When the U.S. Dollar Index peaked at 120.51 in January of 2002, few suspected that it was on the brink of a one-directional correction that would ultimately erase a third of its value. In fact, in just three short years, the dollar index shed, on average, a point a month before ultimately hitting a low of 80.77 in January of 2005. This sharp decline in the dollar index coincided with, and largely fueled, the first few years of the now decade-old bull market in gold.

http://www.marketoracle.co.uk/Article37053.html

Thursday, October 18, 2012

Monday, October 15, 2012

EES: US Dollar Carry Trade Portfolio

This article will explain how to take advantage of the Fed's QE Infinity policy. It assumes that over the long run, the USD will decline most significantly against emerging market and high interest yield currencies. We will explore a few options how to execute this model U.S. Dollar carry trade portfolio.

Read More: http://seekingalpha.com/article/924091-usd-carry-trade-portfolio

Read More: http://seekingalpha.com/article/924091-usd-carry-trade-portfolio

Friday, October 12, 2012

The Inflation Monster

Germany's central bank, the Bundesbank, has established a museum devoted to money next to its headquarters in Frankfurt. It includes displays of Brutus coins from the Roman era to commemorate the murder of Julius Caesar, as well as a 14th-century Chinese kuan banknote. There is one central message that the country's monetary watchdogs seek to convey with the exhibit: Only stable money is good money. And confidence is needed in order to create that good money.

The confidence of visitors, however, is seriously shaken in the museum shop, just before the exit, where, for €8.95 ($11.65) they can buy a quarter of a million euros, shredded into tiny pieces and sealed into plastic. It's meant as a gag gift, but the sight of this stack of colorful bits of currency could lead some to arrive at a simple and disturbing conclusion: A banknote is essentially nothing more than a piece of printed paper.

It has been years since Germans harbored the kind of substantial doubts about the value of their currency that they have today in the midst of the debt crisis. A poll conducted in September by Faktenkontor, a consulting company, and the market research firm Toluna, found that one in four Germans is already trying to protect his or her assets from the threat of inflation by investing in material assets, for example.

http://www.spiegel.de/international/europe/how-central-banks-are-threatening-the-savings-of-normal-germans-a-860021-druck.html

The confidence of visitors, however, is seriously shaken in the museum shop, just before the exit, where, for €8.95 ($11.65) they can buy a quarter of a million euros, shredded into tiny pieces and sealed into plastic. It's meant as a gag gift, but the sight of this stack of colorful bits of currency could lead some to arrive at a simple and disturbing conclusion: A banknote is essentially nothing more than a piece of printed paper.

It has been years since Germans harbored the kind of substantial doubts about the value of their currency that they have today in the midst of the debt crisis. A poll conducted in September by Faktenkontor, a consulting company, and the market research firm Toluna, found that one in four Germans is already trying to protect his or her assets from the threat of inflation by investing in material assets, for example.

http://www.spiegel.de/international/europe/how-central-banks-are-threatening-the-savings-of-normal-germans-a-860021-druck.html

Wednesday, October 10, 2012

Global financial risks have increased, says IMF

Risks to global financial stability

have increased in the past six months despite efforts by policymakers to make

the financial system safer, according to the International Monetary Fund.

It said little progress had been made in making the system more transparent

and less complex, and that confidence in it had become "very fragile".http://www.bbc.co.uk/news/business-19888996?print=true

Monday, October 8, 2012

Mysterious Algorithm Was 4% of Trading Activity Last Week

A single mysterious computer program that placed orders — and then subsequently canceled them — made up 4 percent of all quote traffic in the U.S. stock market last week, according to the top tracker of high-frequency trading activity. The motive of the algorithm is still unclear.

The program placed orders in 25-millisecond bursts involving about 500 stocks, according to Nanex, a market data firm. The algorithm never executed a single trade, and it abruptly ended at about 10:30 a.m. Friday.

BUSTED: Mario Draghi And ECB VP Caught On Microphone Joking About Whether Their Words Will Move Markets

At the conclusion of the Q&A following last week's ECB press conference, ECB president Mario Draghi and vice president Vítor Constâncio forgot to mute their mics before sharing the following exchange:

- Draghi: "Well, I don't think, there shouldn't be any market reaction."

- Constancio: "No, no."

- Draghi: "I guess, no? If there is, I don't know what to say."

- Constancio: "No, no."

- Draghi: "It's more boring..."

- Constancio: "No, markets were not expecting much…"

- Draghi: "Ok."

Trust them – they know what they're doing.

Read more: http://www.businessinsider.com/mario-draghi-ecb-live-microphone-2012-10#ixzz28jty9qsQ

Spending Cuts No Longer Yield Earnings Growth for U.S. Companies

Profit gains earned through job cuts and factory closings in the absence of a global economic recovery are starting to reach their limit.

Third-quarter profits and sales for the Standard & Poor’s 500 Index (SPX) probably fell in unison for the first time in three years, according to analysts’ estimates compiled by Bloomberg. Per-share earnings may have dropped 1.7 percent on average after they were little changed in the second quarter. Sales may have slipped 0.6 percent, the data show.

While most companies plan to keep a lid on spending, lower expenses aren’t leading to the same kinds of increases they reported earlier this year. Hewlett-Packard (HPQ) Co., the world’s largest personal-computer maker, already forecast full-year profit that trailed analysts’ estimates, FedEx Corp. (FDX) cut its annual earnings forecast and Intel Corp. (INTC) projected lower third- quarter sales, with all three citing softening demand.

“A lot of the earnings growth that we’ve seen has been related to cost reductions,” said Peter Jankovskis, co-chief investment officer for Oakbrook Investments in Lisle, Illinois, which manages more than $3 billion. “Now many of those cost reduction efforts have run their course. Without revenue growth, there is no room for profit to expand further.”

Alcoa Inc. (AA), the largest U.S. aluminum maker, kicks off the third-quarter earnings season tomorrow and is projected by analysts to report a 13 percent drop in sales, the biggest drop in three years, on plunging prices for the commodity. That may wipe out per-share earnings, according to estimates.

Friday, October 5, 2012

Jack Welch says White House manipulates data, Krueger admits

Former General Electric Co. (GE) Chief Executive Officer Jack Welch, writing on his Twitter account, accused the Obama administration of manipulating U.S. employment data for political advantage.

http://www.bloomberg.com/news/2012-10-05/former-ge-ceo-jack-welch-says-white-house-manipulates-jobs-data.html

“No serious person would question the integrity of the Bureau of Labor Statistics,” Krueger said in the Bloomberg Television interview. “These numbers are put together by career employees. They use the same process every month. So I think comments like that are irresponsible.”

http://www.bloomberg.com/news/2012-10-05/former-ge-ceo-jack-welch-says-white-house-manipulates-jobs-data.html

“No serious person would question the integrity of the Bureau of Labor Statistics,” Krueger said in the Bloomberg Television interview. “These numbers are put together by career employees. They use the same process every month. So I think comments like that are irresponsible.”

Wednesday, October 3, 2012

Forex volume slows first time in 6 years

Growth is slowing down for the first time in six years, according to a report prepared by analyst Sreekrishna Sankar.

Despite a widespread shift to electronic trading in the past decade and the emergence of technical platforms that cater to institutions, near-zero interest rates and fears of recession in many parts of world are causing banks and asset managers to pull back from foreign exchange trading.

The result: Volume is at $4.3 trillion a day this year, down from peak of $4.7 trillion in October, Celent says.

This remains above 2010 levels. But the only country where volumes are up is the United States, which is showing what Celent calls a “minimal increase.” All other parts of the world are showing a drop in volume from 2011.

Economic crises in Eurpe and elsewhere are slowing FX growth. The biggest drop is in spot markets, Celex said. That is where investors had begun to treat foreign currencies as a new asset class, representative of the strength of different economies.

http://www.tradersmagazine.com/news/institutions-pull-back-from-fx-trading-110369-1.html

Black market currency traders fight riot police in Tehran as rial drops by 40 percent

TEHRAN — Clashes and at least one spontaneous protest erupted in Tehran on Wednesday over the plunging value of Iran’s currency, as black-market money-changers fought with riot police who were dispatched to shut them down, and hundreds of angry citizens demonstrated near the capital’s sprawling merchant bazaar, where many shops had closed for the day. The official media reported an unspecified number of arrests including two Europeans.

http://www.reuters.com/article/2012/09/28/us-cftc-positionlimits-idUSBRE88R1C120120928

http://www.reuters.com/article/2012/09/28/us-cftc-positionlimits-idUSBRE88R1C120120928

Tuesday, October 2, 2012

U.S. Leads in High-Frequency Trading, Trails in Rules

Given the missteps that have prolonged and deepened the European debt crisis, one wouldn’t necessarily expect the continent to be home to far-sighted financial reform. But that is exactly what seems to be happening in the realm of high-frequency, computer-driven trading.

High-speed trading comes with real benefits: lower trading expenses, better prices for investors and increased market liquidity. The costs, however, are fairly significant and can be seen in wild volatility and destabilizing trading snafus.

The U.S. Securities and Exchange Commission, stung by criticism that it lacks the knowledge to analyze the computerized trading that has come to dominate American stock markets, is planning to catch up.

Initiatives to increase the breadth of data received from exchanges and to record orders from origination to execution are at the center of the effort. Gregg Berman, who holds a doctorate in physics from Princeton University, will head the commission’s planned office of analytics and research.

High frequency trading, which some consider the root of all evil in today’s markets, may be on the verge of new regulations that could help avert future catastrophe. The problem is the potential new rules may not solve all of the market’s problems.

At least that’s what Larry Tabb, founder and CEO of the research firm Tabb Group, concludes in prepared commentary ahead of today’s roundtable discussion between the Securities and Exchange Commission and several companies within the industry. High frequency trading is often characterized as the use of supercomputers by sophisticated trading outfits to jump rapidly in and out of markets.

Monday, October 1, 2012

China shows more signs of slowing down

HONG KONG (CNNMoney) -- Activity in China's factory sector continued to slide last month, bringing more bad news for the country's political class as they prepare for a once-a-decade leadership transition.

The Chinese government said Monday that its official manufacturing index hit 49.8 in September, up from 49.2 in August. Any reading below 50 indicates that factory activity is shrinking rather than growing.

Sunday, September 30, 2012

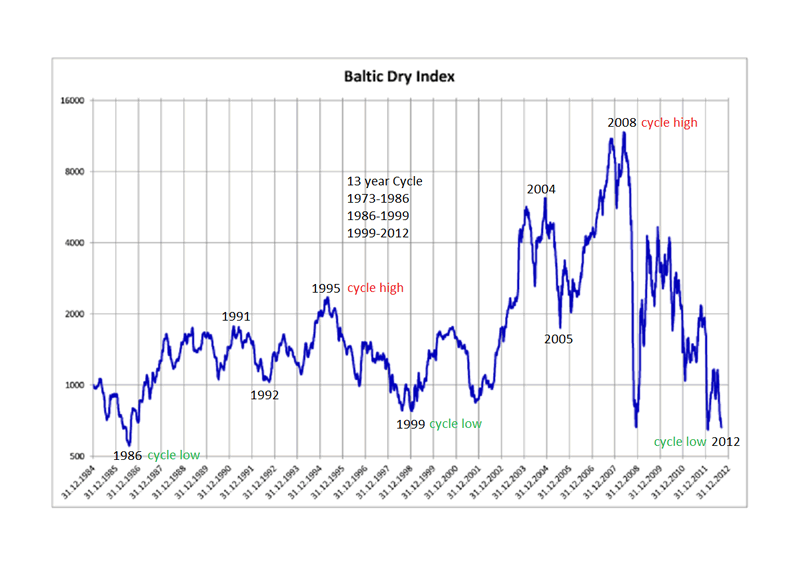

Baltic Dry Index near all time low

http://www.marketoracle.co.uk/images/2012/Sept/baltic_dry_index-1985.png

http://en.wikipedia.org/wiki/Baltic_Dry_Index Most directly, the index measures the demand for shipping capacity versus the supply of dry bulk carriers. The demand for shipping varies with the amount of cargo that is being traded or moved in various markets (supply and demand).

The supply of cargo ships is generally both tight and inelastic—it takes two years to build a new ship, and ships are too expensive to take out of circulation the way airlines park unneeded jets in deserts. So, marginal increases in demand can push the index higher quickly, and marginal demand decreases can cause the index to fall rapidly. e.g. "if you have 100 ships competing for 99 cargoes, rates go down, whereas if you've 99 ships competing for 100 cargoes, rates go up. In other words, small fleet changes and logistical matters can crash rates..."[5] The index indirectly measures global supply and demand for the commodities shipped aboard dry bulk carriers, such as building materials, coal,metallic ores, and grains.

Because dry bulk primarily consists of materials that function as raw material inputs to the production of intermediate or finished goods, such as concrete, electricity, steel, and food, the index is also seen as an efficient economic indicator of future economic growth and production. The BDI is termed a leading economic indicator because it predicts future economic activity.[6]

Friday, September 28, 2012

The end of the euro’s Indian summer

THE sugar-rush brought on by the European Central Bank’s pledge to intervene in bond markets to help troubled euro-zone countries—some diplomats call it “Mario Draghi’s ice cream”—was bound to fade at some point. But nobody expected it to fade quite so suddenly this week.

http://www.economist.com/node/21563774/print

At some point, it will get the balance wrong. And then either Spain will be forced out of the euro. Or the Germans will walk. http://blogs.wsj.com/eurocrisis/2012/09/28/europes-never-ending-crisis/tab/print/

Thursday, September 27, 2012

Listen to EES on Traders Radio Network Friday Sept 28th 3pm EST

THE TRADERS NETWORK

BROADCAST LIVE - WEEKDAYS AT 1PM

CLEAR CHANNEL - KFXR/1190-AM - DALLAS

From the fast action of the trading pit...to the power brokers making the headlines...Michael Yorba interviews the front-page Titans about the latest in trading tools and market trends. Learn how the experts use risk management techniques to build fully diversified portfolios. It's a fast moving, high energy show that presents stocks, commodities, bonds, forex and derivatives in a new light and keeps investors asking for more...

The Traders Network stays ahead of the curve by featuring leading market and business professionals, sophisticated technology, and the analytics needed to identify the most lucrative investment strategies.

Successful performance depends on finding the right opportunities.

So...Shift your thinking and join us as we deliver “tomorrow’s trade today” on The Traders Network weekdays from 1-3pm on KFXR/1190-AM.

Tune in tomorrow at 3pm EST

http://www.yorbamedia.com/radio Instructions

Click here to listen live now

EES page on Yorba TV http://yorbatv.ning.com/profile/eliteeservices

Subscribe to:

Posts (Atom)