It is well-known that as part of the S&P500's ascent to new records,

investor margin debt has also surged to all time highs, surpassing for the past three months previous records set during both prior, the dot com and the housing, stock market bubbles.

And as more attention has shifted to the topic of speculator leverage once more, inquiries into the correlation between bets upon bets and stock performance are popping up once more, in this case in a study by Deutsche Bank titled "Red Flag! - The curious case of NYSE margin debt." Of particular note here is a historical comparison of margin-debt warnings that have recurred throughout history but especially just before major stock bubble crashes, such as in the period 1999/2000, 2007/2008 and of course today, which have time and again been ignored. Here is what was said then, what is being said now, and what is ignored always.

As DB says, "we prepared a collection of press articles which were published around the key events during the past financial crises. Our key finding is straight forward. Irrespective of the publishing date, the articles read alike throughout the two major crisis periods, i.e. the “new technologies market equity bubble” (1999-00) and the “Great/Global Financial Crisis” (2007-08). Most interestingly, literally the same content can be found in todays’ press. Universal phrases include:

- “A rising stock market encouraged more investors to go into debt to buy stocks, sending margin debt levels past their all-time high”.

- “The National Association of Securities Dealers (NASD) has asked members to review their lending requirements in a sign of increasing concern that rising levels of margin debt could exacerbate a stock market plunch.”

- “The Fed is concerned about a sharp rise in margin debt but has been unwilling to attack stock market speculation as high levels of leverage do not necessarily translate into high risk. The last time the Fed adjusted the margin rules was in 1974, when when it reduced the down payment required for stocks to 50 percent of the purchase price, from 65 percent.” […] “The Fed should return to its pre- 1974 policy of actively changing margin requirements in response to stock market speculation”.

- “High margin debts show the effect of over-leveraging and mispricing of risk”.

- “The movements in stocks cause brokerages to stop allowing customers to buy some of the volatile stocks on margin or require clients to put up more cash.”

- “Either the market rises dramatically to make those loans good or in any down move there is tremendous selling pressure”.

- “Until recently, most investors ignored red flags raised by regulators”.

And more detail:

25 May 1999, Event: 1st MoM change in NYSE margin debt > 10%, Reuters News: “Soaring margin debt seen bad for Internet stocks.”

“Soaring margin debt is likely to trigger a debacle in Internet stocks", Charles Biderman, chief executive of TrimTabs.com said Tuesday. "New online investors are buying heavily on margin and it looks like they're buying Internet stocks", Biderman said. TrimTabs.com is a Santa Rosa, Calif.-based firm which collects information on mutual fund flows and other market data. "When people borrow to buy (stocks) that's a very bad sign for the future." Biderman cited figures showing margin debt for customers of New York Stock Exchange (NYSE) member firms at $182 billion at the end of April, up from $156 billion at the end of March and $142 billion at the end of February. He said the nearly 30 percent increase over a two-month span was unprecedented. ” The wild price moves in Internet stocks, which can go up or down tens of dollars a day, have caused brokerages to stop allowing customers to buy some of these volatile stocks on margin or require clients to put up more cash. "Either the market has to rise dramatically to make those loans good or in any down move there's tremendous selling pressure," Biderman said.

08 December 1999, Event: 2nd MoM change in NYSE margin debt >10%; The Cambridge Reporter: "Margin debt oddly overlooked "

"U.S. Federal Reserve figures show that margin debt has grown tremendously. Since 1993 the rate at which margin debt has grown is three times faster than the growth rate for U.S. household debt and overall debt in credit markets. According to a non-profit think tank, Financial Markets Centre, as a percentage of market capitalization or the total value of stocks, margin debt has reached the highest level since just before the 1987 market crash. Too, as a percentage of gross domestic product, margin debt is at the highest level in 63 years, and now of course the over-valued stock market makes that more worrisome. In Canada for reasons of privacy margin debt figures are not disclosed. The U.S. Federal Reserve has been unwilling to attack stock market speculation. Since January, 1974, the Federal Reserve has left margin requirements at 50 percent, despite the huge rise in the stock market. The unwillingness of monetary authorities to deal with the equity markets is unprecedented and puzzling. The failure to acknowledge the role of debt in the stock market surge, something so massive, is difficult to understand. Now, just sitting with folded hands is a prescription for disaster in thee long run for the U.S. and Canada as well."

21 December 1999, Event: 3rd MoM change in NYSE margin debt >10%; The Los Angeles Times: "Monthly increase, largest since 1971, adds to fears that level of speculation in stocks may signal near-term peak"

"The Federal Reserve is concerned about a sharp rise in margin debt, or money borrowed from brokers to purchase stocks, in the last two months of 1999, Fed chairman Alan Greenspan said on Wednesday. Greenspan said, however, that the Fed did not consider raising its margin requirements, currently at 50 percent, an effective way to address the problem. At a Senate Banking Committee hearing on his renomination, Greenspan was asked if the Fed was worried about data showing margin debt rose substantially in November and December. "Obviously," he replied. "It is certainly the case that the numbers that you cite, especially for November and December, have caught our attention." While there has been considerable conversation at the Fed about how to address the problem, Greenspan said changing margin requirements was not the solution. "All of the studies have suggested that the level of stock prices have nothing to do with margin requirements," he said. The Fed has been reluctant to adjust requirements that would not affect large investors, who have other sources of financing, he said. "

26 February 2000, Event: (prior to) Margin debt peak; Reuters News: “NYSE, NASD call for review of margin lending rules.”

“The New York Stock Exchange (NYSE) and the National Association of Securities Dealers (NASD) have asked members to review their lending requirements in a sign of increasing concern that rising levels of margin debt could exacerbate a stock market plunge. [...]Some firms add their own requirements to that rule in order to limit risk but the popularity of margin borrowing still causes concern. Indeed, Federal Reserve Chairman Alan Greenspan said recently that the central bank has been paying increasing attention to a surge in margin debt. Last fall, the NYSE said margin debt held by its member firms equalled $182 billion, or 2 percent of the U.S. gross domestic product. That compared with NYSE member firm margin debt of $30 billion at the start of the decade.”

17 May 2000, Event: (post) Margin debt peak, WSJE: "Margin Debt Fell Almost 10% in April - Turbulence in U.S. Market May Have Curbed Borrowing"

"Margin debt, which has been soaring, fell nearly 10%during the month. The drop marks the first time since August that investors pruned their debt loads. Investor borrowing reached record levels in recent months, drawing the scrutiny of securities regulators who viewed it as a sign of the market's peculative fervor. But until recently,most investors ignored red flags raised by regulators. "The bottom line is that investors got their fingers burned during the recent market downdraft," says Morgan Stanley Dean Witter & Co. analyst Henry McVey. The drop isn't all that surprising, however, given last month's sharp fall in stock prices. Many investors were forced to come up with additional cash or stock to meet margin calls; others had their stocks sold without notice as falling share prices eroded the value of their holdings. The decline in investor borrowing was sharp at some online firms. At Datek Online Holdings Corp., margin debt fell about 20% in April and "looks pretty flat in May so far," says spokesman Mike Dunn. Margin debt also fell about 20% in April at Ameritrade Holding Corp. and is up about 1%or 2%so far this month, a spokeswoman says. About 80% of the decline is due to customers voluntarily cutting back on their borrowing, she adds. Some brokerage firms continue to make it tougher for investors to borrow to buy stock. TD Waterhouse Group Inc. plans to increase its base margin-lending rate to 35% from 30% on June 15. "We think the change is prudent and we think it protects customers, in light of the current volatility we're seeing in the marketplace," says TD Waterhouse spokeswoman Melissa Gitter. The online broker now has more than 800 stocks subject to higher margin requirements, up from 443 on April 13."

19 December 2006, Event: 1st MoM change in NYSE margin debt > 10% DJ News Service, "Margin Debt Saw Big Spike In November"

"A rising stock market encouraged more investors to go into debt to buy stocks last month, sending so-called margin debt to a level not seen in more than six years. […] November was the first month since 2000 that margin debt has topped the $270 billion figure. The last time that happened was in March 2000, when margin debt set a record at $278.53 billion as the Nasdaq Composite Index was reaching its all-time peak. Last month's rise, which left margin debt about 3% below its record, came as stocks continued to rise. The Dow Jones Industrial Average and the Standard & Poor's 500-stock index gained 1.2% and 1.6%, respectively, during November, leaving both market barometers with double-digit percentage gains for the first 11 months of the year. That display has helped inspire margin trading, in which investors use funds borrowed from their brokers to help finance their transactions. "This market has been uni-directional" for a while, and "that gets a lot of money chasing performance," said Art Hogan, chief market analyst at Jefferies. "You're not going to borrow to buy in a market where the trend has been downward."

20 February 2007, Event: All-time high margin debt (Mar-2000) crossed; Dow Jones Intl News: “Margin Debt Tops All-Time High; Reached $285.6B In January”

“A rising stock market continued to inspire investors to go into debt to buy stocks last month, sending margin-debt figures past their all-time high, which had been set several years ago in the waning days of the technology-stock boom.Margin debt as tracked by the New York Stock Exchange totaled $285.61 billion in January, the NYSE said Tuesday, up from $275.38 billion in December and moving past the previous peak of $278.53 billion. That high was set in March 2000, as the Nasdaq Composite Index was peaking. Margin debt's recent advance has come as stocks moved higher.”

11 April 2007, Event: 2nd MoM change in NYSE margin debt > 10% The Globe and Mail: “Record level of margin debt prompts regulator warning”

"As thousands of homeowners in the United States are realizing it's unwise to borrow more than they can afford, the National Association of Securities Dealers is offering a similar warning to investors: It's risky to invest more than you have. The brokerage regulator said yesterday the amount of debt investors took on to buy securities, known as buying “on margin,” had soared to a record $321.2-billion (U.S.) in February. That topped the previous record of $299.9-billion in March, 2000, at the peak of the last bull market in stocks. Margin debt has more than doubled from $141.3-billion in January, 2003, the NASD said, three months after the bottom of a bear market in stocks." “When the Internet bubble imploded, many people were shocked to learn that firms can sell their stock, and they have no choice in what can be sold,” John Gannon, an NASD senior vice-president for investor education, said. Regulators, including the Federal Reserve, the New York Stock Exchange and the NASD, set minimum requirements for margin traders. Brokerages are free to set more stringent standards. Under the minimum requirements, before trading on margin, ordinary investors must deposit at least $2,000 or 100 per cent of the purchase price, whichever is less. Fed rules generally let investors borrow up to 50 per cent of the purchase price of securities that can be bought on margin. NYSE and NASD rules then require equity in an account to be at least 25 per cent of the securities' market value in that account, known as a “maintenance margin.” “You can lose your money fast and with no notice,” the Securities and Exchange Commission said.

12 July 2007, Event Margin debt peak; The Wall Street Journal: "On the NYSE, 'Margin Debt' Jumps to Record $353 Billion"

"Investors are borrowing record sums of money to finance trades on the New York Stock Exchange, according to data due out from the Big Board today. NYSE officials attribute the trend to recent regulatory changes effectively allowing both small and big investors to take on more leverage, or borrowed money, from their brokers. So-called margin debt, a broad measure of leverage, jumped 11% to $353 billion at NYSE in May, up from nearly $318 billion in April.Wall Street has had a love affair with leverage in recent years, typified by hedge funds and private-equity firms that make use of it to buy companies and stocks and bonds. Such financing can also amplify losses if investors' bets go the wrong way. But regulators say that doesn't necessarily translate into more risk. "I wouldn't necessarily say that leverage equates to risk," said Grace Vogel, executive vice president for member regulation at NYSE. "We feel that the amount of margin being collected by the firms is appropriate, given the strategies in [their customers'] portfolios."

27 October 2007, Event: S&P 500 peak, SUNBUS: "Stock market vulnerable to sharp fall as margin debt remains high"

"It has become a source of concern to some investors who worry that it makes the stock market more vulnerable to a nasty tumble, particularly if equities’ resurgence continues. “High margin debts show the effect of over-leveraging and mispricing of risk in our financial system,” says Scott Schermerhorn, chief investment officer for Choate Advisors, which runs about $2.7bn (£1.3bn, e1.9bn). “It indicates that, despite the August runoff, there’s still more problems out there. This will take a long time to work through the system.” Based on historical levels, margin debt makes the market look risky and subject to a sharp downtick right now. It comes to 2.4%of total adjusted-market capitalisation – 3.4 times its 62-year norm of 0.74%. “These are certainly not the kind of numbers you see at the beginning of a bull market,” says Ed Clissold, an analyst for Ned Davis Research. In July,margin debt hit an all-time high of $381bn. But as worries about sub-prime mortgage loans set off a credit crunch in August, more than $50bn of the debt was erased. Almost half of the margin drawdown came from brokerages such as Merrill Lynch, which called loans backing two Bear Stearns hedge funds.What is particularly worrying to some is that margin debt is just one tool available to investors seeking leverage these days. Options and futures make it easier than ever to obtain leverage. So the near-record margin numbers may understate the situation. “As financial markets have grown and become more diversified, margin has become one of many ways to finance securities, so it represents less of a proportion of finance than it used to,” says Henry Kaufman. The one-time chief economist of Salomon Brothers now heads Kaufman & Co, an investment management and financial consulting firm. Granted, recent structural changes that take into account an entire portfolio’s risk have contributed to the gains. If an investor is using options to hedge his risk, new rules give him the ability to borrow more because he has lowered the risk profile of his entire portfolio. But the new rules do nothing to minimise margin lending’s inherent conflicts of interest or its potential to send the market down sharply as it did in August in a cascade of margin calls. Brokers sometimes give investors little or no time to cough up more cash before they liquidate a portfolio at bargain-basement prices. A brokerage firm may force a margin call on the one hand, while helping set the price on the securities sold to meet it on the other."

09 January 2013, Event: 1st MoM change in margin debt > 10%; DJ Newswire: "Margin Debt Soared in January; Sign of Top Nearing?"

"NYSE says margin debt jumped 10% in January alone to $364 billion, 32% higher than a year earlier and the third-highest ever, trailing just June and July 2007. The previous instances, of course, came just a couple months before US stocks last topped out before the ongoing rally, with margin then peaking at $381 billion. So it's pretty clear where the record January rush of cash into equity products came from. Now, what happens if things get a little frisky and some margin debt turns into margin calls?"

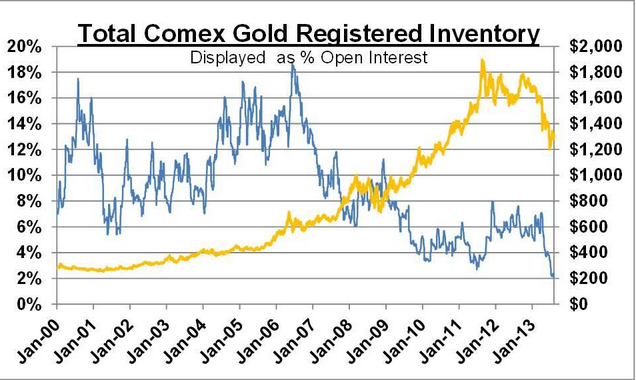

06 May 2013, Event: All-time high margin debt (Jul-2007) crossed (1/2); The Wall Street Journal: “NYSE Margin Debt Raises Eyebrows”

“High levels of margin debt on the New York Stock Exchange are raising concerns about the state of the rally. Stephen Suttmeier, technical research analyst at Bank of America Merrill Lynch, notes leverage, as measured by NYSE margin debt, rose 28% in March from a year ago to $380 billion. That figure is slightly below the July 2007 peak of $381 billion.Market analysts track margin-debt activity as an indication of investors’ appetite for taking on speculative trading. It has been trending higher since bottoming out during the financial crisis and currently is hovering around all-time highs. “Leverage can be used as a sentiment indicator because it is related to investor confidence... Although it should not be used as a market timing tool, the implication is contrarian bearish,” Suttmeier says. ”Peaks in NYSE margin debt preceded peaks in the S&P 500 in both 2007 and 2000.” It's no surprise people have been taking on more risk as the market has moved to record highs. But the question is what happens when the easy ride higher turns south and some of that margin debt turns into margin calls? A potential pitfall for those trading "on margin" is a sharp decline in stock prices, which can expose investors to margin calls, requiring them to post additional collateral lest their brokers sell their securities to cover the debt. A wave of margin calls can worsen selling pressure on stocks and was seen as partly to blame for the market's woes during the financial crisis. "It's rather alarming to see NYSE margin debt just shy of its all-time high as of the March reading," Cullen Roche of Orcam Financial Group wrote on the Pragmatic Capitalism blog (hat tip Business Insider). "My guess is we've actually already surpassed the all-time high though we won't officially know until April data is released. Fun times knowing we live in a world that is built on such a fragile foundation."

31 May 2013, Event: All-time high margin debt (Jul-2007) crossed (2/2):The New York Times “Shades of 2007 Borrowing”

“AMERICAN investors have taken out more margin loans than ever before. That indicates that speculative investing has grown among retail investors, reaching levels that in the past indicated the market was getting to unsustainable levels and might be in for a fall. [...]It was the first time the total had surpassed the 2007 peak of $381 billion, a peak that was followed by the Great Recession and credit crisis. [...][T]he last time the Fed adjusted the margin rules was in 1974, when it reduced the down payment required for stocks to 50 percent of the purchase price, from 65 percent. ...]Nonetheless,margin loans have remained popular among many individual investors, who tend to raise their borrowings during times of market optimism and to reduce them when markets are falling. Thus the margin debt levels now may provide an indication of popular enthusiasm for investments.”

27 June 2013, Event: All-time high margin debt (Jul-2007) crossed = Did margin debt peak already? (1/2);Reuters: "U.S. stock market margin debt falls in May from record April level"

"The value of U.S. equities investors bought with borrowed money fell 1.7 percent in May from the previous month's record high, marking the first monthly decline in margin debt in nearly a year. Margin debt accounts totaled $401.6 billion in May, down from a record $408.7 billion in April, data from the Financial Industry Regulatory Authority showed on Thursday. The level had increased every month since a 2.3 percent drop between June and July 2012. Margin debt is one way to measure how much risk hedge funds and other large investors are taking to enhance their returns through the use of borrowed cash. Extremely high readings are seen as a gauge of overly bullish sentiment. In April, the New York Stock Exchange reported margin debt hit $384.4 billion, surpassing the previous record of $381.4 billion in July 2007. On Thursday, the NYSE said its share of the May total was $377 billion."

27 June 2013, Event: All-time high margin debt (Jul-2007) crossed = Did margin debt peak already? (2/2); ARMNET: "Record margin debt points to a far wider Wall Street Crash coming soon"

"Don’t even think about jumping back into US stocks after the recent modest sell-off. If margin debt is any guide, and historically it has been an excellent guide then what we have just seen is just a warning of a much biggerWall Street crash around the corner. The last time margin debt was at present levels was at a previous peak in July 2007 at $381 billion, just before the global financial crisis struck. Yes it is hard to believe that confidence was that high in stocks just at the wrong moment. Record margin debt: It is the same story now. In March 2013 NYSE margin debt totaled $380 billion. You do not need to be much of a financial analyst to spot almost an exact parallel. But what you should also understand is that margin debt works in both directions. It accelerates the upside in stocks by allowing punters to buy with borrowed money but then it accelerates the drop in a stock market by taking it away from them. How does it do that? Well think about it. If you owe money then you will be forced to sell a perfectly good asset in a falling market to pay off your debt, and that sale accelerates the fall in stock prices. Besides with the bond market weakening the cost of margin debt is going up. That will also be triggering liquidation of this debt with an obvious impact on stock prices supported by this borrowing. [...] The current weakness in gold and silver is also a sign of a coming crash in all major financial assets. Once the weaker investment holders of gold and silver have finished selling precious metals they will continue with other assets, and margin account requirements will force them to liquidate US stocks. Stock market crash: We think the sell-off of precious metals is almost done but it has hardly started with the overinflated US stock market. A historically high US price-to-earnings ratio still anticipates an economic recovery that is just not coming through. US GDP growth in the first quarter was revised down from 2.4 to 1.8 per cent, after the negative fourth quarter. The only economic recovery is in house prices and the stock market, both inflated by cheap money courtesy of the Fed. Rising mortgage rates are going to ditch the housing recovery and rising margin costs will do for the US stock market. Welcome to the liquidation sale of the century!"

* * *

This time must be different.