Summary of today's trading chaos:

GME Stock Rallies After-Hours, Erases Day's Losses.

Protesters At NYSE & Robinhood HQ; Angry At Discount Brokerage.

Robinhood Draws Down On Credit Lines With Banks.

Citadel Securities Denies It Influenced Robhinhood In Restricting Stock Trading In GME.

Robinhood Releases Statement Saying Stock Trading In GME Restarts Friday.

Robinhood Users Complain Their GME Positions Are Being Sold Without Notice.

Elon Musk Agreed With Congresswoman AOC For Investigation In Robinhood Banning Users From Trading GME.

Barstool's David Portnoy Starts Twitter Spat With Citadel Point72's Steve Cohen.

User Sues Robinhood In Southern District of New York For "Removing GME From Platform."

AOC Livid With Robinhood's Decision To Place Trade Restrictions On Users; Calls It "Unacceptable."

Robinhood Confirms Users Having Issues With "Equities, Options, And Crypto" Trading.

Interactive Brokers Put AMC, BB, EXPR, GME, and KOSS Option Trading Into liquidation.

Robinhood Restricts Trading In AMC, BB, BBBY, EXPR, GME, KOSS, NAKD & NOK.

TD Ameritrade Placed GME, AMC On Trade Restrictions.

* * *

The rally appeared to gain ground as Robinhood CEO appeared on CNBC...

“In order to protect the firm and protect our customers we had to limit buying in these stocks,” Tenev told CNBC’s Andrew Ross Sorkin Thursday evening.

“Robinhood is a brokerage firm, we have lots of financial requirements. We have SEC net capital requirements and clearing house deposits. So that’s money that we have to deposit at various clearing houses. Some of these requirements fluctuate quite a bit based on volatility in the market and they can be substantial in the current environment where there’s a lot of volatility and a lot of concentrated activity in these names that have been going viral on social media,” said Tenev.

Tenev also awkwardly denied there was any existing liquidity issue at the firm and said Robinhood had tapped credit lines as a proactive measure.

“We want to put ourselves in a position to allow our customers to be as unrestricted as possible in accordance with the requirements and the regulations,” said Tenev.

“So we pulled those credit lines so that we could maximize within reason the funds we have to deposit at the clearinghouses.”

Dave Portnoy is not buying it...

* * *

Update 1730ET: Robinhood users, many of them restricted in their ability to trade AMC, BB, BBBY, EXPR, GME, KOSS, NAKD, and NOK today, took to the streets with anger in several locations to protest the discount brokerage, hedge funds, and elites.

Update 1730ET: Robinhood users, many of them restricted in their ability to trade AMC, BB, BBBY, EXPR, GME, KOSS, NAKD, and NOK today, took to the streets with anger in several locations to protest the discount brokerage, hedge funds, and elites.

Update 1730ET: Robinhood users, many of them restricted in their ability to trade AMC, BB, BBBY, EXPR, GME, KOSS, NAKD, and NOK today, took to the streets with anger in several locations to protest the discount brokerage, hedge funds, and elites.

Twitter account NYC Protest Updates said a few dozen people were outside the New York Stock Exchange, with at least one person chanting "Robinhood has got to go," and "We want a free market."

One protester was absolutely livid with Robinhood.

Someone held a sign that read "Robincrook."

Someone held a sign that read "Robincrook."

Someone held a sign that read "Robincrook."

"F**K SUITS, BUY bitcoin," another sign read.

Tax the rich protesters also showed up at the New York Stock Exchange.

Protesters also showed up at Robinhood headquarters in Menlo Park, CA.

"Protest outside Robinhood HQ slightly larger. Lots of people honking as they drive by, yelling about Wall Street, GameStop, etc.," said one user.

"Protest outside Robinhood HQ slightly larger. Lots of people honking as they drive by, yelling about Wall Street, GameStop, etc.," said one user.

Protesters at the Robinhood headquarters held signs that said "FREE GME" and "WE LIKE THIS STOCK."

Another sign read "ROBINHOOD LIED."

Luckily Robinhood installed bulletproof glass at its headquarters last year in case frustrated traders show up.

* * *

Update 1655ET: Shortly after Robinhood folded on its earlier decision to block buying of several high-profile stocks, Bloomberg reports the company has drawn down some of its credit lines with banks.

According to people with knowledge of the matter, Bloomberg reports that the firm has tapped at least several hundred million dollars, one of the people said.

Lenders include JPMorgan Chase & Co. and Goldman Sachs Group Inc.

So, perhaps we were right when we noted below the real reason is a sudden liquidity crisis as fees from Citadel evaporates as flows disappeared.

This could be an existential threat to the popular trading app, as one questions the sanity of people who would stay with the firm after today's betrayal knowing they are reportedly facing liquidity issues.

And, while we know we are escalating a little, given that Robinhood is enabling Citadel's primary sources of revenue, what will that mean for Ken?

Robinhood has leaned on its credit with banks to weather turmoil before. In March, the firm drew down an entire $200 million facility from a trio of lenders, people familiar with the matter said at the time, as the pandemic set off a flood of transactions and steep market swings, during which Robinhood’s trading platform suffered repeated outages.

* * *

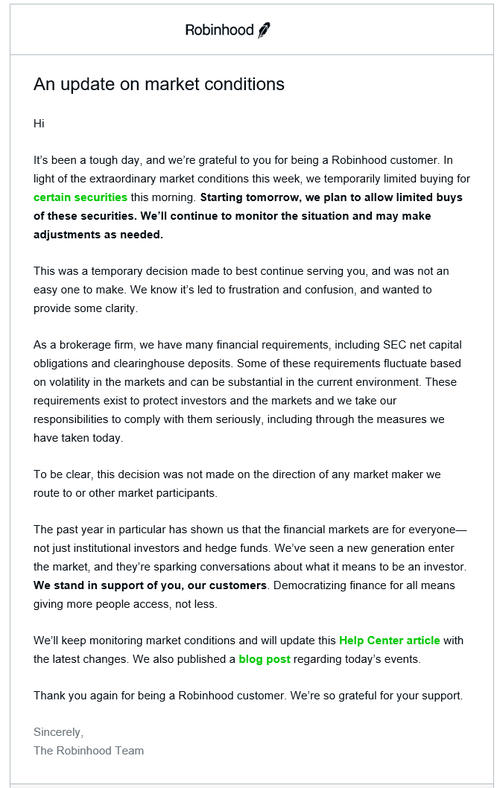

Update 1620ET: Shortly after Citadel Securities issued a statement denying having anything to do with the decisions to block retail traders in GME and other high-profile stocks, Robinhood issues their own statement which basically folded on their earlier decision to stop trading.

This past year, we’ve seen the financial markets become a voice for the voiceless. We’ve seen a new generation of people come into the markets, sparking conversations about what it means to be an investor. Our customers have shown the world that investing is for everyone—not just institutional investors and hedge funds.

[ZH: a voice you silenced today]

Amid this week’s extraordinary circumstances in the market, we made a tough decision today to temporarily limit buying for certain securities. As a brokerage firm, we have many financial requirements, including SEC net capital obligations and clearinghouse deposits. Some of these requirements fluctuate based on volatility in the markets and can be substantial in the current environment. These requirements exist to protect investors and the markets and we take our responsibilities to comply with them seriously, including through the measures we have taken today.

[ZH: why was the decision 'tough' if it was based on facts and risk management?]

Starting tomorrow, we plan to allow limited buys of these securities. We’ll continue to monitor the situation and may make adjustments as needed.

[ZH: So presumably the market makers/hedgies have managed to cover today?]

To be clear, this was a risk-management decision, and was not made on the direction of the market makers we route to. We’re beginning to open up trading for some of these securities in a responsible manner.

[ZH: if it was a risk decision, did the risk drop today or increase?]

We stand in support of our customers and the freedom of retail investors to shape their own financial future. Democratizing finance has been our guiding star since our earliest days. We will continue to build products that give more people—not fewer—access to our financial system. We’ll keep monitoring market conditions as we look to restore full trading for these securities. We will update this Help Center article with the latest changes.

[ZH: except you removed that freedom entirely today?]

We are deeply grateful to our customers.

Presumably, Robinhood figured out that millions of fees from flow would disappear if they kept these stocks blocked.

GME immediately responded with a 20% spike...

And KOSS is up 40% after hours...

* * *

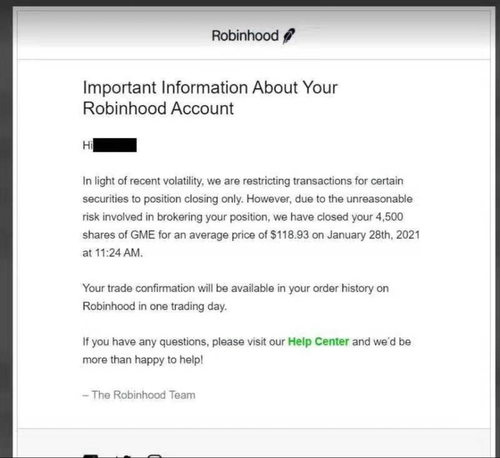

Update 1445 EST: Users are starting to report that Robinhood is selling their GME shares without warning. Screenshots like the one below are starting to make their rounds on social media. Meanwhile, platforms like Webull and Merrill Edge have also joined in the restrictions.

* * *

Update 1430 EST: The list of high-profile people who are infuriated with Robinhood's decision to stop retail investors from trading shares of GME (along with several other companies) has continued to grow. While retail traders were effectively shut out of the market, leaving institutional investors to do what they pleased, a disparate group of public figures, including "Democratic" socialist Congresswoman AOC and world's richest man Elon Musk, banded together to slam Robinhood and its peers.

Musk agreed with AOC's tweet where she said:

"This is unacceptable. We now need to know more about @RobinhoodApp's decision to block retail investors from purchasing stock while hedge funds are freely able to trade the stock as they see fit. As a member of the Financial Services Cmte, I'd support a hearing if necessary."

Musk also agreed with one twitter user who said "make shorting illegal"...

As we noted earlier, Barstool's David Portnoy has been infuriated by Robinhood's decision.

Portnoy tweeted, "PRISON TIME. Dems and Republicans haven't agreed on 1 issue till this. That's how blatant, illegal, unfathomable today's events are. It also shows how untouchable @RobinhoodApp @StevenACohen2C Citadel Point72 all think they are. Fines aren't enough. Prison or bust."

... and believe it or not, Steven Cohen, founder of hedge fund Point72 Asset Management, who with Citadel bailed out Melvin Capital for their Gamestop short, responded to Portnoy and said, "Hey Dave, What's your beef with me. I'm just trying to make a living just like you. Happy to take this offline."

Barstool's founder responded by saying, "I don't do offline. That's where shady shit happens. You bailed out Melvin cause he's you're boy along with Citadel. I think you had a strong hand in today's criminal events to save hedge funds at the cost of ordinary people. Do you unequivocally deny that?"

Cohen responded:

"What are you talking about? I unequivocally deny that accusation. I had zero to do with what happened today Btw, If I want to make an additional investment with somebody that is my right if it's in the best interest of my investors Chill out"

Portnoy has already released a meme of the Twitter spat between himself and Cohen.

Speaking of today's events, Chamath Palihapitiya tweeted, "In moments of uncertainty, when courage and strength are required, you find out who the true corporatist scumbags are."

We wonder who Palihapitiya is speaking of when he mentions "who the true corporatist scumbags are."

* * *

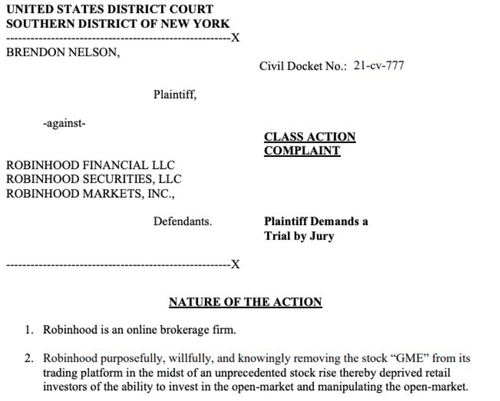

Update 1232 EST: Following the outrage of stock manipulation from AOC, Brendon Nelson (presumably a Robinhood user), sued Robinhood Financial LLC, Robinhood Securities, LLC, and Robinhood Markets, Inc. in the Southern District of New York this afternoon for "removing Gamestop from its trading platform."

The lawsuit reads:

"Robinhood purposefully, willfully, and knowingly removing the stock "GME" from its trading platform in the midst of an unprecedented stock rise thereby deprived retail investors of the ability to invest in the open-market and manipulating the open-market."

Social media users on Twitter were infuriated by the trade restrictions Robinhood and other discount brokerages placed on clients this morning. Some said:

"Now add TD Ameritrade who did the same yesterday and had price manipulated /price fixed/ caused MV buying power destabilizations, that affected not just these stocks. and they did not have the same trading rules on aftermarket or premarket when Institutions covered took profits," on Twitter user said.

"Does this suit mention Robinhood's relationship with Citadel, who are deeply interested in the shorting of GME?" someone else said.

Barstool's David Portnoy tweeted, "Everybody On Wall Street Who Had A Hand In Today’s Crime Needs To Go To Prison."

* * *

Update 1155 EST: Alexandria Ocasio-Cortez (AOC) is absolutely livid with Robinhood's decision to place trade restrictions on users from purchasing certain stocks while large financial institutions can "freely trade the stocks."

AOC called this double-standard "unacceptable."

"This is unacceptable. We now need to know more about @RobinhoodApp's decision to block retail investors from purchasing stock while hedge funds are freely able to trade the stock as they see fit. As a member of the Financial Services Cmte, I'd support a hearing if necessary," AOC tweeted.

Meanwhile, Barstool Sports' Dave Portnoy said he's down a "milly," (we believe that's a reference to $1MM) following the trade restrictions placed by Robinhood and other discount brokerages. He called Robinhood trading app "crooks" and started calling out executives on Twitter.

Portnoy still thinks "$amc and $nok come back the second the free markets open again."

Portnoy had this message to the founder of Robinhood:

Even rapper Ja Rule chimed into the discussion about the corruption on Wall Street. He said, "They hedge fund guy shorted these stocks now we can’t buy them ppl start selling out of fear... we lose money they make money on the short... THIS IS A FUCKING CRIME!!!"

And that's coming from the guy who helped organize Fyre Fest.

* * *

Update 1141 EST: Robinhood is reportedly adding more names to its restricted list, including American Airlines, which was up more than 70% at one point in pre-market trading this morning.

ROBINHOOD ADDS AAL, CTRM, SNDL, OTHERS TO RESTRICTED TRADING

Additionally, it looks as though the first of what is likely to be many lawsuits has been filed against Robinhood. We wonder if Citadel has a good lawyer they can recommend?

ROBINHOOD CUSTOMER SUES OVER REMOVAL OF GAMESTOP

Update 1103 EST: Everyone seems to be piling on Robinhood, including hip hop artist and Fyre Festival bankroller Ja Rule, who says "this is a fucking CRIME" about the measures Robinhood is taking.

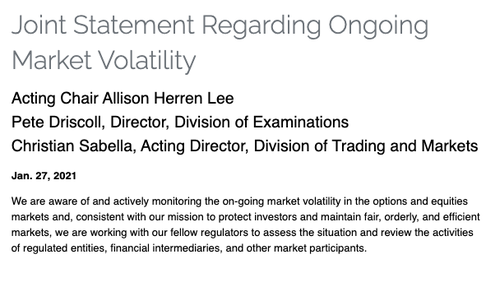

Update 1017 EST: Bloomberg is reporting that the SEC and Fed will likely take "little action" over the trading in GameStop and other names - but that it may include a trading suspension in the names.

Analysts told BBG: “We do not believe the SEC will issue an emergency order nor will the Fed change margin requirements. The only possible action that will potentially be taken is the SEC suspending trading in one or more of the names for one to two business days”

Update 0950 EST: Robinhood (once again) appears to be down. There's no word on whether the disruption is just from the volatility or whether or not it is directly related to the platform's ban of buying certain equities:

ROBINHOOD SAYS ISSUES WITH EQUITIES, OPTIONS, CRYPTO TRADING

ROBINHOOD SAYS DISRUPTION WITH IOS, ANDROID AND WEB APP

ROBINHOOD SAYS EXPERIENCING SERVICE DISRUPTION

Update 0925 EST: Interactive Brokers has joined Robinhood and has put option trading in some names into liquidation. This headline crossed the terminal around 0925EST:

INTERACTIVE BROKERS PUTS SOME OPTION TRADING INTO LIQUIDATION

In a statement to CNBC, IB said:

“As of midday yesterday, (1/27/2021) Interactive Brokers has put AMC, BB, EXPR, GME, and KOSS option trading into liquidation only due to the extraordinary volatility in the markets. In addition, long stock positions will require 100% margin and short stock positions will require 300% margin until further notice. We do not believe this situation will subside until the exchanges and regulators halt or put certain symbols into liquidation only. We will continue to monitor market conditions and may add or remove symbols as may be warranted.”

Additionally, Robinhood has released the following statement:

“We continuously monitor the markets and make changes where necessary. In light of recent volatility, we are restricting transactions for certain securities to position closing only, including $AMC, $BB, $BBBY, $EXPR, $GME, $KOSS, $NAKD and $NOK. We also raised margin requirements for certain securities.”

We can't help but wonder...

Update 0842 EST: Barstool Sports' Dave Portnoy has weighed in on the restriction, stating "Either @RobinhoodApp allows free trading or it’s the end of Robinhood. Period."

He has also Tweeted: "And it turns out @RobinhoodApp is the biggest frauds of them all. “Democratizing finance for all” except when we manipulate the market cause too many ordinary people are getting rich."

He continued: "Somebody is going to have to explain to me in what world [Robinhood] and others literally trying to force a crash by closing the open market is fair? They should all be in jail."

--

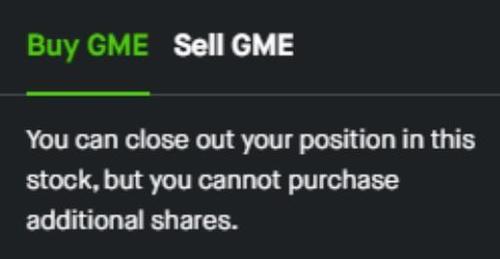

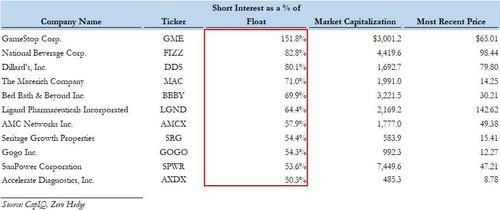

One day after TD Ameritrade implemented unprecedented restrictions on trading in GME, AMC and other massive short squeezes, on Thursday morning reports are circulating on social media that Robinhood is no longer allowing GameStop or AMC share purchases.

"Robinhood Removes GameStop, AMC; Puts Notice On Pages Saying 'You Can Close Out Your Position On This Stock, But You Can Not Purchase Additional Shares'," Benzinga reported at about 0830 EST.

The report was corroborated by additional sources shortly after 0830 EST.

Users are reporting the same on Twitter.

There are also scattered reports that the app has restricted BlackBerry. Users on social media are furious:

Developing...