Monday, October 22, 2012

Forex volume slows, carry trades less profitable

The $4 trillion-a-day foreign-exchange market is losing confidence in central banks’ abilities to boost a struggling world economy.

Rather than sparking bets on growth, the JPMorgan Chase & Co. G7 Volatility Index, which more than doubled in 2007 to 2008 before policy makers employed extraordinary measures to address faltering global expansion, has dropped to a five-year low. While small foreign-exchange swings historically favor the strategy of borrowing in low-yielding currencies to buy those with higher returns, a UBS AG index that tracks profits from the so-called carry trade has fallen to the lowest level since 2011.

Average daily volume in foreign exchange fell 39 percent in September from a year earlier, according to data from ICAP Plc’s EBS trading platform. That’s also harming currency managers’efforts to boost returns.

http://www.bloomberg.com/news/2012-10-21/worst-carry-trades-show-central-banks-reaching-stimulus-limits.html

Sunday, October 21, 2012

Swiss Banks Shun Yanks

http://online.wsj.com/article/SB10000872396390444592704578062570295543436.html?mod=WSJ_hp_LEFTWhatsNewsCollection

Friday, October 19, 2012

EU summit: France says bank deal helps eurozone fusion

http://www.bbc.co.uk/news/world-europe-20005100?print=true

EES: Is Google Error a sign of things to come

http://seekingalpha.com/article/933031-is-google-error-a-sign-of-things-to-come

Thursday, October 18, 2012

Stocks Dip; Google Halted After 9% Drop

http://www.cnbc.com/id/49461731

More research:

http://www.zerohedge.com/news/2012-10-18/google-reports-early-huge-miss-sends-stock-plunging

http://www.zerohedge.com/news/2012-10-18/165-hedge-fund-suddenly-cried-out-terror-and-were-suddenly-silenced

U.S. Dollar Index Disguises Global Inflation Threat

http://www.marketoracle.co.uk/Article37053.html

Monday, October 15, 2012

EES: US Dollar Carry Trade Portfolio

Read More: http://seekingalpha.com/article/924091-usd-carry-trade-portfolio

Friday, October 12, 2012

The Inflation Monster

The confidence of visitors, however, is seriously shaken in the museum shop, just before the exit, where, for €8.95 ($11.65) they can buy a quarter of a million euros, shredded into tiny pieces and sealed into plastic. It's meant as a gag gift, but the sight of this stack of colorful bits of currency could lead some to arrive at a simple and disturbing conclusion: A banknote is essentially nothing more than a piece of printed paper.

It has been years since Germans harbored the kind of substantial doubts about the value of their currency that they have today in the midst of the debt crisis. A poll conducted in September by Faktenkontor, a consulting company, and the market research firm Toluna, found that one in four Germans is already trying to protect his or her assets from the threat of inflation by investing in material assets, for example.

http://www.spiegel.de/international/europe/how-central-banks-are-threatening-the-savings-of-normal-germans-a-860021-druck.html

Wednesday, October 10, 2012

Global financial risks have increased, says IMF

http://www.bbc.co.uk/news/business-19888996?print=true

Monday, October 8, 2012

Mysterious Algorithm Was 4% of Trading Activity Last Week

BUSTED: Mario Draghi And ECB VP Caught On Microphone Joking About Whether Their Words Will Move Markets

- Draghi: "Well, I don't think, there shouldn't be any market reaction."

- Constancio: "No, no."

- Draghi: "I guess, no? If there is, I don't know what to say."

- Constancio: "No, no."

- Draghi: "It's more boring..."

- Constancio: "No, markets were not expecting much…"

- Draghi: "Ok."

Read more: http://www.businessinsider.com/mario-draghi-ecb-live-microphone-2012-10#ixzz28jty9qsQ

Spending Cuts No Longer Yield Earnings Growth for U.S. Companies

Friday, October 5, 2012

Jack Welch says White House manipulates data, Krueger admits

http://www.bloomberg.com/news/2012-10-05/former-ge-ceo-jack-welch-says-white-house-manipulates-jobs-data.html

“No serious person would question the integrity of the Bureau of Labor Statistics,” Krueger said in the Bloomberg Television interview. “These numbers are put together by career employees. They use the same process every month. So I think comments like that are irresponsible.”

Wednesday, October 3, 2012

Forex volume slows first time in 6 years

http://www.tradersmagazine.com/news/institutions-pull-back-from-fx-trading-110369-1.html

Black market currency traders fight riot police in Tehran as rial drops by 40 percent

http://www.reuters.com/article/2012/09/28/us-cftc-positionlimits-idUSBRE88R1C120120928

Tuesday, October 2, 2012

U.S. Leads in High-Frequency Trading, Trails in Rules

Monday, October 1, 2012

China shows more signs of slowing down

Sunday, September 30, 2012

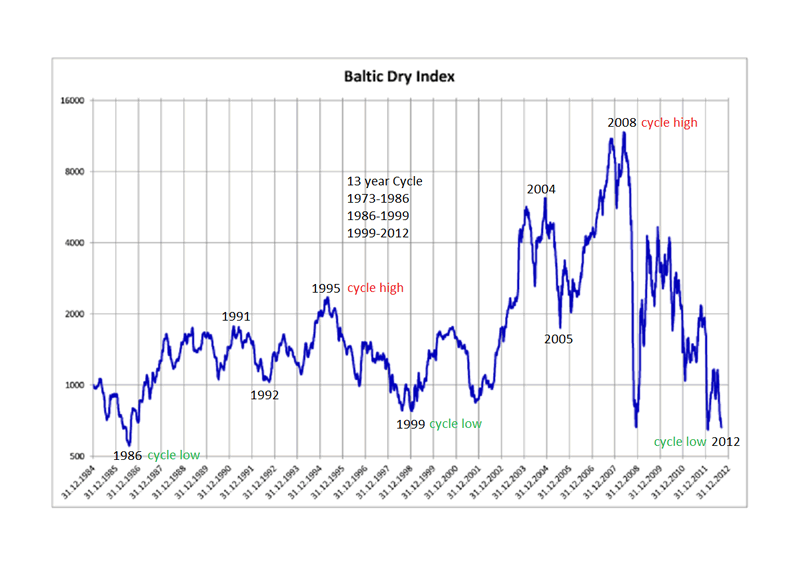

Baltic Dry Index near all time low

http://www.marketoracle.co.uk/images/2012/Sept/baltic_dry_index-1985.png

http://en.wikipedia.org/wiki/Baltic_Dry_Index Most directly, the index measures the demand for shipping capacity versus the supply of dry bulk carriers. The demand for shipping varies with the amount of cargo that is being traded or moved in various markets (supply and demand).

Friday, September 28, 2012

The end of the euro’s Indian summer

THE sugar-rush brought on by the European Central Bank’s pledge to intervene in bond markets to help troubled euro-zone countries—some diplomats call it “Mario Draghi’s ice cream”—was bound to fade at some point. But nobody expected it to fade quite so suddenly this week.

http://www.economist.com/node/21563774/print

At some point, it will get the balance wrong. And then either Spain will be forced out of the euro. Or the Germans will walk. http://blogs.wsj.com/eurocrisis/2012/09/28/europes-never-ending-crisis/tab/print/

Thursday, September 27, 2012

Listen to EES on Traders Radio Network Friday Sept 28th 3pm EST

THE TRADERS NETWORK

BROADCAST LIVE - WEEKDAYS AT 1PM

CLEAR CHANNEL - KFXR/1190-AM - DALLAS

From the fast action of the trading pit...to the power brokers making the headlines...Michael Yorba interviews the front-page Titans about the latest in trading tools and market trends. Learn how the experts use risk management techniques to build fully diversified portfolios. It's a fast moving, high energy show that presents stocks, commodities, bonds, forex and derivatives in a new light and keeps investors asking for more...

The Traders Network stays ahead of the curve by featuring leading market and business professionals, sophisticated technology, and the analytics needed to identify the most lucrative investment strategies.

Successful performance depends on finding the right opportunities.

So...Shift your thinking and join us as we deliver “tomorrow’s trade today” on The Traders Network weekdays from 1-3pm on KFXR/1190-AM.

Tune in tomorrow at 3pm EST

http://www.yorbamedia.com/radio Instructions

Click here to listen live now

EES page on Yorba TV http://yorbatv.ning.com/profile/eliteeservices

Wednesday, September 26, 2012

Social unrest in Spain, fears of Catalonia secession

Study Reveals Germans Less Confident than they Seem

http://www.spiegel.de/international/germany/study-reveals-germans-less-confident-than-they-seem-a-857918.html

Tuesday, September 25, 2012

German High-Frequency Bill to Affect Hedge Funds, Official Says

http://www.bloomberg.com/news/2012-09-25/german-high-frequency-bill-to-affect-hedge-funds-official-says.html

Monday, September 24, 2012

EES: Has the Euro Peaked

http://seekingalpha.com/article/881041-has-the-euro-peaked

Bankers among the least trusted, says Which?

Which? said that recent banking scandals meant there was an urgent need for a "fundamental change" in banking culture and practice.

An industry body said that there was a commitment for change among banks.

Which? conducted a survey of 2,060 people, asking how much they trusted various professions. Nurses, doctors and teachers were the most trusted, with bankers, journalists and politicians in the bottom three.

The consumer group said that bankers should comply with a code of conduct or be struck off. They should also be punished for mis-selling, with bonuses clawed back.

http://www.bbc.co.uk/news/business-19639795?print=true

Friday, September 21, 2012

System Expectations

I found myself outside today looking for an excuse to make a video. It's 80°F / 27°C, sunny skies and a soft breeze in Dallas. The last place anyone wants to be is in front of the computer when the weather is this nice.

No doubt that some active daytraders or people that hate their jobs are thinking the same thing. I suspect that the motivation for most people making automated expert advisors is the dream of making money without doing anything. Turn on the software and wait for the trading profits to roll in. That was certainly the case with the company Forex Made Sleazy... I mean, Forex Made Easy several years ago.

We do have a handful of customers that trade profitably, but even then, it takes a long time for an automated system to get to the point where it's largely hands off. The best conceived ideas, which I would define as plausibly worthy of my own investment funds, takes a bare minimum of several months to execute from start to finish. This also presumes the unlikely notion that the idea has genuine potential to start with.

Even the most simple, valid concepts encounter substantial setbacks before the system can truly run hands-free. It's usually not some kind of epic programming disaster where the client wants black and the programmer makes white. Don't get me wrong; communication is critical. The smoothest projects are always the ones where both parties understand one another readily.

Nonetheless, even the most well-oiled team experiences countless hiccups in the process of morphing from idea to reality. Simple ideas often fall the most vulnerable to real world problems. Trade execution stands out as the most common obstacle. If anything goes remotely unexpected, a potentially profitable scenario may lead to unexpected losses.

I worked with one client that came up with a simple idea that mathematically showed a heavy positive expectation. Yet when we launched the idea in the real world, the prices that the system absolutely required in order to function never came through. Slippage occurred precisely when it was the most damaging.

We had to go back to the drawing board looking for ways to re-engineer the expert advisor where the importance of execution declined. That setback alone took several months to overcome in any meaningful sense.

The take away here is that it's totally unreasonable to expect to hire a forex programmer and expect a dramatic shift in profits and life style. The best ideas take several months before they are worthy of running their full account balance. Unfortunately, most of the ideas out there are not good to begin with. That's why making an EA that is profitable over the long run is so incredibly difficult.

Deutche Bank: Gold is Money

http://www.zerohedge.com/contributed/2012-09-19/deutsche-bank-gold-money

Intercontinental Exchange, the US futures exchange group, has followed rival CME Group by allowing its European clearing house to accept gold bullion as collateral for transactions.

When World War I broke out in 1914. The banks suspended redemption of gold for paper money. This broke their contracts, but the governments all ratified this action. Then the governments had their central banks confiscate the gold that had been stored in the vaults of the commercial banks.

Wednesday, September 19, 2012

Coin mintage collapsed the Roman Empire. Is history repeating itself?

In the third century AD, the Roman Empire went through a hard period, know as the “military crisis”. This period is characterized by political problems, such as the violent death of the emperors and their family, caused by revolts, plots and military uprisings, military problems caused by the invasion of the empire by the barbarian populations such as the Goths and economic problems such as the lack of production, the decrease of the population, famine in some cases and inflation.

http://www.coins-auctioned.com/docs/coin-articles/coin-mintage-collapsed-the-roman-empire-is-history-repeating-itself

Tuesday, September 18, 2012

EES: QE3 to start new US Dollar Carry Trade

http://seekingalpha.com/article/872541-qe3-to-start-new-u-s-dollar-carry-trade

Monday, September 17, 2012

EES: Competitive Devaluation of Currencies via QE3

http://seekingalpha.com/article/870971-competitive-devaluation-of-currencies-what-qe3-means-for-forex

Sunday, September 16, 2012

Swiss banks seek new model as secrecy gone

With their long-cherished secrecy practices increasingly under attack, Swiss banks are scrambling for a new way to attract wealthy foreign clients.

"Banking secrecy is no longer there. That's gone. It is over," international wealth management consultant Osmond Plummer told a gathering of Swiss bankers in Geneva last week.

And once the secrecy ends, he stressed, Swiss financial institutions will have to come up with a new magnet if they want to remain attractive for large foreign placements.

"Something has to change in Switzerland," he told the seminar, focused on wealth management and banking secrecy.

Saturday, September 15, 2012

Japan Hints at Possible Yen Intervention

http://online.wsj.com/article/SB10000872396390444709004577650632272233176.html

http://online.wsj.com/article/SB10001424052702303879604577407743768560590.html

US cannot continue the endless sugar rush

Friday, September 14, 2012

US Credit rating cut to AA - as Fed increases QE

http://www.cnbc.com/id/49037337

Perma-QE: Lessons from Bernanke's Latest Splurge

http://www.marketoracle.co.uk/Article36525.html

The Fed’s launch of QE3 looks more than a tad desperate. If you believe the central premise of the Fed’s action, that propping up asset price gains would have enough effect on consumptions to lift the economy out of stall speed, it would seem logical to sit back a bit and let the recent stock market rally and the (supposed) housing market recovery do their trick. But the Fed has finally taken note of the worsening state of the job creation in an already lousy employment market and has decided it needed to Do Something More.

Read more at http://www.nakedcapitalism.com/2012/09/the-feds-qe3-no-exit.html#Gv1iHbCxHdDBXjPh.99

Wednesday, September 12, 2012

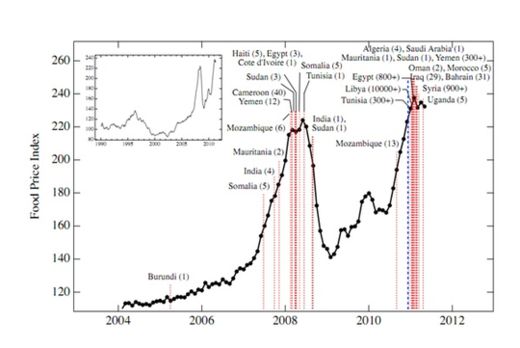

Complex Systems Theorists predict global riots in one year

In a 2011 paper, researchers at the Complex Systems Institute unveiled a model that accurately explained why the waves of unrest that swept the world in 2008 and 2011 crashed when they did. The number one determinant was soaring food prices. Their model identified a precise threshold for global food prices that, if breached, would lead to worldwide unrest.

The MIT Technology Review explains how CSI's model works: "The evidence comes from two sources. The first is data gathered by the United Nations that plots the price of food against time, the so-called food price index of the Food and Agriculture Organisation of the UN. The second is the date of riots around the world, whatever their cause." Plot the data, and it looks like this:

Germany Can Ratify ESM Fund With Conditions, Court Rules

http://www.bloomberg.com/news/2012-09-12/germany-can-ratify-esm-bailout-fund-with-conditions-court-rules.html

Saturday, September 8, 2012

EES: Short-Term Euro To Breakout Higher, Then Its Time To Short

http://seekingalpha.com/article/854961-short-term-euro-to-breakout-higher-then-its-time-to-short

Friday, September 7, 2012

EUR/USD nears 1.28 on ECB bond buying program

http://www.fxstreet.com/news/forex-news/article.aspx?storyid=66e94ca2-c527-48a4-b1f0-65243a38740e

The euro has strengthened to a two-month high against the US dollar, as the European Central Bank's bond-buying plans continued to please the markets... http://www.bbc.co.uk/news/business-19516323

- TILLICH SUPPORTS LEGAL STEPS AGAINST ECB BOND BUYING: WELT

- TILLICH SAYS ECB BOND BUYING SIGNALS EFSF, ESM NOT ENOUGH: WELT

- TILLICH: ECB MANDATE SHOULD NOT INCL. UNLIMIT. BOND BUYING:WELT

Thursday, September 6, 2012

EUR/CHF breaks away from 1.20 peg

According to Commerzbank's strategist Peter Kinsella , as reported by Clare Connaghan for DowJones: "ECB bond purchasing basically removes tail risk of a euro-zone breakup," the analyst says, as reflection of previous Franc strength based on fears of a euro area breakup. Rising the peg could bring many positive effects for Switzerland, but according to Citi, it could also bring extra risks as the foreign currency reserves might reach as high as 100% of its GDP, making the country very vulnerable to Euro exposure in case can't be able to sustain the peg, reported Ira Iosebashvili for DowJones.

Immediate resistance to the upside for EUR/CHF comes at recent session and 3-month highs at 1.2058, followed by March 27 highs at 1.2069, and May 24 highs at 1.2075. For the downside, nearest term support shows at yesterday's highs 1.2046, followed by Feb 27 lows/June 29 highs at 1.2038, and Aug 02 highs at 1.2029.

http://www.fxstreet.com/news/forex-news/article.aspx?storyid=ebaa98d8-19b6-43dd-93dc-e6df7b16733f

http://seekingalpha.com/article/816681-is-the-snb-going-to-unpeg-the-eur-chf

Tuesday, September 4, 2012

EES: Europe's problems much deeper than Euro currency

http://seekingalpha.com/article/845531-europe-s-crisis-much-deeper-than-euro-currency

Moody’s Changes Euro Zone Rating Outlook to ‘Negative’

http://www.cnbc.com/id/48888752