Global stock and bond markets have seen $25 trillion of 'paper' wealth erased in the last month, wiping out all the gains from the Dec 2018 crash lows....

Source: Bloomberg

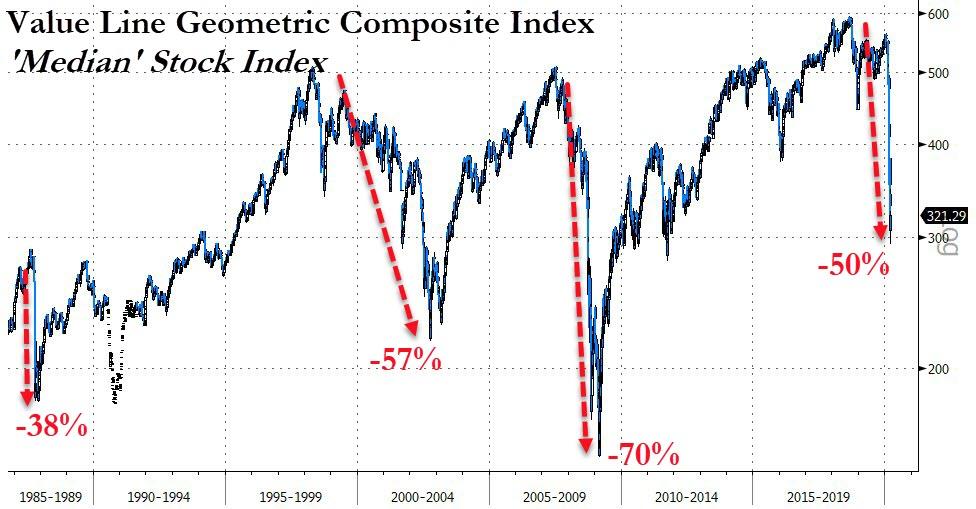

Global bonds are actually still up around $5 trillion while global stocks have lost around $5 trillion since the Dec 2018 lows, and a lot of those losses come from the US markets where the median stock is now down 50% from its highs... (because the Value Line index below is based on a geometric average the daily change is closest to the median stock price change)

Source: Bloomberg

As Washington signs and promises more and more bailouts and helicopter money drops, USA sovereign risk is starting to get a little spooked...

Source: Bloomberg

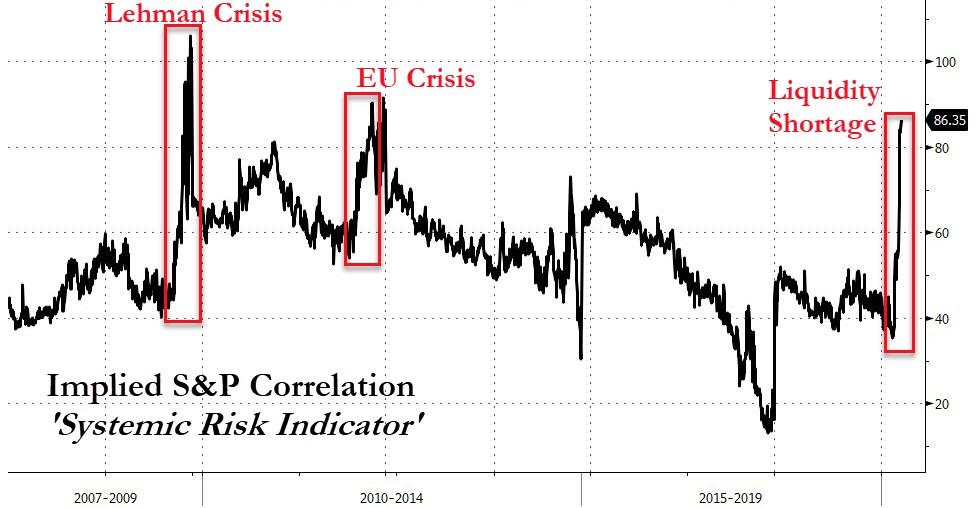

Systemic risk remains extremely elevated...

Source: Bloomberg

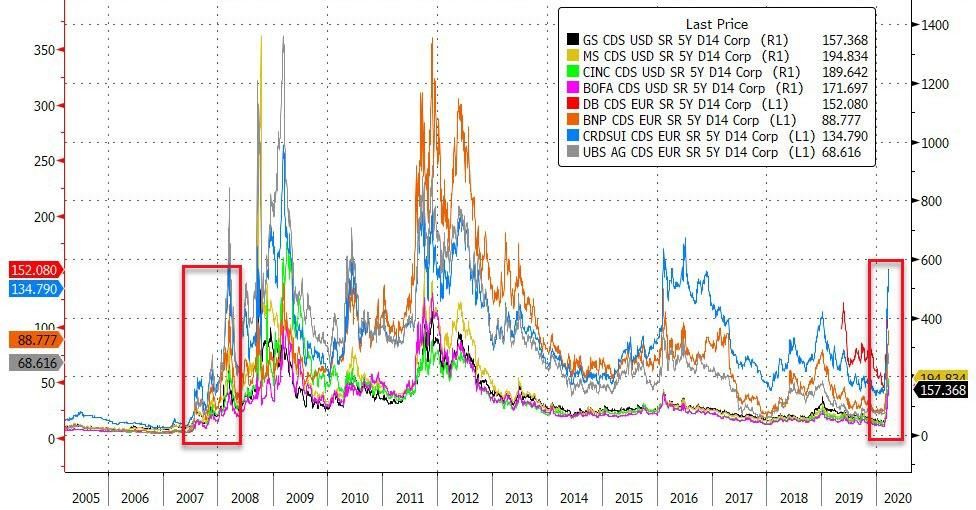

Which makes sense when the world's largest banks are seeing their credit risk explode like it did ahead of the Lehman crisis...

Source: Bloomberg

And despite the endless liquidity from global central banks and polititicians, financial conditions are tightening at their fastest rate ever...

Source: Bloomberg

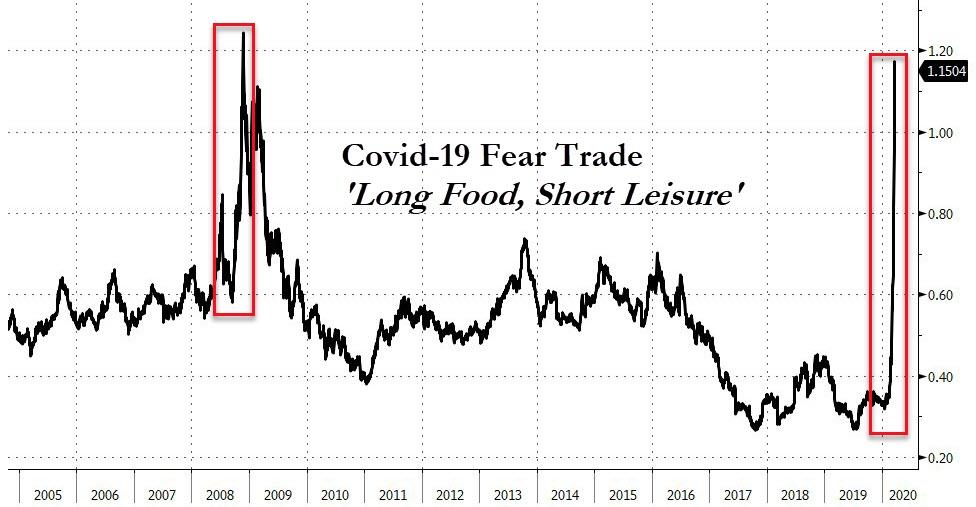

And the real 'fear' trade is now at its most extreme since the peak of the Lehman crisis...

Source: Bloomberg

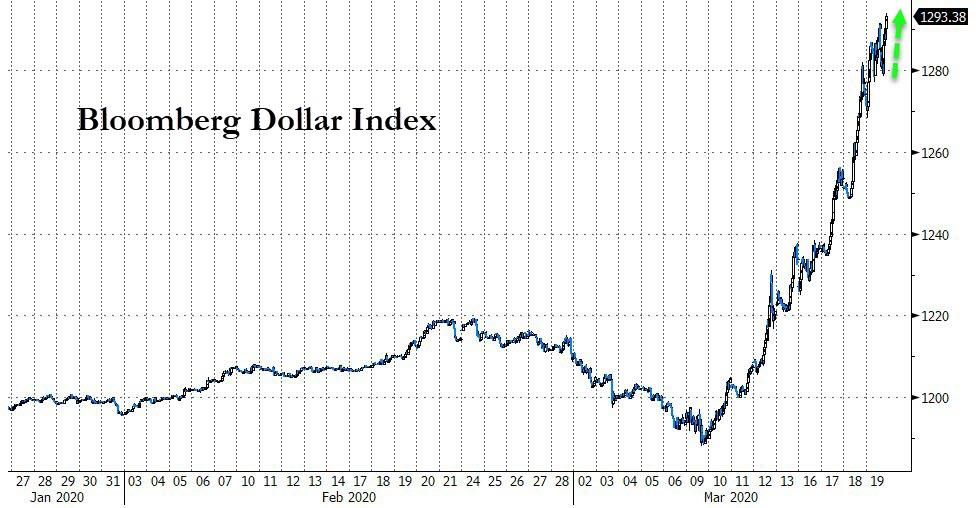

Policy Fail - The Dollar rallied for the 8th straight day, soaring to a new record high despite The Fed opening unlimited FX Swap Lines...

Source: Bloomberg

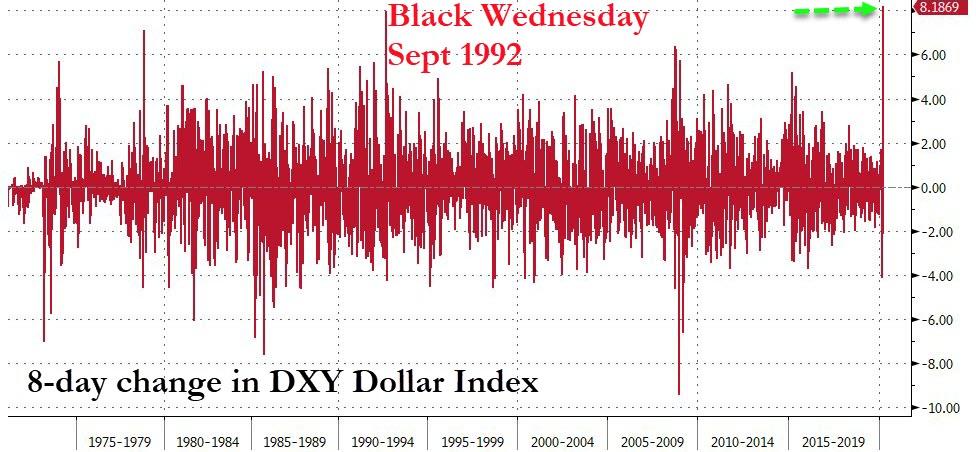

This is the largest 8-day rally in the DXY Dollar Index... ever! Greater even than when Soros broke The Bank of England in Sept 1992...

Source: Bloomberg

But The Fed will "never give in"...

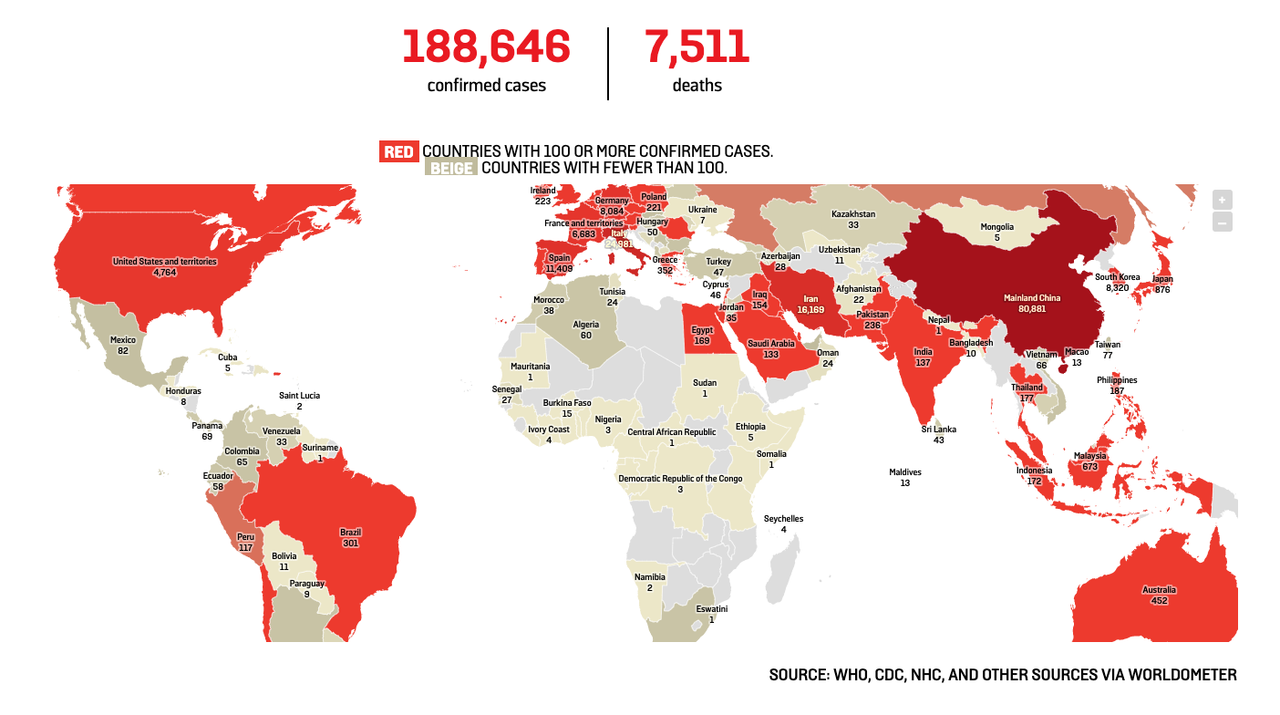

Since the COVID-19 Malrarkey began, Chinese stocks remain the leaders (down only 12%), while Europe is the laggard...

Source: Bloomberg

US equity markets soared today (thanks to the biggest short-squeeze in 7 years), but failed to erase yesterday's gains... (NOTE Nasdaq just tagged unch from Tuesday and then rolled over - algo-tom-foolery)...

On the week, it's still a shitshow with The Dow worst, down 13%...

Today saw "Most Shorted" stocks soar 8% - the biggest short-squeeze since August 2013...

Source: Bloomberg

Directly virus-affected sectors rebounded today...

Source: Bloomberg

VIX fell notably today, testing below 70 ahead of tomorrow's Quad-Witch option expiry...

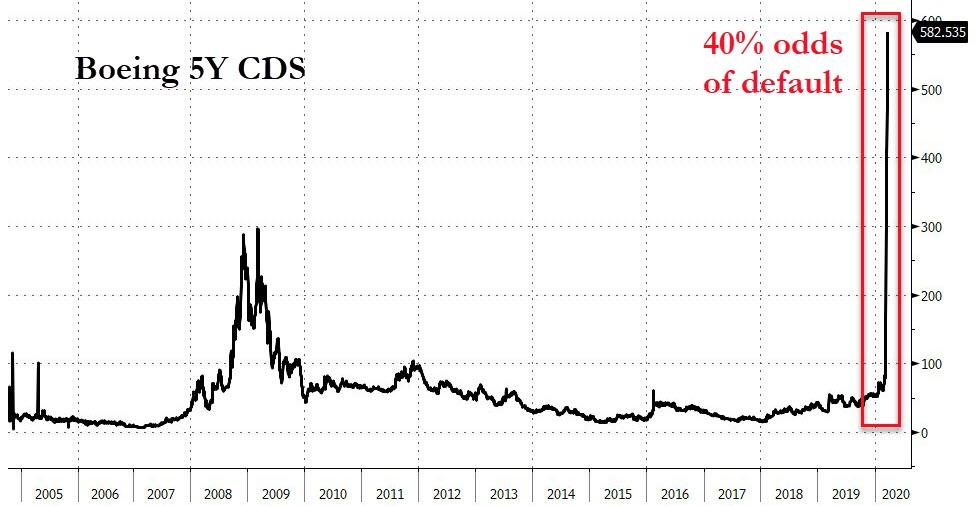

Meanwhile, Boeing credit risk continues to soar (as questions rise about whether they should be bailed out or not)...

Source: Bloomberg

And Ford suspended its dividend and withdrew its guidance sending its credit risk soaring...

Source: Bloomberg

Credit markets were not buying what stocks were selling today...

Source: Bloomberg

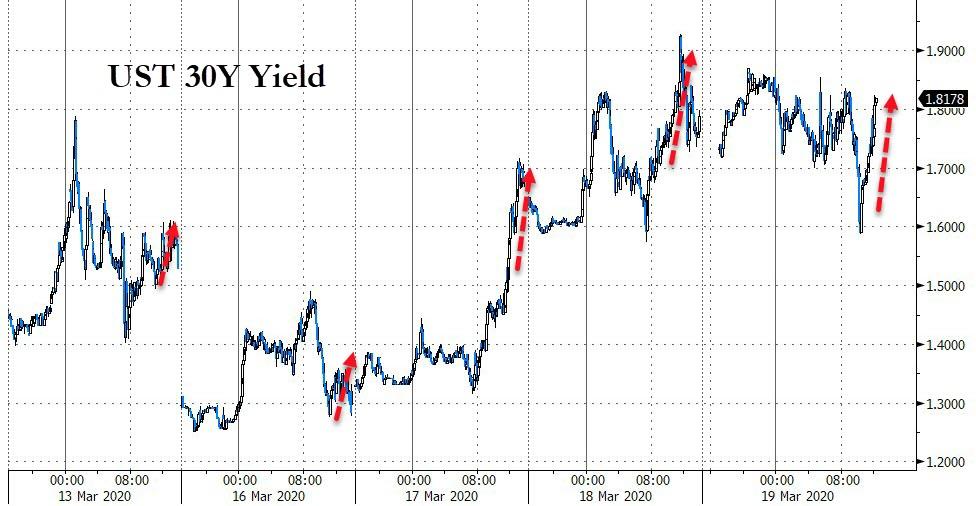

Treasury yields were mixed with the long-end higher and rest of the modestly lower (despite a huge range)... (10Y yields briefly dipped below 1.00% today)

Source: Bloomberg

Another late-day purge in yields pushed 30Y to end higher on the day...

Source: Bloomberg

Munis were massacred today - 10Y yield spiking 47bps!! (MUNI-BOND OUTFLOW ALMOST THREE TIMES PREVIOUS RECORD)

Source: Bloomberg

EUR tumbled today to 3 year lows today in biggest loss since Jan 2001 (bigger than Jun 2016 Brexit vote loss)

Source: Bloomberg

And Cable crashed to the weakest since 1985...

Source: Bloomberg

Cryptos had a big day with Bitcoin Cash outperforming...

Source: Bloomberg

Today's commodity markets were dominate by oil's biggest rally ever...however, given the carnage in crude, WTI is still down 20% on the week...

Today was oil's biggest daily gain... ever. Bouncing off a $20 handle and helped by talk of Trump intervention, WTI was up around 25%!! However, in context, it doesn't look like much (apart from the insane $2 spike at settlement for a 35% surge intraday)...

Oil and the dollar both rallied together late on...

Source: Bloomberg

Gold was modestly lower on the day but silver actually managed gains, bouncing off $12 again..

And on a somewhat related note, is this the other reason why gold has been sold?

Source: Bloomberg

Volatile day in PMs with Palladium best and Platinum worst...

Source: Bloomberg

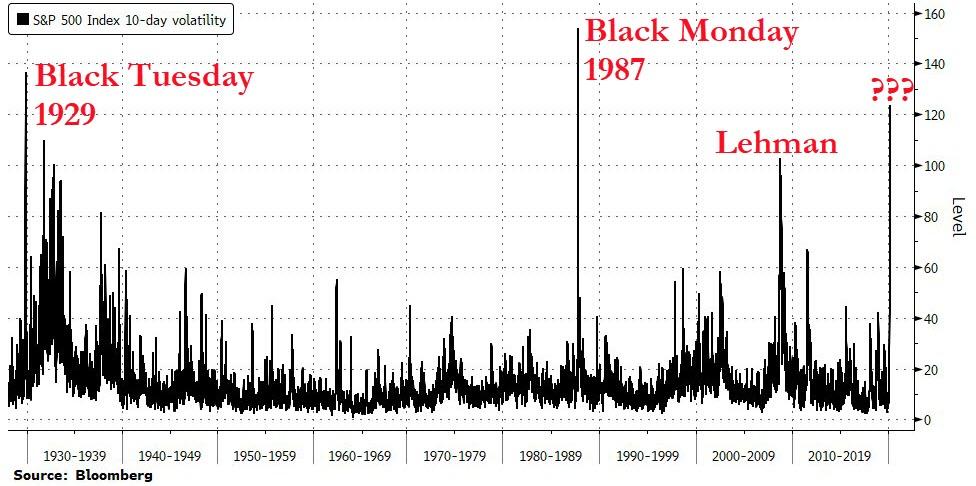

Finally, as Bloomberg notes, anyone referring to the past month’s plunge in U.S. stocks as a crash has history on their side. The S&P 500 Index’s volatility for the 10 trading days ended Wednesday was 122%, according to data compiled by Bloomberg.

Source: Bloomberg

Only two periods have produced higher readings: the aftermath of the 1929 Black Tuesday crash and the 1987 Black Monday crash. The volatility gauge climbed more than 17-fold from Feb. 19, when the S&P 500’s latest bull market ended, through Wednesday.

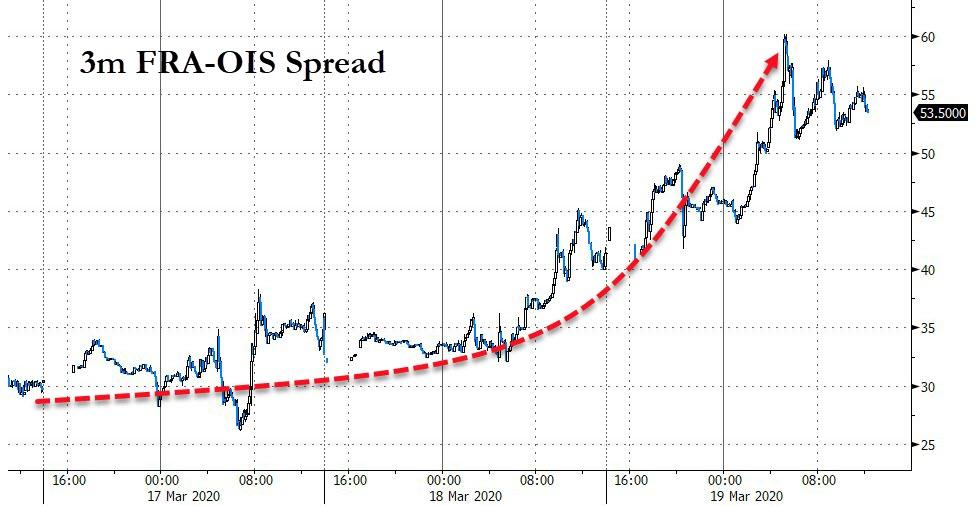

The FRA-OIS spread spiked once again today signaling major tensions in the liquidity markets remain...

Source: Bloomberg

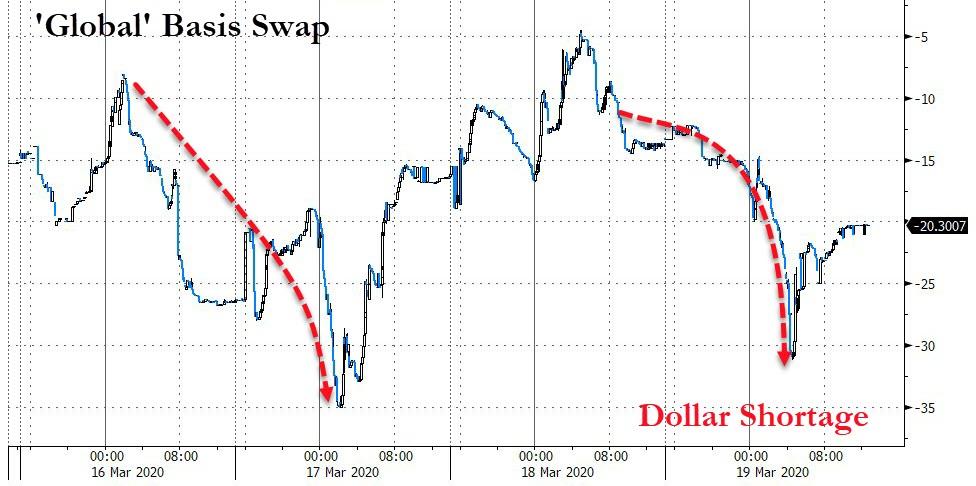

And global basis swaps spiked again (led by JPY) as the dollar shortage worsened today...

Source: Bloomberg

In other words - whatever The Fed is doing - "It's Not Working!"