(Eliteeservices.net) - 10/10/2017 Dover, DE -- Elite E Services, a FinTech virtual corporation in the Currency business for 15 years, has today published a digital book about Bitcoin and the Blockchain entitled "Splitting Bits : Understanding Bitcoin and the Blockchain" available on Kindle exclusively, for $2.99 digitally. Get it now from www.pleaseorderit.com

With the world of Bitcoin and Blockchain moving faster than ever, EES felt an urgent need to research this Currency niche and publish our findings in a book. Bitcoin is a Currency, and EES has been in the Currency management business for 15 years. What we learned is fascinating, that Bitcoin isn't just a 'fad' but quite the opposite - Blockchain technology seems that soon it will be used everywhere. Get it now from www.pleaseorderit.com

Book Description:

Splitting Bits takes the Bit World of Bitcoin and the Blockchain and splits it into bite sized pieces for your digestion pleasure. We explain Bitcoin for what it is - a digital currency, not so different from fiat currencies such as the Euro or Yen. Splitting Bits is the natural sequel to Splitting Pennies - Understanding Forex. A new Bit Paradigm has begun and the computer arms race to mine and hash and mint your own coin is important for everyone to understand. Blockchain is the most explosive, potent technology ever which is about to change the world, starting with Wall St. Bitcoin may be a 'fad' but the underlying Distributed Ledger Technology (DLT) is the new standard in Currency Trading, Banking, Securities, and new markets yet to be created. Old systems will be renovated and re-invented. Blockchain is spreading faster than a virus around the world where soon a "Kodak Moment" will make businesses obsolete (such as when Smartphones make Kodak irrelevant). If you're feeling as you missed the opportunity to make 500,000% return by not buying some Bitcoin in 2011, now is an even greater opportunity - as we explain in this book. Bitcoin isn't actually going up in price, it's the US Dollar going down - there is a limited supply of Bitcoin, but the supply of US Dollar is unlimited. If you want to integrate Bitcoin for your business, Splitting Bits is your practical guide to simple steps of how you can accept Bitcoin payments and manage the risk of a volatile currency. For traders and investors, we explore the markets as they exist now and what the short term future holds. Splitting Bits has something for everyone, including our own proprietary Better Coin - learn how to make your own Coin logically, algorithmically. Learn how to avoid the fraud, which exists everywhere. Splitting Bits also includes how to guide for Bitcoin mining, and practical information for anyone who is confused, curious, or otherwise wants to improve their Bitcoin knowledge. Of course, we describe many Cryptocurrencies but use Bitcoin as the prime example. Join the Bit Paradigm and buyer beware - you won't think the same about investing after reading. WARNING: Crypto trading is contagious!

Get it now from www.pleaseorderit.com

Tuesday, October 10, 2017

Sunday, October 8, 2017

Insider Trading and Financial Anomalies Surrounding the Las Vegas Attack

Authored by Kip Herriage of VRAletter.com | October 7, 2017

—

Note: This is an update to my article of 10/7/17. Nothing has been removed or edited from the original article. This updated article includes additional financial/trading anomalies I have uncovered since posting the original piece.

Included in this updated article:

Included in this updated article:

1) Additional trading research on OSIS (OSI Systems), the global leader in baggage, shipping and people detection systems (airports and now MUCH more, like hotels/casinos). Like the other 4 co’s that I have found, OSIS also began to rise on 9/11/17 (remember this date as you will see it in each company) and it rose on large share/option volume increases. The shares of OSIS would rise as much as 16% from its 9/11/17 lows to just after the attack.

2) OLN (Olin Corp) makes Winchester ammunition. Beginning on 9/11/17 their shares began to rise on a large increase in volume and a HUGE increase in call option purchases (so far I’ve found more than 6000 calls were purchased in OIH the week prior to the attack with someone making a ton of money in these calls). The shares of OLN would soar as much as 23% from their 9/11/17 lows to just after the attack.

Insider Trading and Financial Anomalies Surrounding the Las Vegas Attack

Note: With this report, I make no claim to specific knowledge of any wrongdoing or improprieties. Instead, this report includes trading patterns, news releases and/or public record SEC filings.

We will examine the share price movements of two gun manufacturers (American Outdoor Brands and Sturm Ruger) and the share price movement of MGM (which owns Mandalay Bay). We will also examine additional financial events surrounding MGM, including what can only be referred to as massive levels of insider selling in the shares of MGM, by the CEO/Chairman and MGM officers/directors. As you’ll see, more than $200 million in MGM shares were sold in the weeks leading up to the attack.

Background. Interesting Trading Patterns in AOBC, RGR and MGM.

Over the course of my 32 years in the investment industry I have constructed a proprietary investing model that I refer to as the “VRA Trading & Investing System”. In short, its design is to track money flows in the stock market and detect sector and stock analysis/movements that then alert me as to when/where money is flowing in the markets.

For example, prior to the 2016 Presidential Elections, the VRA System noticed that the share price of gun manufacturers had begun to decline rapidly. This was one of our first financial clues that Trump might beat Clinton (Trump’s strong support of 2A). As you can see below, American Outdoor Brands (AOBC, formerly Smith & Wesson), hit a high of $31/share in August of 2016. As the bottom began to fall out, it would ultimately drop 55% in price, before hitting its low price of just over $13 on 9/11/17.

The market is referred to as a “discounting mechanism” and as such, it often predicts future events. It certainly did so in the case of the election and the share price of AOBC.

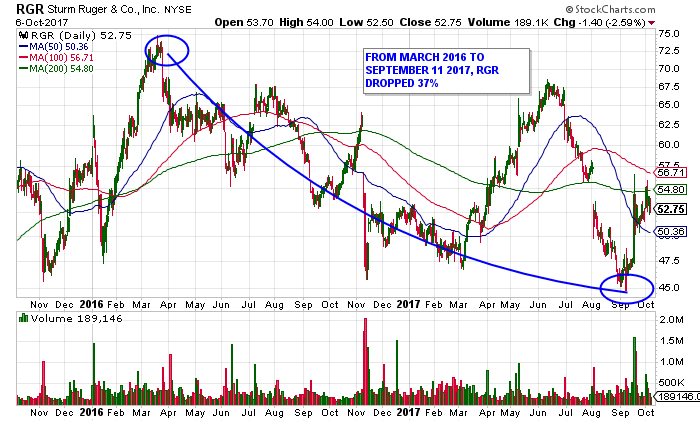

We see the same trading pattern in gun manufacturer Sturm Ruger (RGR). RGR traded as high as $73 in March of 2016 before ultimately dropping 37%, when it too bottomed within one trading day of AOBC hitting it’s lows (9/8/17). Again, my system noted the rapid decline in gun stocks, which led me to believe that Trump may in fact win the election. Remember this point; both AOBC and RGR hit their lows at the same time, just over two weeks prior to the Las Vegas shooting.

We see the same trading pattern in gun manufacturer Sturm Ruger (RGR). RGR traded as high as $73 in March of 2016 before ultimately dropping 37%, when it too bottomed within one trading day of AOBC hitting it’s lows (9/8/17). Again, my system noted the rapid decline in gun stocks, which led me to believe that Trump may in fact win the election. Remember this point; both AOBC and RGR hit their lows at the same time, just over two weeks prior to the Las Vegas shooting.

Something Changed in September

Let’s now examine the trading patterns of AOBC and RGR in detail, just over two weeks “prior” to the attack. As you can see, AOBC bottomed on 9/11/17 at $13.30 before the spike higher began. From 9/11 to just after the attack, AOBC rose 23% in price. It did so on a noticeable increase in buy-side trading volumes.

Below, we see the same chart and reaction in the shares of Sturm Ruger (RGR). From its 9/8/17 lows, RGR bottomed at $46.24 and then spiked to $55.90 just after the attack, for a move higher of 21%.

After falling in price from early-mid 2016 to their early September 2017 lows, the two largest publicly traded gun manufacturers bottomed, then spiked higher, at almost exactly the same time. In addition, buy-side volume increases rose sharply as well.And, while not covered in this report (more work is needed), we also saw a spike in call option purchases in both AOBC and RGR, in the days/weeks leading up to the attack.

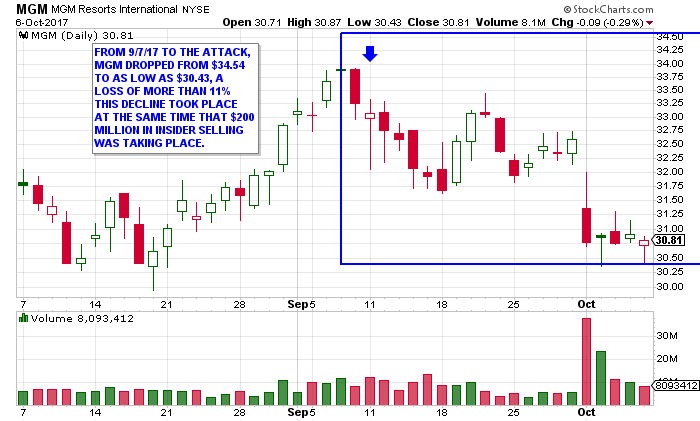

This final chart shows the share price of MGM (owner of Mandalay Bay) in the days leading up to the attack to present. MGM shares declined more than 10%, from 9/7/17 to recent lows. This decline occurred as some $200 million in insider selling was taking place.

Bottom line: Beginning in early-mid September to this report, gun manufactures AOBC and RGR rose in price 23% and 21% (on higher trading volumes), while the shares of MGM fell in price by 11% (as $200 million in insider selling occurred).

MGM: Heavy Levels of Insider Selling

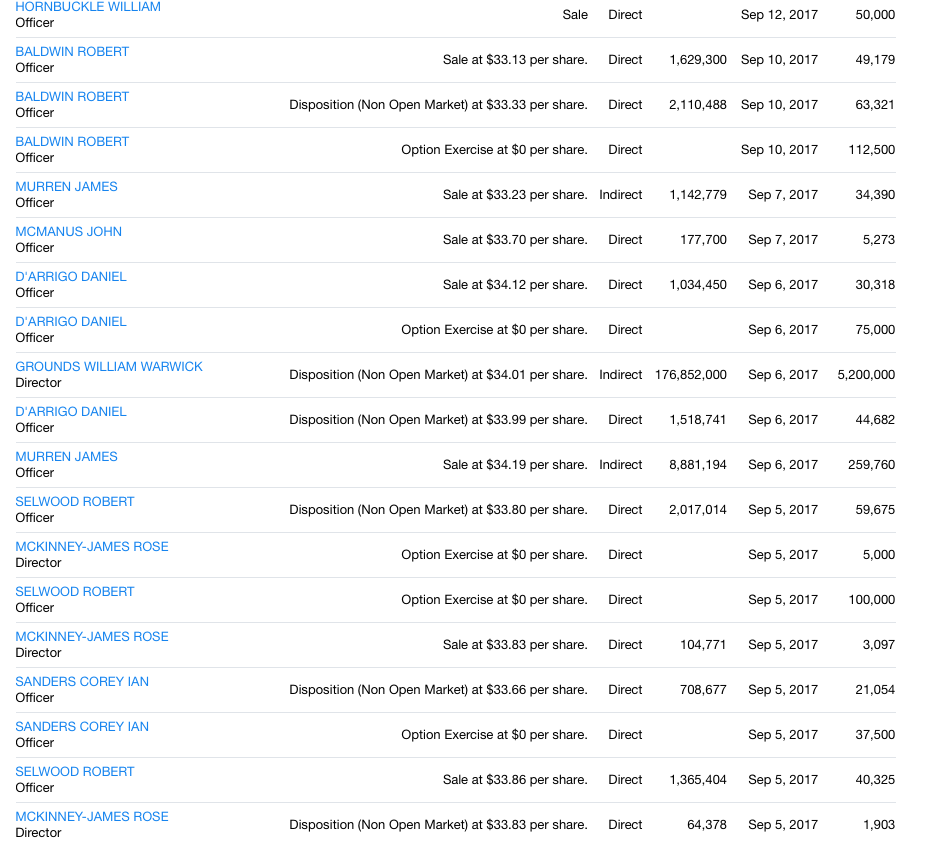

As the SEC insider transaction reports below detail, from 9/5/17 to 9/12/17, approximately 6 million shares of MGM were sold by officers and/or directors of the company, totaling approximately $200 million in proceeds to sellers. Included in this group is the selling of approximately 450,000 shares by MGM CEO and Chairman James Murren (a seller of size since late July) and who appears to have sold more than 85% of all holdings. We also see that MGM Board member Grounds William Warwick sold 176 million shares of his MGM stock on 9/6/17.

We have no indication that MGM insiders sold these 6 million shares due to any advance knowledge of the 10/1 attack. I am not making that claim. I am simply pointing out facts that cannot be in question.

But I will make a few observations:

1) If MGM/Mandalay Bay were to lose law suits associated with this attack, the downside risks to MGM share price may be extensive.

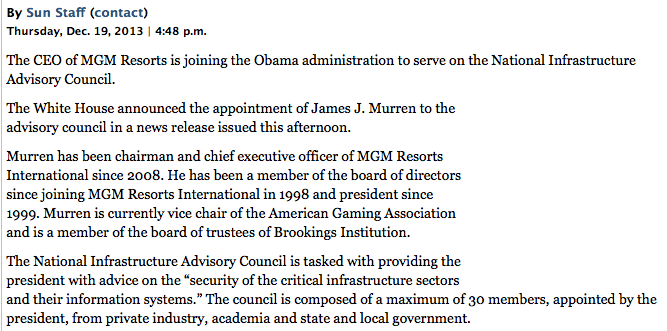

2) We also know that MGM CEO James Murren was appointed to the Homeland Security National Infrastructure Advisory Council by President Obama in December 2013. This fact could make for some interesting depositions, as it relates to exactly what type of advanced security systems Mandalay Bay had in place, leading up to and on the night of 10/1/17.

“The National Infrastructure Advisory Council is tasked with providing the president with advice on the “security of the critical infrastructure sectors and their information systems.” The council is composed of a maximum of 30 members, appointed by the president, from private industry, academia and state and local government.”

3) I am also aware of the fact that MGM put options activity spiked as well (needs more work), beginning at the same time gun stocks were rising and MGM was falling in price.

4) For those curious about the trading in other major Las Vegas Hotel casino stocks, during this same time frame, this also needs more work. However, I can report that at the same time MGM’s share price was falling, the share prices of Las Vegas Sands (LVS) and Wynn Resorts (WYNN) were actually rising.

There’s more…like the recent trading pattern in OSIS, which makes “detection systems” of all kinds (similar to their subsidiary “Rapiscan”, which makes the TSA body scanners that were put in place following 9/11). Many are wondering how long it might be before we are forced to walk through similar devices, as we enter hotels/casinos.

In my original piece I only mentioned OSI Systems (OSIS) and their trading pattern around the Las Vegas attack. I’m updating this to include the chart from the same time frame and additional comments.

Below is the chart of OSIS. From the lows of 9/11/17 to after the attack, the shares of OSIS have jumped 16%. In addition (more work is being done here), call option volume also spiked higher, 2 weeks before the attack.

I have also confirmed that OSIS is working on plans to place their baggage/people detection systems in hotels/casinos around the world. Deepak Chopra is the CEO and Founder of OSIS.

Here’s another interesting piece to the puzzle. Olin Corp (OIH) makes Winchester ammunition (among other things). Beginning on 9/11/17 their shares began to rise on a large increase in volume and a HUGE increase in call option purchases (so far I’ve found more than 6000 calls were purchased in OIH the week prior to the attack. Someone is making a ton of money in these calls). The shares of OLN would soar as much as 23% from their 9/11/17 lows to just after the attack.

I am also including the anonymous 4 chan post (below) that everyone is talking about. As I see it, these are (among) the 5 publicly traded companies that the planner of the Las Vegas attack would want to target. It is most interesting that each of these stocks began their moves on 9/11/17, just one day after the 4chan post. This is what we know after less than 1 week after the attack. What might we know in another week?

Closing:

In closing, let me repeat; I make no claims or assertions that anyone mentioned in this piece has done anything nefarious. They likely did not.

The question I might ask is, “Did someone else profit from the heinous acts of 10/1/17? Possibly the planners?”

Like many of you, I am interested and I am asking questions. I also remember that during 9/11/01, reports surfaced widely in the financial media that “many, many millions” in profits were made off of the purchase of put options in the shares of United Airlines and American Airlines, the two airliners that operated the four aircraft that were hijacked on 9/11 (among other well-documented reports of large put option purchases in numerous companies that had the most exposure to a shocked US economy).

There’s more…like the recent trading pattern in OSIS, which makes “detection systems” of all kinds (similar to their subsidiary “Rapiscan”, which makes the TSA body scanners that were put in place following 9/11). Many are wondering how long it might be before we are forced to walk through similar devices, as we enter hotels/casinos.

I will continue to follow this story. Should you have information that might assist in my research, you can reach me at kip@vraletter.com.

I am a proud American. I want the best for our country. Wherever the truth leads us, that is where we must go. Follow the money.

Kip Herriage

VRALetter.com

Saturday, September 30, 2017

SEC Files First-Ever Civil Fraud Charges Against ICO Companies

That didn't take long.

After issuing a ruling in July that officially declared that the tokens sold during initial coin offerings must be registered as securities - a ruling that many hoped would lend a badly needed veneer of legitimacy to the shady ICO market - the SEC is following through with what we imagine will be the first of many civil actions against ICOs and the individuals who launch them.

The agency on Friday announced civil actions against two companies and their founder, businessman Maksim Zaslavskiy, for violating anti-fraud and registration provisions of federal securities laws after misleading investors in a pair of so-called initial coin offerings (ICOs) purportedly backed by investments in real estate and diamonds.

It's important to remember that this is civil complaint - the SEC doesn't have the power to make arrests; to do that, it must work in tandem with the FBI. Zaslavskiy is a free man. However, his assets - and those belonging to his companies - have been frozen. Instead, the agency is seeking to permanently ban Zaslavskiy from participating in any future digital-currency offerings, along with what we imagine will be hefty fines.

In its press release, the SEC accused Maksim Zaslavskiy and his companies of selling unregistered securities, while also alleging that the digital tokens or coins he was peddling didn't really exist. According to the SEC's complaint, investors in REcoin Group Foundation and DRC World (also known as Diamond Reserve Club) were told (presumably by Zaslavskiy) that they could expect sizeable returns from the companies' operations, when neither had any real operations to speak of.

As we've previously reported, the ICO market has exploded since late last year. The total sum raised has already reached $1.3 billion, with more expected by year's end. However, the ease with which unscrupulous people could fraudulently market their tokens (and earn big money) has attracted attention from regulators all over the world. China cited fears about abuses related to ICOs as the reason for shuttering all local digital-currency exchanges. Russia briefly flirted with the idea as well.

Earlier today, FINMA, the Swiss government body responsible for regulating markets, said it was investigating several ICOs for possible fraud. In its press release announcing the investigations, the regulator explained that because ICOs are structured in a similar way to traditional stock offerings, they fall under the agency's purview. So every time it has received a complaint related to ICOS, its representatives have pursued that complaint.

To the best of our knowledge, these are the first indications that any official regulatory action is being taken against ICO purveyors in either the US or Switzerland.

In its civil complaint, the SEC alleges that "from July 2017 to the present, Zaslavskiy, the President and sole owner of the Companies, fraudulently raised at least $300,000 from hundreds of investors, through various material misrepresentations and deceptive acts relating to supposed investments in digital “tokens” or “coins” offered, first by REcoin, then by Diamond, during the ICOs."

Zaslavskiy allegedly touted REcoin as "The First Ever Cryptocurrency Backed by Real Estate." Alleged misstatements to REcoin investors included that the company had a "team of lawyers, professionals, brokers, and accountants" that would invest REcoin's ICO proceeds into real estate when in fact none had been hired or even consulted. Zaslavskiy and REcoin allegedly misrepresented they had raised between $2 million and $4 million from investors when the actual amount is approximately $300,000.

Zaslavskiy then carried his scheme over to Diamond Reserve Club. He marketed the organization as one that invests in diamonds and obtains discounts with product retailers for individuals who purchase "memberships" in the company. Despite their representations to investors, the SEC alleges that Zaslavskiy and Diamond have not purchased any diamonds nor engaged in any business operations. Yet they allegedly continue to solicit investors and raise funds as though they have.

Read the rest of the complaint below:

2017.09.29icocomplaint by zerohedge on Scribd

http://www.zerohedge.com/news/2017-09-29/sec-files-first-ever-civil-fraud-charges-against-ico-companies

Wednesday, September 27, 2017

How One Trader Made Billions With Ethereum, And What He's Doing Next

Former Fortress Principal Michael Novogratz left the firm's colossal macro hedge fund almost two years ago, but has been discussing investments in virtual currencies since 2013 when he told a UBS conference...

"Put a little money in Bitcoin...Come back in a few years and it’s going to be worth a lot."

He was of course correct, Bitcoin was trading around $200 at the time and as recently as three weeks ago was worth $5000...

The last time we heard from Novogratz was in June 2017, at the CB Insights Future of Fintech conference in New York, where he told attendees that he has cut holdings (in Bitcoin and Ethereum) after the cryptocurrencies' latest "spectacular run," warning that "Euthereum had likely hit its highs for the year," and "cryptocurrencies were likely the biggest bubble of his lifetime."

However, while this all sounded desperately downbeat, Novogratz was still very "positively constructive" on the space overall. He should be - he has 20% of his net worth invested in the sector... and now, as Bloomberg reports, Mike Novogratz is reinventing himself as the king of bitcoin.

Novogratz has had a very good run. Aside from his epic call in Bitcoin, he has done extremely well in Ethereum, as Bloomberg details...It started with a late-2015 visit to a friend’s startup in Brooklyn.

“I expected to see Joe, a dog and one assistant. Instead I saw 30 dynamic young people crammed in a Bushwick warehouse, coding, talking on the phone, making plans for this revolution,” Novogratz said.“Macro guys are instinctive. My instinct was, ‘I want to buy a chunk of this company.”He decided instead to invest in ether, the cryptocurrency token used on the Ethereum network.Novogratz bought about $500,000 at less than a dollar per ether and left on a vacation to India. By the time he returned a few weeks later, the price had risen more than fivefold. He bought more.Over the course of 2016 and into 2017, as ether surged to almost $400 and bitcoin topped $2,500, Novogratz sold enough to make about $250 million, the biggest haul of any single trade in his career.

He said he paid tax on the profits, bought a Gulfstream G550 jet and donated an equal amount to a philanthropic project for criminal justice reform.

Novogratz was hooked, and according to a person familiar with his plans, Bloomberg reports that the outspoken macro manager is starting a $500 million hedge fund to invest in cryptocurrencies, initial coin offerings and related companies. Novogratz will put up $150 million of his own money and plans to raise $350 million more by January, mainly from family offices, wealthy individuals and fellow hedge fund managers.

“This is going to be the largest bubble of our lifetimes,” Novogratz said.“Prices are going to get way ahead of where they should be. You can make a whole lot of money on the way up, and we plan on it.”

At that size, the Galaxy Digital Assets Fund would be the biggest of its kind and signal a growing acceptance of cryptocurrencies such as bitcoin and ether as legitimate investments.

Where others see volatility and liability, Novogratz, a former Goldman Sachs partner, smells opportunity.

“In a lot of ways, this is a market like any other market,” Novogratz said.“You see the psychology of fear and greed in the charts the same way you’d see it in charts of the Indonesian rupiah or dollar-yen or Treasuries. They’re exaggerated because of less liquidity and because you can’t get short.”“I sold at $5,000 or $4,980,” he said.“Then three weeks later I’m trying to buy it in the low $3,000s. If you’re good at that and you’re a trading junkie, it’s a lot of fun.”

And bubble or not, "Novo" as his friends call him, concluded eloquently on the extreme nature of cryptocurrencies' potential...

“Remember, bubbles happen around things that fundamentally change the way we live,” he said.“The railroad bubble. Railroads really fundamentally changed the way we lived. The internet bubble changed the way we live. When I look forward five, 10 years, the possibilities really get your animal spirits going.”

http://www.zerohedge.com/news/2017-09-26/how-one-trader-made-billions-ethereum-and-what-hes-doing-next

Subscribe to:

Comments (Atom)