Yesterday, as the gamma meltup insanity of the past month finally rolled over and tech names tumbled, we said "the real questions emerge and first and foremost is who was it that led this furious gamma charge higher, taking on virtually every dealer?"

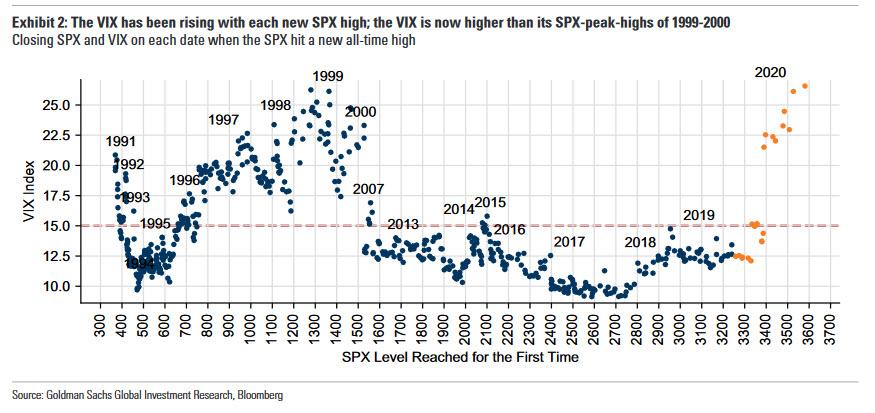

As a reminder, this came following several weeks of bizarre market moves duly discussed here, which we said could be described as an unprecedented "epic battle" in gamma "between one or more funds who were aggressively loading up on gamma and bidding up calls to the point that VIX was surging even as stocks hit 9 consecutive all time highs, while dealers were stuck "short gamma" and in their attempts to delta-hedge the ever higher highs, would buy stocks thereby creating a feedback loop where the higher the market rose, the more buying ensued."

Yesterday, we first identified the solitary party that was responsible for the unprecedented call-buying insanity as Japan's bizarro VC/media conglomerate SoftBank, and elaborated:

It is hardly unreasonable to imagine SoftBank, the "brains" behind such catastrophic investments as WeWork,

WireFraudWireCard, and countless other failed "unicorns" would desperately try to Volkswagen not just a handful of tech names, but the entire market in the process. After all, Masa Son is desperate to deflect attention from the fact that as we put it last October, "SoftBank is the Bubble Era's "Short Of The Century." And if there is one thing that can salvage the Japanese VC titan's reputation it is a second tech bubble which blows out the valuation of his countless (otherwise worthless) investments which form the backbone of SoftBank's "AI Revolution" whatever that means.

Today, one day after our original report, the Financial Times catches up and confirms that SoftBank has been "unmasked as the 'Nasdaq Whale' that stoked the tech rally", writing that Masa Son's investing vehicle "has bought billions of dollars’ worth of US equity derivatives in a move that stoked the fevered rally in big tech stocks before a sharp pullback on Thursday, according to people familiar with the matter" (oddly enough, the FT forgot to note that "this was first reported by Zero Hedge" but whatever.)

While traditionally SoftBank for investing in either unicorns or megafrauds such as WireCard, the FT repeats what we first said, namely that SoftBank has "also made a splash in trading derivatives linked to some of those new investments, which has shocked market veterans." It goes on to quote a derivatives-focused US hedge fund manager "These are some of the biggest trades I’ve seen in 20 years of doing this. The flow is huge."

How huge? Huge enough to send the implied vol of calls of the world's biggest company, Apple, soaring at the same time as its stock price hit record highs.

It's also why the S&P kept rising alongside the VIX, which hit a record high at a time when the S&P was also at an all time high, as we first pointed out on Wednesday, warning that the last time this happened was when the dot com bubble burst.

How much did SoftBank buy? According to the WSJ, which also moments ago confirmed our original reporting, SoftBank...

... spent roughly $4 billion buying call options tied to the underlying shares it bought, as well as on other names

... which due to the embedded leverage in options, is the equivalent of buying tens if not hundreds of billions of underlying stocks, thus sparking the massive upward move in the handful of tech stocks which then spilled over everywhere.

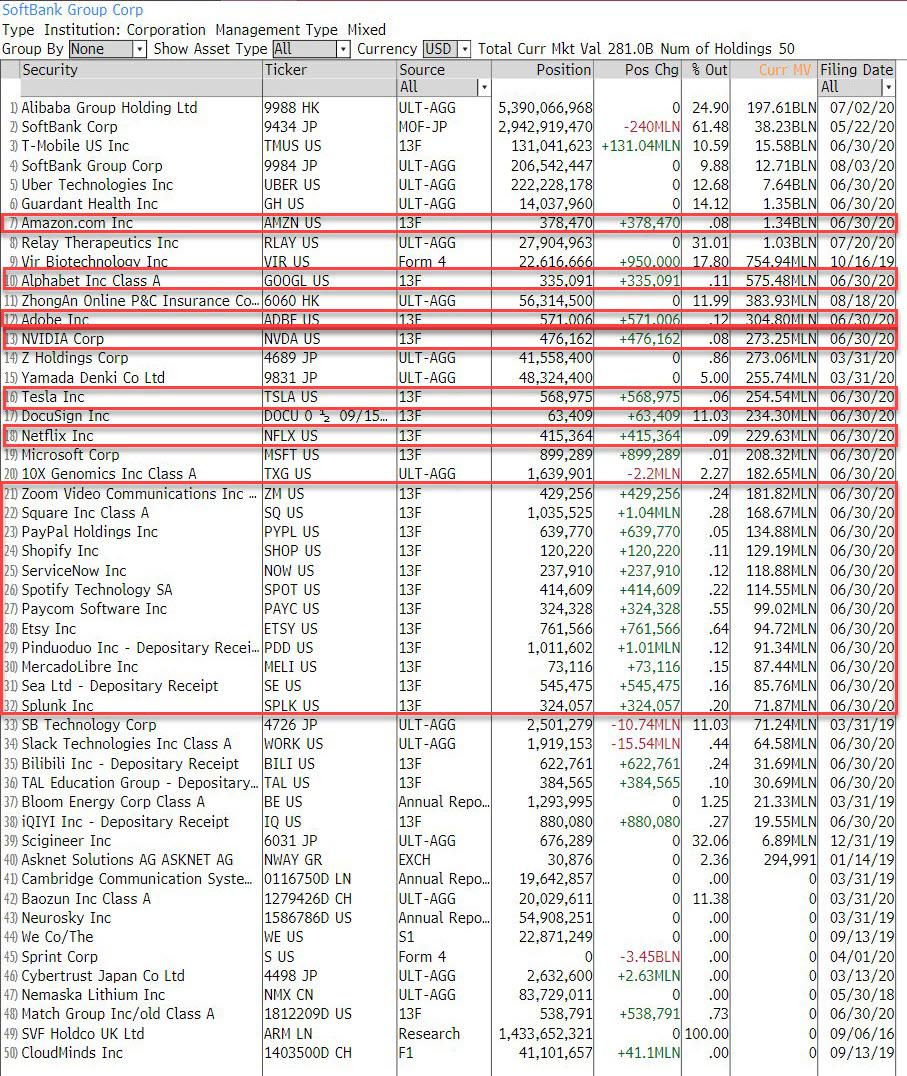

And speaking of underlying stocks, in Q2 SoftBank just so happened bought brand new stakes in all the super high beta names including Amazon, Google, NVidia, Tesla, Netflix, Zoom and so on.

SoftBank's trade was simple: buy billions in underlying ultra-high beta stocks, then also buy billions in call options to take advantage of illiquid markets and gamma, and sure enough all the "SoftBank stocks" exploded to all time highs, and in the process dragged the entire market higher.

Going back to the FT's confirmation of our original report, it quotes another anonumous "person familiar with SoftBank’s trades" who said it was “gobbling up” options on a scale that was even making some people within the organisation nervous.

"People are caught with their pants down, massively short. This can continue. The whale is still hungry."

Or not, because if SoftBank "forgot" to take profits and has been piling on gamma, it is now entirely at the dealers' mercy as we first explained yesterday, which incidentally explains today's continued plunge in tech names as traders brace for the unwind of all that gamma.

Of course, that's the last thing SoftBank - which already is hurting from the dismal performance of so many of its recent investments - wants, and is why a banker "familiar with the latest options trading activity" told the FT that Thursday’s market pullback would have been painful for SoftBank (well, duh), and "he expected the buying to resume" unless of course the dealers double down and sell all those same calls that exploded in recent days. The FT then added, perhaps for the benefit of its Robinhood readers that "a larger and longer-lasting stock-market decline would be more damaging for this strategy, and would probably involve rapid declines."

While there was nothing actually new in the FT report beside merely confirming what our readers already knew, all we can say is that we sincerely hope that Masa Son publishes all his material derivative holdings so the public can take the other side and finally crush this grotesque company which last October we said was the "Bubble Era's "Short Of The Century"."

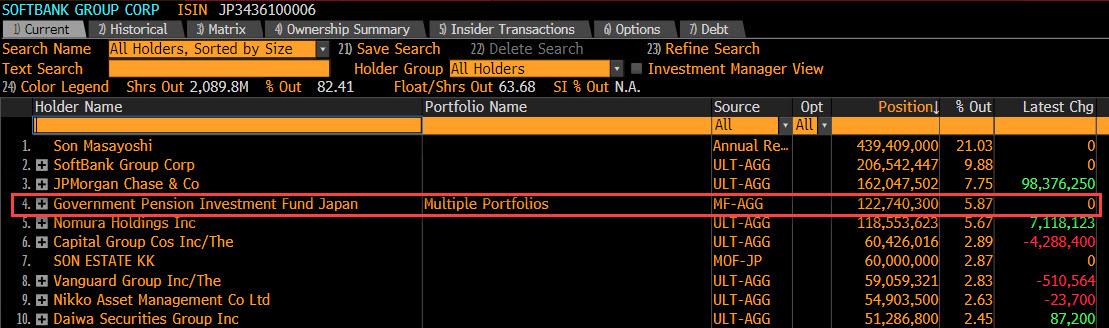

Meanwhile, for those wondering just how far from the Minsky Moment we are, it appears that Japanese pensioners - who are the 4th largest holder of SoftBank - are now indirectly buying deep OTM Apple and Tesla calls:

One final point: while there is an amusing feud brewing between the FT and the WSJ about who broke the SoftBank story (spoiler alert: neither)...

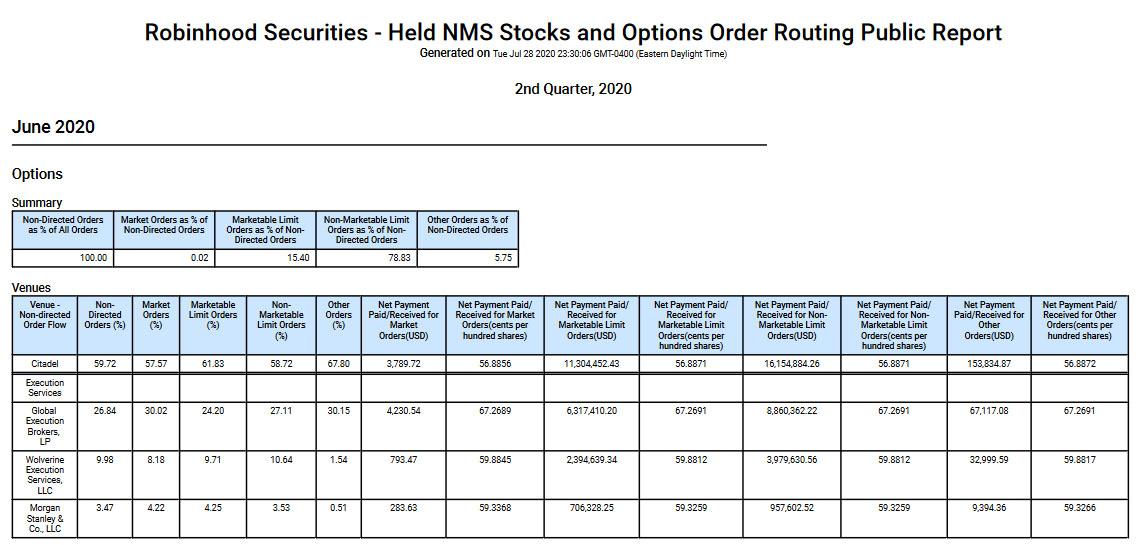

... the real question is which media publication will refuse to touch on the next part of this story, and where the rabbit hole really goes: namely the frontrunning of call options by certain HFTs who clearly magnified the gamma effect sparked artificially by SoftBank.