorba interviews the front-page Titans about the latest in trading tools and market trends. Learn how the experts use risk management techniques to build fully diversified portfolios. It's a fast moving, high energy show that presents stocks, commodities, bonds, forex and derivatives in a new light and keeps investors asking for more...

The Traders Network stays ahead of the curve by featuring leading market and business professionals, sophisticated technology, and the analytics needed to identify the most lucrative investment strategies.

Successful performance depends on finding the right opportunities.

So...Shift your thinking and join us as we deliver “tomorrow’s trade today” on The Traders Network weekdays from 1-3pm on KFXR/1190-AM.

Tune in tomorrow at 3pm EST

http://www.yorbamedia.com/radio Instructions

Click here to listen live now

EES page on Yorba TV http://yorbatv.ning.com/profile/eliteeservices

Wednesday, September 26, 2012

Social unrest in Spain, fears of Catalonia secession

Study Reveals Germans Less Confident than they Seem

http://www.spiegel.de/international/germany/study-reveals-germans-less-confident-than-they-seem-a-857918.html

Tuesday, September 25, 2012

German High-Frequency Bill to Affect Hedge Funds, Official Says

http://www.bloomberg.com/news/2012-09-25/german-high-frequency-bill-to-affect-hedge-funds-official-says.html

Monday, September 24, 2012

EES: Has the Euro Peaked

http://seekingalpha.com/article/881041-has-the-euro-peaked

Bankers among the least trusted, says Which?

Which? said that recent banking scandals meant there was an urgent need for a "fundamental change" in banking culture and practice.

An industry body said that there was a commitment for change among banks.

Which? conducted a survey of 2,060 people, asking how much they trusted various professions. Nurses, doctors and teachers were the most trusted, with bankers, journalists and politicians in the bottom three.

The consumer group said that bankers should comply with a code of conduct or be struck off. They should also be punished for mis-selling, with bonuses clawed back.

http://www.bbc.co.uk/news/business-19639795?print=true

Friday, September 21, 2012

System Expectations

I found myself outside today looking for an excuse to make a video. It's 80°F / 27°C, sunny skies and a soft breeze in Dallas. The last place anyone wants to be is in front of the computer when the weather is this nice.

No doubt that some active daytraders or people that hate their jobs are thinking the same thing. I suspect that the motivation for most people making automated expert advisors is the dream of making money without doing anything. Turn on the software and wait for the trading profits to roll in. That was certainly the case with the company Forex Made Sleazy... I mean, Forex Made Easy several years ago.

We do have a handful of customers that trade profitably, but even then, it takes a long time for an automated system to get to the point where it's largely hands off. The best conceived ideas, which I would define as plausibly worthy of my own investment funds, takes a bare minimum of several months to execute from start to finish. This also presumes the unlikely notion that the idea has genuine potential to start with.

Even the most simple, valid concepts encounter substantial setbacks before the system can truly run hands-free. It's usually not some kind of epic programming disaster where the client wants black and the programmer makes white. Don't get me wrong; communication is critical. The smoothest projects are always the ones where both parties understand one another readily.

Nonetheless, even the most well-oiled team experiences countless hiccups in the process of morphing from idea to reality. Simple ideas often fall the most vulnerable to real world problems. Trade execution stands out as the most common obstacle. If anything goes remotely unexpected, a potentially profitable scenario may lead to unexpected losses.

I worked with one client that came up with a simple idea that mathematically showed a heavy positive expectation. Yet when we launched the idea in the real world, the prices that the system absolutely required in order to function never came through. Slippage occurred precisely when it was the most damaging.

We had to go back to the drawing board looking for ways to re-engineer the expert advisor where the importance of execution declined. That setback alone took several months to overcome in any meaningful sense.

The take away here is that it's totally unreasonable to expect to hire a forex programmer and expect a dramatic shift in profits and life style. The best ideas take several months before they are worthy of running their full account balance. Unfortunately, most of the ideas out there are not good to begin with. That's why making an EA that is profitable over the long run is so incredibly difficult.

Deutche Bank: Gold is Money

http://www.zerohedge.com/contributed/2012-09-19/deutsche-bank-gold-money

Intercontinental Exchange, the US futures exchange group, has followed rival CME Group by allowing its European clearing house to accept gold bullion as collateral for transactions.

When World War I broke out in 1914. The banks suspended redemption of gold for paper money. This broke their contracts, but the governments all ratified this action. Then the governments had their central banks confiscate the gold that had been stored in the vaults of the commercial banks.

Wednesday, September 19, 2012

Coin mintage collapsed the Roman Empire. Is history repeating itself?

In the third century AD, the Roman Empire went through a hard period, know as the “military crisis”. This period is characterized by political problems, such as the violent death of the emperors and their family, caused by revolts, plots and military uprisings, military problems caused by the invasion of the empire by the barbarian populations such as the Goths and economic problems such as the lack of production, the decrease of the population, famine in some cases and inflation.

http://www.coins-auctioned.com/docs/coin-articles/coin-mintage-collapsed-the-roman-empire-is-history-repeating-itself

Tuesday, September 18, 2012

EES: QE3 to start new US Dollar Carry Trade

http://seekingalpha.com/article/872541-qe3-to-start-new-u-s-dollar-carry-trade

Monday, September 17, 2012

EES: Competitive Devaluation of Currencies via QE3

http://seekingalpha.com/article/870971-competitive-devaluation-of-currencies-what-qe3-means-for-forex